Rajasthan Board RBSE Class 12 Accountancy Chapter 5 Company Accounts: Issue of Shares and Debentures

RBSE Class 12 Accountancy Chapter 5 Textbook Questions

RBSE Class 12 Accountancy Chapter 5 Multiple Choice Questions

RBSE Solutions For Class 12 Accountancy Chapter 5 Question 1.

Total amount of equity and liabilities part of the balance sheet includes the following :

(a) authorized capital

(b) issued capital

(c) subscribed capital

(d) paid up capital

Answer:

d

RBSE Solution Class 12 Accountancy Question 2.

Premium received on issue of shares is shown on :

(a) equity and liabilities part of the balance sheet

(b) assets part of the balance sheet

(c) income part of the statement of profit and loss

(d) expenses part of the statement of profit and loss

Answer:

a

RBSE Solutions For Class 12 Accountancy Question 3.

Equity shareholders are :

(a) customers of the company

(b) officers of the company

(c) creditors of the company

(d) owners of the company

Answer:

d

RBSE Solutions For Class 12 Accountancy Chapter 5 Question 4.

Premium on issue of shares cannot be used for :

(a) issuing bonus shares to members

(b) paying dividend to members

(c) writing off preliminary expenses

(d) writing off discount on issue of debentures

Answer:

b

RBSE Solutions For Class 12 Maths Question 5.

As per Table F a company can pay interest on calls-in-advance at

(a) 8%

(b) 10%

(c) 12%

(d) 14%

Answer:

c

Company Accounts Issue Of Shares Question 6.

The part of uncalled capital which can be called up only when the company being wound up is called

(a) issued capital

(b) reserve capital

(c) capital reserve

(d) unissued capital

Answer:

b

RBSE Solutions For Class 12 Accountancy Chapter 5 Question 7.

Debenture holders are

(a) owners of the company

(b) customers of the company

(c) loam providers of the company

(d) none of these

Answer:

c

RBSE Solutions 12th Accounts Question 8.

Debenture holders receive.

(a) profit

(b) dividend

(c) rent

(d) interest

Answer:

d

RBSE Solutions 12 Maths Question 9.

Discount or loss on issue of debentures to be written off after 12 months from the date of balance sheet or after the period of operating cycle is shown as :

(a) other non-current assets

(b) other non-current liabilities

(c) other current assets

(d) other current liabilities

Answer:

a

Company Accounts Issue Of Shares And Debentures Question 10.

The debentures which can be converted into equity shares are called :

(a) redeemable debentures

(b) registered debentures

(c) bearer debentures

(d) convertible debentures

Answer:

d

Issue Of Shares Class 12 Solutions Question 11.

In the case of issue of debentures as collateral security, if entry is pass which account will be debited :

(a) loan account

(b) debenture account

(c) debenture suspense account

(d) bank account

Answer:

c

RBSE Class 12 Accountancy Chapter 5 Very Short Answer Questions

RBSE Solutions For Class 12 English Medium Question 1.

Define a company.

Answer.

A company is an entity; incorporated by a group of person through the process of law for undertaking a business.

Class 12 Maths RBSE Solutions Question 2.

What is one person company?

Answer.

One person company is a company which has only one person as a member. It is a company incorporated as a private company which has only one member.

RBSE Solutions For Class 12 English Question 3.

What is meant by share?

Answer.

Total capital of the company is divided into units of small denominations. Each such unit is called “Share”.

Maths RBSE Solutions Class 12 Question 4.

Name of two types of share.

Answer.

- Preference share,

- Equity share.

RBSE Solutions Class 12 Maths Question 5.

Give the meaning of registered capital.

Answer.

According to Section 2 (8) of the company act 2013, Authorized/Registered capital means such capital as is authorized by the memorandum of a company to be the maximum amount of share capital of a company.

RBSE Solutions For Class 12 Accountancy Chapter 3 Question 6.

What is meant by issued capital?

Answer.

“Issued Capital” means such capital as the company issue from time to time for subscription. Issue capital is a part of the Authorized Capital.

RBSE Solution Class 12 Maths Question 7.

What is meant by subscribed capital?

Answer.

“Subscribed Capital” means such part of the capital which is for the time being subscribed by the members of company.

Debentures In Balance Sheet Question 8.

What do you mean by over subscription?

Answer.

When the number of share applied for is more than number of shared offered for subscription called over subscription.

RBSE Solutions Class 12 Accountancy Question 9.

What is meant by convertible preference share?

Answer.

Holder of preference shares have a right to get their preference share converted into equity share at their option according to the terms of issue called convertible preference shares.

RBSE Solutions For Class 12 Accountancy Chapter 5 Question 10.

What is meant by allotment of shares?

Answer.

Allotment of share means distribution of shares between applicant. One applicant can make shareholder after allotment.

RBSE Solutions Of Class 12 Maths Question 11.

What is meant by pro-rata allotment of shares?

Answer.

In this allotment (In over subscription condition). Some application are accepted in full, some are rejected and proportional allotment is made to the remaining application called pro rata allotment.

RBSE Solutions Maths Class 12 Question 12.

What is meant by issue of share at premium?

Answer.

Issue of share at premium means share have been issued at a value that is more than the nominal (face) value of the share.

Issue Of Shares Class 12 Question 13.

Under the Companies Act, 2013, can a company issue it’s share at discount?

Answer.

No, under the Company Act 2013 not any company can issue their share at discount.

RBSE Solution Class 12th Accountancy Question 14.

Give the meaning of calls-in-arrears.

Answer.

Calls in arrears means the amount not received by the company or not paid by shareholders against the amount called.

RBSE Solutions For Class 12th Accountancy Question 15.

Give the meaning of debenture?

Answer.

In addition to raising of capital by issue of shares a company requiring funds on long term basis may borrow money by issue of debentures.

A debentures certificate contains the terms of the repayment of principal sum at a specified date & term of payment of interest at a fixed percentage.

RBSE Solution Class 12 English Question 16.

What is bond?

Answer.

Bond’s formation and subject matter is equal to debenture. Traditionally, it is issued by govt.

RBSE Solutions For Class 5 Question 17.

What is meant by safe or secured debenture?

Answer.

The debenture which are secured either on particular assets of the company called fixed charge or on all assets of the company. If the company is unable to repay the debenture on the due date, the debenture holders can realize their money from the assets mortgaged with them.

RBSE Solutions For Class 12 Accountancy Chapter 7 Question 18.

What is meant by non-convertible debentures?

Answer.

Those debentures which cannot be changed in shares or in other.

Class 12 Accountancy RBSE Solutions Question 19.

What is the difference between shares and debentures?

Answer.

Share is a part of capital of company while debenture is acceptance of the loan.

RBSE Solutions Accountancy Class 12 Question 20.

What is meant by issue of debentures as collateral security?

Answer.

When a company takes a loan from bank or from other party. The company may have to issue debentures as a subsidiary or secondary security in addition to the principal security called issue of debenture as collateral security.

RBSE Solutions For Class 12 Accounts Question 21.

What is the nature of interest on debentures?

Answer.

Its nature is revenue expenditure.

RBSE Solution Maths Class 12 Question 22.

What is meant by loss on issue of debentures?

Answer.

When debentures are issued on discount and make redemption on premium its called loss on issue of debentures.

RBSE Class 12 Accountancy Chapter 5 Short Answer Questions

Accounts Class 12 RBSE Solutions Question 1.

What are the main characteristics of a company?

Answer.

- Incorporation,

- Separate legal entity,

- Perpetual existence,

- Limited liability,

- Transfer ability of shares,

- Management and Ownership,

- Common seal.

Class 12 RBSE Solutions Maths Question 2.

What is private company?

Answer.

Private Company: A private company is one which has minimum paid up. Share capital as may be prescribed and which by its Articles of Association.

- Restricts the right to transfer its shares if any.

- Except in the case of one person company limits the number of its numbers excluding its present or part employee members to 200.

Where shares are held by two or more persons jointly they shall be treated as a single member. - Prohibits any invitation to the public to subscribe for any securities of the company.

A private company must have atleast 2 members. The name of a private company ends with the words “Private Limited”.

RBSE Solutions For Class 12 Commerce Question 3.

What do you mean by the company limited by shares?

Answer.

Such a company the liability of the members is strictly limited to the extent of the nominal value of shares held by each of them called the company limited by shares.

RBSE Solutions For Class 12 Maths Chapter 5 Question 4.

What is difference between equity shares and preference shares.

Answer.

Dividend is paid to preference share before it is paid to equity share and on winding up the preference shares capital is repaid before the equity share capital is paid.

RBSE Solutions Of Class 12 Accountancy Question 5.

Explain three types of the preference shares.

Answer.

- Cumulative Preference Share

- Non-cumulative Preference Share

- Participating Preference Share

RBSE Solutions Class 12 English Question 6.

What is meant by reserve capital?

Answer.

Reserve Capital means “A part of uncalled capital which has been reserved by the company by passing a special resolution to be called only in the event of its liquidation.”

Question 7.

State the provision in Section 52 for the utilization of securities premium account.

Answer.

Utilization of Securities Premium: Under Section 52(2) of the Companies Act, 2013, the amount of securities premium reserve may be used only for the following purposes :

- In writing off the preliminary expenses of the company.

- For writing off the expenses, commission or discount allowed on issue of shares or debentures of the company.

- For issuing fully paid bonus shares to the shareholders of the company.

- For providing for the premium payable on redemption of redeemable preference shares or debentures of the company.

- For buy back of its own shares and other securities as per Section 68.

Question 8.

What do you mean by minimum subscription?

Answer.

