Make use of our RBSE Class 12 Accountancy Notes here to secure higher marks in exams.

Rajasthan Board RBSE Class 12 Accountancy Notes Chapter 1 General Introduction of Partnership

Meaning and Definition of Partnership:

“A type of business or organization in which two or more individuals pool money, skills and other resources and share profit and loss in accordance with term of partnership agreement called partnership.”

The persons who have established the business individually are called partner and collectively a firm. According to Indian Partnership Act, 1932 Section (4), “Partnership is the relation between persons who have agreed to share the profit of a business carried on by all or any one of them acting for all.”

According to Sir Frederik Palak, “Partnership is an agreement between two or among those persons who have state to share profit by someone from all side and by all acting in business.”

Need of Partnership:

There are certain limitations of a sole trader. In a sole trading concern only one man invests capital, undertakes the risk involved in the business and controls the whole affairs of the business. But one man’s capital, skill, controlling and risk taking capacity are generally limited. Therefore, some persons may combine and enter into an agreement to form a partnership.

Characteristics of Partnership:

The essential characteristics of partnership are :

1. Two or More than Two Persons: There must be at least two persons to form a partnership and all such persons must be competent to contract. According to Indian Contract Act, 1872, every person except the following is competent to contract:

- Minor

- Persons of unsound mind

- Persons disqualified by any law.

Section 464 of the Companies Act, 2013 empowers the government to prescribe maximum numbers of partners in a firm subject to be 50 vide rule 10 of the Companies (Miscellaneous) Rules, 2014.

2. Agreement Among Partners : Partnership is the result of an agreement. It must come into existence by an agreement and not by the operation of law. On the contrary, a Hindu undivided family comes into existence by the operation of law and not by an agreement. Such an agreement can be either oral or in written. The agreement forms the basis of mutual rights and duties of partners.

3. Sharing of Profit : The agreement between/among the partners must be to share profits or losses of the business. It is not essential the all the partners must share losses also. There may be a provision in the partnership deed that a particular partner or partners shall not bear the losses.

4. Carrying of Business : Agreement among partners should be for carrying on of a business the purpose of which should be to share profits. To be a co-owner of a property is not a partnership.

5. Business Carried on by Ail or Any of them Acting for All : It means that each partner can participate in the conduct of business and each partner is bound by the acts of other partners in respect to the business of the firm.

6. Responsibility of Partners : Every partner is liable jointly and separately for all the acts of the firm. The liability of all partners cannot limited.

7. Relationship of Principal and Agent : Each partner is an agent as well as a partner of the firm. An agent, because he can bind the other partners by his acts and a principal because he himself can be bound by the acts of the other partners.

8. Mutual Agency : The business of a partnership concern may be carried on by all the partners or any of them acting for all. This statement has two important implications. First, every partner is entitled to participate in the conduct of the affairs of its business. Second, that there exists a relationship of mutual agency between all the partners.

Each partner carrying on the business is the principal as well as the agent for all the other partners. He can bind other partners by his acts and also is bound by the acts of other partners with regard to business of the firm. Relationship of mutual agency is so important that can one say that there would be no partnership if the element of mutual agency is absent. ‘

9. Unlimited Liabilities : In partnership each partner has unlimited liabilities.

10. No separate Existence : There is no separate existence of partners from partnership. So, all agreements of the firm apply on the firm as well as on each partner individually or collectively.

![]()

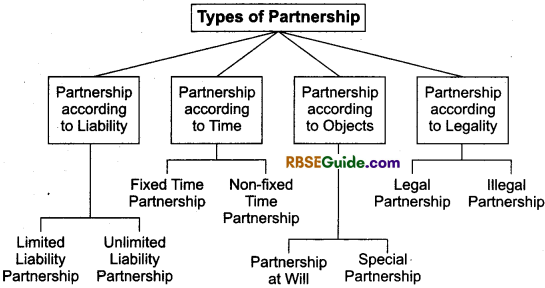

Types of Partnership:

1. Limited and Unlimited Partnership : When liability of a partner is limited to the extent of his contribution in the firm, it is called Limited Partnership.On the other hand, when all the partners of the firm are individually and collectively responsible for discharging the liabilities of the firm then it is called Unlimited Partnership.

2. Fixed Time Partnership and Non-fixed Time Partnership : When a partnership is formed for some specific period, for example; for 2 years, 5 years or so on, it is called Fixed Time Partnership. In this case, the partnership is dissolved as soon as that specific period expires. When no period is fixed for partnership, it is called Non-fixed Time Partnership.

3. Partnership at Will and Special Partnership : When a partnership is formed to carry on business for an uncertain period, it is called Partnership at Will. Such partnership may be dissolved with the consent of all the partner or by any one partner giving notice for dissolution.

When a partnership is formed for a specific purpose or specific work, it is called Specific or Special Partnership. The partnership under this case the partnership, is automatically dissolved as soon as the work is completed. For example, to undertake construction of road, dam, bridge etc.

4. Legal and Illegal Partnership : Although, registration of a partnership is not compulsory yet is has to carry on its business as per the Provisions of Partnership Act. For example; minimum number of partners must be 2 and maximum number of partners not more than 50 in a firm. When a partnership firm carries on its business in accordance with the provisions of the act, it is called Legal Partnership.

On the other hand, the partnership is called Illegal in the following cases :

- When number of partners less than 2 or more than 50 in a firm.

- When the object of partnership is illegal.

- When the business of partnership is against the public code of conduct.

- When any one or more than one partner belongs to enemy country.

Partnership Deed:

Partnership begins with a verbal or written agreement between partners. Such a written document contains the terms of agreement is called partnership deed. It is also called “Articles of Partnership”.

Main Contents in Partnership Deed :

- The name and address of the firm

- Name and address of the partners

- The type and nature of the business the firm proposes to do

- Amount of capital to be contributed by each partner

- Interest on capital

- Amount of drawings

- Interest on drawings

- Profit sharing ratio

- Salary, commission, bonus of the partner

- Goodwill

- Accounting period of firm

- Method of recording of firm’s accounts

- Auditing

- Date of commencement of partnership

- Duration of partnership

- Bank accounts operation

- Rules to be followed in case of admission of a partner

- Rules to be followed while settling the accounts on retirement

- Settlement of disputes

- Death of a partner

- Methods and conditions of dissolution of the firm

- Use of the decision of Garner vs. Murray. .

- Registration of firm

- Terms and conditions at the time of insolvancy of a partner.

- Rights, duties and liabilities of a partner should be mentioned in partnership deed.

Rules Applicable in the Absence of Partnership Deed:

In the absence of partnership deed in written or oral, the provisions affecting of Indian Partnership Act, 1932 are applicable. The important rules are as follows :

- Profits and losses are to be shared equally irrespective of their capital contribution.

- No interest on capital is to be paid, nor charged on drawings.

- No salary, commission or bonus is payable to partners for doing extra work.

- Interest on loan is to be given at 6% per annum on amount advanced by any partner to the firm.

- Every partner can take part day to day business operations of the firm. Every partner has access to books of accounts of the firm.

- A new partner can be admitted at the consent of all partners.

- Firm’s property/ assets will not be personally use by any partner.

