Make use of our RBSE Class 12 Accountancy Notes here to secure higher marks in exams.

Rajasthan Board RBSE Class 12 Accountancy Notes Chapter 5 Company Accounts: Issue of Shares and Debentures

Meaning and Definitions of Company :

A company or a Joint-stock company is an entity, incorporated by a group of persons through the process of law for undertaking (usually) a business. It is an artificial person and is separate from its members (shareholders). It normally has a share capital divided into units called shares, the owners of which are known as Members or Shareholders. Unlike partnership, insolvency or death of a member does not affect the life of a company, i.e., the company remains functional even if a members becomes insolvent or dies.

“Company means a company incorporated under this act or any previous company law.” Section 2(20) of the Companies Act, 2013

“A company is an artificial person, created by law having separate entity with a perpetual succession and a common seal.”

Prof. Haney

Characteristics of a Company :

(1) Incorporation : A company is an artificial person established through the process of law i.e., the Companies Act, 2013 or any previous company law.

(2) Separate Legal Entity : A company is an artificial person having a legal entity separate from its shareholders, it can own property enter into contract, conduct business sue or be sued for its debts and actions. The scope of its activities and the working of the company is regulated by its Memorandum of Association, Articles of Association and Provision of the Companies Act.

(3) Perpetual Existence : A company has a perpetual succession not affected by the death. Lunacy or bankruptcy of its members of shareholders. The life of a company comes to an end only by winding up through the process of law.

(4) Limited Liability : Liability of its members is limited to the value of the share subscribed by them except in the case of companies incorporated with unlimited liabilities.

(5) Transferability of Shares : The shares of a company are freely transferable except in case of private companies.

(6) Management and Ownership : A company is not run by all the members but by their elected representatives called Directors. Thus, management and ownership are separate.

(7) Common Seal : A company may or may not have a common seal. If it has a common seal, it is affixed to all the important documents of the company.

![]()

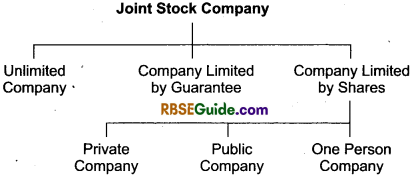

Kinds of Companies :

Companies registered under the Companies Act, 2013, maybe classified as below :

1. Unlimited Company :

Unlimited company is a company where there is no limit on the liability of its members. It means when a company suffers loss and the company’s property is not sufficient to pay off its debts the private property of its members will be used to meet the claims of creditors. As the risk involved in such companies is too high, these are not found in India even though permitted by the Companies Act.

2. Company Limited by Guarantee :

In case of such a company the liability of the members is limited to the extent of the guaranteed given by them in the event of the winding up of the company. The liability of its member will arise only in the event of winding up of the company.

3. Company Limited by Shares :

In case of such a company the liability of the members is strictly limited to the extent of the nominal value of shares held by each of them. If a member has already paid the full amount of the shares he will not be liable to pay any amount. If a member has partly paid shares he can be forced to pay the remaining amount during the existence of the company as well as during the winding up. Such companies may be sub-divided into private, public and one person companies.

(a) One Person Company :

One person company is a company which has only one person as a member. It is a company incorporated as a private company which has only one member. Rule 3 of the Companies (Incorporation), Rules 2014 provides that :

- Only a natural person being an Indian citizen and resident in India can from one person company or can be nominee for the role member of one person company.

- One person can form only one “one person company” or become nominee of only one such company.

- It can be formed for charitable purposes.

- It cannot carry out non-banking financial investment activities including investments in securities of anybody corporate.

- Its paid up share capital is not more than ₹ 50 lakhs.

- Its average annual turnover should not exceed ₹ 2 crores.

(b) Private Company : A private company is one which has minimum paid up. Share capital as may be prescribed and which by its Articles of Association.

- Restricts the right to transfer its shares if any.

- Except in the case of one person company limits the number of its numbers excluding its present or part employee members to 200. Where shares are held by two or more persons jointly they shall be treated as a single member.

- Prohibits any invitation to the public to. subscribe for any securities of the company. A private company must have atleast 2 members. The name of a private company ends with the words “Private Limited”. [Section 2(68) of the Companies Act, 2013]

(c) Public Company: A pubic company is company which:

- is not a private company.

- has a minimum paid up capital as may be prescribed.

- is a private company being a subsidiary of a company which is not a private company.

- A public company must have atleast 7 members. There is no restriction on the maximum number of members.

- The name of a public company ends with the word “Limited”.

- A public company can raise its capital by issue of shares to public for subscription. [Section 2(7) of the Companies Act, 2013]

Shares :

Total capital of the company is divided into units of small denominations. Each such unit is called “Share”. For example, if the total capital of the company is ₹ 10,00,000 divided into 1,00,000 units of ₹ 10 each, each unit of ₹ 10 will be called a Share (of ₹ 10 each). Thus, in the above case, the company has 1,00,000 shares of ₹ lOeach. Shares must be numbered so that they may be identified.

Kinds of Shares :

Under Section 43 of the Companies Act, 2013, a company may issue two types of shares :

(1) Preference shares

(2) Equity shares

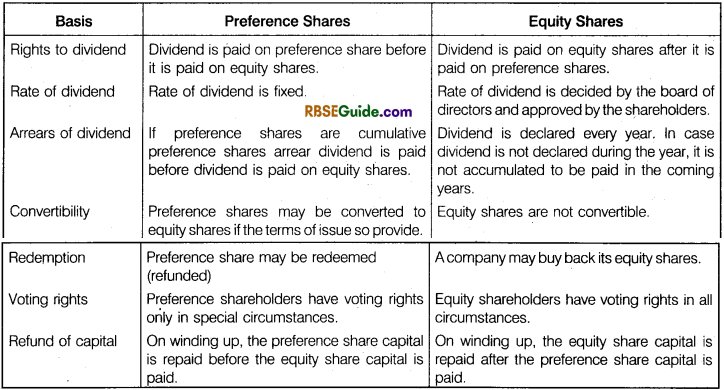

1. Preference Shares :

Preference shares are those which carry the following two rights :

(i) They have a right to receive dividend at a fixed rate before any dividend is paid on the equity shares.

(ii) When the company is wound up they have a right to the return of capital before that of equity shares.

In addition to the above the preference shares may carry some more rights such as the right to participate in excess profits when a specified dividend has been paid on the equity shares or the right to receive a premium at the time of redemption. .

Types of Preference Shares :

(i) Cumulative Preference Shares : Cumulative preference shares are those preference shares which carry the right to receive arrears of dividend before dividend is paid to the equity shareholders. For example, a company has 10,000, 7% preference shares of ₹ 100 each and dividend for the years 2016 and 2017 has not been paid. The company earns adequate profits won in the year 2018. In this case, the company shall pay ₹ 2,10,000 as dividend for three years to the preference shareholders before dividend is paid to the equity shareholders.

![]()

(ii) Non – Cumulative Preference Shares : Non – cumulative preference shares are those preference shares which do not carry the right to receive arrears of dividend. In the above example preference shareholders share be entitled to receive dividend only for the year 2018 i.e., ₹ 70,000 before dividend is paid to equity shareholders.

(iii) Participating Preference Shares : The Articles of Association of a company may provide that after dividend has been paid to the equity shareholders, the holders of preference shares will also have a right to participate in the remaining profits. The preference shares carrying this right are called Participating Preference Shares.

(iv) Non-Participating Preference Shares : Preference shares which do not carry the right to participate in the profits remaining after equity shareholders have been paid dividend are Non-Participating Preference Shares.

(v) Convertible Preference Shares : Holder of these shares have a right to get their preference shares converted into equity shares at their option according to the terms of issue.

(vi) Non-Convertible Preference Shares : When the holders of preference shares have not been conferred the right of getting their preference shares converted into equity shares, such shares are called Non – Convertible Preference Shares.

(vii) Redeemable Preference Shares: Such shares are those which will be repaid by the company within a stipulated period in accordance with the terms of issue and the fulfilment of certain conditions laid down in Section 55 of the Companies Act, 2013.

(viii) Irredeemable Preference Shares : Irredeemable preference shares are those the capital of which cannot be refunded before winding up. According to Section 55 of the Companies Act, 2013, no company limited by shares shall issue any preference share which is irredeemable or is redeemable after the expiry of 20 years from the date of its issue.

2. Equity Shares :

Equity shares are those shares which are paid dividends only when profits are left after the preference shareholders have been paid fixed rate of dividends. In other words, there will be no fixed rate of dividend on the equity shares. If in a particular year there are no profits or insufficient profits the equity shares will receive nothing.

If the company earns more profits they get a higher rate of dividend. As regards return of capital, equity share capital is returned only when preference share capital is returned in full. Equity shareholders have voting rights and control the affairs of the company.

Difference between Preference Shares and Equity Shares :

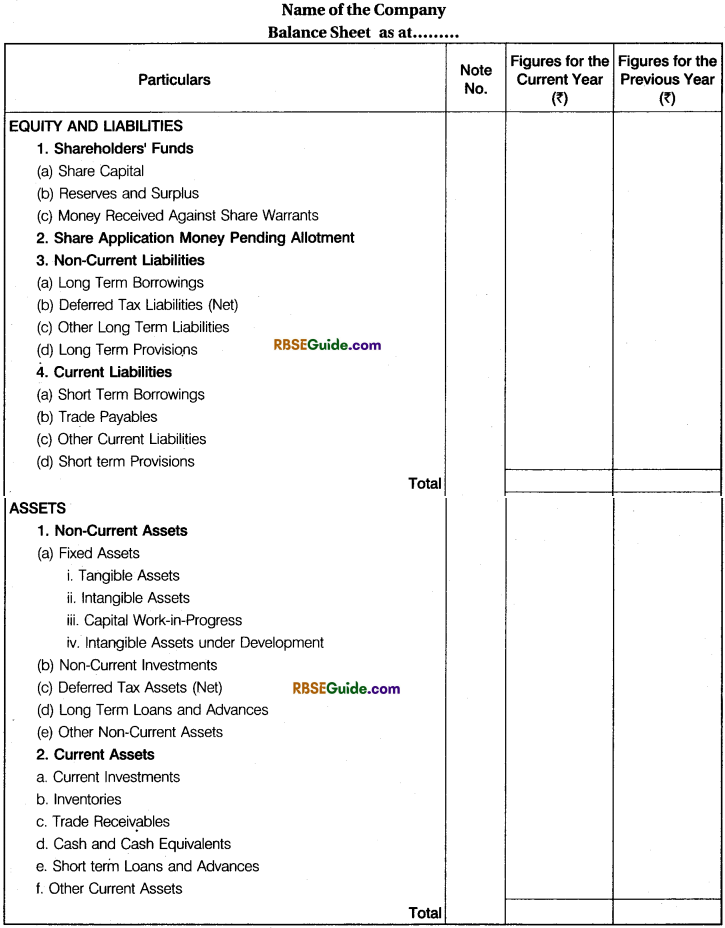

Kinds of Share Capital of Company :

Schedule III of the Companies Act, 2013 requires a company to show :

(1) Authorised or Nominal Capital :

According to Section 2(8) of the Companies Act, 2013, “Authorised capital or nominal capital” means such capital as is authorised by the memorandum of a company to be the maximum amount of share capital of a company. It is stated in the Memorandum of Association and is the maximum amount that a company can arise as share capital.

It is stated separately for each class of shares, i.e., preference shares and equity shares. It is the maximum amount of share capital under each class of shares which a company can issue for subscription. If a company has to issue more shares than authorised capital, it must increase the authorised or nominal capital first and thereafter, issue shares for subscription. Authorised share capital under each class (equity or preference) may be more or at the most equal to the issued share capital but cannot be less than the issued capital.