According Sec 39 (1) of the Company Act, 2013 provided that a company cannot allot any security of the company to public unless the amount of stated in the prospectus at the minimum amount has been subscribed and the sum payable on application for the amount. So, stated have been received by the company.

According to SEBI guidelines minimum subscription has been fixed at 90% of the issued amount.

Question 9.

What is meant by sweat equity shares?

Answer.

As per Section 2 (88) of the Companies Act, 2013, “Sweat Equity Shares” means such equity shares as are issued by a company to its directors or employees as a discount or for consideration other than cash called sweat equity share.

Question 10.

Write meaning of the employee stock option plan.

Answer.

Employees Stock Option Plant-ESOP : Employees Stock Option Plan (ESOP) means option granted by the company to its employees and employee directors to subscribe the shares at a price that is lower than the market price i.e., fair value. It is option or right granted by the company but it is not an obligation on the employee to subscribe it. The employees may or may not exercise the option.

Question 11.

Explain about Escrow account.

Answer.

Escrow Account: An escrow account is a temporary pass through account hold by a third party during the process of a transaction on between two parties. This is a temporary account as it operates until the completion of a transaction process which is implemented after all the conditions between the buyer and the seller are settled.

Question 12.

What are the types of debentures?

Answer.

(1) On the basis of security:

- Secured,

- Unsecured debenture.

(2) On the basis of registration:

- Registered,

- Bearer debenture.

(3) On the basis of Redemption:

- Redeemable,

- Irredeemable debenture.

(4) On the basis of Payment:

- First,

- Secondary Debenture.

(5) On the basis of Rate of Interest:

- Fixed,

- Zero Interest Debenture.

(6) On the basis of Convertibility:

- Convertible,

- Non-convertible debenture.

Question 13.

Give any four points of difference between shares and debentures.

Answer.

Distinction Between Shares and Debentures

| S.No. | Basis of Distinction | Share | Debenture |

| 1. | Capital vs Loan | A share is the part of capital of the company therefore the shareholders are the owner of the company. | A debenture is a part of the loan and as such the debenture holders are the creditors of the company. |

| 2. | Dividend vs Interest | A shareholder gets dividend from the company. | A debenture holder gets interest from the company. |

| 3. | Fluctuating or fixed rate of dividend or interest | Dividend is paid only when there are profits. The rate of dividend may fluctuate from year to year depending upon the profits and decision of the directors. | The rate of interest is fixed and it must be paid irrespective of the company making a profit or incurring a loss. |

| 4. | Voluntary or compulsory redemption | It is at the option of the company to return the amount of shares by buying back its own shares. | The amount of debentures must be returned according to the terms of the issue. |

| 5. | Priority of repayment of principal in case of winding up | In case of winding up the payment of share capital is made after the repayment of debentures. | In case of winding up the payment of debentures is made before the payment of share capital. |

| 6. | Unsecured or secured | A share is always unsecured. Hence they bear more risk. | Debentures are usually secured on the assets of the company. Hence they bear little risk. |

| 7. | Restriction on issue at discount | Under Section 53 of the Companies Act, 2013, shares cannot be issued at discount except sweat equity shares. | There are no restrictions on the issue of debentures at discount. |

| 8. | Voting rights | Shares confer son its holder the right to participate in and vote at company’s meetings. | A holder of debenture neither possesses any voting right in the company’s meeting nor can be participate in the meeting. |

Question 14.

Explain the meaning and accounting treatment of issue of debentures as collateral security.

Answer.

Collateral security means secondary security in addition to the principal security. There are two method of dealing with such debentures in the Books of Accounts of the Company:

(1) First Method: In this method, no entry need to be passed in the books of the company, as the debentures are not actually issued, but only given away as collateral security. As such under this method, entry is passed only for taking a loan. If the loan is taken from a bank the entry will be:

Bank A/c Dr.

To Bank Loan A/c

On the equity and liabilities side of the balance sheet a note is appended below the loan that the loan is secured by the issue of debentures as collateral security.

(2) Second Method: In this method the entry for issuing debentures as collateral security is also recorded with the entry for taking the loan.

(i) On Taking a Loan

Bank A/c Dr.

To Bank Loan A/c

(ii) On Issuing the Debentures as Collateral Security

Debenture Suspense A/c Dr.

To Debentures A/c

Question 15.

Tarun Ltd. purchased building for Rs 4,00,000 and plant and machinery for Rs 2,60,000 from Hari. The purchase price was paid by issuing 8% Debentures of Rs 100 each at a premium of 10%. Give necessary journal entries.

Solution.

(1) Building A/c Dr. 4,00,000

Plant & Mach. A/c Dr. 2,60,000

To Hari 6,60,000

(Being building & plant & machinery purchased from Hari)

(2) Hari’s A/c Dr. 6,60,000

To 8% Debenture A/c 6,00,000

To Security Premium A/c 60,000

(Being 6,000 8% debenture of Rs 100 each issued to Hari at a premium of 10%)

Question 16.

Abhinav Ltd. issued 2,000, 9% Debentures of Rs 100 each at 4% discount which will be redeemed at 5% premium. Pass journal entries in the books of Abhinav Ltd. at the time of issue of debentures.

Solution.

(1) Bank A/c Dr. 1,92,000

To Debenture Application A/c Dr. 1,92,000

(Being application money received from 2000 debenture @ Rs 96 each)

(2) Debenture Application A/c Dr. 1,92,000

Discount on Issue of Deb. A/c Dr. 8,000

Loss on Issue of Debenture A/c Dr. 10,000

To 9% Debenture 2,00,000

To Premium on Redemption of Debenture A/c 10,000

(Being 9% debenture issue at discount and provided for premium payable on redemption.)

Question 17.

Debentures outstanding, and ’Loss on Issue of debentures’ will be shown under which heads in the balance sheet?

Solution.

Debenture outstanding is shown in Balance Sheet maid head non-current liabilities subhead long term borrowing in part of equity and liabilities:

As per AS-26 borrowings costs and discount on issue or premium on redemption relating to borrowing could be amortized over loan period.

Unamortised portion of such expenses be shown on the assets side of the balance sheet under the head “Current/Non-Current Assets” depending on whether the amount will be amortised in the next 12 months or there-after.

Discounter loss on issue of debenture is a capital loss. It should be written off as early as possible but within the lifetime of the debentures. It can be written off by debiting to securities premium reserve account or statement of profit or loss.

RBSE Class 12 Accountancy Chapter 5 Essay Type Questions

Question 1.

What do you mean by company? State it’s essential features and different types of companies.

Answer.

Meaning and Definitions

A company or a joint stock company is an entity, incorporated by a group of persons through the process of law for undertaking (usually) a business. It is an artificial person and is separate from its members (shareholders). It normally has a share capital divided into units called Shares, the owners of which are known as Members or Shareholders. Unlike partnership, insolvency or death of a member does not affect the life of a company, i.e., the company remains functional even if a members becomes insolvent or dies.

“Company means a company incorporated under this act or any previous company law.”

—Section 2(20) of the Companies Act, 2013

“A company is an artificial person, created by law having separate entity with a perpetual succession and a common seal.”

—Prof. Haney

Characteristics of a Company

- Incorporation: A company is an artificial person established through the process of law i.e., the Companies Act, 2013 or any previous company law.

- Separate Legal Entity: A company is an artificial person having a legal entity separate from its shareholders. It can own property enter into contract, conduct business sue or be sued for its debts and actions. The scope of its activities and the working of the company is regulated by its Memorandum of Association, Articles of Association and Provision of the Companies Act.

- Perpetual Existence: A company has a perpetual succession not affected by the death. Lunacy or bankruptcy of its members of shareholders. The life of a company comes to an end only by winding up through the process of law.

- Limited Liability: Liability of its members is limited to the value of the share subscribed by them except in the case of companies incorporated with unlimited liabilities.

- Transfer ability of Shares : The shares of a company are freely transferable except in case of private companies.

- Management and Ownership: A company is not run by all the members but by their elected representatives called Directors. Thus, management and ownership are separate.

- Common Seal: A company may or may not have a common seal. If it has a common seal, it is affixed to all the important documents of the company.

Kinds of Companies

(a) One Person Company: One person company is a company which has only one person as a member. It is a company incorporated as a private company which has only one member. Rule 3 of the Companies (Incorporation), Rules 2014 provides that:

- Only a natural person being an Indian citizen and resident in India can from one person company or can be nominee for the Role member of one person company.

- One person can form only one “one person company” or become nominee of only one such company.

- It can be formed for charitable purposes.

- It cannot carry out non-banking financial investment activities including investments in securities of anybody corporate.

- Its paid up share capital is not more than Rs 50 lakhs.

- Its average annual turnover should not exceed Rs 2 crores.

(b) Private Company: A private company is one which has minimum paid up. Share capital as may be prescribed and which by its Articles of Association.

- Restricts the, right to transfer its shares if any.

- Except in the case of one person company limits the number of its numbers excluding its present or part employee members to 200.

Where shares are held by two or more persons jointly they shall be treated as a single member. - Prohibits any invitation to the public to subscribe for any securities of the company.

A private company must have atleast 2 members. The name of a private company ends with the words “Private Limited”. [Section 2(68) of the Companies Act, 2013]

(c) Public Company: A public company is a company which:

- is not a private company.

- has a minimum paid up capital as may be prescribed.

- is a private company being a subsidiary of a company which is not a private company.

A public company must have atleast 7 members. There is no restriction on the maximum number of members.

The name of a public company ends with the word “Limited”.

A public company can raise its capital by issue of shares to public for subscription.

Question 2.

What is the difference between equity shares and preference shares? Explain.