Capital Accounts of Partners :

There are two methods to keep capital accounts of partners :

1. Fixed Capital Account Method : Fixed capital means capital of the partners are fixed. There is no change in the capital brought by them. In this situation the capital accounts of the partners is called fixed capital accounts. When fixed capital method is followed, two accounts, a capital account and a current account for each partner is maintained.

(A) Partner’s Capital Account : Fixed capital means that the capital remains unaltered, fixed unless additional capital is introduced or withdraw is made from the existing capital. Thus, if fresh capital is not introduced or capital is not withdrawn, capital account of a partner will continue to show same balance year after years.

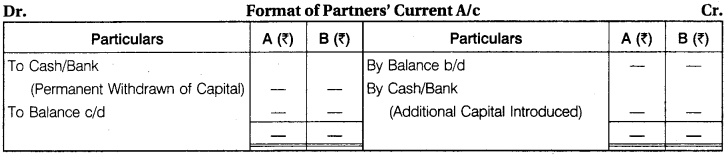

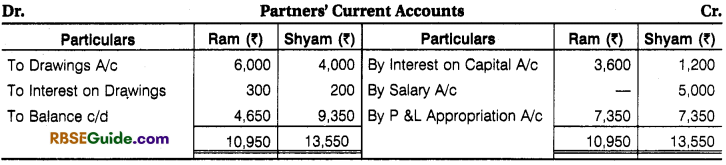

(B) Partners Current Account :

Current account is maintained to record transactions other than introduction and withdrawal of capital, such as interest on capital, interest on drawings, salary or commission to a partner, share of profits/losses. As a result, the balance of current account fluctuates with every transaction with the partner.

Current account of each partner is debited with :

(a) Drawings made by him

(b) Interest on drawings

(C) Share of loss

(d) Transfer of any amount to capital account permanently.

Similarly, current account of each partner is credited with :

(a) Interest on capital

(b) Salary or commission

(c) Share of profit

(d) Transfer of any amount from capital account permanently.

![]()

Normally, partners’ current account has a credit balance but if a partner has drawn more than his or her share of the profits, then it will have a debit balance. The balances of the partners’ capital account are shown on the liabilities side of the balance sheet, as that much amount is due on them. Credit balance in current account is shown on the liabilities side and debit balance on the assets side of balance sheet.

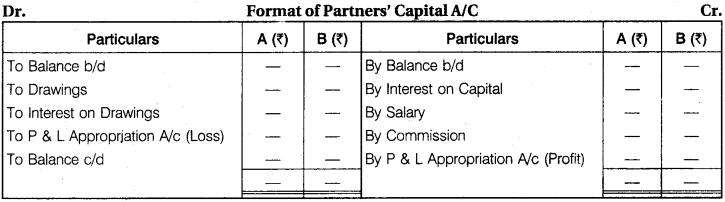

2. Fluctuating Capital Account Method : When the capitals are fluctuating, the balances in capital accounts go on changing from time to time called fluctuating capital method. Under fluctuating capital account method only one account namely is “capital account” is maintained for each partner.

All transactions of a partner (e.g., salary or commission, interest allowed on capital, drawings, interest charged on drawings, share of profit or share of loss etc.) are recorded in his capital account. As a result, balances in the capital account fluctuates with every transaction.

Capital account Having credit balances are shown on the liabilities side while capital accounts having debit balances are shown on the assets side of the balance sheet. Fluctuating capital method is normally followed for maintaining capital accounts and therefore, in the absence of any instruction, this method should be followed for maintaining the partners’ capital account.

Notes:

1. If there is no information in question of maintaining method of Partner’s Capital Account it should assumed that Partner’s Capital Account should maintain by Fluctuating Capital Method.

2. If in question, current account balance shown in Balance Sheet it is assumed that partner’s capital account maintained by Fixed Capital Method.

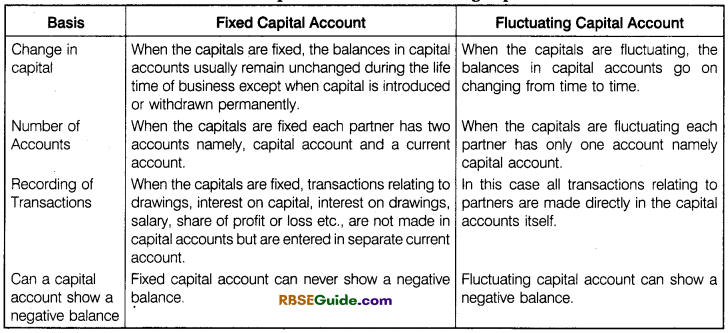

Difference between Fixed Capital Account & Fluctuating Capital Account Method :

Distribution of Profits/Losses among the Partners:

Profits or losses are distributed among the partners in predetermined ratio as per agreement. In the absence of agreement, the profits and losses are shared equally by all of them. There are certain appropriations of profit for interest on capital, salary, commission, bonus etc. which are to be made. As such, profit and loss appropriation account is prepared.

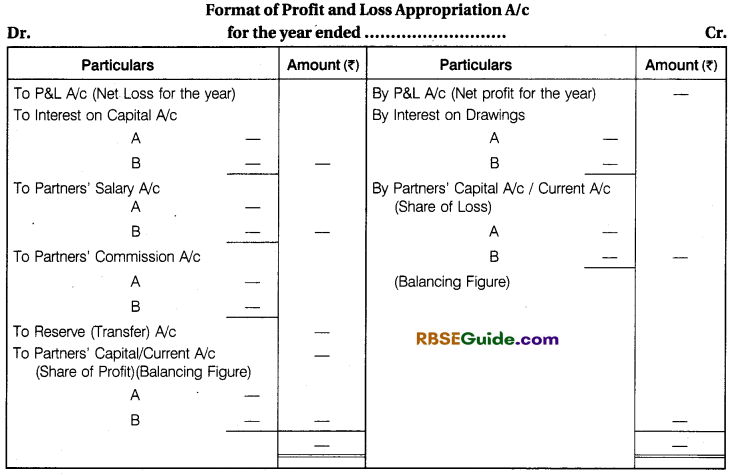

Profit and Loss Appropriation Accounts:

It is a nominal account. This account is credited with net profit and interest on drawings of the partners. It is debited with interest on Capital of Partner’s, Salaries, Commission, Bonus etc. of the partners. Sometimes, a certain sum or part of current years net profit is also to be transferred to reserve fund which will also appear on debit side of this account. The balance of net profit called distributable profit is divided among the partners in their predetermined profit sharing ratio.

Notes :

1. If in a question, net profit is given after charging certain items, it means those items should not be debited in profit and loss appropriation account, but shall be credited in partners’ capital/current account.

2. If in a question, net profit is given before charging certain items, then those items should be debited in profit and loss account and credited to partners’ capital/current account.