(2) Issued Capital :

According to Section 2(50) of the Companies Act 2013, “Issued capital” means such capital as the company issues from time to time for subscription. Thus issued capital is a part of the authorised capital that is issued for subscription. It includes besides shares issued for subscription. Shares allotted for consideration other than cash, shares subscribed by signatories to the Memorandum of Association and shares taken by directors as qualifying shares. It should be kept in mind that issued capital cannot exceed the company’s authorised share capital.

![]()

(3) Subscribed Capital :

According to Section 2(86) of the Companies Act, 2013, “Subscribed capital” means such part of the capital which is for the time being subscribed by the members of company. Thus, subscribed capital is a part of issued capital which the company has issued for cash or for consideration other than cash. It includes shares issued for subscription and subscribed shares subscribed by signatories to the Memorandum of Association, shares subscribed by the directors as qualifying shares and shares allotted for consideration other than cash.

(4) Called up Capital :

It is that part of subscribed capital which is called by the company to pay on shares allotted. It is not necessary for the company to call for the entire amount on shares subscribed for by shareholders. The amount which is not called on subscribed shares is called, Uncalled Capital.

(5) Paid up Capital :

It is that part of called up capital which actually paid by the shareholders. Therefore it is known as Real Capital of the company. Whenever a particular amount is called and a sharesholder fails to pay the amount fully or partially it is known as Unpaid Calls on Calls-in-Arrears.

Paid up Capital = Called up Capital – Calls in Arrears

Format of Company’s Balance Sheet :

The format of Balance Sheet in Company Act, 2013 schedule III part I is following :

Issue of Shares :

A company may issue shares either :

1. For cash and/or

2. For consideration other than cash

1. Issue of Shares for Cash :

Shares are said to be issued for cash when the company receives amount (by cheque or a banking instrument) against the issued shares. There shares may be issued at par (at face value) or at premium (above the face value). Issue price may be payable either :

(i) In lump sum along with the application or

(ii) In instalments at different stages it means partly on application, partly on allotment and balance in one or more calls.

(i) Share Payable in Lump-Sum : When shares issued are payable in one instalment the shares are said to have been issued against lump-sum payment.

(ii) Shares Payable in Instalments : Amount against the shares may be received in instalments like application, allotment, first call, second call etc.

A company may issue shares :

(i) At Par : Issue of shares at par means shares have been issued at their nominal (face) value i.e. issue price and nominal (face) value are same. For example, a share with nominal (face) value of ₹ 10 is issued at ₹ 10.

(ii) Issue of Shares at Premium : Issue of shares at premium means shares have been issued at a value that is more than the nominal (face) value of the share i.e., issue price is more than the nominal (face) value. For example, a share with face value of ₹ 10 is issued at ₹ 15, premium being ₹ 5.

Section 53 of the Companies Act, 2013 prohibits issue of shares at discount, except when sweat equity shares are issued.

Procedure for Issue of Shares :

Following steps are to be taken by a public company for the issue of shares to public :

(i) To Issue Prospectus :

Prospectus is an invitation to the public to purchase its shares. It describes the profitability and soundness of the business of the company to attract the investing public. It contains the following informations :

Name and address of the registered office of the company, names and addresses of the directors, objects of the company, risks involved in the issue, consent from SEBI (Securities and Exchange Board of India), authorised and issued capital of the company and the number of shares now offered for subscription, terms of present issue, dates of opening and closing of the issue etc.

(ii) To Receive Applications :

After reading the prospectus the public applies for shares in the company on a prescribed form. Each application must accompany the application money which is mentioned in the prospectus but it should not be less than 25% of the issue price of each share. The amount of share application money must be deposited by the public in a scheduled bank. The name of the company’s scheduled bank is also mentioned in the prospectus.

![]()

(iii) To Make Allotment of Shares :

After the last date fixed for receipt of application money expires, the bank sends all applications to the company. The directors of the company cannot proceed to allot shares unless minimum subscription mentioned in the prospectus has been received by the company.

Minimum Subscription :

Section 39(1) of the Companies Act, 2013 provides that a company cannot allot any securities of the company to public unless the amount stated in the prospectus as the minimum amount has been subscribed and the sums payable on application for the amount so stated have been received by die company by cheque or other instrument which has been paid.

Minimum subscription means the amount which in the opinion of the directors is the minimum to be raised by the issue of shares so as to provide for the following requirements :

- For the payment of purchase price of any property purchased or agreed to be purchased.

- For the payment of preliminary expenses, including underwriting commission and brokerage on issue of shares.

- For the repayment of any money borrowed by the company for the above purposes.

- For working capital.

- For any other expenditure required for the usual conduct of business operations.

According to SEBI guidelines minimum subscription has been fixed at 90% of the issued amount. As per Section 39(3), the company has to get minimum subscription within 30 days from the date of the issue of the prospectus. If the company fails to receive the minimum subscription within the said period the company cannot proceed with the allotment of shares and the entire application money must be returned within next 15 days. It there is a delay in refund of such amount by more than 15 days. The company shall be liable to repay it with interest at the rate of 5% per annum for the delayed period.

Each allotte will be issued share certificates for eligible number of shares. In case of over subscription of shares, the allotment shall be on a proportionate basis according to the number of shares applied for. For example, if a company issues a prospectus inviting applications for 1,00,000 shares and if applications are received for 4,00,000 shares, the issue has been over subscribed by 4 times. In such a case an applicant in the category of500 shares is entitled to the proportionate allotment

of \(\frac {500}{4} \) = 125 shares.

As a result of over subscription, some applications may be rejected in full. Others may be partially accepted and still others may be accepted in full. Those who are allotted shares are sent ’Letters of Allotment, indicating the numbers of shares allotted and the amount now due on allotment. Those who are not allotted shares are sent ‘Letters of Regret’ a long with a cheque for the refund of application money.

(iv) To Make Calls : The amount paid on applications and allotment are not calls but subsequent instalments as and when demanded are calls. A company may demand the whole amount of share on application in one instalment. If the whole of the amount of share is not paid on application and allotment, the unpaid amount may be called by the directors in one or more instalments. Each instalment is named as first call, second call etc. Calls must be made strictly in accqrdance with the provisions of the Articles of Association. In the absence of the Articles of Association, the provisions of Table F of Schedule I of the

Companies Act, 2013, shall apply. These provisions are :

- The amount to be called up either on applications or on allotment or on any one call shall not exceed 25% of the total quantum of the issue.

- All amount of shares should be fully called up within a period of 12 months from the date of allotment.

- There must be an interval of atleast one month between the making of two calls.

- Atleast fourteen days notice must be given to the shareholders to pay the amount of call.

- Calls must be made on a uniform basis on all the shares within the same class of shares.

A call letter must specify the amount of the call mode of remitting money address to which call money is required to be sent and the last date for sending the money.

2. Issue of Shares for Consideration Other than Cash :

It is not necessary to issue the shares only for cash. A company may issue fully paid shares for consideration other than cash.

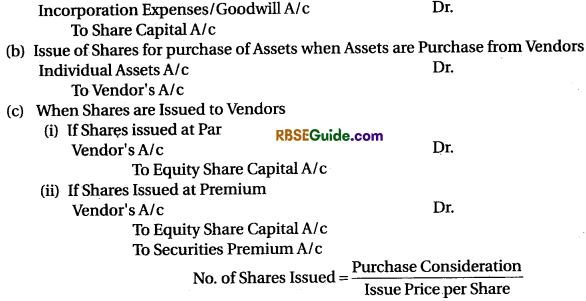

Journal Entries for Issue of Shares :

(i) Issue of Shares for other then Cash :

(a) Issue of Shares to Promoters : Promoters of a company may be issued shares in the company for the services rendered by them.

The entry will be :

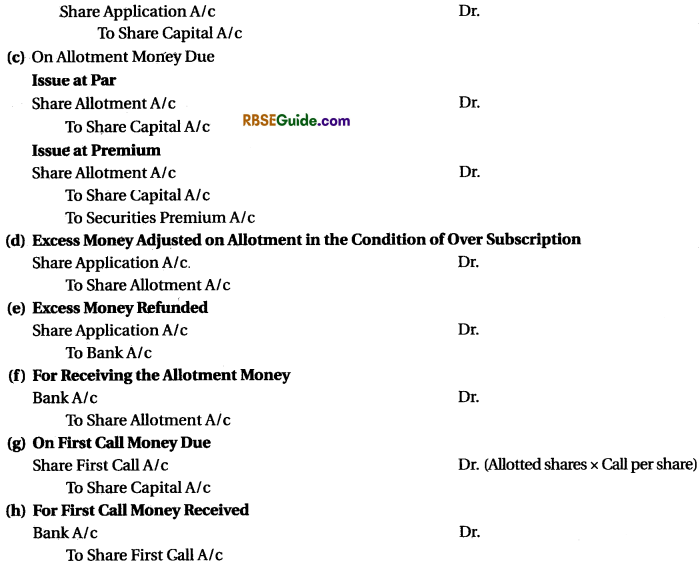

(ii) Issue of Shares for Cash

(b) Over Subscription of Share :

When the number of shares applied for is more than the number of shares offered to the public for subscription. However, as the company cannot allot shares more than that offered for subscription, the board of directors will have to allot shares on Pro-rata basis. It means that smaller number of shares are allotted to each applicant according to the number of shares applied by him.

Calls-in-advance account is shown on the equity and liabilities side of balance sheet under the main head “Current Liabilities” and sub-head “Other Current Liabilities”.

Interest on Calls-in-Advance : The amount received as calls-in-advance is a debt of the company. It is liable to pay interest on capital on calls-in-advance from the date of receipt till the date when the call is due for payment. Generally, the Articles of the Company specify the rate at

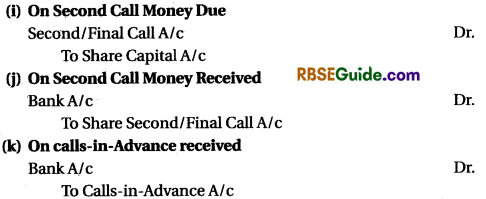

which interest is payable on calls-in-advance. However, if the articles to not contain such rate, Table F of Schedule I of the Companies Act, 2013 shall be applicable which leaves the matter to the board of directors subject to maximum rate of 12% p.a. It is to be noted that interest on calls-in-advance is a charge against the profit of the company.

![]()

Interest on Calls-in-Arrears : The company is authorised to charge interest on calls-in-arrears at a specified rate mentioned in its articles from the due date to the date of actual payment. But if the articles are silent, Table F of Scheduled of the Companies Act, 2013 shall be applicable, according to which interest shall be charged at a rate not exceeding 10% p.a. However, the directors have the right to waive the payment of such interest wholly or in part. Entry will be :

Issue of Shares at Premium :

When a company issues a share at a price which is above its face value, it is said to be issued at premium. For example, if a share of the face value of ₹ 10 is issued at ₹ 12, ₹ 2 will be the premium on the share. There is no legal restriction on issue of shares at a premium.

The premium on issue of shares is a capital profit and not a revenue profit and as such, must be credited to a separate account called “Securities Premium Reserve Account”. It must be shown separately in the balance sheet on the equity and liabilities side under the head “Reserve and Surplus.”

Utilisation of Securities Premium : Under Section 52(2) of the Companies Act, 2013, the amount of securities premium reserve may be used only for the following purpose :

- In writing off the preliminary expenses of the company

- For writing off the expenses, commission or discount allowed on issue of shares or debentures of the company.

- For issuing fully paid bonus shares to the shareholders of the company.

- For providing for the premium payable on redemption of redeemable preference shares or debentures of the company.

- For buy back of its own shares and other securities as per Section 68.