Answer.

Difference between Preference Shares and Equity Shares

|

S.No. |

Basis | Preference Shares |

Equity Shares |

| 1. | Rights to dividend | Dividend is paid on preference share before it is paid on equity shares. | Dividend is paid on equity shares after it is paid on preference shares. |

| 2. | Rate of dividend | Rate of dividend is fixed. | Rate of dividend is decided by the board of directors and approved by the shareholders. |

| 3. | Arrears of dividend | If preference shares are cumulative preference shares arrears dividend is paid before dividend is paid on equity shares. | Dividend is declared every year. In case dividend is not declared during the year, it is not accumulated to be paid in the coming years. |

| 4. | Convertibility | Preference shares may be converted to equity shares if the terms of issue so provide. | Equity shares are not convertible. |

| 5. | Redemption | Preference share may be redeemed (refunded) | A company may buy back its equity shares. |

| 6. | Voting rights | Preference shareholders have voting rights only in special circumstances. | Equity shareholders have voting rights in all circumstances. |

| 7. | Refund of capital | On winding up, the preference share capital is repaid before the equity share capital is paid. | On winding up, the equity share capital is repaid after the preference share capital is paid. |

| 8. | Income Security | Income are fixed and secured. | Income are unsecured and not fixed. |

| 9. | Ownership | Preference shareholders are not real owner of company. | Equity shareholder are assumed real owner. |

| 10. | Compulsory of Issue | Preference share’s are not compulsory to issue. | Equity share’s are compulsory for issue to a company. |

| 11. | Risk | On these share’s risk is low. | On these share’s risk is high from preference shares. |

| 12. | Right to Act in Management | No right. | Elected shareholders right to Act in management. |

Question 3.

Describe the different types of share capital.

Answer.

Kinds of Share Capital of Company

Schedule III of the Companies Act, 2013 requires a company to show:

(1) Authorised or Nominal Capital : According to Section 2(8) of the Companies Act, 2013, “Authorised capital or Nominal capital” means such capital as is authorised by the memorandum of a company to be the maximum amount of share capital of a company. It is stated in the Memorandum of Association and is the maximum amount that a company can arise as share capital. It is stated separately for each class of shares, i.e., preference shares and equity shares. It is the maximum amount of share capital under each class of shares which a company can issue for subscription. If a company has to issue more shares than authorised capital, it must increase the authorised or nominal capital first and thereafter issue shares for subscription.

Authorised share capital under each class (equity or preference) may be more or at the most equal to the issued share capital but cannot be less than the issued capital.

(2) Issued Capital: According to Section 2(50) of the Companies Act, 2013, “Issued capital” means such capital as the company issues from time to time for subscription. Thus, issued capital is a part of the authorised capital that is issued for subscription. It includes besides shares issued for subscription. Shares allotted for consideration other than cash, shares subscribed by signatories to the Memorandum of Association and shares taken by directors as qualifying shares. It should be kept in mind that issued capital cannot exceed the company’s authorised share capital.

(3) Subscribed Capital: According to Section 2(86) of the Companies Act, 2013, “Subscribed capital” means such part of the capital which is for the time being subscribed by the members of company. Thus subscribed capital is a part of issued capital which the company has issued for cash or for consideration other than cash. It includes shares issued for subscription and subscribed shares subscribed by signatories to the Memorandum of Association, shares subscribed by the directors as qualifying shares and shares allotted for consideration other than cash.

(4) Called up Capital: It is that part of subscribed capital which is called by the company to pay on shares allotted. It is not necessary for the company to call for the entire amount on shares subscribed for by shareholders. The amount which is not called on subscribed shares is called Uncalled Capital.

(5) Paid up Capital: It is that part of called up capital which actually paid by the shareholders. Therefore, it is known as Real Capital of the company. Whenever a particular amount is called and a shareholder fails to pay the amount fully or partially it is known as Unpaid Calls on Calls-in-Arrears.

Paid up Capital = Called up Capital – Calls in Arrears

(6) Reserve Capital: It is that part of uncalled capital which has been reserved by the company by passing a special resolution to be called only in the event of its liquidation. This capital cannot be called up during the existence of the company. It would be available only in the event of liquidation as an additional security to the creditors of the company.

Question 4.

What is meant by preference shares? Describe the different kinds of preference shares.

Answer.

Preference Shares

Preference shares are those which carry the following two rights:

- They have a right to receive dividend at a fixed rate before any dividend is paid on the equity shares.

- When the company is wound up they have a right to the return of capital before that of equity shares.

In addition to the above the preference shares may carry some more rights such as the right to participate in excess profits when a specified dividend has been paid on the equity shares or the right to receive a premium at the time of redemption.

Types of Preference Shares

(i) Cumulative Preference Shares : Cumulative preference shares are those preference shares which carry the right to receive arrears of dividend before dividend is paid to the equity shareholders. For example, a company has 10,000, 7% preference shares of Rs 100 each and dividend for the years 2015 and 2016 has not been paid. The company earns adequate profits in the year 2017. In this case, the company shall pay Rs 2,10,000 as dividend for three years to the preference shareholders before dividend is paid to the equity shareholders.

(!i) Non-Cumulative Preference Shares: Non-cumulative preference shares are those preference shares which do not carry the right to receive arrears of dividend. In the above example, preference shareholders share be entitled to receive dividend only for the year 2017 i.e., Rs 70,000 before dividend is paid to equity shareholders.

(iii) Participating Preference Shares: The Articles of Association of a company may provide that after dividend has been paid to the equity shareholders, the holders of preference shares will also have a right to participate in the remaining profits. The preference shares carrying this right are called Participating Preference Shares.

(iv) Non-Participating Preference Shares : Preference shares which do not carry the right to participate in the profits remaining after equity shareholders have been paid dividend are Non-Participating Preference Shares.

(v) Convertible Preference Shares : Holder of these shares have a right to get their preference shares converted into equity shares at their option according to the terms of issue.

(vi) Non-convertible Preference Shares : When the holders of preference shares have not been conferred the right of getting their preference shares converted into equity shares, such shares are called Non-convertible Preference Shares.

(vii) Redeemable Preference Shares: Such shares are those which will be repaid by the company within a stipulated period in accordance with the terms of issue and the fulfillment of certain conditions laid down in Section 55 of the Companies Act, 2013.

(viii) Irredeemable Preference Shares : Irredeemable preference shares are those the capital of which cannot be refunded before winding up. According to Section 55 of the Companies Act, 2013, no company limited by shares shall issue any preference share which is irredeemable or is redeemable after the expiry of 20 years from the date of its issue.

Question 5.

What is meant by debentures? Describe the different kinds of debentures.

Answer.

Meaning of Debenture

In addition to raising of capital by issue of shares a company requiring funds on long term basis, may borrow money by issue of debentures. A debenture issued by a company is usually in the form of a certificate, given under the seal of the company. Thus, a debenture is a written acknowledgement of a debt taken by the company as these are issued under the seal of the company.

A debenture certificate contains the terms of the repayment of the principal sum at a specified date and the terms of payment of interest at a fixed percent.

According to Section 2 (30) of the Companies Act, 2013 “Debenture includes debentures stock bonds and any other securities of a company whether constituting a charge on the assets of the company or not”.

Types of Debentures

A company may issue the following types of debentures :

(1) Secured or Mortgage Debentures: These debentures are those debentures which are secured either on particular assets of the company called Fixed Charge or on all assets of the company in general, called a Floating Charge. Fixed charge denies the company from dealing with mortgaged assets, where as the floating charge does not prevent the company from using the assets. If the company is unable to repay the debentures on the due date, the debentureholders can realise their money from the assets mortgaged with them. First mortgage debentures are those that have a first claim on the assets charged and second mortgage debentures are those that have a second claim on the assets charged. In India, debentures have necessarily to be secured.

(2) Unsecured or Naked Debentures: These debentures are those debentures which are not given . any security. The holders of such debentures are treated as unsecured creditors at the time of liquidation of the company. Such debentures are not very common these days, so much so that, unless otherwise stated, a debenture is presumed to be secured.

(3) Registered Debentures: Names and address of the holders of such debentures are recorded in a register of the company called “Register of Debenture holders”. Such debentures are not freely transferable. The transfer of such debentures requires the execution of a proper transfer deed. Principal amount and interest on such a debenture is paid to the person whose name appears in the company’s register.

(4) Bearer Debentures: Names and address of the holders of such debentures are not recorded in the company and these debentures are transferable by mere delivery. Payment of principal and interest is made to the bearer of such debentures. Coupons are attached with these debentures and the interest is paid to such persons who produce the coupons in the specified bank.

(5) Redeemable Debentures: Redeemable debentures are those debentures which will be repaid by the company either in lump-sum at the end of a specified period or by installments during the lifetime of the company. Most of the debentures are generally of this type.

(6) Irredeemable or Perpetual Debentures : Irredeemable debentures are those debentures which are not repayable by the company during its lifetime. These debentures are repayable only at the time of liquidation of the company.

(7) Convertible Debentures: Convertible debentures are those debentures which are convertible into equity shares or other securities at a stated rate of exchange either at the option of debenture holders or at the option of the company after a specified period. When only a part of the amount of debenture is convertible into shares, such debentures are called “Partly Convertible Debentures”. When the full amount of debenture is convertible into shares such debentures are called “Fully Convertible Debentures”. SEBI guidelines require that where the conversion is to be made at or after 18 months from the date of allotment but before 36 months any conversion in part or whole shall be optional on the part of the debenture holders. Convertible debentures are very popular these days, as they provide liquidity, safety capital appreciation and assured return to the investors.