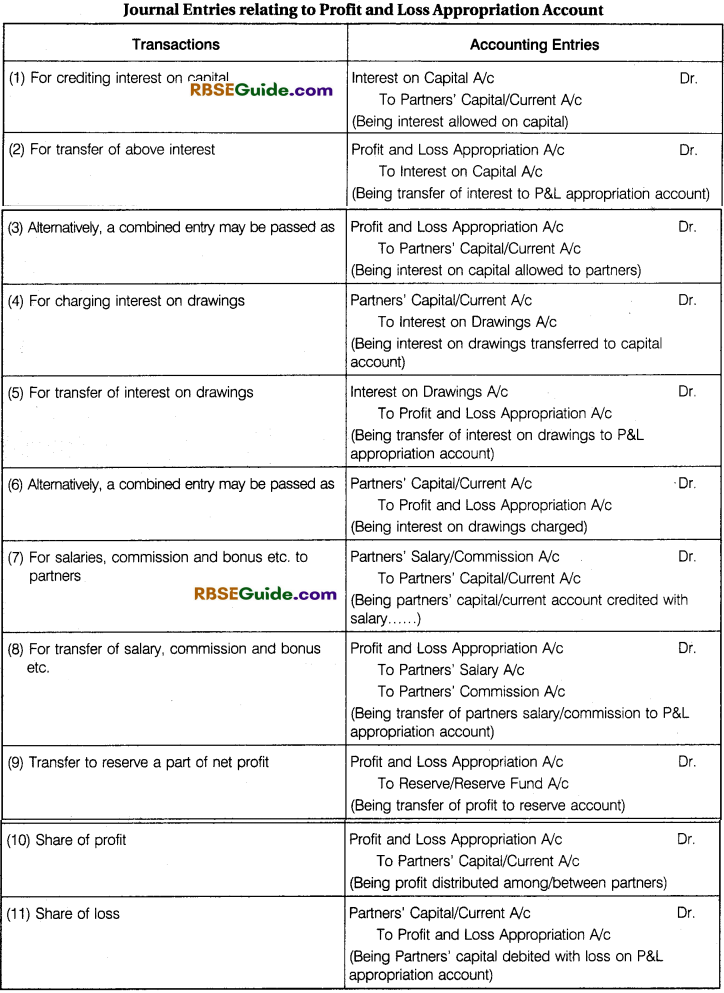

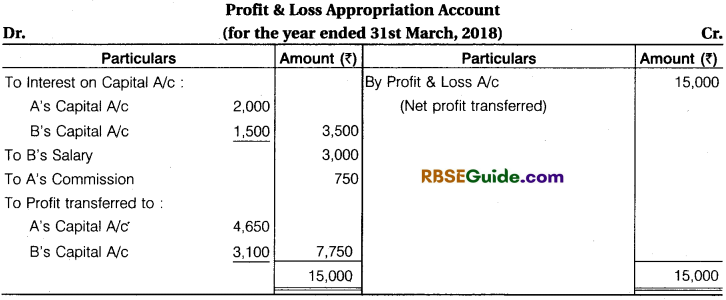

Illustration 1.

A and B are partners sharing profits in the proportion of 3 : 2 with capitals of ₹ 40000 and ₹ 30,000 respectively. Interest on capital is agreed @ 5% per annum. B is to be allowed an annual salary of ₹ 3,000 which has not been withdrawn. A provision of 5% of net profit is to be made in respect of commission to A. During the year ended 31st March, 2018, the net profit prior to these calculation amounted to ₹ 15,000.

Prepare an account showing the allocation of divisible profits on the basis of Journal entries and Partner’s capital accounts.

Solution:

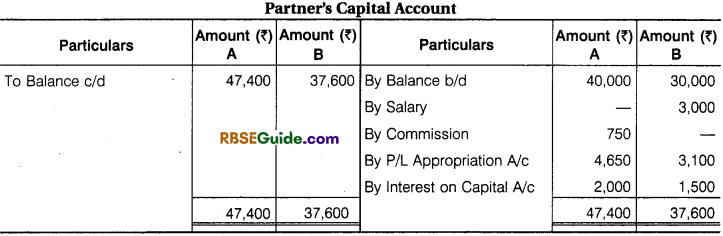

Illustration 2.

Monu and Sonu are partners in a firm sharing profits and losses in the ratio of 3 : 1. The profit & loss account of the firm for the year ending 31st March, 2018 shows a net profit of ₹ 1,50,000. Prepare Profit & Loss Appropriation Account and Current Accounts by taking into consideration the following information :

- Partners’ Capital on 1st April, 2017 : Monu ₹ 30,000; Sonu ₹ 60,000.

- Current accounts balances on 1st April, 2017: Monu ₹ 30,000 (Cr.); Sonu ₹ 15,000 (Cr.).

- Partner’s drawings during the year: Monu ₹ 20,000; Sonu ₹ 15,000.

- Interest on Capital was allowed @ 5% per annum.

- Interest on drawings was to be charged @ 6% per annum at an average of six months.

- Partner’s Salaries: Monu ₹ 15,000 and Sonu ₹ 10,000.

Solution:

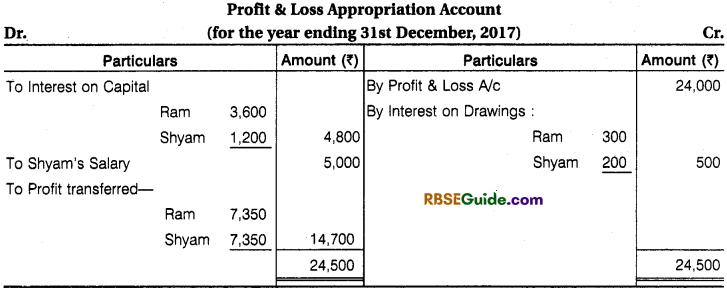

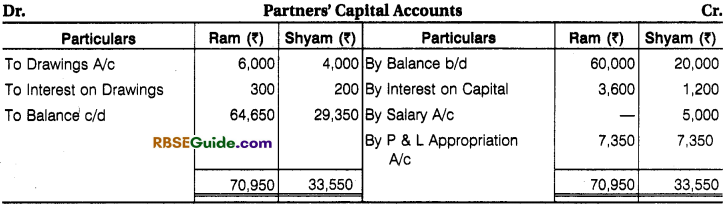

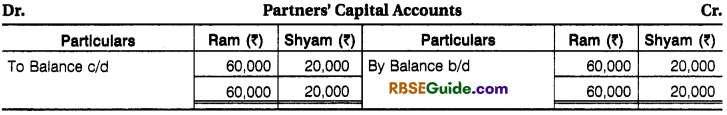

Illustration 3.

Ram and Shyam are partners with capital of ₹ 60,000 and ₹ 20,000 respectively on 1st January, 2017. The trading profit (taking into account the provisions of the Deed) for the year 2017 was ₹ 24,000. Interest on capital is to be allowed 6% p.a. Shyam is entitled to a salary of ₹ 5,000 p.a. The drawings of the partners were ₹ 6,000 and ₹ 4,000. The interest for drawings of Ram being ₹ 300 and for Shyam ₹ 200. Show how the profit will be divided between Ram and Shyam and also show the Capital Accounts

1. when Capital is Fluctuating

2. when Capital is fixed.

Solution:

1. When Capital is Fluctuating :

2. When Capital Is Fixed :

Interest on Partners’ Capital :

No partner is entitled to receive interest on capital unless it is expressly provided in partnership agreement. Usually, interest on capital is allowed in the following two cases :

- When partners’ capital are not equal but profit sharing ratio is equal.

- When partners’ capital are equal but profit sharing ratio is not equal.

