Make use of our RBSE Class 12 Accountancy Notes here to secure higher marks in exams.

Rajasthan Board RBSE Class 12 Accountancy Notes Chapter 4 Dissolution of Firm

Meaning of Dissolution of the Firm :

According to Section 39 of Indian Partnership Act 1932, “The end of partnership among all partners of a firm is called Closure or Dissolution of a Firm.”

When partnership among all partners ends and it is decided to close or sell the business of the firm, it is called Dissolution of the Firm. On dissolution of a firm all assets of the firm are sold and liabilities paid, thereafter, if some money is left, it is used in payment of the final settlement of accounts of the partners.

Meaning of Dissolution of Partnership :

Dissolution of partnership only means that relation of one of the partners break with the other partners. In this case it is not necessary that firm’s business is closed. Remaining partners may continue the business. For example, A partnership is dissolved if a partner dies becomes bankrupt, retires on term of partnership expires, but dissolution of firm may be done but it is not entirely dependent on the agreement among partners, therefore, dissolution of partnership is not dissolution offirm. A firm can continue business even after dissolution of partnership. But dissolution of a firm is dissolution of partnership. On dissolution of partnership all business activities end.

Modes of Dissolution of Partnership Firm :

A partnership firm can be dissolved in any of the following ways :

1. Without the Intervention of the Court :

(i) When all partners agree to dissolve the firm. (Section 40)

(ii) Compulsory dissolution (Section 41)

(a) When all or except one partner ofthe firm becomes insolvent.

(b) When business of the firm becomes unlawful.

(iii) On the happening of any one of the following incidents (Section 42)

(a) On the insolvency of a partner.

(b) On the fulfilment of the object for which the firm was formed.

(c) On the expiry ofthe period for which the firm was formed.

(d) On the death of any partner of the firm.

(iv) When the duration of the partnership firm is not fixed and it is at will any partner by giving notice to other partners can dissolve the firm. (Section 43)

2. By Order of the Court (Section 44)

The court may on an application by a partner order the dissolution of the partnership firm under the following circumstances :

- When a partner has become of unsound mind.

- When a partner other than the partner filing a suit has become permanently incapable of performing his duties as a partner.

- When a partner other than the partner filing a suit is guilty of misconduct that may harm the partnership.

- When a partner other than the partner filing a suit wilfully or persistently commits breach of partnership agreement.

- When a partner other than the partner filing a suit has transferred the whole of his interest in the firm to a third party.

- When the court is satisfied that the firm cannot be carried on except at a loss.

- When the court is satisfied that the dissolution is just and equitable due to some other reasons.

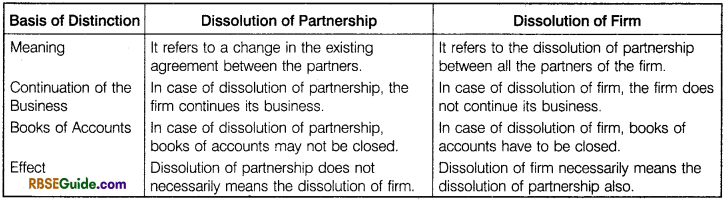

Difference between Dissolution of Partnership and Dissolution of Firm :

Statutory Procedure of Closure of Books of Account on Dissolution of a Firm :

Following is statutory procedure to close books of accounts on dissolution of firm :

(1) All losses-or deficiencies are first met by profit then by capital and lastly by getting additional amount from partners.

(2) The sums obtained on sale of assets and brought by partners are utilised in the following manner:

- Payment ofsecured loans.

- Payment ofloans from outside parties (proportionately).

- Payment ofloans from partners (proportionately).

- Repayment of capital balances to partners (proportionately).

- If any surplus remains then in payment to partners in their profit sharing ratio.

![]()

Provision of Section 48 of Partnership Act, 1932 Relating to Settlement of Accounts at the Time of Dissolution

1. All losses including reduction of capital will be paid as follows :

- First of all from profits

- Then from capital

- Lastly, ifnecessary by the sums would be brought in by partners in their profit sharing ratio.

2. All assets including cash brought in partner will be utilised as follows :

- To pay all loans of the firm including partners’ wives.

- To pay every partners’ capital proportionately.

- If any surplus remains, to distribute among partners in the profit sharing ratio.

In other words, it can be concluded that available sum will be utilised in the following order :

- To meet our expenses incurred on sale ofassets and expenses incurred on realisation ofdebts.

- To pay outside loans including partners’ wives loans.

- To pay loans from partners.

- To repay capital of partners.

- If any surplus remains then to distribute it among partners in profit sharing ratio. [Section 48 (b)]

Accounting Treatment in Case of Dissolution :

With the dissolution of firm normal business activity stops and process of realisation of firm’s assets and payment of liabilities starts. To complete this process following accounts are prepared :

- Realisation account

- Bank or cash account

- Partners’ capital account

- Other necessary accounts

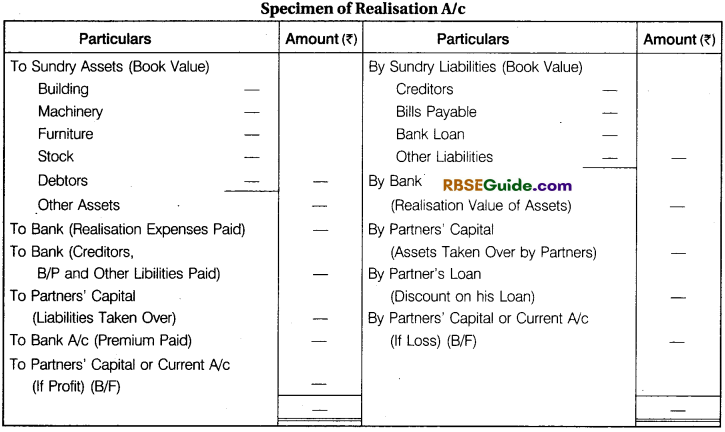

1. Realisation Account : Realisation account is opened on the dissolution ofa firm. The object of preparing this account is to determine gain (profit) or loss on the realisation ofassets and payment of liabilities. Realisation account is prepared by :

- Transferring all assets except cash or bank account to the debit side of the account.