Under Subscription of Shares : The shares are said to be under subscribed if the number of shares applied for in less than the number of shares offered to public for subscription. In case of under subscription accounting entries are made on the basis of shares applied since allotment is made in full to all the applicants.

Over Subscription of Shares : Shares are said to be over subscribed when the number of shares applied for is more than the number of shares offered for subscription. In the case of over subscription shares can be allotted by the company by any of the following three alternatives :

![]()

(i) First Alternative : Some applications are accepted in full and excess applications are rejected outrightly and their application money is refunded. This is known as Rejection of Applications. For example, applications are invited for 50,000 shares and applications received are for 70,000 shares. Applications for shares in excess of 50,000 shares i.e., 20,000 shares are not accepted and their applications money is refunded.

(ii) Second Alternative : All applicants are allotted shares in proportion. This is called Partial or Pro-rata Allotment. For example, considering the above example shares are allotted to all the applicants in the ratio of 5 shares for 7 applied.

(iii) Third Alternative : A combination of the above two alternatives may be adopted. Some applications are accepted in full, some applications are rejected and proportional allotment is made to the remaining. For example, applicants are allotted shares as follows :

Applications for 20,000 shares are accepted in full, applications for 10,000 shares are rejected and the balance applications are allotted on pro-rata basis i.e., in the ratio of 3 shares for every 4 shares applied

Issue of Share at Par :

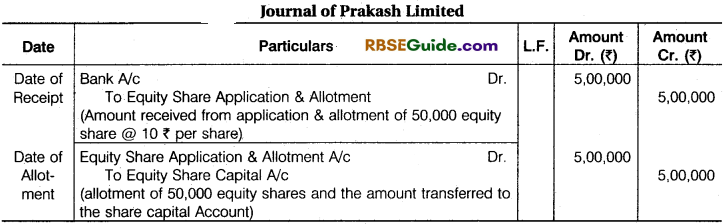

Illustration 1.

Prakash Ltd. registered with a Capital of ₹ 10,00,000 divided in 1,00,000 Equity share of ₹ 10 each. Out of than 50,000 Equity share were offered to the Public. Full amount was being payable on application. All the offered share were taken by the public and paid off. Pass the Journal Entries in the Book of the Company

Solution:

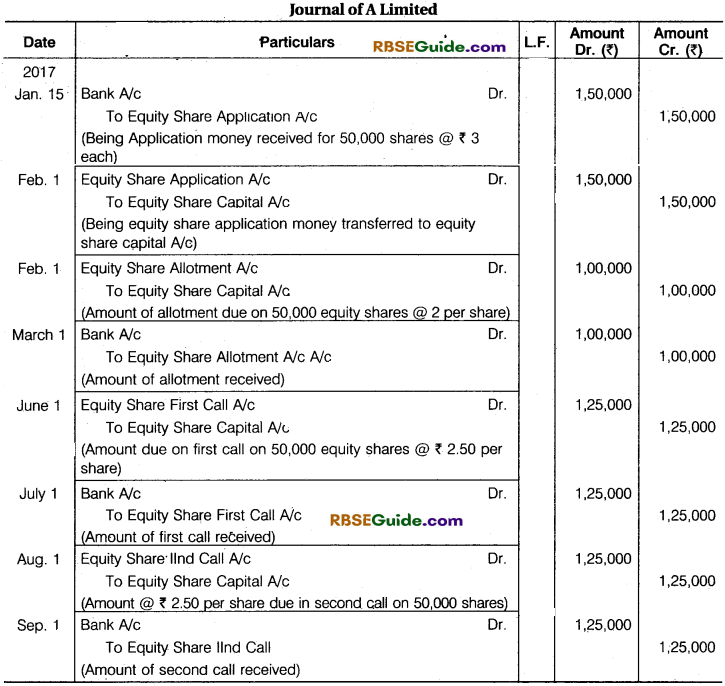

Illustration 2.

A Limited Issue 50,000 equity share of ₹ 10 each in 1st Jan. 2017. The subscription on lists were closed on 15th Jan. 2017. Allotment was made on 1st Feb. 2017, and the amount due on allotment was payable on or before 1st March 2017. The first and second calls were made respectively 1st June and 1st Aug. 2017. The amount of two calls were payable on or before 1st July and 1st Sep. 2017 respectively. The respective amount were called and received on due date. The amount payable per share were ₹ 3 on Application. ₹ 2 on allotment ₹ 2.50 on First Call, ₹ 2.50 on Second call.

Give Journal Entries in the Books of Company.

Solution:

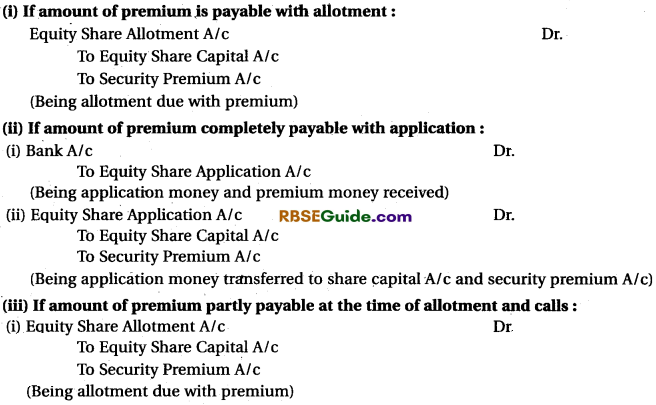

Journal Entries for Issue of Shares at Premium :

Generally, amount of premium due on allotment if there is no information is question, it should assumed that amount of premium is due on allotment.

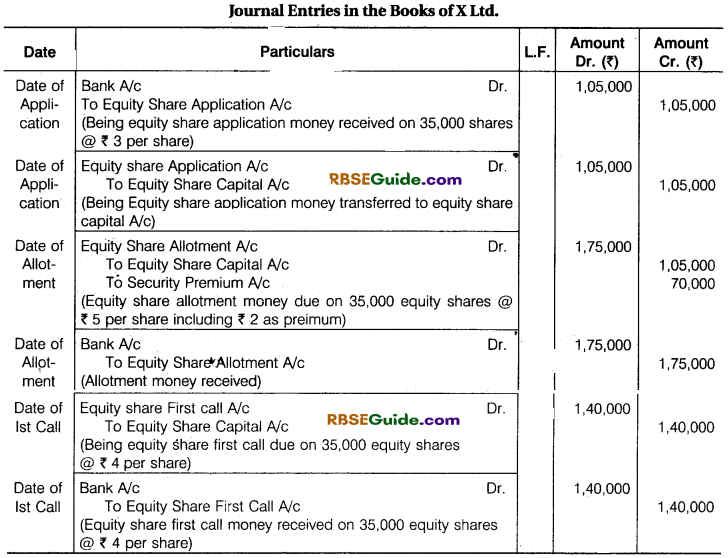

Illustration 3.

X Company Ltd. Issued 3,5000 Equity shares of ₹ 10 each at a premium of ₹ 2 payable as follows :

On Application ₹ 3, On Allotment ₹ 5 (Including Pre.) on 1st Call Amount Rest Amount. The issue was fully subscribed and all the money was duly received. Record Journal entries in the books of X company Ltd.

Solution :

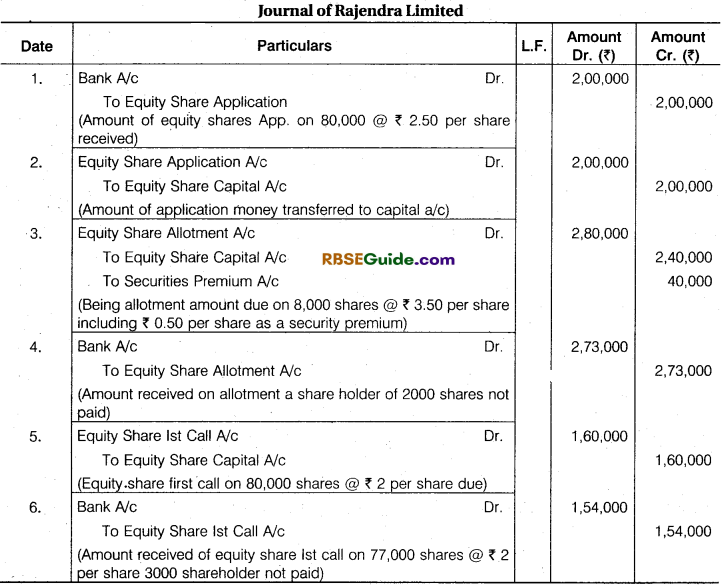

Illustration 4.

Rajendra Ltd. was formed with an authorised Capital of ₹ 20 Lakh divided into 2,00,000 Equity shares of ₹ 10 each. It issued 85,000 Equity shares to the public at ₹ 10.50 per share Payable as to 2.50 on application, ₹ 3.50 (including Preimum) on allotment, ₹ 2 as First Call and the Balance as and when required. 80,000 shares were subscribed by the public. All the money except the Second and Final call were called by company. The respective amount were received from the shareholders with the following exceptions :

A holder of 2000 shares failed to pay the allotment money and the first call money another holder of 1000 shares failed to pay first call money. Enter the following Transactions in the cash Book and Journal of the Company and show how share capital and Securities Premium will appear in the Balance Sheet as per Part I of Schedule III.

Solution:

Working Notes :

(i) ₹ 7,000 and ₹ 6,000 is outstanding respectively in Equity Share Allotment A/c Share First Call A/c.

(ii) Amount received on allotment calculated as under :

Call ₹ 3.50 included 3.00 share and 0.50 ₹ premium.

Total payable amount : 2,80,000 (2,40,000 + 40,000)

2,000 shareholder not paid = 2,000 x 3.50 = ₹ 7,000

Received amount = 2,80,000 – 7,000 = ₹ 2,73,000

(iii) Amount received on 1st call :

Total share 80,000 @ ₹ 2 per share payable

Total payable amount = 80,000 x 2 = ₹ 1,60,000

(2,000 + 1,000) share = 3,000 share holders not paid

3,000 x 2 = ₹ 6,000

Received on 1st call = 1,60,000 – 6,000 = ₹ 1,54,000

(iv) Premium called on allotment, so premium which is not received :

2,000 sharehlders not pay the allotment money

2,000 x 0.50 = ₹ 1,000 premium not received.

Which is deducted in Balance Sheet in “Reserve and Surplus”.

![]()

Illustration 5.

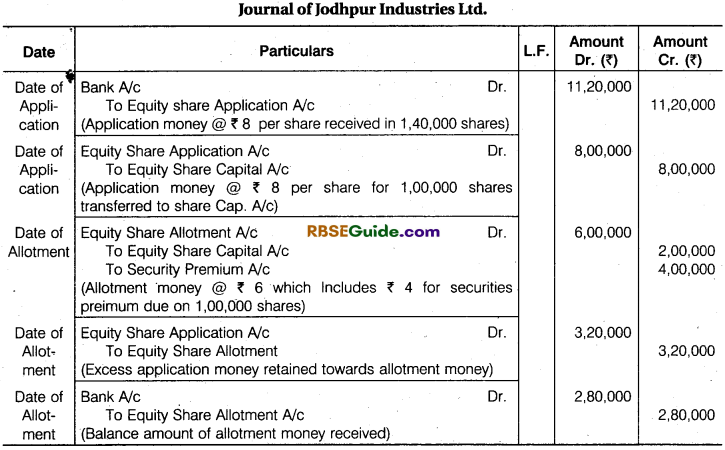

Jodhpur Industries Limited invited application for Issuing of 1,00,000 Equity shares of ₹ 10 each at a Premium of ₹ 4 per share. ₹ 8 Per share were payable on application and Balance amount on allotment. The Issue was over subscribed by 40,000 Shares and the allotment was made on Pro rata basis. All the money were received on their respective dates. Pass Journal Entries in the Books of Jodhpur Industries Limited.