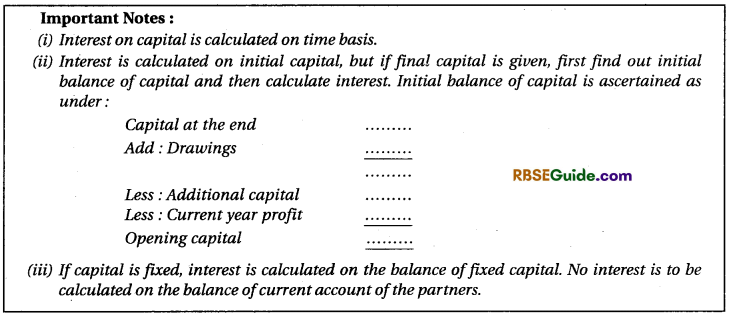

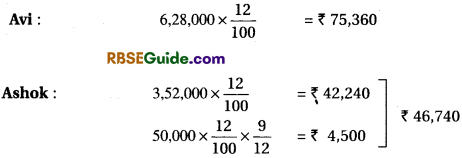

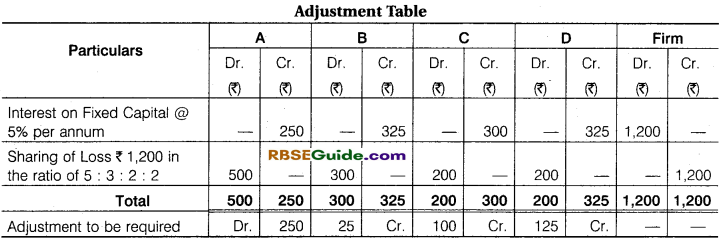

Calculation of Interest on Capital : Interest on capital is computed on the opening balances of the partners’ capitals. If additional capital is introduced by a partner during the year, interest is also allowed on it for the period, it has remained in business. The provisions regarding interest on capital are given below:

![]()

1. When the partnership agreement is silent as to interest on capital, it is not allowed.

2. When the partnership agreement provides for interest on capital, but is silent as to its treatment as a charge or as an appropriation then :

- In Case of Loss : Interest on capital is not allowed.

- In Case of Profit before Interest are sufficient : Interest on capital is allowed at the agreed rate.

- In Case of Profit before Interest is Less than Total Amount of Interest : Interest on capital will be given only to the extent of available profit which will be shared by the partners’ in the ratio of interest on capital of all the partners.

- When the partnership agreement provides for interest on capital as charge against profit, interest on capital is allowed to all partners’ whether there are sufficient profit or there is loss.

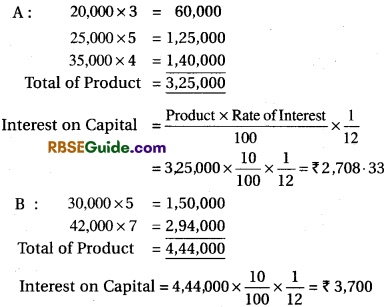

Illustration 4.

A and B are Partner in a Firm – They contributed ₹ 20,000 and ₹ 30,000 respectively as capital on 1st April 2017. They invested additional Capital in the partnership during the year as under:

A – ₹ 5,000 on 1st July, 2017 and ₹ 10,000 on 1st December 2017

B – ₹ 12,000 on 1st September, 2017

Calculate Interest on A’s and B’s Capital @ 10% per year for the year 2017 – 18.

Solution:

Interest on Capital (Simple Method) :

Product Method :

Illustration 5.

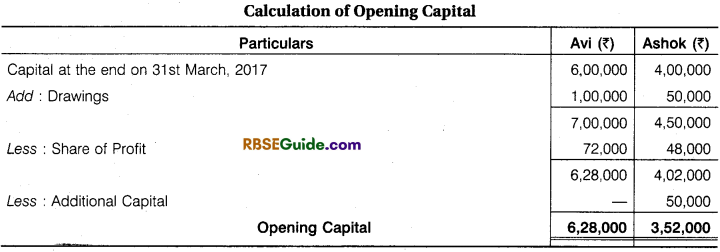

Avi and Ashok are partners sharing profits and loss in the Ratio of 3 :2. Their capitals at the end of the financial year 2016-17 were ₹ 6,00,000 and ₹ 4,00,000 Respectively. During the year 2016-17 Avi’s drawings were ₹ 1,00,000 and the drawings of Ashok were ₹ 50,000 which had been duly debited to Partners Capital Accounts. Profit before Charging interest on Capital for the year was ₹ 1,20,000. The same had also been credited in their Profit sharing Ratio. Ashok had brought Additional capital ₹ 50,000 on 1st July 2016. Calculate Interest on Capital @ 12% p.a. for the year 2016-17.

Solution:

Interest on Capital :

Interest on Partners’ Drawings :

Drawings mean the amount withdrawn, in cash or in kind, by partners for their personal use. Interest is not charged from the partners, if the partnership deed does not provide for charging interest on drawings. If the partnership deed provides and interest is charged, it is credited to the profit and loss appropriation account.

It is debited to partners’ capital account, if the capital accounts are maintained, following fluctuating capital account method or partners’ current account, if capital accounts are maintained following fixed capital account method. Interest on drawings is calculated with reference to the time for which the amount remains withdrawn depending upon the availability of information, interest on drawings in different cases is calculated as follows:

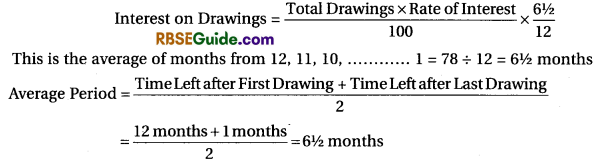

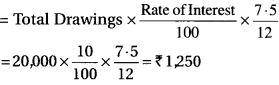

(1) If a partner withdrawn fixed amount in the beginning of every month, interest is charged on . the whole amount for 6\(\frac {1}{2} \) months.

Notes : Average period should be used only when :

- The amount of drawings is uniform.

- The time interval between the two consecutive drawings is also uniform.

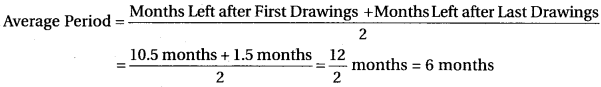

(2) If a partner withdrawn fixed amount at the end of every month, interest is charged for 5\(\frac {1}{2} \) months (i.e., average period)

![]()

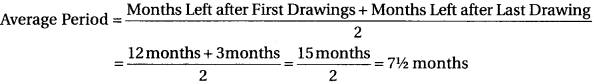

(3) If a partner withdrawn a fixed amount in the middle of every month, interest is charged for 6 months.

![]()

Illustration 6.

A partner withdrawn ₹ 1,000 per month. Under the partnership deed, interest to be charged @ 15% p.a. Calculate interest that should be charged to the partner if the drawings are made:

- in the beginning of the month

- in the middle of the month

- at the end of the month.

Solution:

Total amount of drawings is ₹ 12,000. Interest in the three situations will be

1. When drawings are made in the beginning of the month

![]()

2. When drawings are made in the middle of the month

![]()

3. When drawings are made at the end of the month

![]()

(4) If fixed amount is withdrawn in the beginning of each quarter during the year, interest is charged on the whole amount for an average period of 7\(\frac {1}{2} \) months.

![]()

It is the average of months for which period the drawings are made.

(5) If fixed amount is withdrawn in the middle of each quarter during the year, interest is charged on the whole amount for an average period of 6 months.