- Transferring all liabilities except partner’s loan account and partners’ capital account to the credit side of the account.

- Amount realised on sale of assets is credited to the account.

- Liabilities paid are debited to the account.

- Expenses incurred by the firm on dissolution are debited.

Balance in the account is either profit or loss which is transferred to the capital account of the partners in their profit sharing ratio.

Difference between Realisation Account and Revaluation Account :

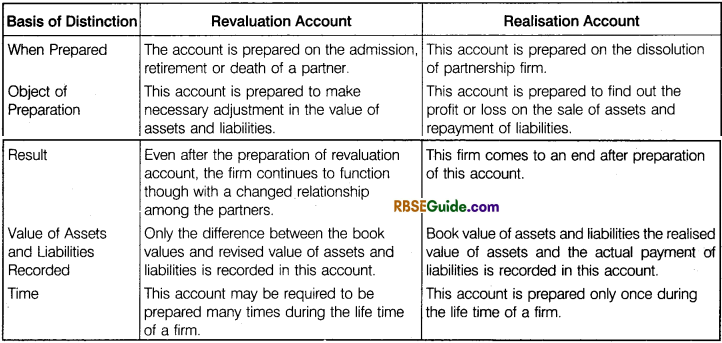

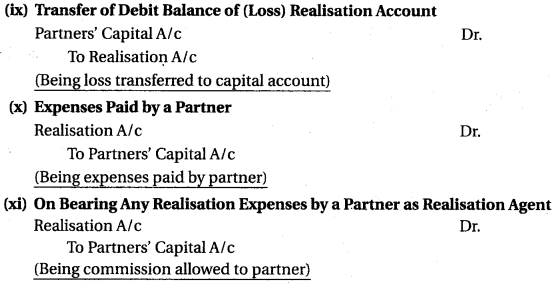

Accounting Entries Regarding Dissolution :

Note : Sometimes, liabilities are not transferred to realisation account. In such a case the liabilities are directly paid only profit/loss if any arising out of it is transferred to realisation account. When such liabilities a long with other liabilities which are not transferred to realisation account are paid and the following accounting entries are done in the following manner.]

[Note : Lastly, the balance in cash/bank is only as much as it is to be paid to the partners hence, with the last entry all accounts of the firm close automatically.]

[Note : Lastly, the balance in cash/bank is only as much as it is to be paid to the partners hence, with the last entry all accounts of the firm close automatically.]

![]()

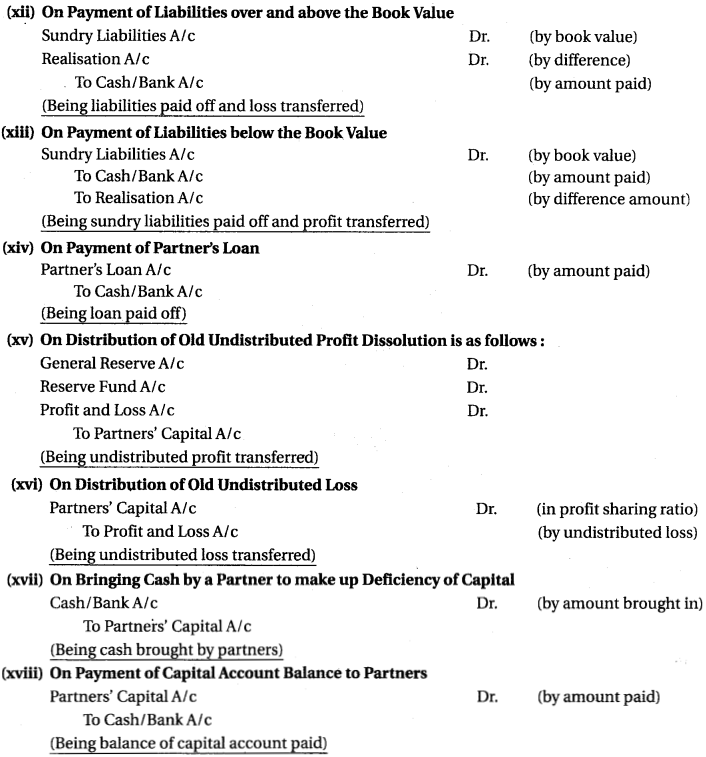

Unrecorded Assets and Liabilities :

Some physical assets even through existing but are not shown in the books due to the reason that they have been fully written off in the books of the firm. Since they still may be in working condition, therefore some realisation may still be made on sale of those assets. Similarly, there may be some liabilities which are not there in books but their payment has become necessary, such as discounted bills, some guarantee or liability arising out of a litigation these are called as Contingent Liabilities. Since, such assets and liabilities do not exist in the books ofaccount therefore, question of transferring them to realisation account does not arise. However, accounting on realisation or payment is made. The accounting entries to made in such cases are given under :

(a) No entry shall be made on payment ofliability which is not shown in books paid through an assets which is also not shown in the books.