Solution:

Journal of Jodhpur Industries Ltd.

Working Notes:

(i) Excess Amount received on application = 40,000 x 8 = ₹ 3,20,000

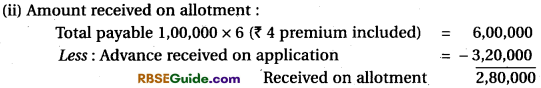

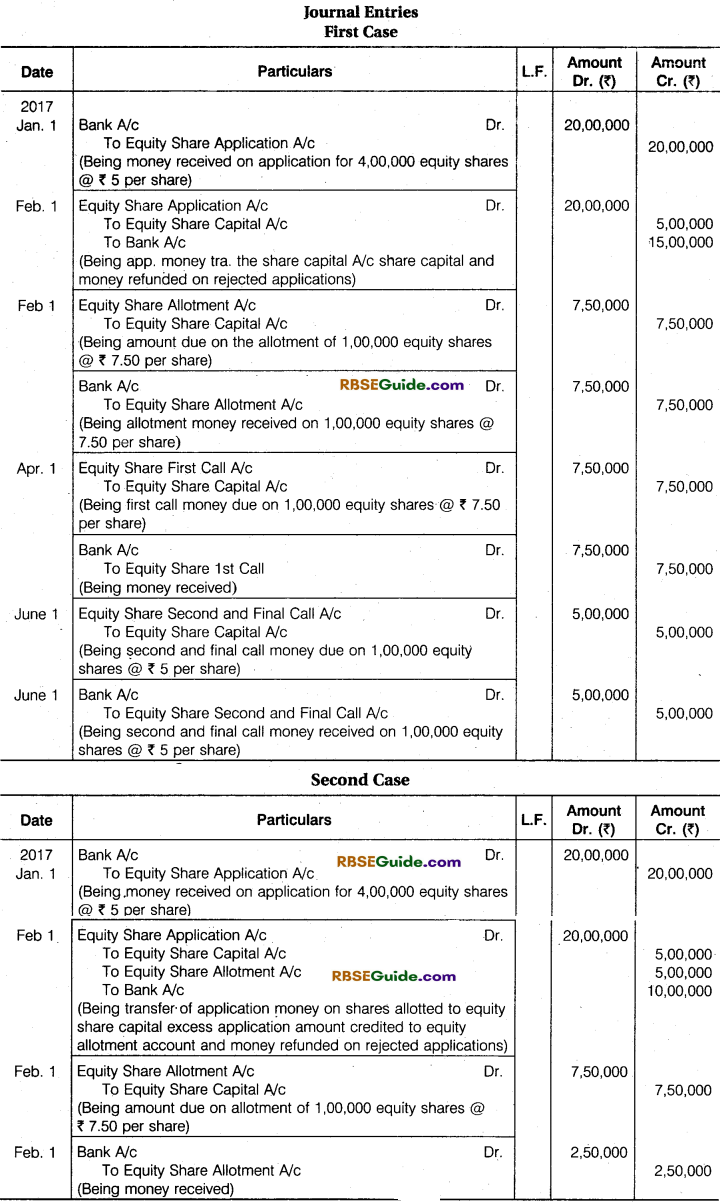

Journal Entries for Over-Subscription of Shares

Illustration 6.

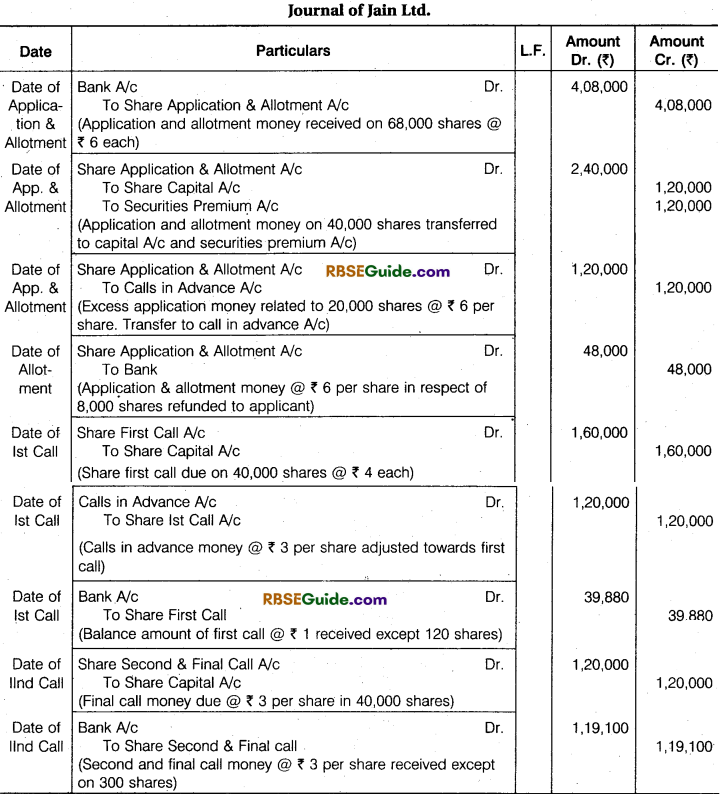

Jain Limited invited applications for Issue of 40,000 Equity shares of ₹ 10 each a premium of ₹ 3 per share payable as follows –

Application were received for 68,000 shares. Application for 8,000 shares were rejected and application money were returned. Pro Rata allotment was made to remaining applicants.

Excess application and allotment money was adjusted on the sums due on First Call. The Balance amount of First Call money was not received as 120 shares and Second call money was not received on 300 shares.

Pass necessary Journal Entries in the Books of Jain Ltd.

Working Notes :

Illustration 7.

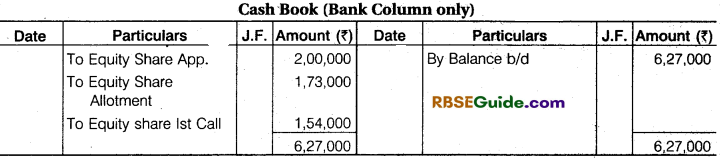

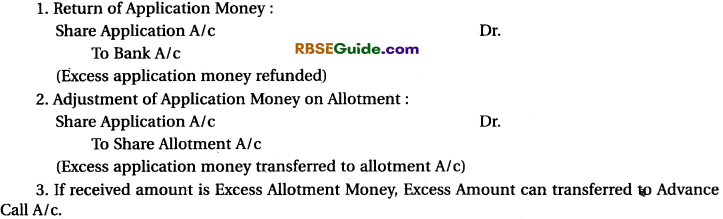

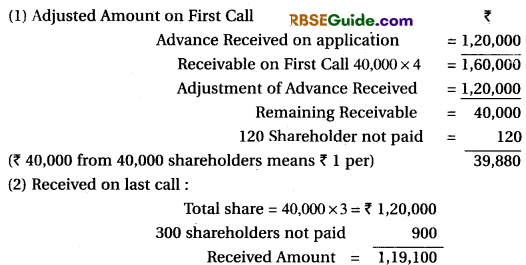

Janta Papers Limited invited applications for 1,00,000 equity shares of ₹ 25 each payable as under :

Applications were received for 4,00,000 shares on January 1, 2017 and allotment was made on February 1, 2017. Record journal entries in the books of the company to record these share capital transactions under each of the following circumstances :

1. The directors decide to allot 1,00,000 shares in full to selected applicants and the applications for the remaining 3,00,000 shares were rejected outright.

2. The directors decide to make a pro-rata allotment of 50% of the shares applied for to every applicant, to apply the balance of application money towards amount due on allotment, and to refund the amount remaining thereafter.

![]()

3. The directors totally reject applications for 2,00,000 share, accept full application for 80,000 shares and make a pro-rata allotment of the 20,000 shares to remaining applicants the excess of application money is to be adjusted towards allotment and calls to be made.

[Note : The entries regarding the two calls would be the same Third Case as under the preceding method.]