Question 6.

Write the difference between shares and debentures.

Answer.

Distinction Between Shares and Debentures

|

S.No. |

Basis of Distinction | Share | Debenture |

| 1. | Capital Vs Loan | A share is the part of capital of the company therefore the shareholders are the owner of the company. | A debenture is a part of the loan and as such the debenture holders are the creditors of the company. |

| 2. | Dividend Vs Interest | A shareholder gets dividend from the company. | A debenture holder gets interest from the company. |

| 3. | Fluctuating or fixed rate of dividend or interest | Dividend is paid only when there are profits. The rate of dividend may fluctuate from year to year depending upon the profits and decision of the directors. | The rate of interest is fixed and it must be paid irrespective of the company making a profit or incurring a loss. |

| 4. | Voluntary or compulsory redemption | It is at the option of the company to return the amount of shares by buying back its own shares. | The amount of debentures must be returned according to the terms of the issue. |

| 5. | Priority of repayment of principal in case of winding up | In case of winding up the payment of share capital is made after the repayment of debentures. | In case of winding up the payment of debentures is made before the payment of share capital. |

| 6. | Unsecured or secured | A share is always unsecured hence, they bear more risk. | Debentures are usually secured on the assets of the company. Hence, they bear little risk. |

| 7. | Restriction on issue at discount | Under Section 53 of the Companies Act, 2013, shares cannot be issued at discount except sweat equity shares. | There are no restrictions on the issue of debentures at discount. |

| 8. | Voting rights | Shares confer son its holder the right to participate in and vote at company’s meetings. | A holder of debenture neither possesses any voting right in the company’s meeting nor can be participate in the meeting. |

RBSE Class 12 Accountancy Chapter 5 Numerical Questions

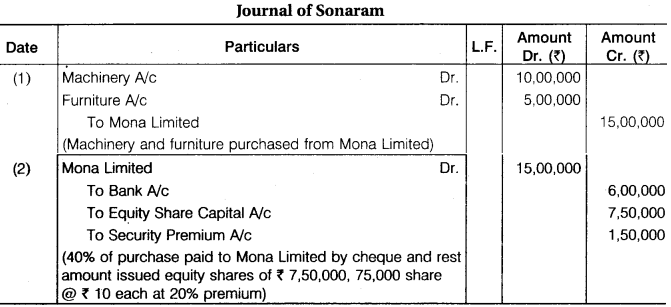

Question 1.

Sona Ltd. purchased machinery of Rs 10,00,000 and furniture of Rs 5,00,000 from Mona Ltd. Sona Ltd. paid 40% of the amount by the cheque and for the balance amount by issue equity shares of Rs 10 each at a premium of 20%. Pass necessary journal entries to record the above transactions in the books of Sona Ltd.

Solution:

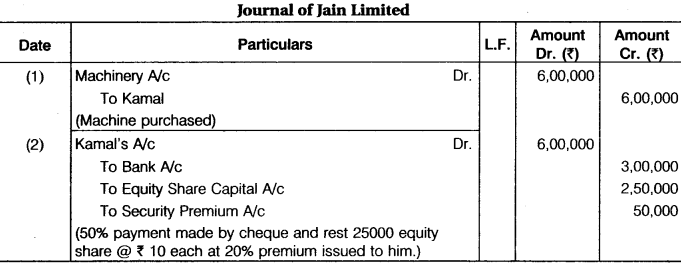

Question 2.

Jain Ltd. purchased a machine of Rs 6,00,000 from Kamal, 50% of the payment was made by cheque and for the remaining the company issued equity share of Rs 10 each at a premium of 20%. Give necessary journal entries in the books of Jain Ltd. for the above transactions.

Solution:

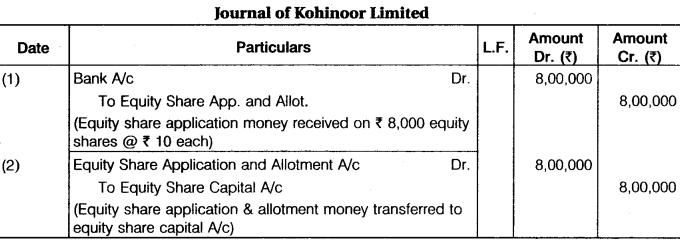

Question 3.

The authorised capital of Kohinoor Ltd. was Rs 10,00,000 which is divided into Rs 10,000 equity shares of Rs 100 each. Out of these shares 8,000 equity shares were issued to the public. The full nominal value if payable on application. All the shares were subscribed by the public and total amount was paid for. Give necessary journal entries in the books of Kohinoor Ltd.

Solution:

Question 4.

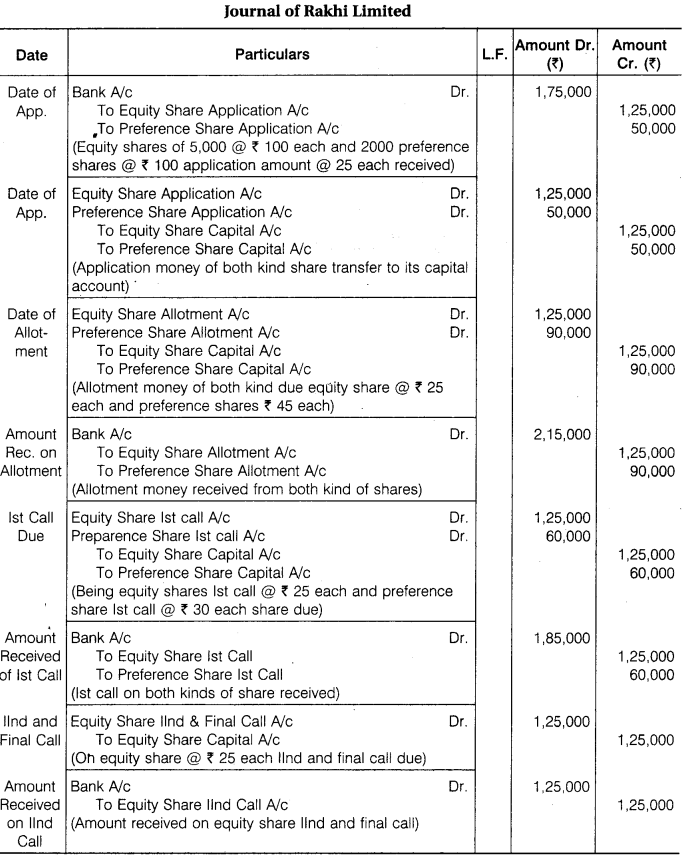

Rakhi Ltd. was registered with an authorised capital of Rs 20,00,000 divided into Rs 12,000 equity shares of Rs 100 each and Rs 8,000, 8% Preference shares of Rs 100 each. 5,000 Equity shares and 2,000 preference shares were offered to public on the following terms :

| Equality Share(Rs) | Preference Share(Rs) | |

| Payable on application per share | 25 | 25 |

| Payable on allotment per share | 25 | 45 |

| Payable on first call per share | 25 | 30 |

| Payable on second and final call per share | 25 |

All the shares were applied for and allotted. All money was duly received. Give necessary journal entries to record the above transactions in the books of Rakhi Ltd. and show the share capital in the balance sheet.

Solution:

Question 5.

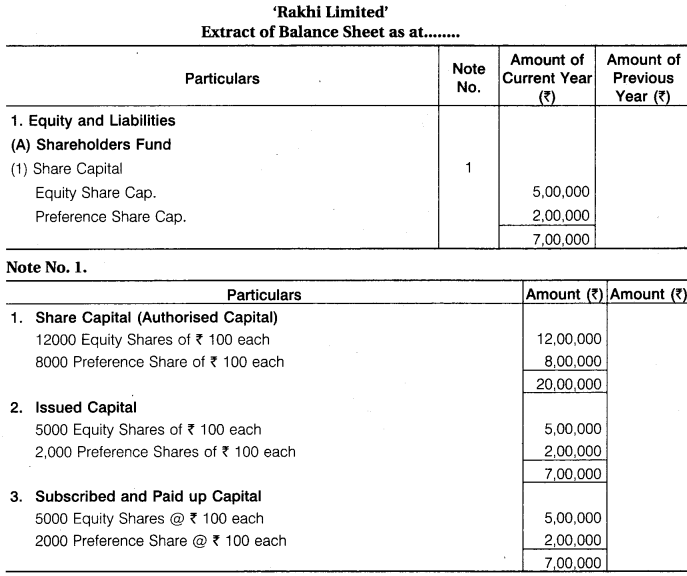

Gajendra Ltd. offered for subscription Rs 30,000 equity shares of Rs 10 each to public. Per share amount was payable as follows:

On application Rs 3, on allotment Rs 4 and balance as and when required. Applications were received for Rs 50,000 shares. No share was allotted to the applicants of Rs 10,000 shares, their application money was refunded. Share were allotted to remaining applicants on pro-rata basis, allotment money was received in due time. Give journal entries for above transactions and prepare the Balance Sheet.

Solution:

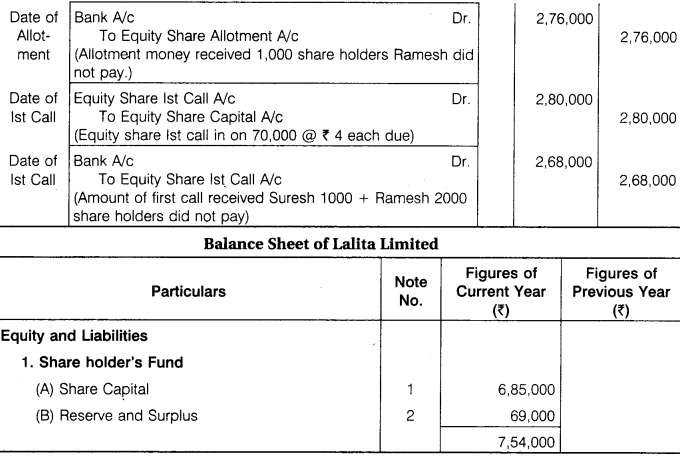

Question 6.