(b) No entry shall be made no direct use of an assets which is shown in book, for payment of a liability which is also shown in books.

(c) No entry shall be made on payment of a liability which is shown in the books and paid through an assets which is not shown in the books. However, if some part of it remains unpaid then its payment entry will be made as shown earlier.

(d) No entry shall be made on payment of a liability, which is not shown in the books and paid through an assets which is shown in books.

Accounting of Goodwill in Dissolution of Partnership :

Treatment of goodwill is very easy in case of dissolution of a firm. It may be summarized as under :

(i) If goodwill is already appearing in the balance sheet, it is treated like any other asset, and is transferred to the realisation account at the value given in balance sheet. Following entry is passed for it :

![]()

(ii) If goodwill is not appearing in the balance sheet, the above mentioned entry will not be passed.

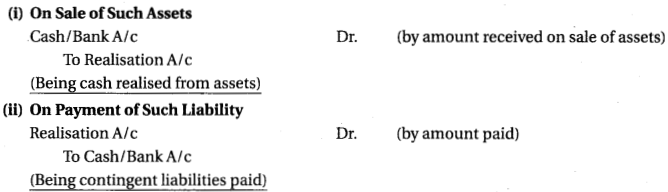

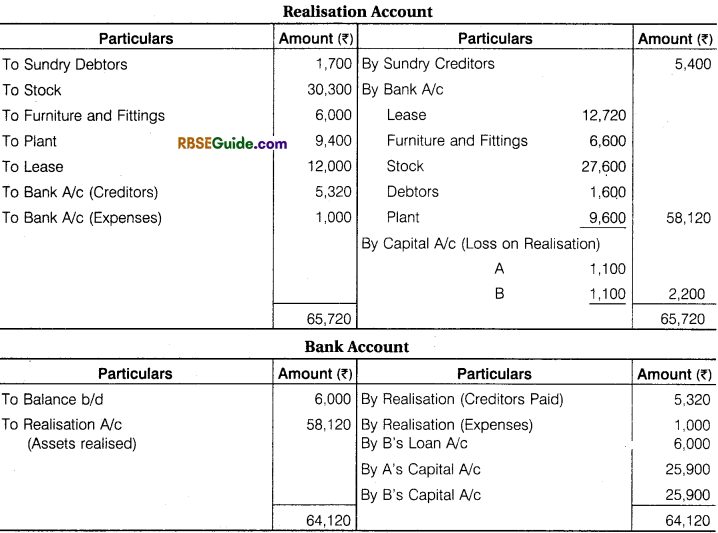

2. Cash or Bank Account :

Opening balance of cash and bank and all the receipts are entered on the debit side of this account and all the payments are entered on the credit side of this account. This account must be prepared and closed last of all and the total of both the sides of this account must be equal. In this way this account also helps in the verification of the arithmetical accuracy of the account.

[Note : If cash balance and bank balance both are given in the balance sheet, only one account either a cash account or a bank account is prepared. Ifcash account is prepared an entry is passed for withdrawing the bank balance and ifa bank account is prepared, the cash balance is deposited into the bank.]

![]()

3. Partners’ Capital Account :

After the transfer of profit or loss on realisation, undistributed profit reserves etc. to the capital account of the partners, the balance of capital account are closed in the following manner :

1. When a partner is required to bring in cash to clear off his debit balance. The entry will be

2. When a partner is paid the credit balance of his account :

4. Other Required Accounts :

On the dissolution of firm, partner’s loan Account, partners’ current account, reserve and undistributed losses, accounts are prepared and deficiency account in case of insolvency of all partners is also prepared.