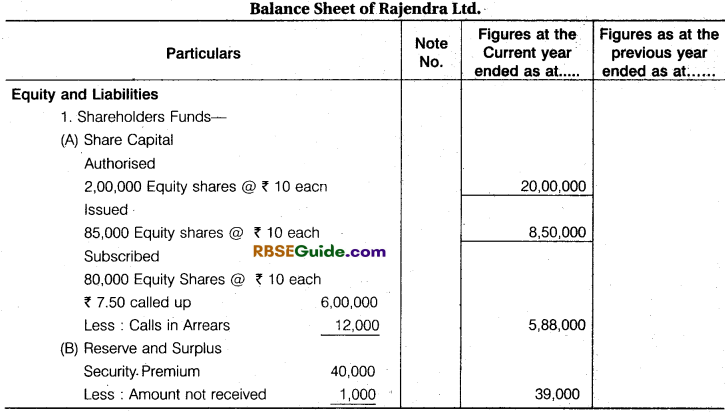

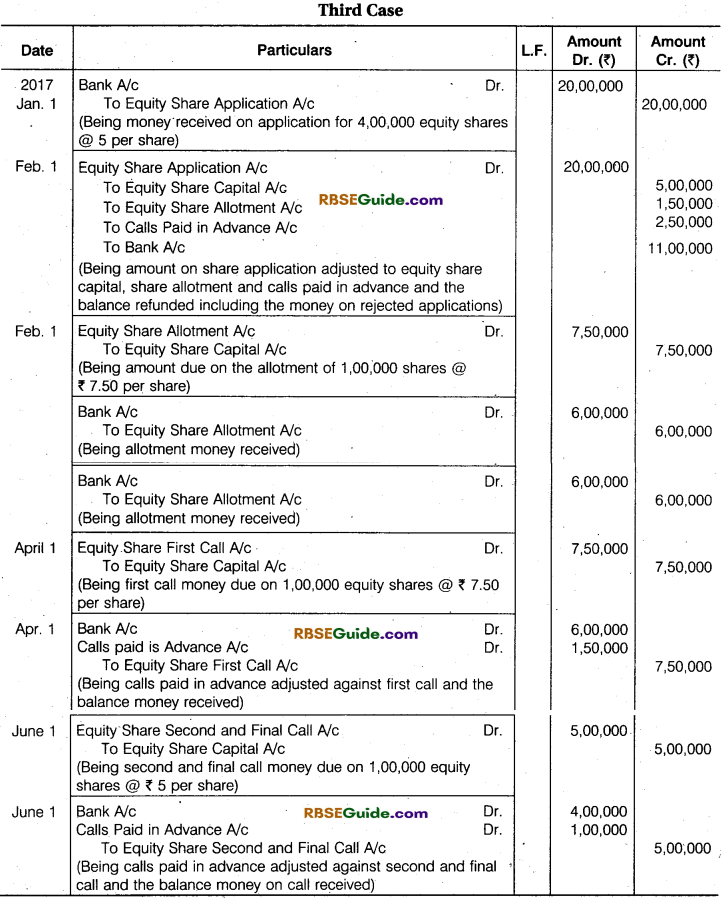

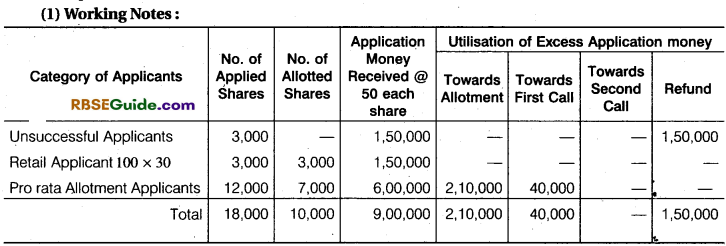

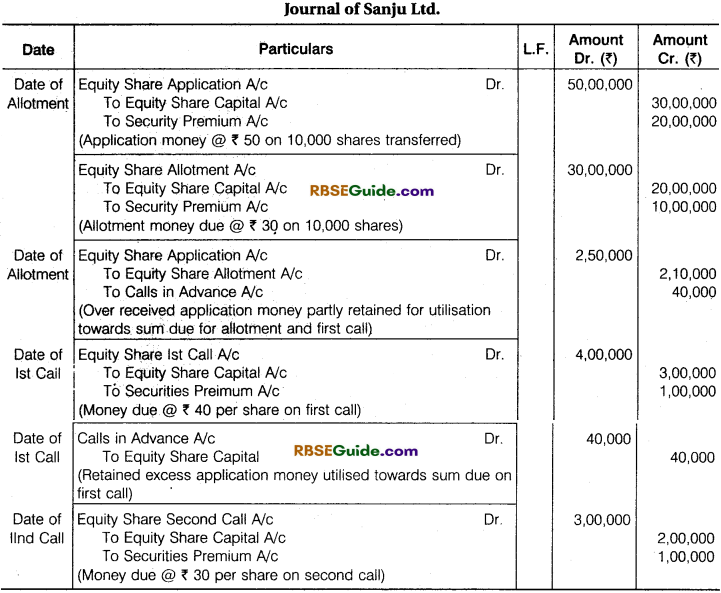

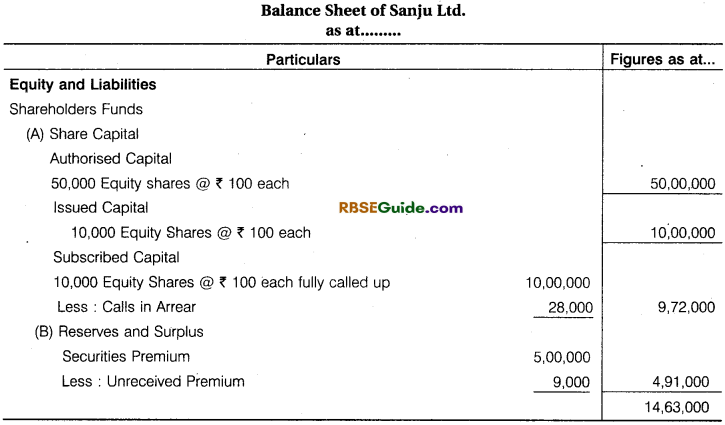

Illustration 8.

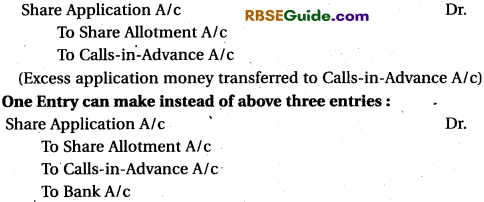

Sanju Limited was incorporated with authorised capital of ₹ 50 Lakhs divided into 50,0 equity shares of ₹ 100 each. It issued a prospectus inviting applications for 10,000 Equity shares at a Premium of ₹ 50 per share payable as follows :

On Application ₹ 50 (Including ₹ 20 Premium). On allotment ₹ 30 (Including ₹ 10 Premium) on First call ₹ 40 (Including ₹ 10 Premium) on Ilnd & Final Call ₹ 30 (Including ₹ 10 Premium).

Application were received for 18000 shares. Application for 3000 shares were rejected 3000 shares were allotted to 30 retail applicants who applied. For 100 shares each and prorata allotment was made to the remaining applicants.

![]()

Money over paid on application was utilised towards sum due on allotments & calls. Shubham who has applied for 720 shares failed to pay two calls. Madhu who had applied for 100 shares failed to pay allotment and subsequent calls.

Pass entries in Cash Book and Journal of the Company and show relevant item in equity and liabilities in Company’s Balance Sheet. Excess application money may be first adjusted towards securities premium.

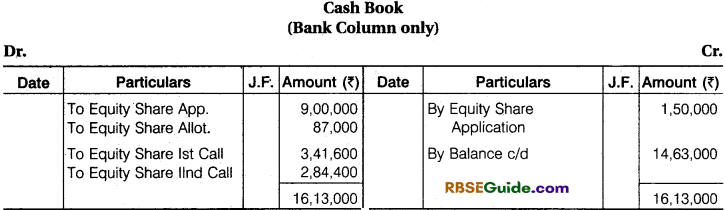

Solution:

(2) Excess amount received on application adjustment will done as follows :

Excess amount received on application = 6,00,000 – 3,50,000 = ₹ 2,50,000

Adjustment on allotment = 2,50,000

Adjusted on 1st call = 40,000

40,000 ÷ 7000 = 5.714 Advance per share

1st call is ₹ 40, so 40 – 5 .7144 = ₹ 34.2857 @ per share should be call.

(3) Amount received on allotment :

10,000 share @ ₹ 30 per share = ₹ 3,00,000

100 shareholders not paid = 100 x 30 = ₹ 3000

Excess amount received on application adjusted = ₹ 2,10,000

Net amount received = 3,00,000 – 2,10,000 – 3,000 = ₹ 87,000

(4) Received Amount on 1st call :

10,0 shaer @ ₹ 40 each = 10,000 x 40 = ₹ 4.00,000

Advanced on application = ₹ 40,000

420 shareholders not paid – (proportionate calculation) = 420 x 34 – 2857 = 14,400

100 shareholder not paid 100 x 40 = ₹ 4,000

Total = 40,000 + 14,400 + 4,000 = ₹ 58,400

Net,Amount received = 4,00,000 – 58,400 = ₹ 3,41,600

(5) Received on Ilnd Call:

Note :

Amount of premium not received is calculated as under :

420 x (4.2847 + 10) = ₹ 6,000

100 x (10 + 10 + 10) = 3,000 = 6000 + 3000 = 9000

Issue of Sweat Equity Shares :

Sweat equity shares refers to equity shares given to the company’s employees on favourable terms in recongnition of their work. It is one of the modes of making share based payments to employees of the company. The issue of sweat equity allows the company to retain the employees by rewarding them for their services.

Sweat equity rewards the beneficiaries by giving them incentives in lieu of their contribution towards the development of the company further, it enables greater employee stake and interest in the growth of an organisation as it encourages the employees to contributa more towards the company in which they feel they have a stake.

As per Section 2(88) of the Companies Act, 2013, “Sweat equity shares” means such equity shares as are issued by a company to its directors or employees at a discount or for consideration other than cash, for providing their know-how or making available rights in the nature of intellectuals property rights or value addition by whatever name called.

Issue of Right Shares :

Under Section 62 of the Companies Act, 2013 every public limited company, whenever it proposes to increase its subscribed capital shall be required to offer those shares to the existing shareholders of equity shares in their existing proportion. Such as issue is known as Rights Issue. If for example, a company which has already issued 3,00,000 shares wants to make a further issue of 1,00,000 shares, it shall have to offer the existing shareholders a right to subscribe for 1 new share for every 3 old shares hold. The existing shareholders can authorise the company by passing a special resolution to offer such shares to the public. Right issue is advantageous to the existing shareholders specifically when the market price of the share is higher than the issue price.

![]()

Employees Stock Option Plant – ESOP :

Employees Stock Option Plan (ESOP) means option granted by the company to its employees and employee directors to subscribe the shares at a price that is lower than the market price i.e., fair value, it is option or right granted by the company but it is not an obligation on the employee to subscribe it. The employees may or may not be exercise the option.

Employee Stock Option plan is a category of sweat equity. Sweat equity is a wider term than ESOP. A company may issue stock (shares) options fulfilling the following conditions :

1. These shares are of the same class of shares already issued.

2. It is authorised by a special resolution passed by the company.

3. The resolution specifies the number of shares the current market price consideration, if any.

Escrow Account : An escrow account is a temporary pass through account hold by a third party during the process of a transaction on between two parties. This is a temporary account as it operates until the completion of a transaction process which is implemented after all the conditions between the buyer and the seller are settled.

Initial Public Offer (IPO) : An initial public offering or IPO is the very first sale of stock issued by a company to the public. Prior to an IPO the company is considered private, with a relatively small number of shareholders made up primarily of early investors (such as the founders, their families and friends) and professional investors. The public on the other hand consists of everybody else any individual or institutional investor who wasn’t involved in the early days of the company and who is interested in buying shares of the company. Until a company’s stock is offered for sale to the public, the public is unable to invest in it.

Debentures :

Meaning of Debenture :

In addition to raising of capital by issue of shares a company requiring funds on long term basis, may borrow money by issue of debentures. A debenture issued by a company is usually in the form of a certificate, given under the seal of the company. Thus, a debenture is a written acknowledgement of a debt taken by the company as these are issued under the seal of the company.

A debenture certificate contains the terms of the repayment of the principal sum at a specified date and the terms of payment of interest at a fixed percent. According to Section 2(30) of the Companies Act, 2013 “Debenture includes debentures stock bonds and any other securities of a company whether constituting a charge on the assets of the company or not”.

Characteristics of Debentures :

(1) A debenture is issued by a company in the form of a certificate which is a written acknowledgement of debt taken by the company.

(2) A debenture is issued under the seal of the company.

(3) It contains a contract for the repayment of principal sum at a specified date.

(4) As per Companies Act, 2013, no company is allowed to issue debentures having a maturity date of more than 10 years from the date of issue. However, a company engaged in infrastructure , projects can issue debentures for more than 10 years but not exceeding 30 years.

(5) Usually the debentures are issued with a specified rate of interest, which is called “Coupon Rate”. A debentureholder receives interest on his debentures at this specified rate, as mentioned in the certificate payment of interest is made, normally after every six months, whether the company makes a profit or not.

(6) A debenture is generally secured by a charge on the assets of the company. This means that if the company is unable to repay the debentures as per the terms of issue the debentureholders can move the court and realise their money by getting the assets of company sold.

(7) Funds raised by the issue of debentures are of long term nature and usually, the debentures are repaid after a long period, such as seven years, ten years or twelve years. As such, the loan , raised by the issue of debentures is also called as “Loan Capital”.

Types of Debentures :

A company may issue the following types of debentures :

(1) Secured or Mortgage Debentures : These debentures are those debentures which are secured either on particular assets of the company called Fixed Charge or on all assets of the company in general, called a Floating Charge. Fixed charge denies the company from dealing with mortgaged assets, where as the floating charge does not prevent the company from using the assets.

If the company is unable to repay the debentures on the due date, the debentureholders can realise their money from the assets mortgaged with them. First mortgage debentures are those that have a first claim on the assets charged and second mortgage debentures are those that have a second claim on the assets charged. In India, debentures have necessarily to be secured.

(2) Unsecured or Naked Debentures : These debentures are those which are not given any security. The holders of such debentures are treated as unsecured creditors at the time of liquidation of the company. Such debentures are not very common these days, so much so that, unless otherwise stated, a debenture is presumed to be secured.

(3) Registered Debentures : Names and address of the holders of such debentures are recorded in a register of the company called “Register of Debentureholders”. Such debentures are not freely transferable. The transfer of such debentures requires the execution of a proper transfer deed. Principal amount and interest on such a debenture is paid to the person whose name appears in the company’s register.

![]()

(4) Bearer Debentures : Names and address of the holders of such debentures are not recorded in the company and these debentures are transferable by mere delivery. Payment of principal and interest is made to the bearer of such debentures. Coupons are attached with these debentures and the interest is paid to such persons who produce the coupons in the specified bank.

(5) Redeemable Debentures : Redeemable debentures are those debentures which will be repaid by the company either in lump-sum at the end of a specified period or by instalments during the lifetime of the company. Most of the debentures are generally of this type.