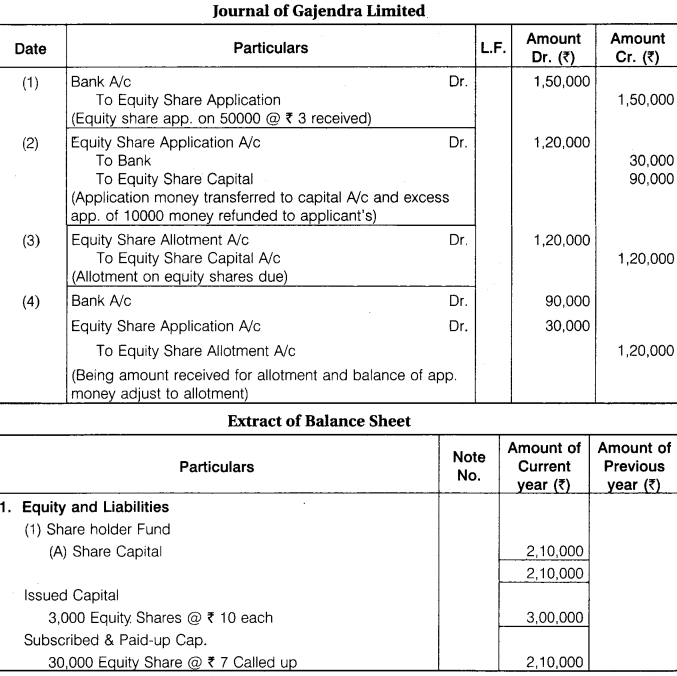

Lalita Ltd. was established with an authorised capital of Rs 10,00,000 divided into Rs 1,00,000 equity shares of ? 10 each. Company issued Rs 75,000 shares to the public at Rs 11 per share, which was payable as follows :

Rs 3 on application, Rs 4 (including premium) on allotment and balance on first and final call. Applications were received for 70,000 shares from public. Ah the amount were received in time except the following :

Ramesh who holds Rs 1,000 shares, failed to pay the allotment and first and final call money. Suresh holds Rs 2,000 shares, failed to pay first and final cash money. Record the above transactions in the cash book and journal of the company and prepare Balance Sheet.

Solution:

Question 7.

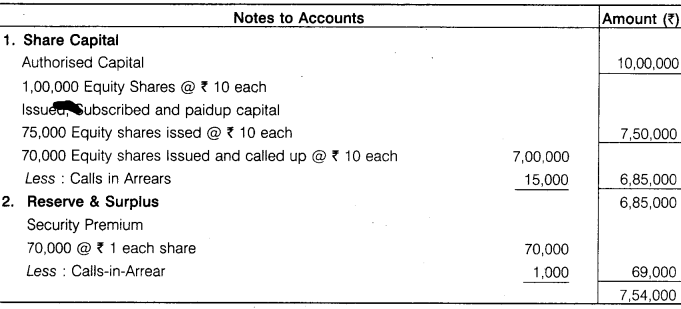

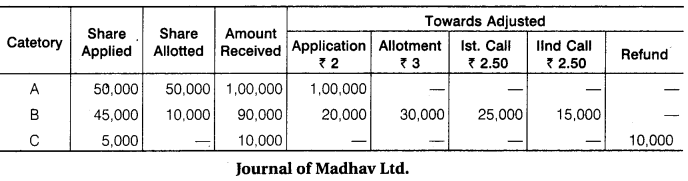

Madhav Ltd. issued Rs 60,000 shares of Rs 10 each to the public, which were payable as follows :

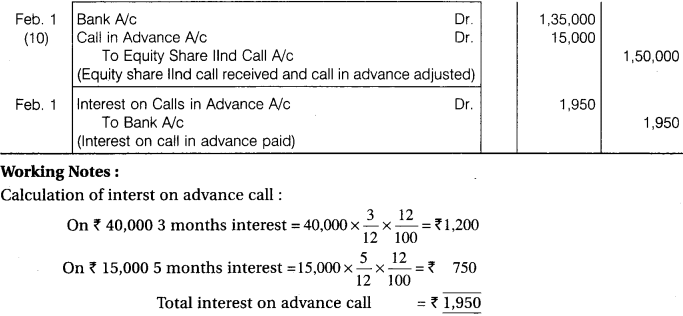

On application Rs 2 (payable on 1st April, 2017), on allotment Rs 3 (payable on 1st June, 2017), on first call Rs 2.5 (payable on 1st September, 2017) and on second and final call Rs 2.5 (payable on 1st February, 2018). Applications were received for 1,00,000 shares and allotment was made as under. To application for 5,000 shares-full; to applicants for 45,000 shares-10,000 shares and to applicants for 5,000 shares nil. Excess money received on application was utilized towards allotment and subsequent calls. Interest on call-in-advance was paid as per Table F. Give journal entries to record the above transactions, assuming all amount due were received in time.

Solution:

Question 8.

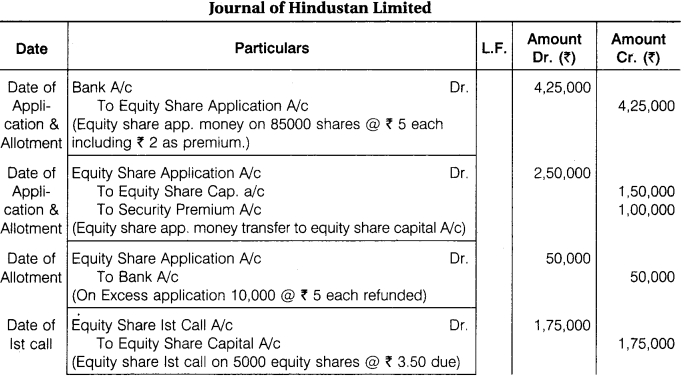

Hindustan Ltd. issued 50,000 equity shares of Rs 10 each at Rs 2 per share premium, to the public, which were payable as follows :

On application and allotment Rs 5 per share (including premium)

On first call Rs 3.5 per share

On second and final call Rs 3.5 per share

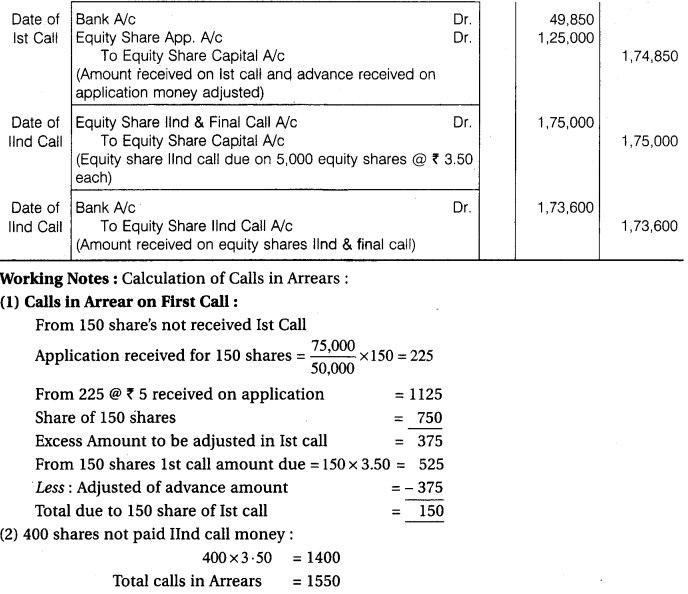

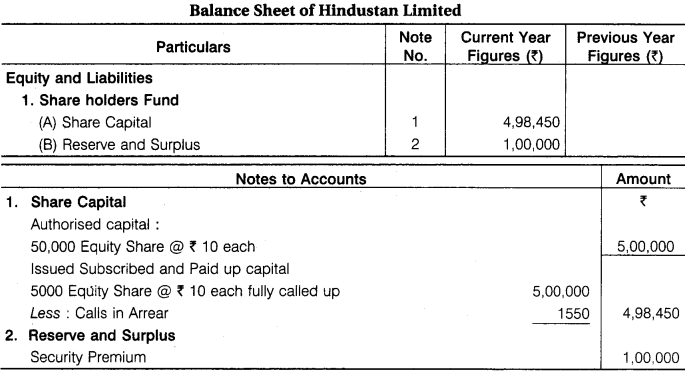

Applications were received for 85,000 shares, applications for 10,000 shares were refused and application money thereon were returned. Shares were allotted to remaining applicants on pro-rata basis. Allotment money was adjusted on the sums due on first call. First call was not received on 150 shares. Second and final call money was not received on 400 shares. Give journal entries in the books of Hindustan Ltd. and show the share capital in the balance sheet.

Solution:

Question 9.