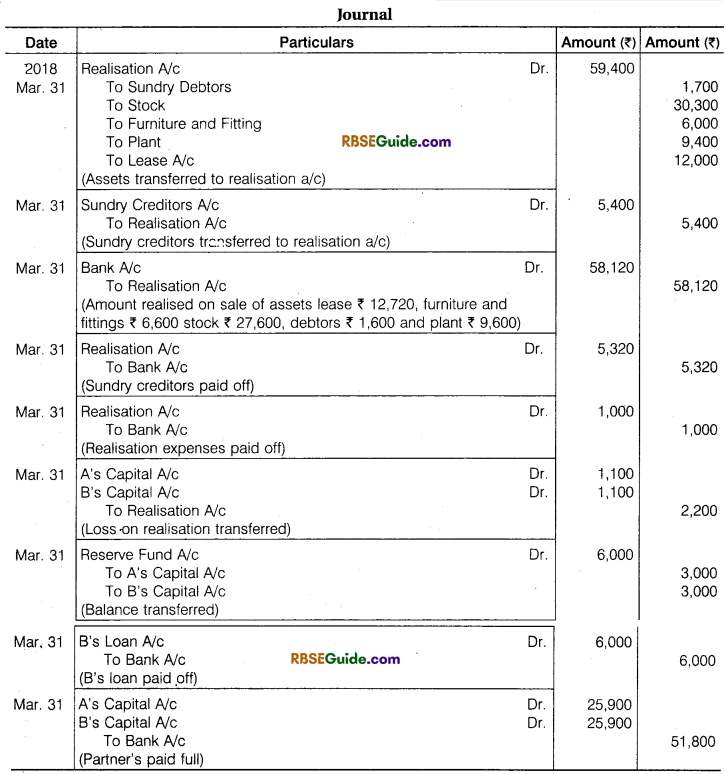

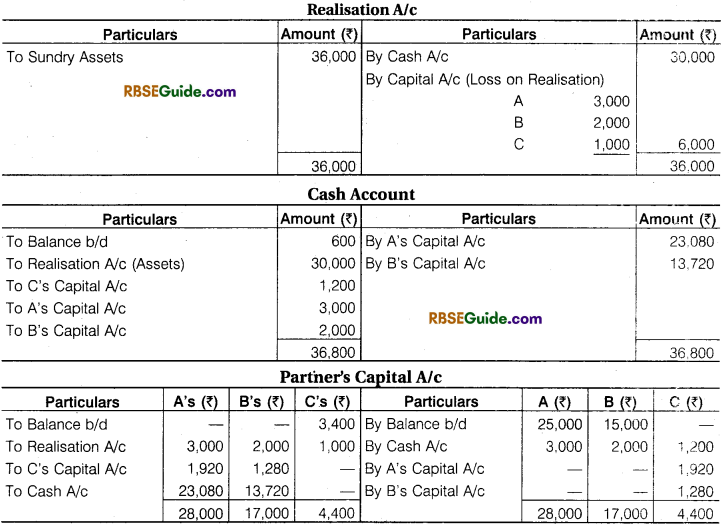

Illustration 1.

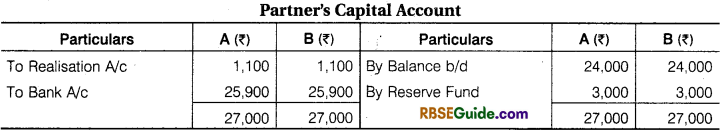

Aand B were equal partner in a firm. They decided to dissolve the partnership on 31st March, 2018. Their financial position was : Lease was sold for ₹ 12,720, Furniture and Fittings for ₹ 6,600 and Stock for ₹ 27,600, Debtors Realised only ₹ 1,600 and Plant Realised ₹ 9,600. Creditors were paid ₹ 5,320 in final setdement. Expenses of Realisation amounted ₹ 1,000.

Make necessary journal entries to close the books of the firm and prepare Realisation, Bank and Partner’s Capital Account.

Solution:

Illustration 2.

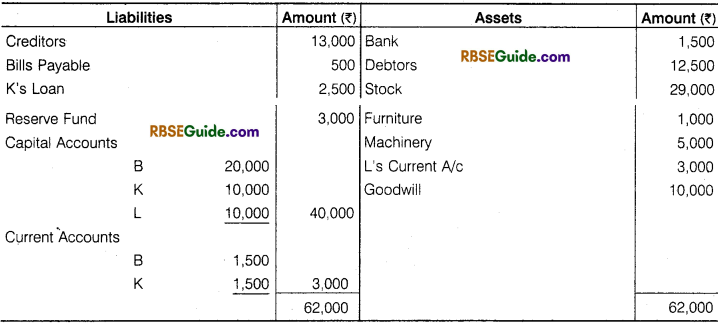

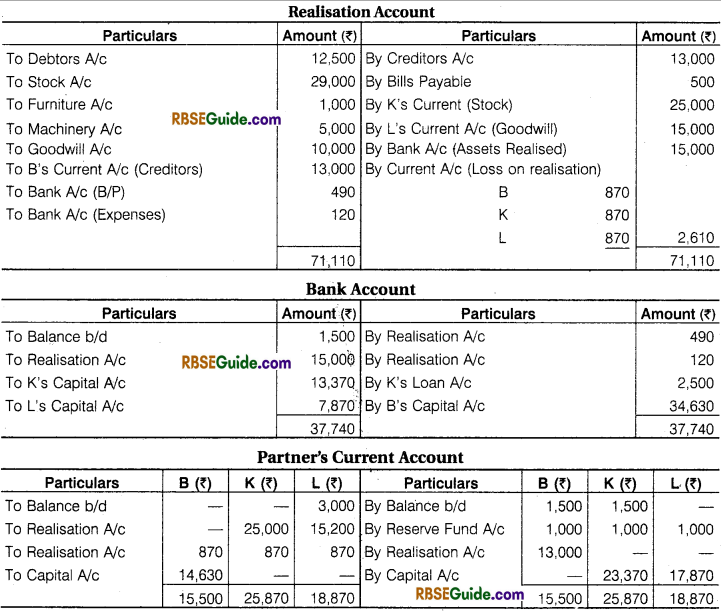

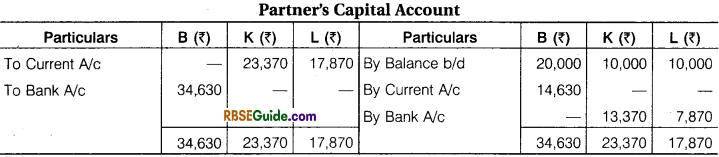

B. K. L. are in partnership sharing profit and losses equally. On 31st March, 2018 their balance sheet was as follows :

On 31st March 2018, they decided to dissolve their partnership and the following agreement was made among the partner’s :

- B agree to pay creditors

- K takes over the stock at an agreed valuation of ₹ 25,000,

- L takes over goodwill at ₹ 15,000

- Bills Payable were cleared off ₹ 10 being allowed for discount

- the remaining assets were realised ₹ 15,000

- Expenses of realisation amounted to ₹ 120

- K’s loan was paid off.

Show the Realisation account, Bank Account, Current Account and Partner’s Capital Accounts.

Solution:

Illustration 3.