Interest on Drawings

![]()

It is the average of months for which period the drawings are made.

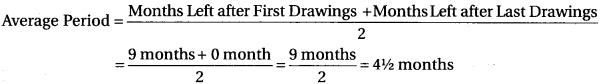

(6) If fixed amount is withdrawn at the end of each quarter during the year, interest is charged on the whole amount for an average period of 4\(\frac {1}{2} \) months.

![]()

It is the average of months for which period the drawings are made.

Illustration 7.

Ram and Shyam are partners in a Firm. They share profits and losses equally. Their quarterly drawing’s are ₹ 5,000 each. Interest on Drawing is to be charged @ 10% per annum. Calculate Interest on Ram’s drawings, assumings drawings are made :

- In the beginning of every quarter.

- In the middle of every quarter.

- At the end of every quarter.

Solution:

Ram’s Total Drawings = 5,000 x 4 = ₹ 20,000

Case (i) : Interest on Drawings

Case (ii) : Interest on Drawings

![]()

Case (iii) : Interest on Drawings

![]()

(7) If fixed amount is withdrawn during 6 months

1. In the beginning of each month

Interest on Drawings

![]()

2. In the middle of each month

Interest on Drawings

![]()

3. At the end of each month

Interest on Drawings

![]()

Illustration 8.

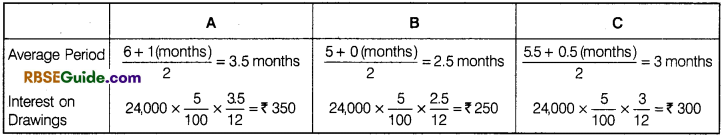

A, B, C are partners sharing profits equally. A withdrawn regularly ₹ 4,000 in the beginning of every month for the six months ended 30th September, 2017, B withdrawn regularly ₹ 4,000 at the end of every month for the six months ended 30th September, 2017. C withdrawn regularly ₹ 4,000 in the middle of every month for the six months ended 30th September, 2017, Calculate Interest on Drawings @ ? 5% p.a.

Solution:

The drawings of each partner = 4,000 x 6 = ₹ 24,000

(8) When unequal amount is withdrawn at different dates, interest on drawings is calculated with the help of simple method or product method as below :

Simple Method : Under this method, the interest on drawings is calculated for the period the amount has been utilised. The interest is calculated with reference to each single drawing.

Product Method : Under this method, the amount of drawings is multiplied with the number of months or number of days (as the case may be) it has been used. The product so obtained is totalled and the interest is calculated thereon for one month, if the period taken is in month and for one day if the period taken is in days.

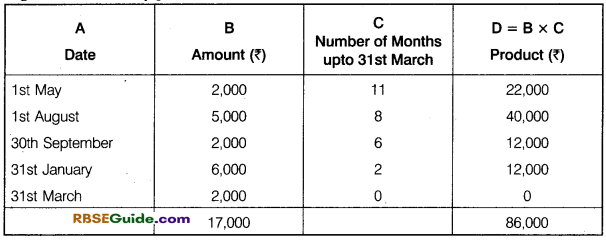

![]()

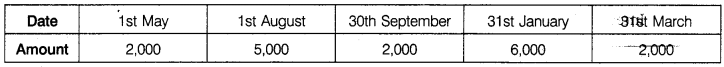

Illustration 9.

(Calculation of interest on drawings by simple method and product method) In a partnership partners are charged interest on drawings @ 15% p.a. During the year ended 31st March, 2017, a partner withdrawn as follows :

What is the interest chargeable to the partner?

Solution:

1. Simple method:

interest = 2,000 x \(\frac {15}{100} \) x \(\frac {11}{12} \) = ₹ 275

2. Product Method :

When drawings are made in uneven amounts at different dates, interest on drawings is calculated by product method as :

Interest on ₹ 86,000 @15% p.a. for one month

![]()

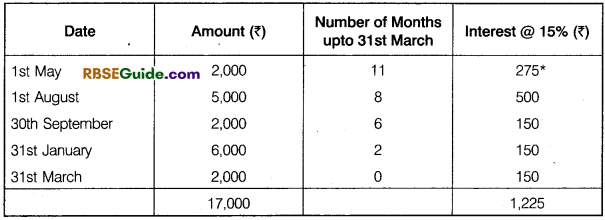

(9) If the date of withdrawal is not given, then interest on total drawings for the year is calculated for six months on the average basis.

![]()

Illustration 10.

Calculate interest on drawings of Rakesh @ 10% p.a. for the year ended 31st March, 2017 in each of the following alternative cases:

Case (i) : If the drawings during the year were ₹ 30,000.

Case (ii) : If the withdrawn ₹ 2,500 per month during the year.

Solution:

(i) Assuming that drawings were made evenly throughout the year. Interest on drawings has been calculated for an average period for 6 months.

Interest on Drawings = 30,000 x \(\frac {10}{100} \) x \(\frac {6}{12} \) = ₹ 1,500

(ii) Total Drawings = 2,500 x 12 = ₹ 30,000

Interest on Drawings = 30,000 x \(\frac {10}{100} \) x \(\frac {6}{12} \) = ₹ 1,500

Important Note :

If the date of drawings in not given and accounting period is less than 6 months, then the interest on total drawings is calculated for half of the accounting period.

(10) When the rate of interest is given without the word “per annum” (p.a.), interest is charged without considering the time factor.

Illustration 11.

Calculation interest on A’s drawings @ 10% if he withdrawn ₹ 2,50,000 during the year.

Solution:

Interest on Drawings = 2,50,000 x \(\frac {10}{100} \) = ₹ 25,000.

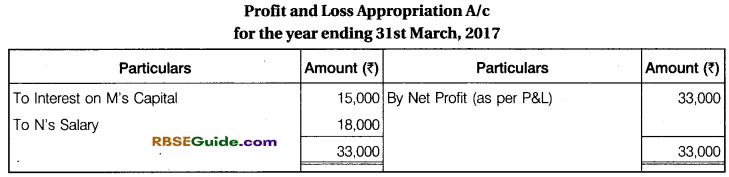

Illustration 12.

M and N are partners sharing profits in the ratio of 3 : 2. M is a non-working partner. He contributed ₹ 2,00,000 as his capital. N did not contribute any capital. The partnership deed provides interest on capital @ 10% p.a. and salary to N as ₹ 2,000 p.m. The net profit before providing interest on capital and salary amounts to ₹ 33,000 for the year ended 31st March, 2017. Show the distribution of profits for the year.

Solution:

Remember : Interest on drawings is an income for the firm and hence, is credited to profit and loss appropriation account. On the other hand, interest on drawings is a loss to the partner and hence is debited to his capital account (in case of fluctuating capital) or current account (in case of fixed capital).