(6) Irredeemable or Perpetual Debentures : Irredeemable debentures are those debentures which are not repayable by the company during its lifetime. These debentures are repayable only at the time of liquidation of the company.

(7) Convertible Debentures : Convertible debentures are those debentures which are convertible into equity shares or other securities at a stated rate of exchange either at the option of debentureholders or at the option of the company after a specified period. When only a part of the amount of debenture is convertible into shares, such debentures are called “Pardy Convertible Debentures”.

When the full amount of debenture is convertible into shares such debentures are called “Fully Convertible Debentures”. SEBI guidelines require that where the conversion is to be made at or after 18 months from the date of allotment but before 36 months any conversion in part or whole shall be optional on the part of the debentureholders. Convertible debentures are very popular these days, as they provide liquidity, safety capital appreciation and assured return to the investors.

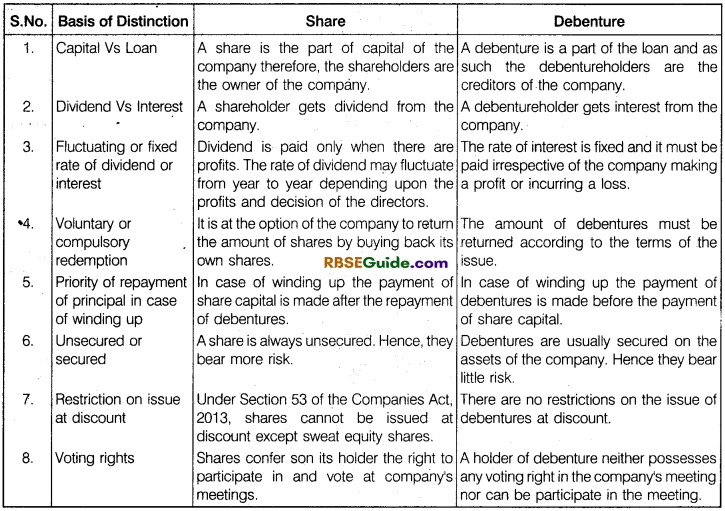

Distinction Between Shares and Debentures

Issue of Debentures :

The company issuing debentures has to issue prospectus inviting public to subscribe debentures of th? company. The company can also make private placement of debentures following the laid down procedure. The intending lenders apply for debentures in the company on a prescribed form. The application and the application money is deposited with the company. The company may call the amount for debentures to be paid in lump-sum or in instalments. It debentures are issued, amount being payable whethere in lump-sum or in instalments procedure followed is same as is in the case of shares.

Debentures like shares may be issued for (i) Cash or (ii) Consideration other than cash Debentures whether issued for cash or otherwise may be issued :

(1) At par

(2) At premium

(3) At discount

Debentures can be issued at a discount but a company cannot issue shares at discount, except when sweat equity shares are issued.

Issue of Debentures for Cash :

Debentures may be issued at par, at premium or at discount.

1. Debentures may be issued at par i.e., at the nominal (face) value of the debentures.

2. Debentures may be issued at premium and the premium received is credited to “securities premium reserve account”. Securities premium reserve can be utilised for the purposes specified in section 52(2) of the Companies Act, 2013.

3. A company can issue debentures at discount also. The Companies Act, 2013, has not specified the maximum rate of discount that can be allowed on debentures. Thus, a company can issue debentures at a price decided by it. Discount on issue of debentures is debited to an account titled discount on issue of debentures.

The amount of debentures can be collected in lump-sum in instalments i.e., on application, on allotment and on calls.

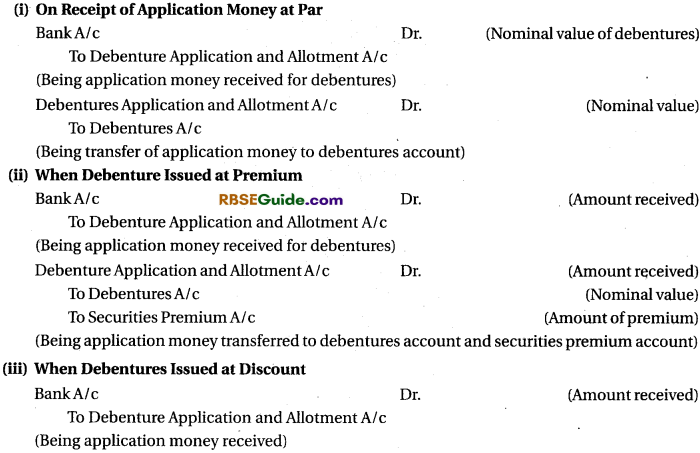

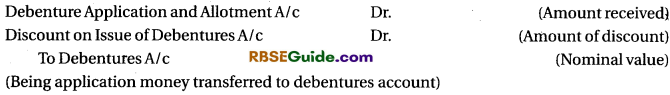

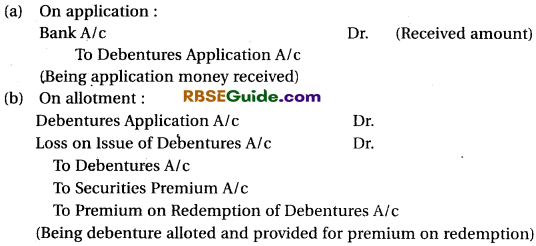

Accounting entries are also same as are in the case of issue of shares. Difference lies only in the title or name of accounts. Entries are passed in the following manner :

Accounting Entries on the Issue of Debentures :

(A) When Debentures Amount is Received in Lump-Sum

(B) When Debentures Amount is Received in Instalments :

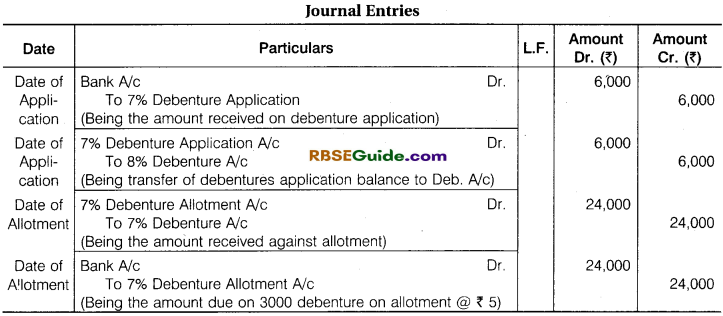

Illustration 9.

A company Issued 3000, 7% Debenture of ₹ 10 each payable as ₹ 2 on Application and the remaining amount on Allotment. The Public Applied for all and these debenture were allotted. The all money has been received. Give the Journal Entries.

Solution :

Illustration 10.

Ramesh Limited Issued 5000,9% Debenture of ₹ 100 each of discount of 3% on these debentures ₹ 25 Payable on Application and balance on Allotment. Pass the necessary Journal Entries in the Books of Ramesh limited.

Solution :

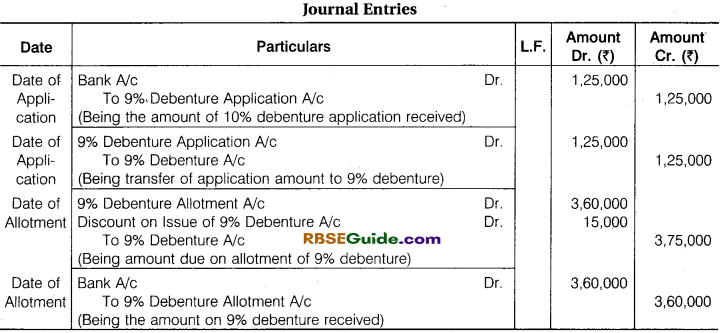

Illustration 11.

X Ltd. Software Issued 4000 Debentures of ₹ 100 each at a ₹ 5 Premium. The Debenture were payable ₹ 20 on Application, ₹ 25 on Allotment including Premium and the Balance in two calls of ₹ 30 each. All money on Allotment and Calls were duly received.

Give the Journal Entries in respect of the Issue of Debenture.

Solution :

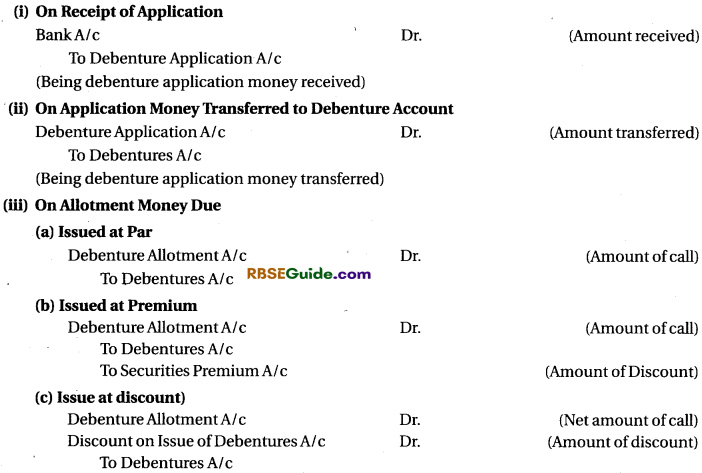

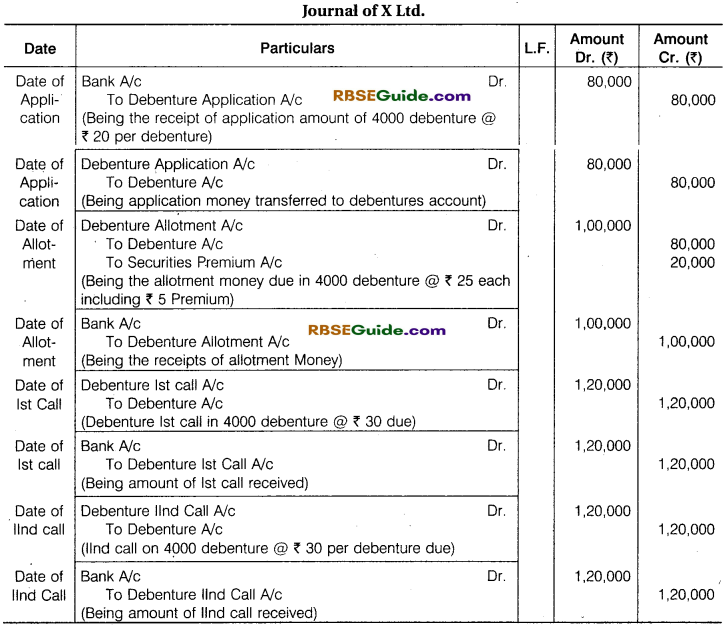

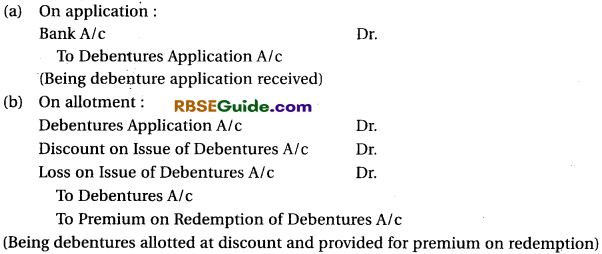

Issue of Debentures according to the Condition of Redemption

Journal Entries :

(1) If issue of debenture at par and redemption also at par :

[Loss on issue of debentures A/c is a capital loss and premium on redemption of debenture isa provision for payable at redemption of debentures.]

(3) On Issue at par.and redemption on discount :

In this position above 1 (a) and (b) Journal entry will make. Discount on redemption is a probably future profit. No entry will make until it is not received.

(4) If Issue & Redemption both on premium :

(5) Issue on discount and redemption on premium :

[Note: (1) ‘Loss on Issue of Debentures A/c’ and ‘Discount on Issue of Debentures A/c’ both are capital loss which are written off from capital profit and revenue profit.