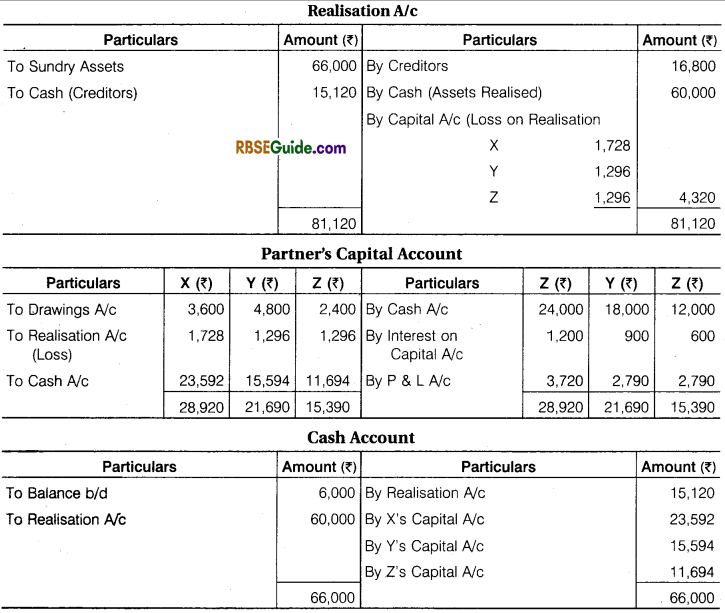

Z, Y, Z commenced business on 1st April, 2017 in partnership. They agreed to share the profit and losses in the ratio of 4: 3 : 3. They brought for their capital ₹ 24,000, ₹ 18,000 and ?12,000 respectively. The partnership deed provided for interest on capital @ 5% per annum. During the year 2017-18, the firm earned a profit of ₹ 12,000.

Before providing interest on capital during the year partner’s drawing were X ₹ 3,600, Y ₹ 4,800 and Z ₹ 2,400 due to some unavoidable reasons partner’s decided to dissolve the firm on 21st March, 2018. The assets were sold which realised ₹ 60,000 and cash in hand was ₹ 6,000. There were creditors to the extent of? 16,800 which were paid offat discount of 10%.

Prepare the necessary account to close the books of the firm :

Working Note :

(1) To calculate Balance of Capital of partners on 31 March, 2018 carved profit during the year table is as follows :

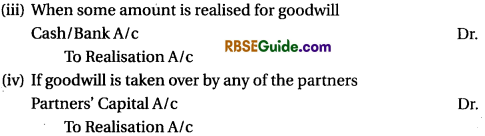

Insolvency of Partner :

It is possible that after making entries relating to dissolution a partners’ capital account shows debit balance. If the partner is solvent then he will bring cash and settle his account. But if such a partner is declared insolvent then he will not be able to pay off his liability towards the firm. The deficiency will have to be met by other solvent partners. Now, one important question arises which ratio this deficiency will be borne by the remaining partners.

Whether in the profit sharing ratio or in capital ratio? Before 1903 the partners used to share deficiency of an insolvent partner in profit sharing ratio. But in that year a British Court pronounced an important verdict in the case of Garner vs. Murry establishing a new principle. According to this principle the deficiency ofinsolvent partner shall be borne by remaining partners in their capital ratio. The details and the principle laid down in the case are as under.

![]()

Facts of Garner vs Murray Case :

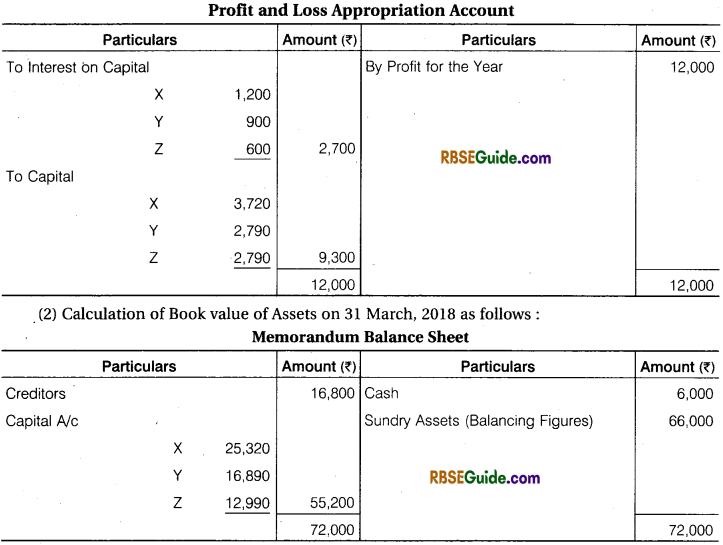

Garner, Murray and Wilkins were partners. They were equal partners. The dissolution of the firm took place on 30th June, 1900 and assets of the firm were sold and creditors paid. After all this firm’s status was as under :

Wilkins was declared insolvent and nothing could be realised. His total liability towards firm was £ 263 + (1/3 of £ 635) = £ 475. The question before the court was by which ratio should Garner and Murray share Willkins capital loss ?

Verdict Delivered in the Case :

It was pronounced that insolvent partner’s deficiency of capital shall be borne by remaining partners in the capital ratio showing in the balance sheet mad prior to dissolution of firm. The verdict was based on the principle that the loss arising out of insolvency of a partner is different from business loss.

Explanation of Verdict :

On the basis of verdict in the case following two points emerge out :

(1) Deficiency of capital of insolvent partner would be borne in their capital ratio.

(2) Solvent partners should bring in cash for their share of realisation loss.