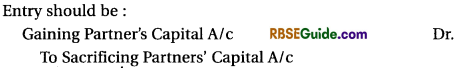

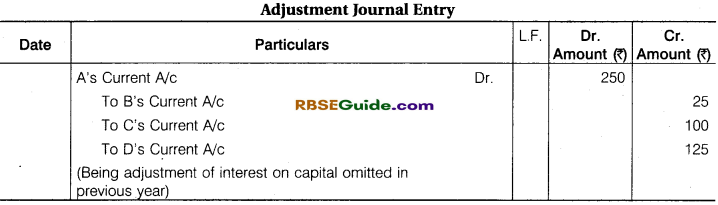

Adjustment In Closed Partnership Accounts :

Sometimes partnership accounts are closed without taking care of conditions given in the partnership deed in respect of interest on capital, interest on drawings, partners’ salary, commission, interest on loan, etc. Similarly, sometimes partners’ decide some new arrangements in respect of aforesaid adjustments or profit sharing ratio applicable with retrospective effect after close of partnership accounts. Under such circumstances, rectification may be done.

1. By means of one adjustment entry, or

2. By means of profit and loss adjustment account.

1. By One Adjustment Entry :

- An adjustment table is prepared in which the names of all the partners are horizontally written with debit and credit, two columns for every partner.

- The amount payable to partners are written in credit columns of partners and anything chargeable are written in debit columns. Similarly, one column of the firm is also drawn with debit and credit columns.

- Thereafter, debit and credit columns of every partner is totalled. The amount of difference is ascertained if the firm’s debit and credit columns, which will reveal either profit or loss.

- The amount of profit or loss will be divided among the partners in profit sharing ratio. Lastly every partner’s debit and credit columns are totalled and difference is ascertained, then one entry will be passed at the beginning of next accounting year by debiting or crediting partners’ current account or capital account, as the case may be.

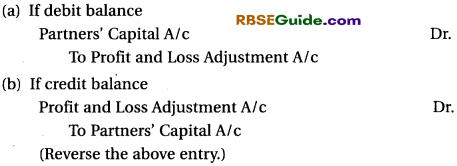

2. By Opening Profit and Loss Adjustment Account :

This account is a nominal account. In case of loss to the firm, this account is debited and partners’ capital or current account credited. In case of profit to the firm, reverse entry is passed.

(iii) Then prepare profit and loss adjustment account and balance will be transferred to partners’ capital/current account in profit sharing ratio.

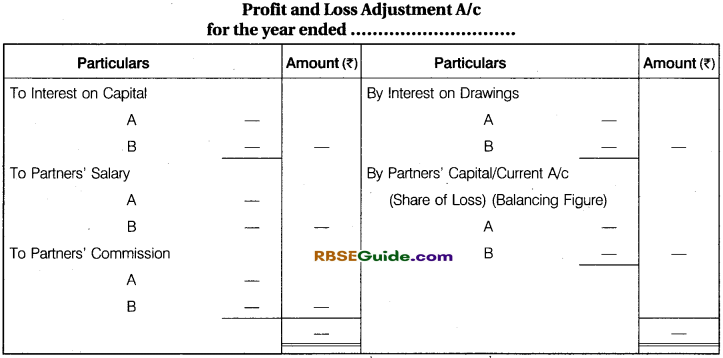

Illustration 13.

A, B, C and D are sharing profits in the ratio of 5 : 3 : 2 : 2. Their respective fixed capitals are ₹ 5,000, ₹ 6,500, ₹ 6,000 and ₹ 6,500 respectively. On 31st December, 2017, after closing the books it is round that interest on capital @ 5% per annum was omitted.

Pass the necessary adjustment entry for providing interest on capital. Show your working notes clearly.

Solution:

Illustration 14.

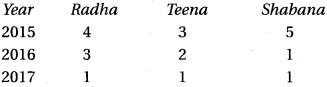

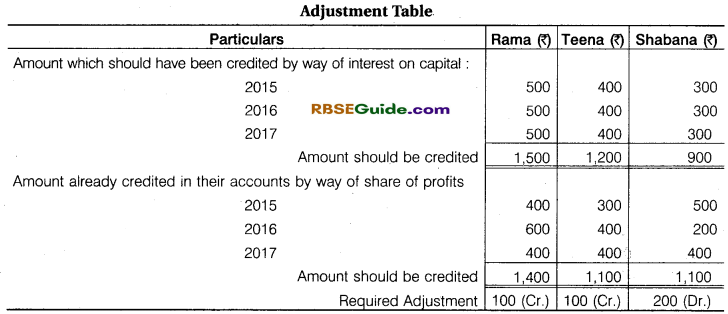

Radha, Teena and Shabana are partners whose fixed capitals were ₹ 10,000, ₹ 8,000 and ₹ 6,000 respectively. As per the partnership agreement, there is a provision for allowing interest on capitals @ 5% p.a. but entries for the same have not been made for the last three years. The profit sharing ratio during three years remained as follows :

Make necessary adjustment entry at the beginning of the fourth year i.e., Jan. 2016.

Solution:

Adjustment Table :

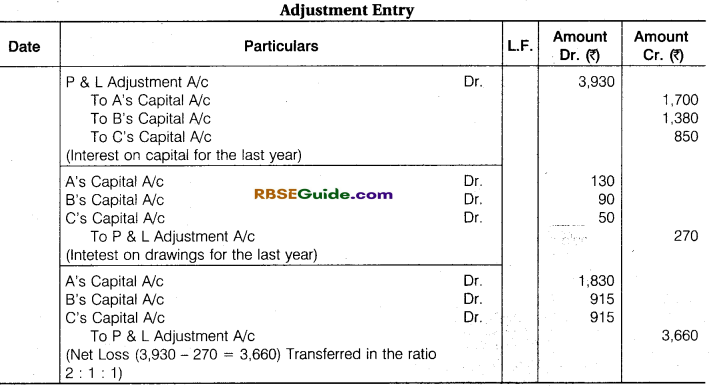

Illustration 15.

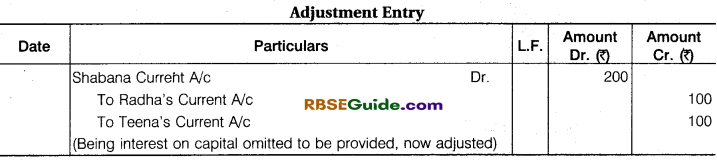

The capital of A, B and C stood at ₹20,000, ₹ 15,000 and ₹10,000 respectively after the necessary adjustments in respect of the Drawings and Net Profits. Subsequently, it was discovered that interest on capital at 10% p.a. and interest on drawings ₹ 130, ₹ 90 and ₹ 50 respectively have been ignored. Profit of the year already adjusted was ₹ 8,000. Drawings of the partners were ₹ 1,000, ₹ 800 and ₹ 500 respectively. They shared profit and losses in the ratio of 2 : 1 : 1. Give necessary entry to satisfy the accounts.

Solution:

Calculation of Opening Capital of A, B and C

Illustration 16.

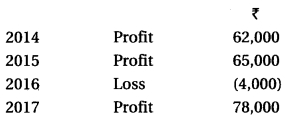

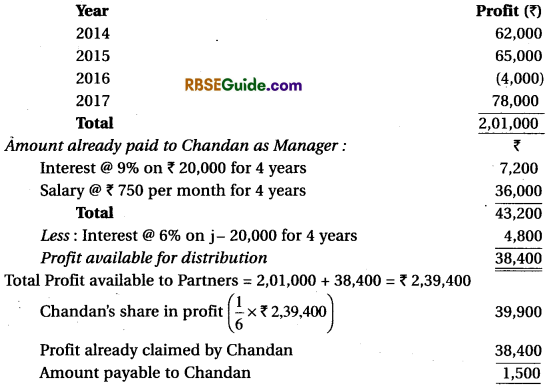

Kapil and Prashant are partners, sharing profits in the ratio of 3 : 2. They employed Chandan as their manager, to whom they paid a salary of ₹ 750 p.m. Chandan deposited ₹ 20,000 on which interest is payable @ 9% p.a. At the end of 2017 (after the division of profit) it was decided that Chandan should be treated as partner w.e.f. Jan. 1,2014 with l/6th share in profits. His deposit being considered as capital carrying interest @ 6% p.a. like capital of other partners. Firm’s profits after allowing interest on capital were as follows:

Record the necessary journal entry to give effect to the above.