(2) ‘Premium on Redemption of Debentures A/c’ is a provision which is shown in Balance Sheet, in liabilities side and which is written off at the time of redemption.

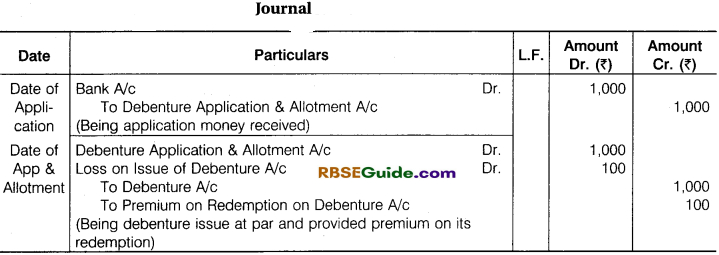

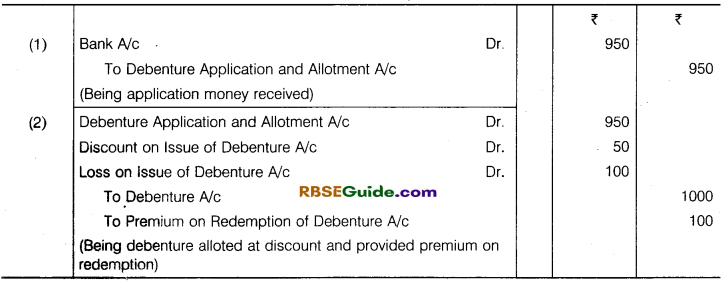

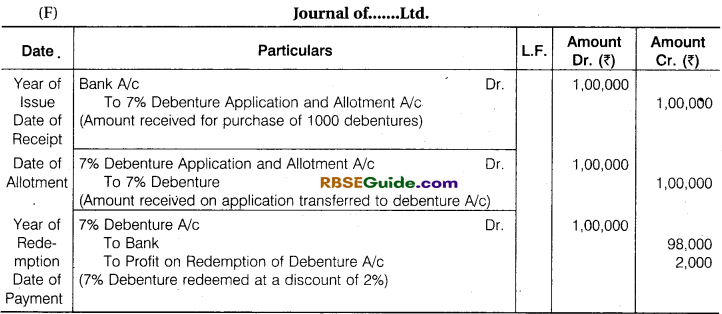

Illustration 12.

Make Journal Entries each of the following transactions to record issue of one debenture in the Books of a Company.

(i) Debenture Issued at ₹ 1000 of ₹ 1000 which will redeemed at ₹ 1100

(ii) ₹ 1000 Debenture Issued at ₹ 1100 which will be redeemed at ₹ 1150.

(iii) ₹ 1000 Debenture Issued at ₹ 950 which will be redeemed at ₹ 1100.

Solution:

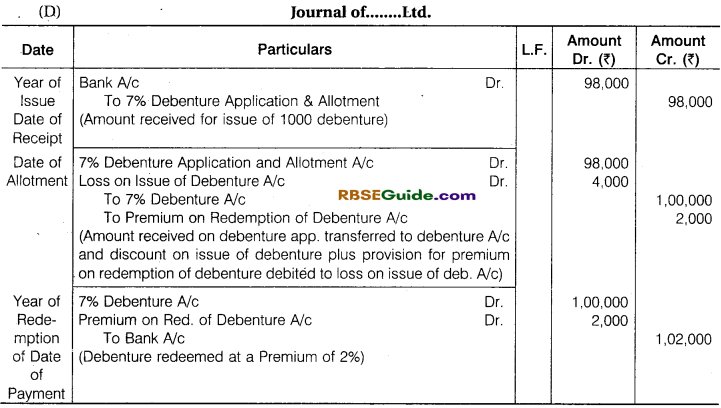

(i) When issue on at par and redemption on premium :

(ii) When debenture issue on premium & redemption also on premium :

(iii) When debenture issue on discount and redemption on premium :

Working Note :

(1) Loss on Issue of debenture is a capital loss and premium on redemption on debenture “Premium Payable at Redemption” is a provision.

![]()

(2) Amount of loss on issue of debenture and discount on issue of debenture can be written off upto redemption of debenture.

Illustration 13.

What Journal Entry will be passed in each of the following cases for issue and redemption of debentures.

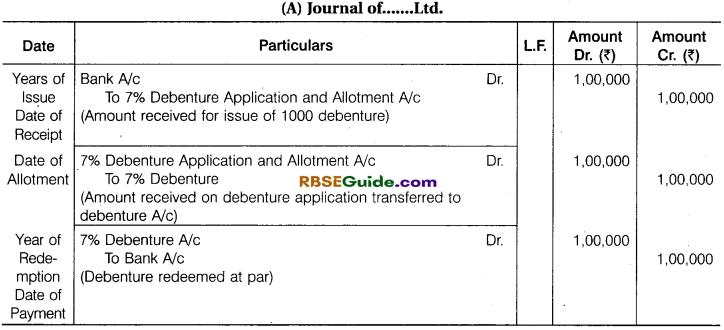

(A) 1,000, 7% Debenture of ₹ 100 each Issued at par and Redemption at par.

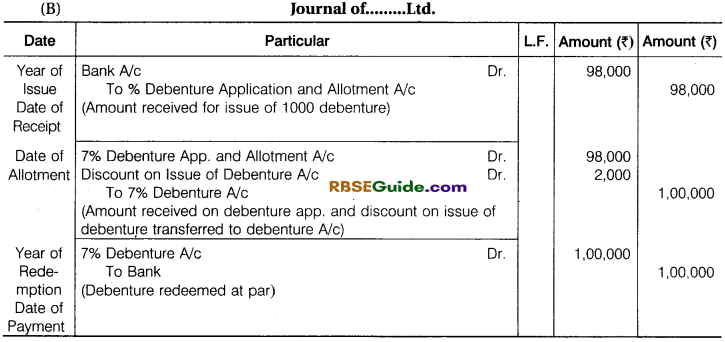

(B) 1000, 7% Debenture of ₹ 100 each Issued at Dis. in ₹ 98 and Redemption on ₹ 100.

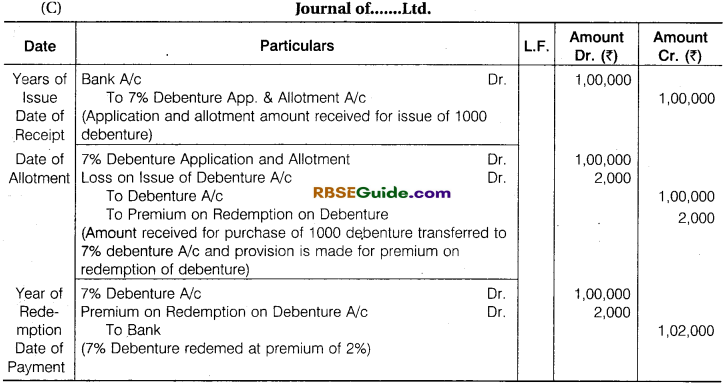

(C) 1000, 7% Debenture of ₹ 100 Issued at par and Redemption on ₹ 102.

(D) 1000, 7% Debenture of 100 each. Issued at ₹ 98 and Redemption at ₹ 102.

(E) 1000, 7% Debenture of ₹ 100. Issued at ₹ 102 and Redemption on ₹ 100.

(F) 1000, 7% Debenture ₹ 100 each Issued at ₹ 100 and Redemption at ₹ 98.

Solution :

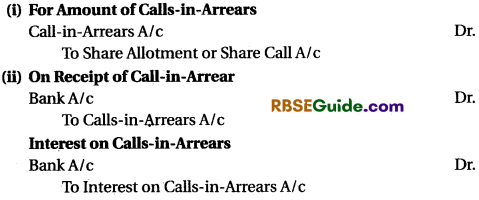

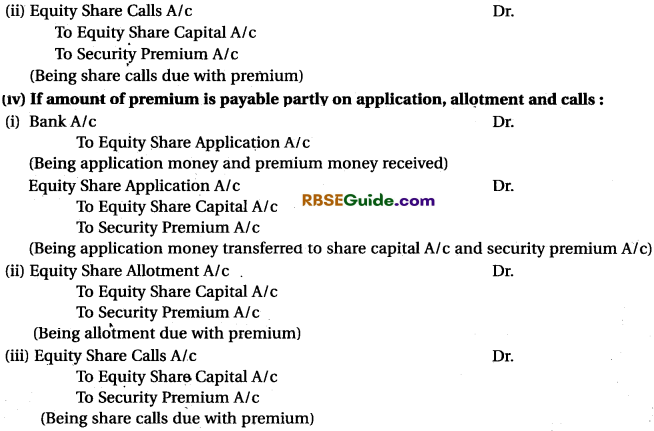

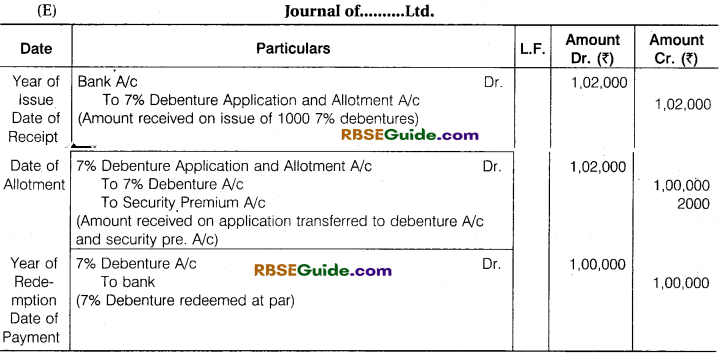

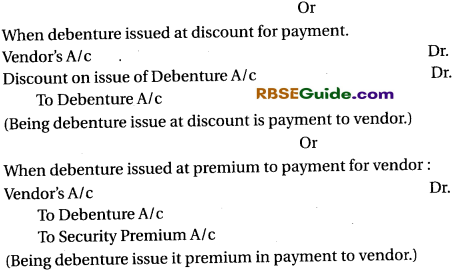

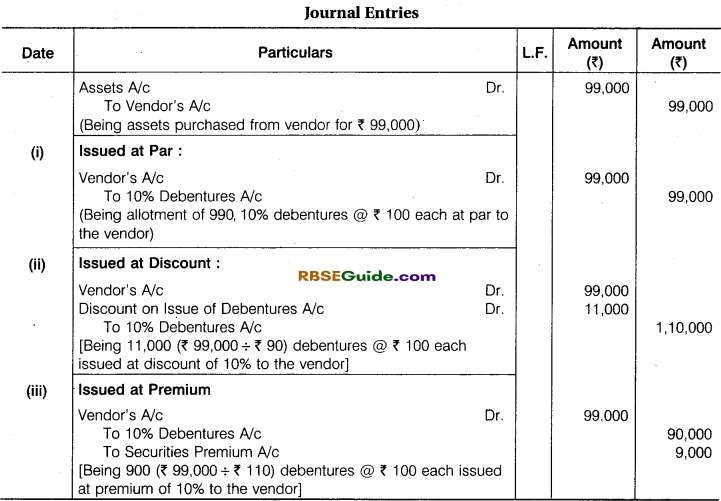

Issue of Debentures for Consideration other than Cash :

Sometimes a company purchases some assets from the vendor and instead of paying the vendor in cash the company may decide to issue debentures to the vendor in payment of purchase consideration. Such an issue of debentures to vendors is known as Issue of Debentures for consideration other than cash. Debentures can be issued to vendors at par, at a premium or at a discount. Debentures can be issued to vendors against purchase of assets or for purchase of business.