Capital ratio of the solvent partners would be derived from the regular balance sheet made prior to the dissolution of firm. For example, if firm’s balance sheet is made on 31st December every year then balance sheet made on 31st December prior to dissolution of firm would be used to find capital ratio for purpose. It is to be remembered that this capital can only be basis ifcapital account is fixed and not fluctuating. Ifcapital accounts are fluctuating then adjustment will have to be made

in partners’ capital account for reserves profit-loss account etc.

(But only prior to adjustment related to dissolution). The adjusted capital thus, obtained would be used for sharing capital loss of the insolvent partner. It is to be remembered further, that if there is debit balance in any partners’ capital account before distribution of realisation loss then that partner will not share deficiency of insolvent partner.

[Note : In the absence ofany information the question must be solved on the basis of Garner vs. Murray rule.]

![]()

Non-Application of Garner vs Murray Rule :

In case of non-application of Garner vs. Murray rule the remaining solvent partners would share insolvent partner’s deficiency in their profit sharing ratio since nothing is said about such circumstances in the Indian Partnership Act, 1932.

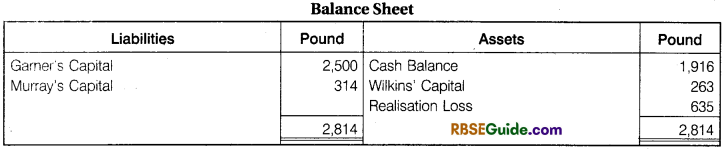

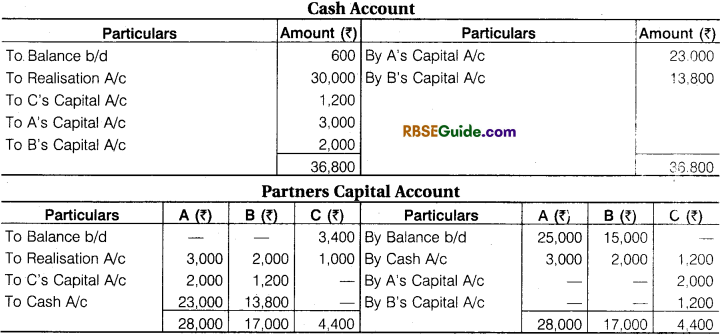

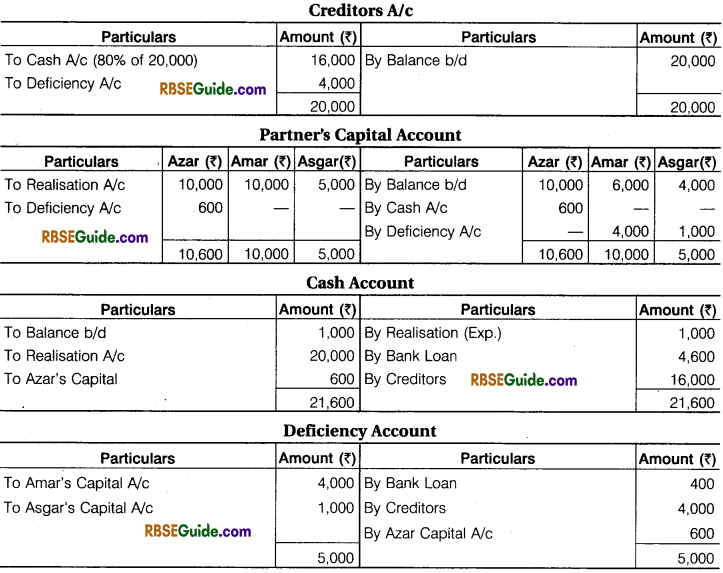

Illustration 4.

A, B and C sharing profit and losses in the ratio of 3 : 2 : 1 decided to dissolve the firm on 31st March, 2018 on this date Balance Sheet of the firm stood as under :

Assets realised ₹ 30,000. C become insolvent and ₹ 1,200 could be realised from his private assets. Close the books of the firm if

(i) If Garner vs Murray rules is not applicable

(ii) is applicable.

Solution:

(i) If Garner vs Murray law not apply.

(ii) If Garmer Vs Murray rules apply.

(1) Realisation A/c will prepare as above.

Working Note :

- It is assumed that loss on realisation partner’s brings in cash in their own share.

- In apply of Garner vs Murray law loss of capital ₹ 3200 will share A & B in their capital ratio in 5 : 3.

- The not apply of Garner Vs Murray law loss of capital of ₹ 3200 partner will share in their prfit & loss share ratio in 3 : 2.

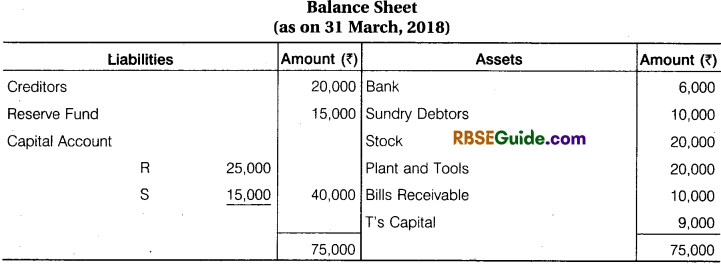

Illustration 5.

Following is the balance sheet of R. S. and T as on 31 March, 2018 :

T become insolvent and he could pay only ₹ 2,000 :

It was decided to dissolve the firm assets realised as follows :

Sundry Debtors ₹ 7,500, Bills Receivable ₹ 7,000, Stock ₹ 16,000, Plant and Tools ₹ 14,000. Realisation expenses were ₹ 2,500.