Illustration 17.

A, B and C are partners in a firm. Balances of their capital accounts as on 1st April, 2017 were ₹ 50,000, ₹ 30,000, and ₹ 10,000 respectively. The partnership agreement provides :

(1) ‘C’ shall be credited with a salary of ₹ 600 per month.

(2) Interest on Capital is allowed @ 10% p.a.

(3) Interest on Drawings is charged @ 15% p.a.

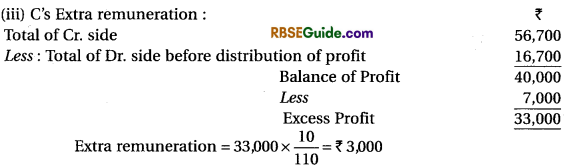

(4) After providing (1) to (3) mentioned above and after making provision for extra remuneration in this para (4) C shall be entitled to 10% of all the profits in excess of ₹ 7,000 p.a.

(5) ‘B’ is to have 1/3 of the profits after charging all amounts under (1) to (4) and this para (5) and the balance profit is to be divided between A and C in ratio 3 : 2.

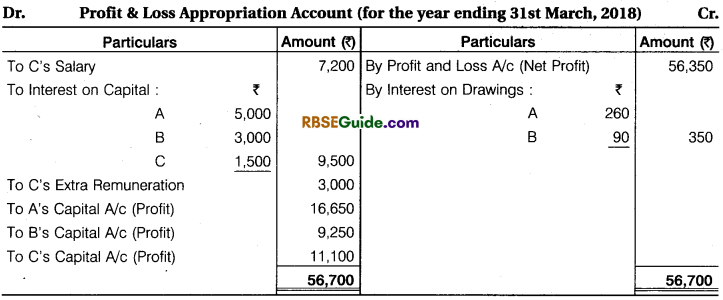

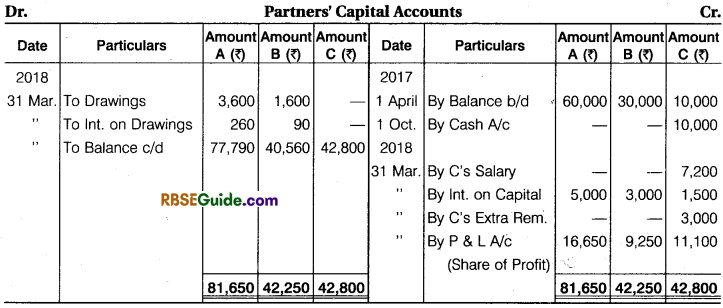

C contributed ₹ 10,000 as an additional Capital on 1st October, 2017. A withdrawn ₹ 2,000 on 1st August, 2017 and ₹ 1,600 on 31st Dec., 2017, where as C has not drawn any amount. B has withdrawn ₹ 400 at the end of every 3 months, the net profit for the year ended 31st March, 2018 before making above adjustment was ₹ 56,350. Prepare Profit & Loss Appropriation Account for the accounting year 2017-2018 and also Partners’ Capital Accounts.

Solution:

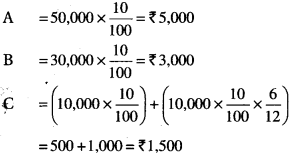

Working Notes:

1. Interest on Capital is calculate as under:

= 500 + 1,000 = ₹ 1,500

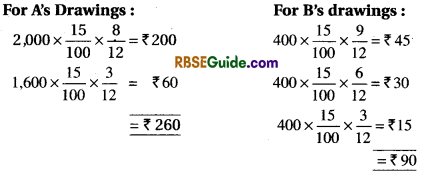

2. Calculation of Interest on Drawings:

Note :

Last drawing has drawn by B on 31st March, ₹ 400. So, there is no calculation of interest.

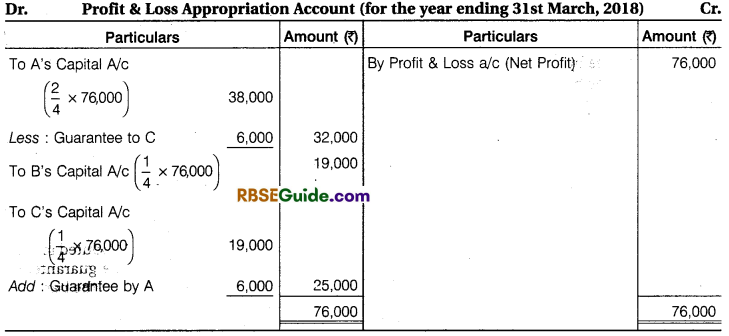

Calculation of B’s Share of Profit:

After adjustment of interest on capital and drawing, salary and extra remuneration. Balance of net profit is ₹ 37,000. In this B’s share of profit is include. So, B’s share of profit is :

![]()

Guarantee of Profit to a Partner :

Sometimes a partner is admitted into the firm who is having a specialised knowledge in a particular field, e.g., sales and marketing, professional efficiency of specific type, etc. Such type of partner wants a minimum guaranteed amount as share in the profits of the business from the other partners. Such a guarantee is given either by (a) one of the old partner or (b) all the partners in a certain ratio. Such type of guarantee can be given in four ways as follows :

- Guarantee by the firm

- Guarantee by a partner

- Guarantee by a partner to the firm

- Guarantee by a partner to the firm and guarantee by firm to a partner

1. Guarantee by the Firm : This situation arises when profit of the firm is not adequate or in case of loss, therefore, the payment of minimum guarantee profit is not possible to the partner who has been given such a guarantee. In such situation, minimum guaranteed amount or any shortfall in it would be borne by remaining partners. However, in case his share in profits is over and above the guaranteed amount, he would get share in profit as per profit ratio agreed among partners at the time of his admission.

2. Guarantee by a Partner: First of all distributable profits of the firm will be distributee^ to the partners in their profit sharing ratio. Afterwards if there is any share shortfall in the guaranteed amount, the required profit would be adjusted by deducting from the share of profit of the partner who has given such a guarantee. The same adjusted amount would be added in the share of guaranteed partner.

3. Guarantee by a Partner to the Firm: It’s also possible that a partner gives a guarantee of minimum earnings to the firm. In practice, such type of guarantee is given by professionals, such as Chartered Accountants,.Fashion Designers, etc. to the firm fc a certain profit. If partners fail to earn such minimum guaranteed earnings for the firm, the shortfall would be recovered from his capital.

4. Simultaneous Guarantee by the Partner to the Firm and by Firm to the Partner : If a partner earns less than the guaranteed amount to the firm, the difference of amount as recovered from him would be credited to profit and loss appropriation account. In case of a firm which gives guarantee to a partner of minimum profit, then after giving such minimum amount to that partner, balance amount would be distributed to remaining partners in profit sharing ratio (if profit are inadequate).