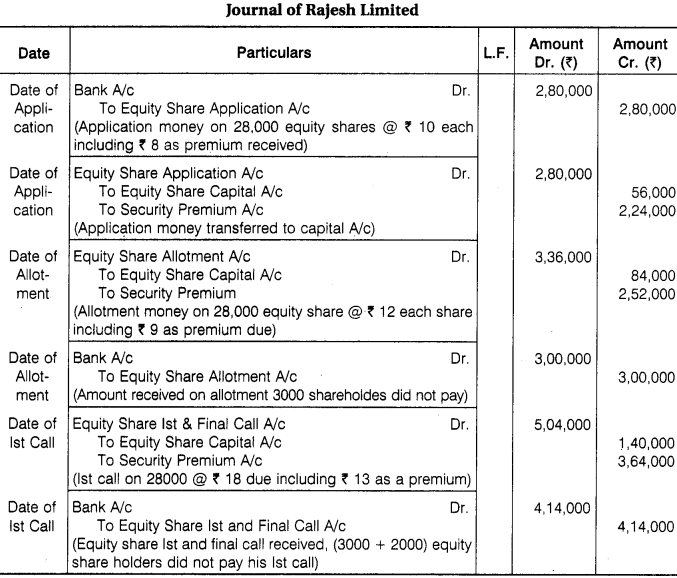

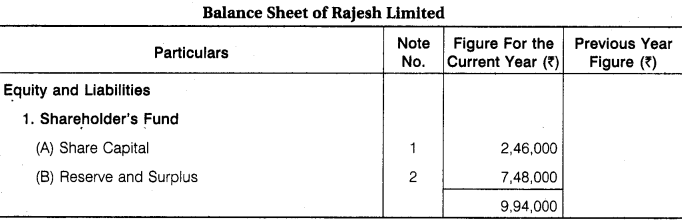

Rajesh Ltd. invited applications for issuing 30,000 equity shares of Rs 10 each at a premium of Rs 30 per share. The amount was payable as follows:

On application Rs 10 per share (including Rs 8 premium); on allotment Rs 12 per share (including ? 9 premium); on first and final call-balance : Applications for 28,000 shares were received. All the calls were made and were duly received except on 3,000 shares held by Hari, who failed to pay allotment and first and final call money and on 2,000 shares held by Om who did not pay the first and final call. Give necessary journal entries in the books of Rajesh Ltd. and show the times in the balance sheet

Solution:

Question 10.

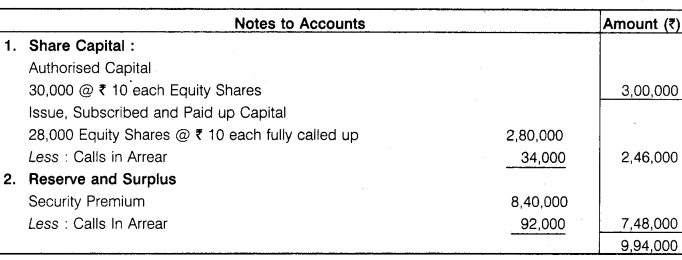

Modern Ltd. offered to public 10,000 equity shares of Rs 10 each at Rs 11 per share. Amount was payable as follows :

On application Rs 3; on allotment 4 (including premium) and on first and final call Rs 4. Applications were received for 12,000 shares and directors allotted on pro-rata basis.

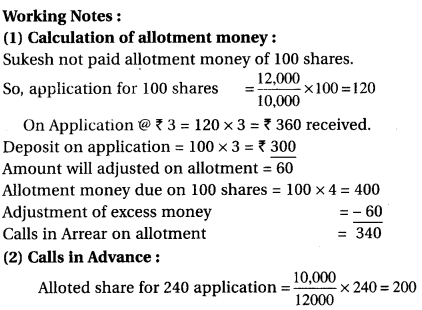

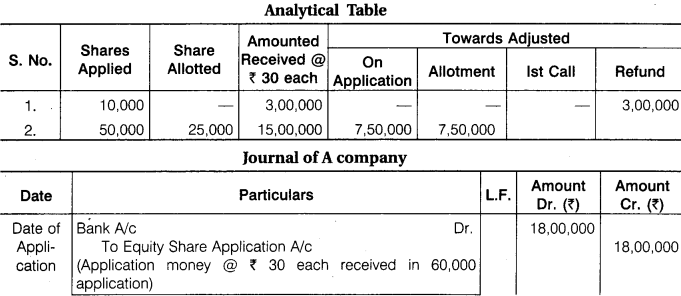

Rakesh, who applied for 240 shares paid call money along with allotment money. Sukesh to whom 100 shares were allotted paid allotment money along with call money. Give necessary journal entries.

Solution:

200 shareholders had paid their 1st call on the time of allotment, it means advance payment. So, Calls in Advance = 200 x 4 = 800

Question 11.

Agrasen Ltd. offered 20,000 equity shares of Rs 10 each of public for application on these payment was payable as follows :

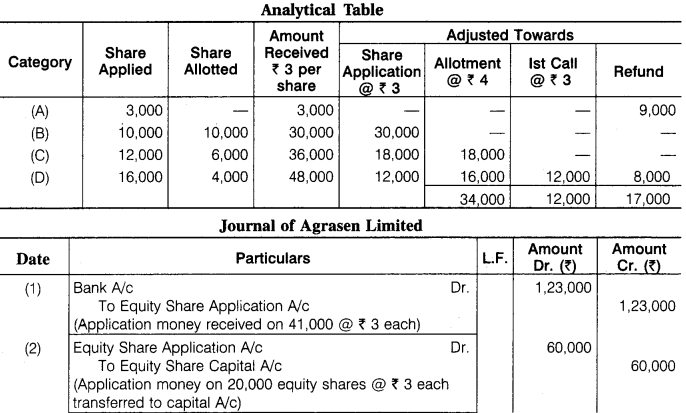

Rs 3 on application, Rs 4 on allotment and Rs 3 on first and final call. Applications were received for 41,000 shares and allotment was made as follows applicants of 3,000 shares were allotted non-shares, applicants of 10,000 shares were allotted 100 percent shares, Applicants of 12,000 shares were allotted 50 percent shares and applicants of 16,000 shares were allotted 25 percent shares. Excess money received on application was adjusted on allotment and call money. The applicants to whom no shares were allotted, application money was refunded, all money was received in time. Give journal entries in the books of company.

Solution:

Question 12.

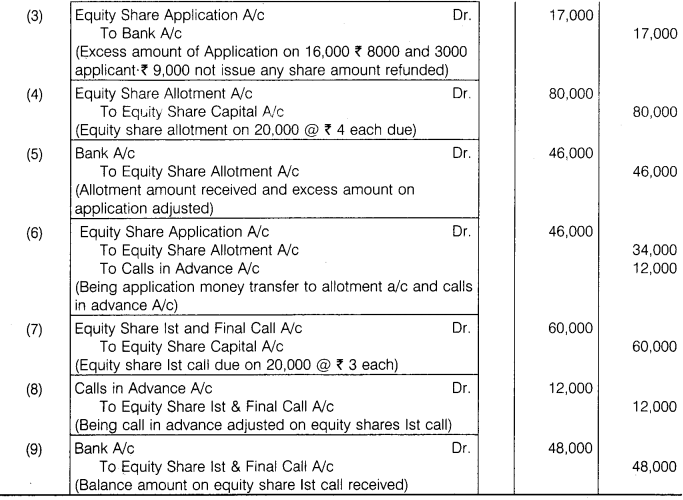

A company issued 25,000 equity shares of Rs 100 each to public. Amount on shares were payable as follows :

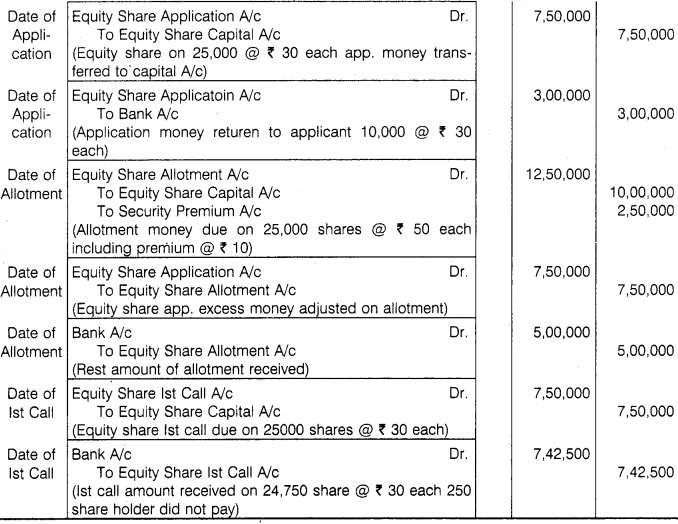

(a) Rs 30 on application, (b) Rs 50 (including premium) on allotment, (c) Rs 30 on first and final call. Applications were received for 60,000 shares. No share was allotted to the applicants of 10,000 shares and their application money was refunded. Remaining applicants were made pro-rata allotment. Ganesh, to whom 250 shares were allotted failed to pay first and final call money, other shareholders has paid with in time. Give journal entries for above transactions in the books of the company.

Solution:

Question 13.