Prepare account to close the books of firm if :

(i) Capital is fixed

(ii) Capital is fluctuating follow the rules of Gamer Vs Murray.

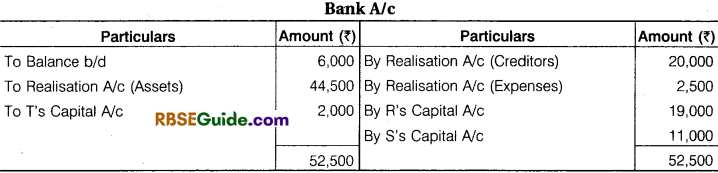

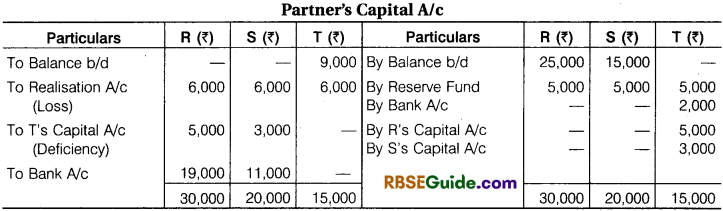

Solution :

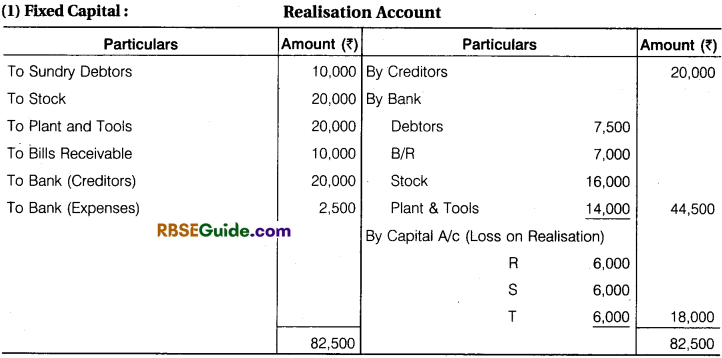

(2) Where Capitals are Fluctuating :

Note : Realisation A/c will prepare as above.

Working Note :

- Loss of capital ofT is shared by R & S in their capital ratio.

- It fixed capital method is Adopted so capital Ratio ₹ 25,000 : 15,000 = 5:3 share will be ₹ 5,000, ₹ 3,000.

- It fluctuation capital method adopted capital ratio will 30,000 : 20,000 = 3:2 = ₹ 4,800 & 3,200 will share.

- Balance amount of capital of R & S will return.

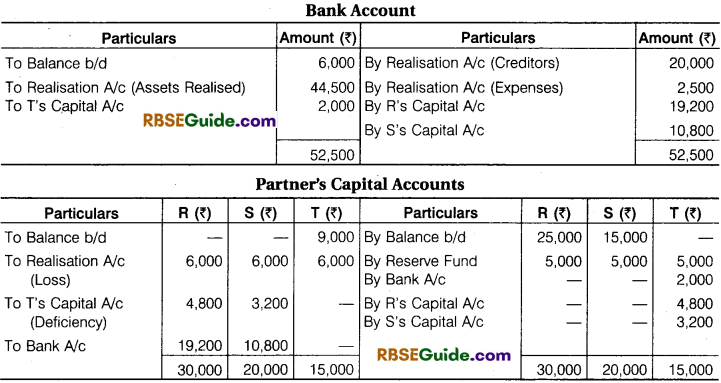

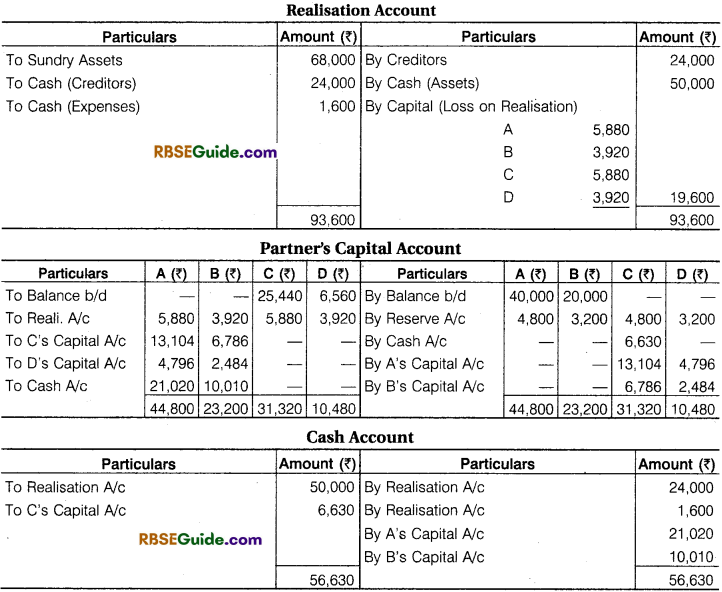

Illustration 6.

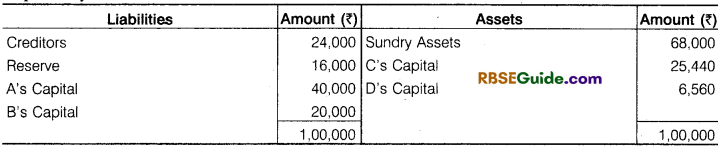

A, B, C and D are partner in a firm sharing profit and loss in the ratio of 3 : 2 : 3 : 2 respectively. Their balance sheet as on the date of dissolution was as under :

On the above date C and D become insolvent C’s estate could contribute 25 paisa in a rupee whether nothing could be realised from D’s estate. Assets realized ₹ 50,000 and the expenses of realisation were ₹ 1,600.