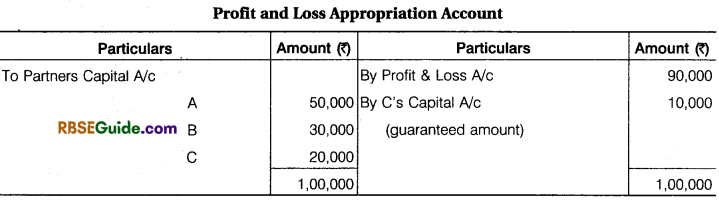

Illustration 18.

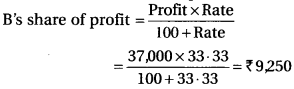

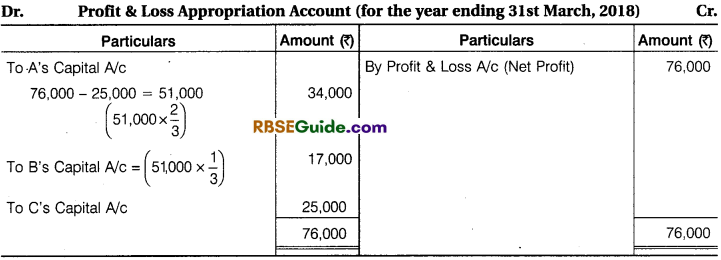

A and Bare partners in a firm sharing profit and loss in the ratio of 2 : 1. They decided to admit C with l/4th share in profits with a guaranteed amount of ₹ 25,000. They decided that the profit sharing ratio between A and B does not change. The firm earned profits of ₹ 76,000 for the year 2017-2018. Prepare Profit & Loss Appropriation Account when:

1. Guarantee is provided by firm

2. Guarantee is provided only by A.

Solution:

(1) When Guarantee is given by the firm :

(2) When Guarantee is given by A’ :

Calculation of Profit and Loss Ratio :

Suppose total profit of firm is ₹ 1.

Share of profit given to C = \(\frac {1}{4} \)

Balance Share of Profit = 1 – \(\frac {1}{4} \) = \(\frac {3}{4} \)

As Ratio \(\frac {2}{3} \) of \(\frac {3}{4} \) = \(\frac {2}{4} \)

B’s Ratio \(\frac {1}{3} \) of \(\frac {3}{4} \) = \(\frac {1}{4} \)

So, A = \(\frac {2}{4} \) B = \(\frac {1}{4} \) C = \(\frac {1}{4} \)

New Profit Sharing Ratio = 2 : 1 : 1

![]()

Illustration 19.

A, B and C are partner, sharing profit in ratio 5 : 3 : 2 C gives guarantee to firm of minimum ₹ 50,000 earnings but C could earn only ₹ 40,000 for the firm. Total profit earned by the firm is ₹ 90,000. Prepare Profit & Loss appropriation account for distribution of profit among partners.

Solution:

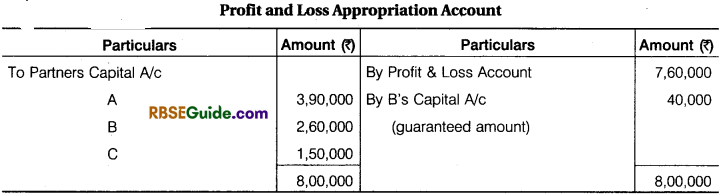

Illustration 20.

A, B and C are Partner, sharing profit in ratio 3 : 2 : 1. It was agreed that 1. C would get minimum profits ₹ 1,50,000, 2. B made guarantee to the firm that he would earn minimum ₹ 2,40,000. Firm earned ₹’ 7,60,000 for the current year it included ₹ 2,00,000 earned by B.

Solution:

Working Note:

(1) B guaranteed to the firm to earn minimum profit ₹ 2,40,000. But B earn only 2,00,000. Rest ₹ 40,000 charged by B’s capital account.

(2) C’s share of profit of 8,00,000 x – \(\frac {1}{6} \) = 1,33,333 while C was guaranteed by firm for profit ₹ 1,50,000.

So, balance of profit 8,00,000 – 1,50,000 = 6,50,000 is distributed between A and B in the ratio of 3 : 2.

General Introduction of Partnership Notes Important Terms

→ Partnership : Partnership is the relation between persons who have agreed to share the profits of a business carried on by all or any one of them acting for all.

→ Partners : The persons who have established the business are individually called patners.

→ Name of Firm : The trade runs by the name is called firm.

→ Partnership Deed : A written document which contains the terms of agreement is called “Partnership Deed”.

→ Partner’s Capital : Partner’s capital is the money which invested by individual partner in a firm.

→ Fixed Capital : Fixed capital means that the capital remains unaltered or no change in capital account.

→ Fluctuating Capital : When the capital are fluctuating the balances in capital accounts go on changing time to time called fluctuating capital.

→ Drawing : Money/goods withdrawn for personal use from business by a partner called drawing.

→ Profit Sharing Ratio : The agreement between among the partner’s must be share profits or losses of the business called profit sharing ratio.

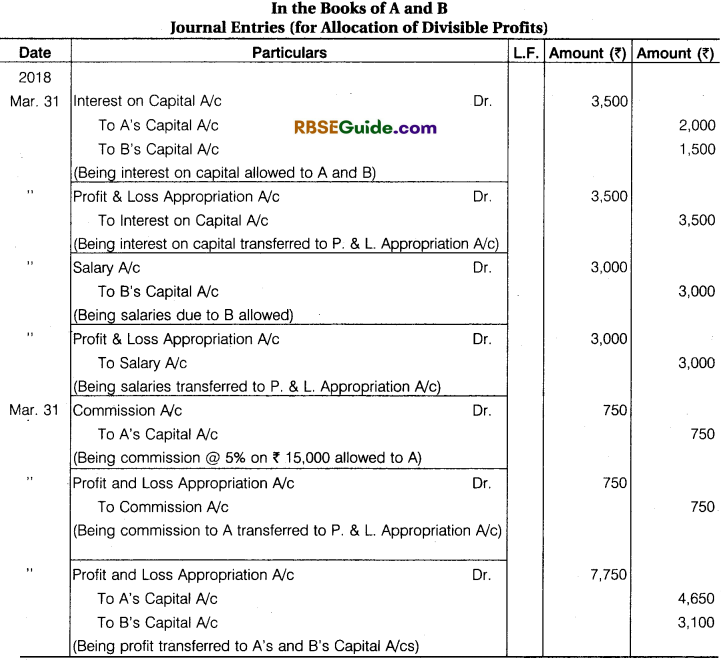

→ Profit and Loss Appropriation Account : After ascertaining net profit as per profit and loss account for the -year. Profit and loss appropriation account is also to be prepared to show distribution of profit amount the partners. This account is credited with net profit and interest on drawings of the partners.

It is debited with interest on capital of partners, salaries, commission, bonus etc. of the partners. Sometimes, a certain sum or part of current years’ net profit is also to be transferred to reserve fund which will also appear on debit side of this account. The balance of net profit called Distributable Profit is divided among the partners in their predetermined profit sharing ratio.

![]()