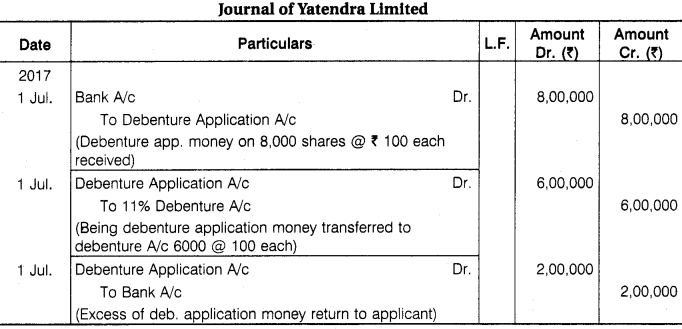

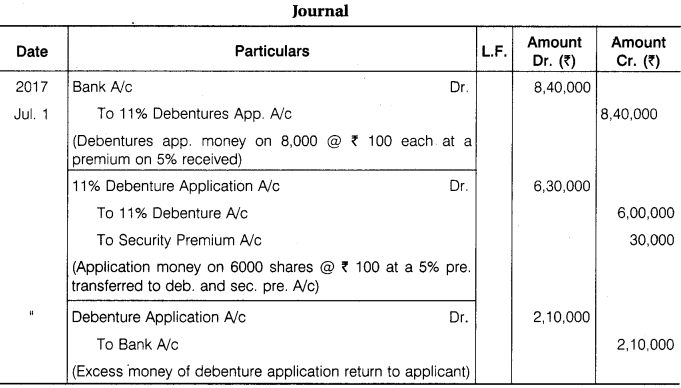

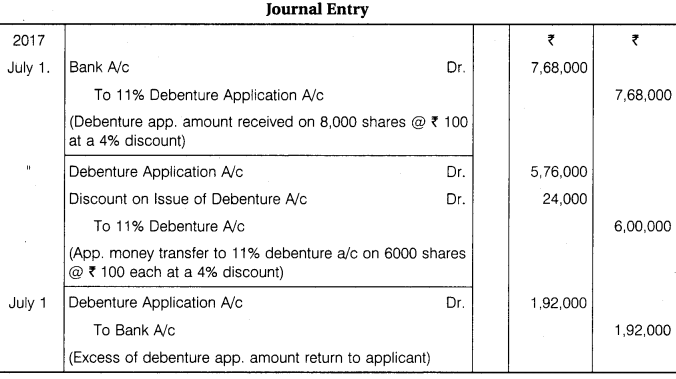

Yatendra Ltd. issued 6,000, 11% Debentures of Rs 100 each to the public. Whole of the amount was payable on application on 1st July, 2017. The company received applications for 8,000 debentures. The directors made pro-rata allotment on 31st July, 2017 and refunded the excess application money. Give necessary journal entries in the books of the company, if debentures are issued

(i) at par,

(ii) at 5% premium,

(iii) at 4% discount.

Solution:

(i) If debenture issued at par:

(ii) If debenture issued at 5% premium:

(iii) When debenture are issue on 4% discount:

Question 14.

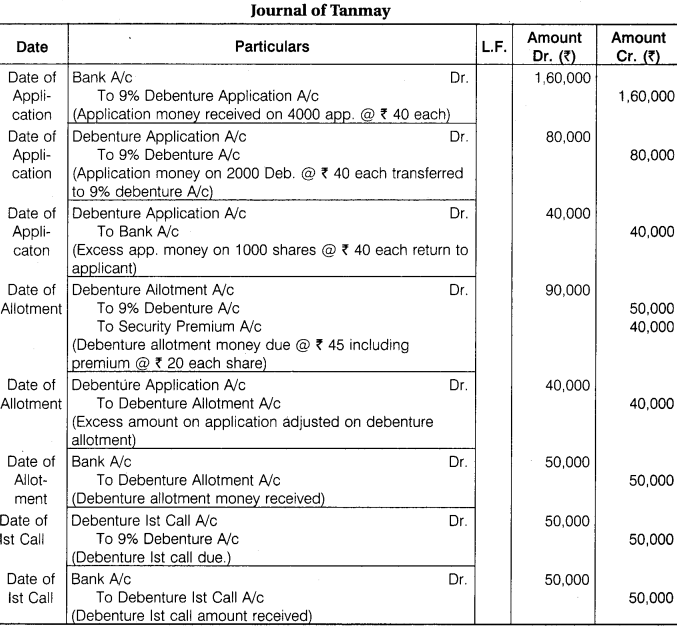

Tanmay Ltd. issued 2,000, 9% Debentures of Rs 100 each at 20% premium, payable as follow :

Rs 40 on application, Rs 45 (including premium) on allotment and balance on first and final call, Applications were received for 4,000 debentures. Applicants for 1,000 debentures were refused to allot debentures and 2,000 debentures were allotted among remaining applicants. Excess application money was adjusted on allotment. All the amount was received in time. Give necessary journal entries.

Solution:

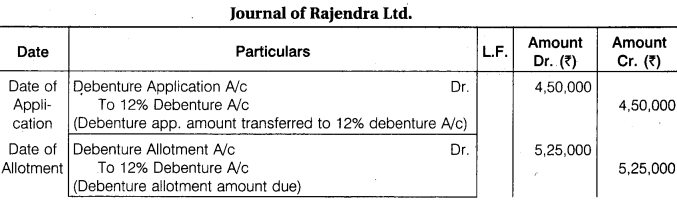

Question 15.

Rajendra Ltd. issued 15,000, 12% Debentures of Rs 100 each at a discount of 5% payable as follows :

30% on application, 35% on allotment and balance on first and final call. Applications were received for whole of the debentures and debentures were allotted. All the amount was received in time except one debenture holder, whole hold 500 debentures did not pay the first and final call. Give entries in journal and cash book of the company.

Solution:

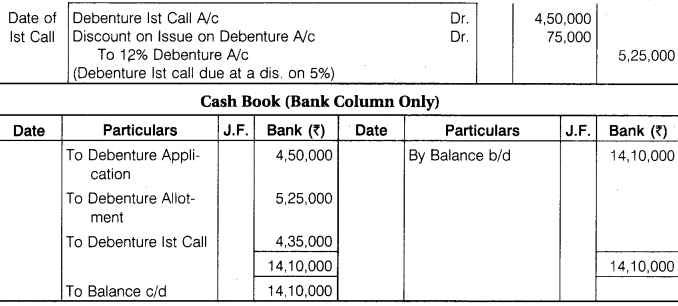

Question 16.

Vishnu Ltd. purchased the business of Vipin with the assets of Rs 12,00,000 and liabilities of Rs 1,92,000. Purchase consideration was paid by issuing 7% Debentures of Rs 100 each. Give journal entries in the books of Vishnu Ltd. for purchase of business and issue of debentures, if debentures are issued (A) at par, (B) at 5% premium, (C) at 4% discount.

Solution:

Question 17.

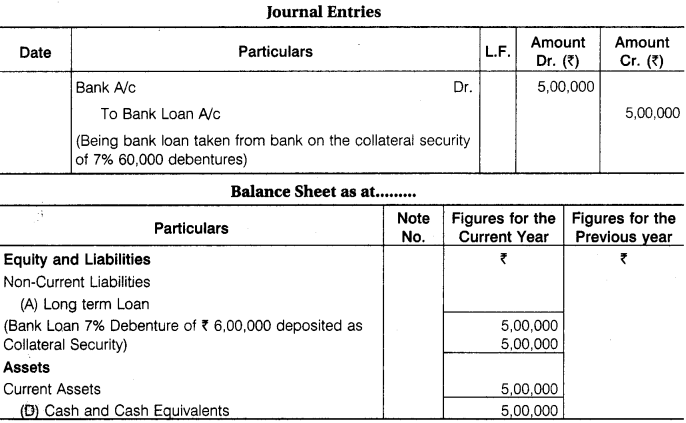

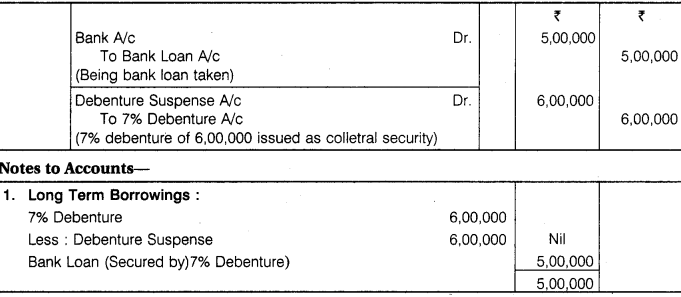

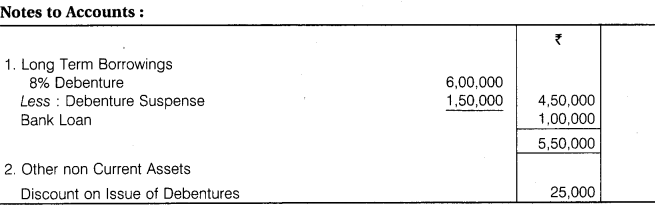

Gajendra Ltd. took a loan of Rs 5,00,000 from Bank of India and put 7% Debentures of Rs 6,00,000 to the bank as collateral security. Give journal entries in the books of Gajendra Ltd. and draw balance sheet. If

(i) no entry was made,

(ii) entry was passed for issue of debentures as collateral security.

Solution.