Prepare necessary ledger accounts to close the books the firm.

Working Note :

1. Being partner capital A/c are maintain by fluctuation method so Adding of amount of Reserve in partners capital A/c calculated. Which are for A 40,000 + 4800 = ₹ 44,800 and for B 20000 + 3200 = 23,200 so capital ratio will = 44,800 : 23,200 = 56 : 29.

2. Loss of capital of C 19,890 and D’s capital loss ₹ 7,280 will share A and B in 56 : 29 ratio .

![]()

Liability of a Minor Partner in Case of Insolvency of Firm :

According to Indian Partnership Act, 1932, liability of a minor partner is limited to the invested capital and earned profit, meaning thereby that only capital ofthe minor partner can be used to pay to pay off firm’s liabilities. His personal assets cannot be used for the purpose. If all partners except the minor partners are declared insolvent and minor has sufficient property even than his personal assets cannot be used to pay firm’s liability. This has been explained by the following example:

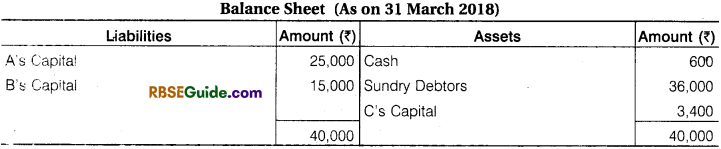

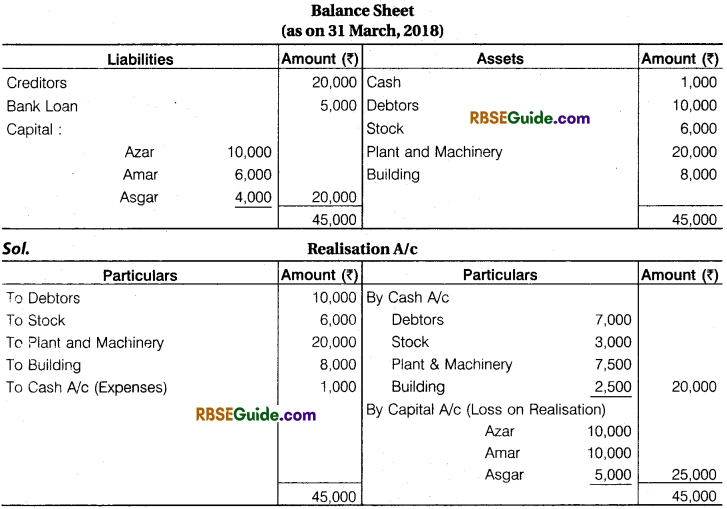

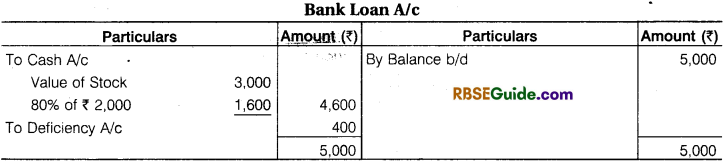

Illustration 7.

Azar, Amar and Asgar are partner’s in a firm sharing profit and losses in the ratio 2:2:1 Asgar is a minor partner. Their balance sheet as on 31 March, 2018 as follows :

They decided to dissolve the firm on 1 April, 2018. Bank loan is secured by a pledge of stock. Assets are realised as follows Debtors ₹ 7,000, Stock ₹ 3,000, Plant and Machinery ₹ 7,500 and Building ₹ 2,500, Realisation Expenses amounted to ₹ 1,000. Amar become insolvent and nothing could be realised from him. The private estate of Azar was ₹ 5,600 and Private Debts amounted ₹ 5,000. The personal assets ofAsgar amounted ₹ 22,500 and he did not have any private liabilities.

Prepare necessary account to close the books of the firm.

Working Note :

(1) Available only ₹ 600 to firm after payment of personal liaitities of Azar.

(2) Asgar is a Minor partner so he liable only upto invested capital. Not any other amount can received from his personal assets.

(3) Unsecured creditors of insolvent firm is = 20,000 + 2000 = ₹ 22000. Amount Avaiblable in firm is ₹ 1000 + 20,000 + 600 – 1000 – 3000 = ₹ 17,600 so to unsecured creditors 17600 ÷ 22000 = 80 paisa or the rate of 80% will pay. Remaining amount will transfer to deficiency account.

![]()

Dissolution of Firm Notes Important Terms

→ Dissolution of Firm : Dissolution of the firm means business of the firm comes to an end. Assets of the firm are sold and liabilities paid. In effect business relationship among the partners comes to an end.

→ Dissolution of Partnership : It means change in relationship of partners of the firm but the firm continues its business. In other words, there is dissolution of partnership whenever a partnership is reconstituted viz. admission, retirement, death or insolvency ofa partner.

→ Firm’s Debts : Firm’s debts means the debts owed by the firm to outsiders.

→ Private Debts : Private debts means debts owed by a partner to any other person.

→ Realisation Account : It is account to which assets owed by the firm and liabilities owed to outsiders are transferred at the time of firm’s dissolution amounts realised from assets and payments of liabilities are recorded in this account. The balance is gain (profit) or loss in realisation of assets and settlement of liabilities.

→ Unrecorded Assets : Assets which are not recorded in the books (balance sheet) of the firm but exist are called Unrecorded Assets.

→ Unrecorded Liabilities : Liability which is not recorded in the books of the firm but payable is known as Unrecorded Liability.