(i) If no entry made on issue of debenture:

(ii) If entry made on issue of debenture:

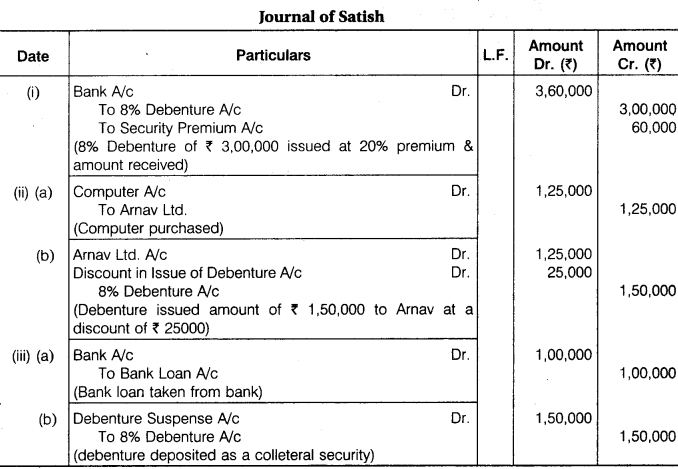

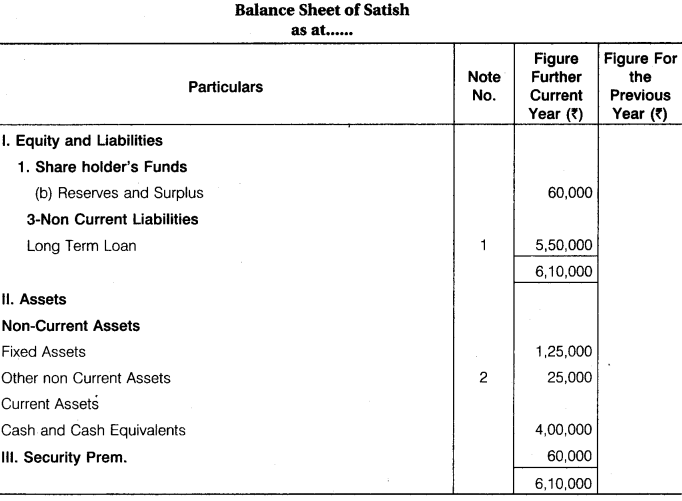

Question 18.

Satish Ltd. issued 8% Debentures Rs 6,00,000 as follows :

(i) 8% Debentures of Rs 3,00,000 at 25% premium for cash,

(ii) A computer of Rs 1,25,000 purchased from Amar Ltd., for the consideration of it, issued 8% debentures with a nominal value of Rs 1,50,000.

(iii) Taken a loan of Rs 1,00,000 from bank deposited to the bank, 8% Debentures of Rs 1,50,000 as collateral security.

Give journal entries in the books of Satish Ltd. and prepare Balance Sheet.

Solution:

Question 19.

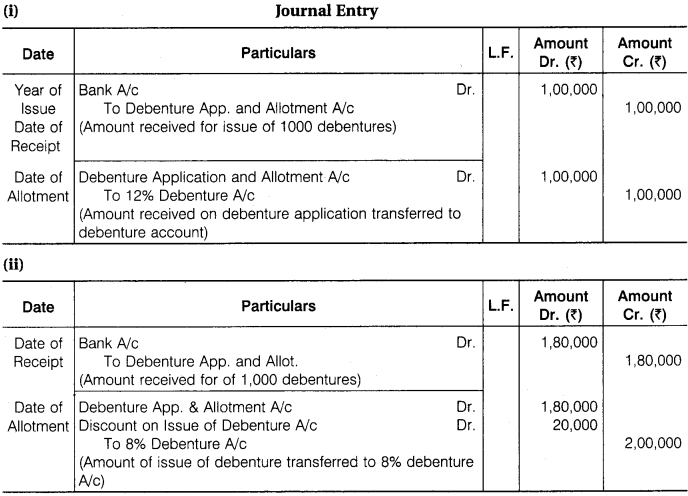

Give necessary journal entries for issue of debentures in the following cases :

(I) A company issued 1,000, 12% Debentures of Rs 100 each at par, redeemable at par.

(II) A company issued 2,000, 8% Debentures of Rs 100 each at discount of 10%, redeemable at par.

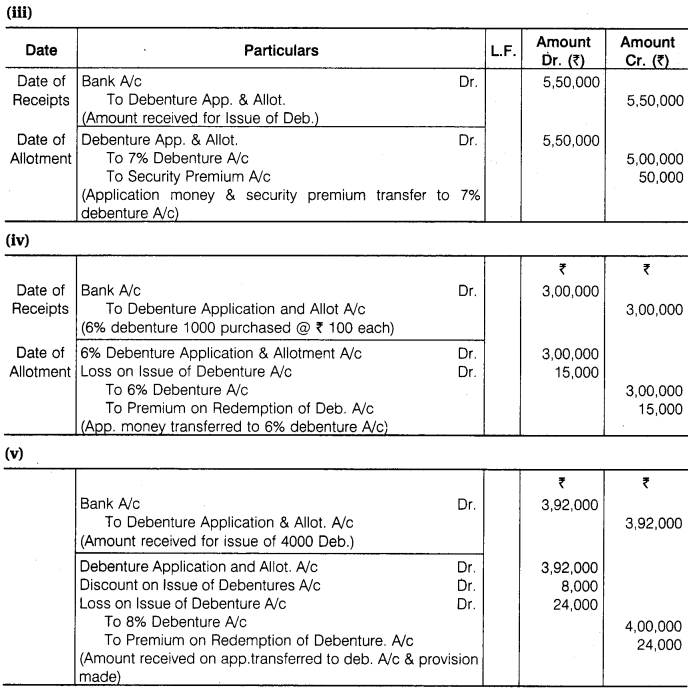

(III) A company issued 5,000, 7% Debentures of Rs 100 each at a premium of 5%, redeemable at par.

(IV) A company issued 3,000, 6% Debentures of Rs 100 each at par, redeemable at 5% premium.

(V) A company issued 4,000, 8% Debentures of Rs 100 each at a discount of 2%, redeemable at 6% premium.

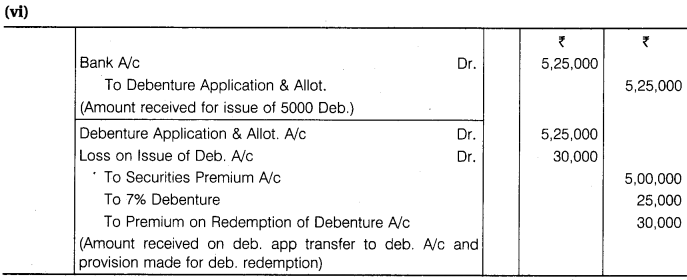

(VI) A company issued 5,000, 7% Debentures of Rs 100 each at a discount of 5%, redeemable at 6% premium.

Solution.

Question 20.

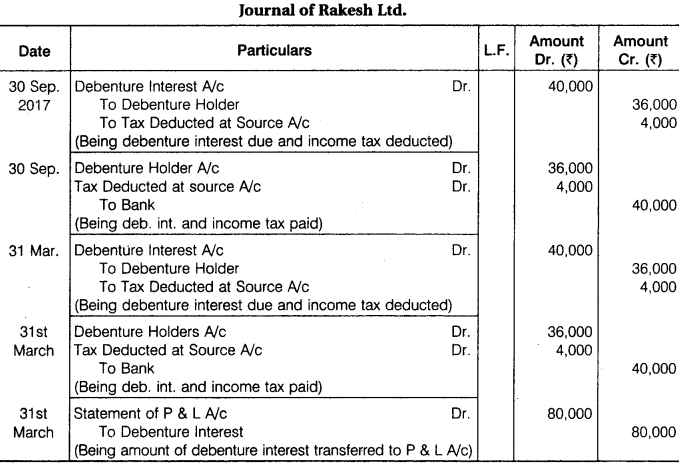

Rakesh Ltd. offered to public 12% Debentures of Rs 8,00,000, Rs 100 each. Whole amount was payable on application on or before 1st May, 2017. As per term of issue debentures interest was payable half yearly basis on 30th September and 31st March each year, after deducting income tax at the rate of 10%. Public offered to purchase 8,000 debentures. Company made allotment of debentures on 01st June, 2017. Give journal entries in the books of the company for payment of debentures interest for the year 2017-18 and transferred it to statement of profit and loss.

Solution:

Question 21.

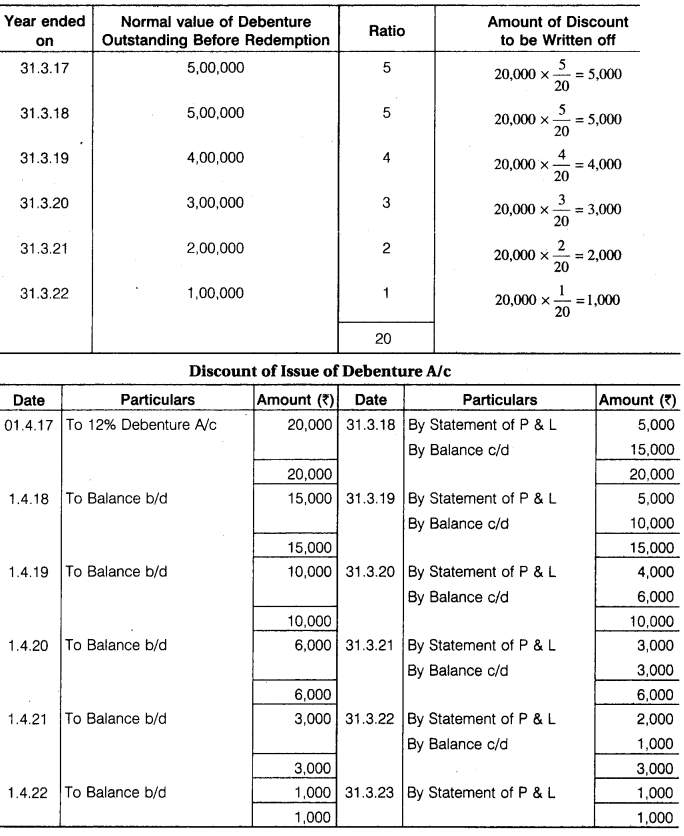

Z Ltd. issued 5,000, 12% Debentures of Rs 100 each at a discount of 4% on 1st April, 2016. The debentures were repayable by annual drawings of Rs 1,00,000 starting on 31st March, 2018. Calculate the Amount of Discount to be written off each year and also prepare Discount on Debentures Account in the banks of the company.

Solution:

Statement of Showing Amount of Discount to be written off