The journal entries passed are :

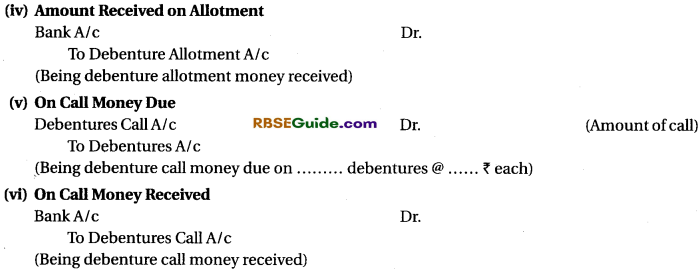

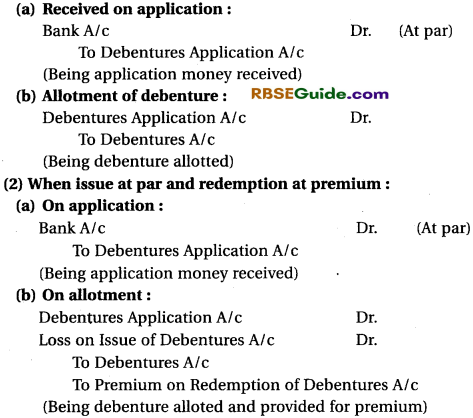

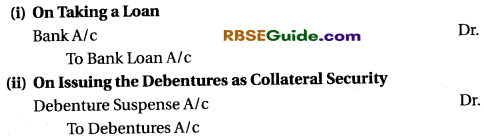

Issue of Debentures as Collateral Security :

Sometimes, when a company takes a loan from a bank or from some other party, the company may have to issue debentures as a subsidiary or secondary security in addition to the principal security. In other words, collateral security means secondary security in addition to the principal security.

The bank or the other persons to whom such debentures are issued as collateral security will not be entitled to any interest on these debentures. They are entitled to get interest on the original loan advanced by them. If a default is made either in the payment of interest or in the payment of principal debt, the lender will first realise its debt from the principal security. But if the full amount of debt is not realised from the principal security, it may claim all the rights of a debentureholder.

As soon as the company pays the final instalment of loan its can take it debenture back. There are two methods of dealing with such debentures in the books of accounts of the company.

![]()

(1) First Method : In this method, no entry need to be passed in the books of the company, as the debentures are not actually issued, but only given away as collateral security. As such under this method, entry is passed only for taking a loan. If the loan is taken from a bank the entry will be :

![]()

On the equity and liabilities side of the balance sheet a note is appended below the loan that the loan is secured by the issue of debentures as collateral security.

(2) Second Method: In this method the entry for issuing debentures as collateral security is also recorded with the entry for taking the loan

In the balance sheet debenture suspense will be shown as a deduction from the debentures account on the equity and liabilities side. As and when the loan is repaid, both the entries passed above are reversed.

Illustration 14.

Z Company purchased assets of the book value of ₹ 99,000 from another firm. It was agreed that the purchase consideration be paid by issuing 10% Debentures of ₹ 100 each. Assume debentures have been issued (i) at par, (ii) a discount of 10% and (iii) at a premium of 10%. Give Journal Entries.

Solution :

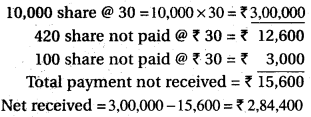

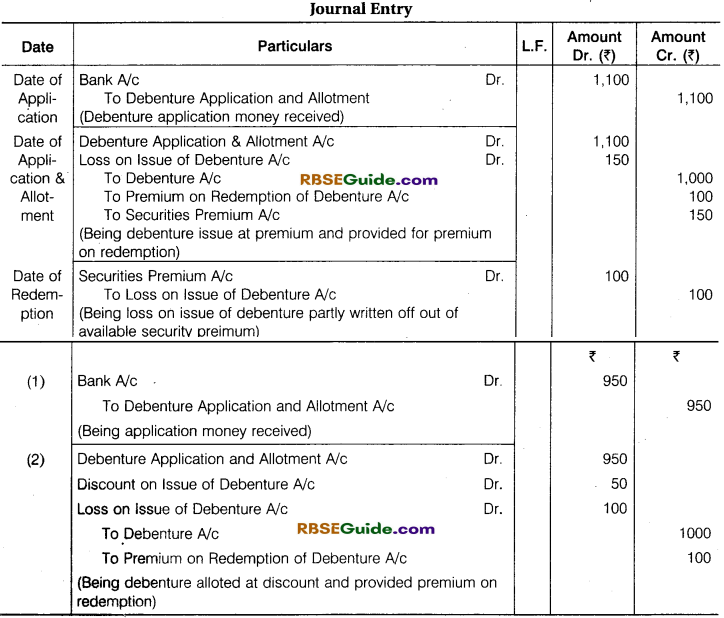

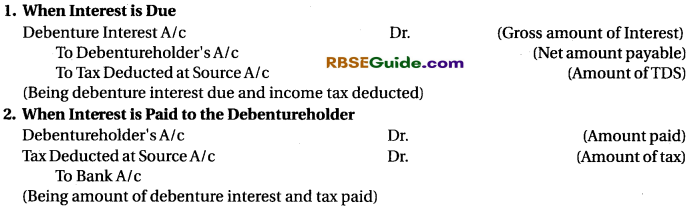

Interest on Debentures :

Interest on debentures is usually paid half yearly. Interest on debentures is a charge against the profits of the company. It has to be paid regularly even if the company suffers a loss or does not earn profit. The rate of interest payable on debentures is prefixed on debentures.

For example if the rate of interest is 15% p.a., the name given to debentures will be 15% Debentures. As per Income Tax act, a company is required to deduct income tax at the prescribed rate from the gross amount of debenture interest before any amount is paid to the debentureholders. The tax thus, deducted is to be deposited with the income tax authorities on behalf of the debentureholders.

3. On Transfer of Debenture Interest to Statement of Profit and Loss

Illustration 15.

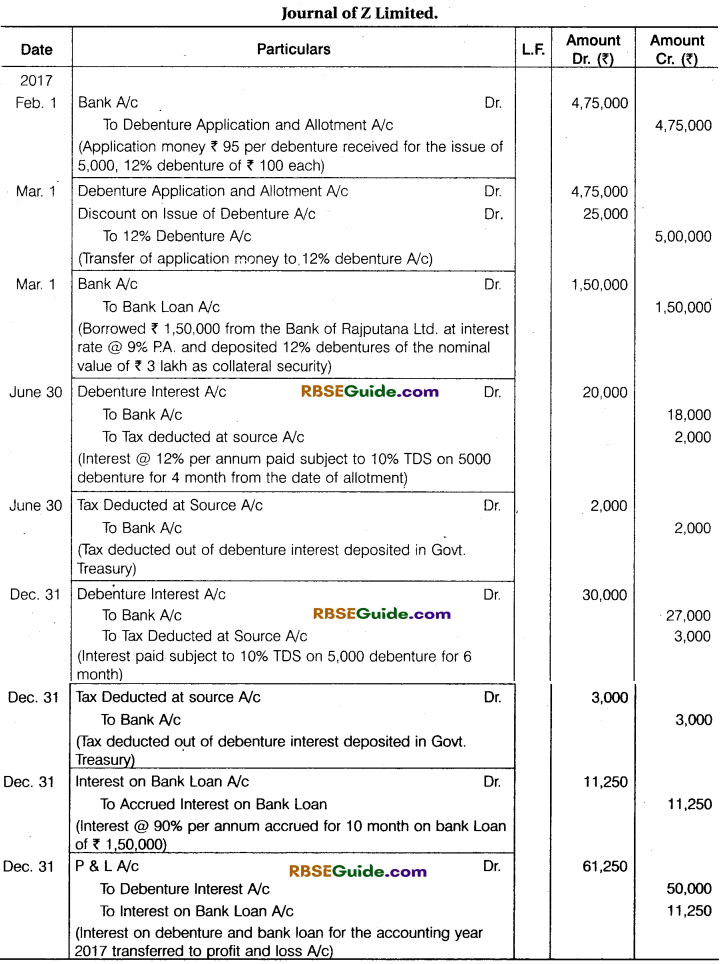

On 1st January, 2017 Z Limited offered to Public 5000,12% Debenture of ₹ 100. each at a discount of 5% Payable in full on Application as on before 1st Feb. 2017. Interest on Debenture would prepaid Half yearly on 30th June and 31st Dec. every year subject to 10% deduction at source of on Interest. In response to company offer Public Subscribed for 5000 debenture. Company made allotment to debenture on 1st March, 2017.

On the same date Z Ltd. Borrowed ₹ 1,50,000 form the Rajputana Bank Ltd. at annual Interest rate of 9% and deposited with its 12% Debenture of the Face Value of ₹ 3,00,000 as a Collateral Security. Pass Necessary Journal Entries regarding the issue of Debenture, rising of Bank Loan and Payment of Debenture Interest for year ended 31 st Dec. 2017. Also show the terms of Debenture in the Company’s Balance Sheet as on 31st Dec. 2016.

Note : According to Fluctuating System of Accounting for 3,00,000,12% Debenture. Deposited as Collateral Security on 1 March, 2017. Entry will be :

![]()

(Issue of 12% debenture as collateral security for loan from Bank of Rajputana Ltd.)

Both type are shown in Balance Sheet.

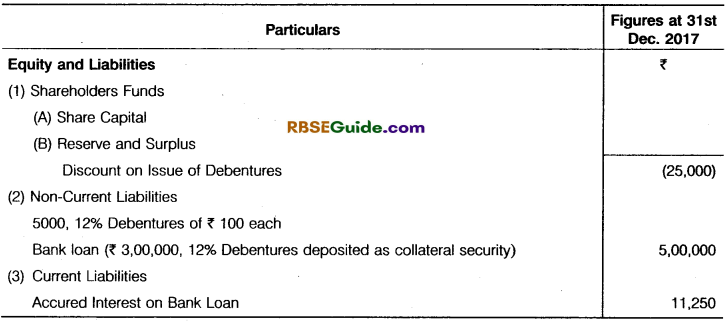

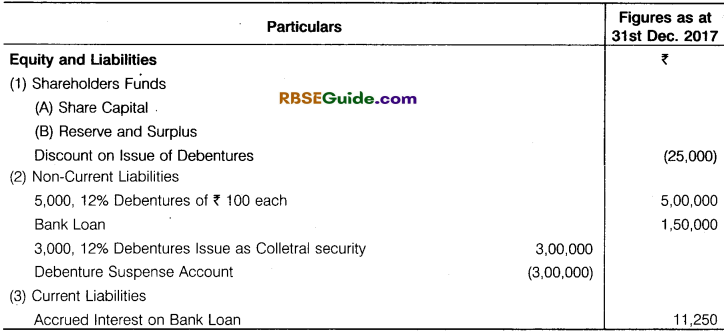

Discloser in the Balance Sheet of Z Ltd. as on 31st Dec. 2017

By Fluctuating System :

Discloser in the Balance Sheet as of Z Ltd. as on 31st Dec. 2017

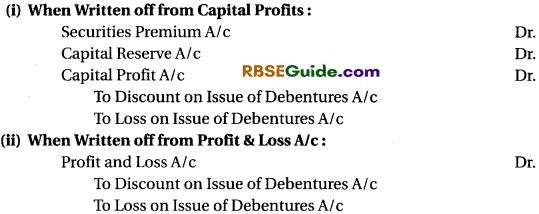

Writing off Discount/Loss on Issue of Debentures :

Discount on issue of debentures is a loss of capital nature. It will appear on the asset side of balance sheet till it is written off. It is desirable that it is written off as quickly as possible. Discount on issue of debentures, being a loss of capital nature, it can be written off in two ways :

First Method : In this case the total amount of discount on debentures is spread over the life of debentures equally. Suppose the debentures are issued at discount to be redeemed after five years. The amount of discount will be divided by five and the amount so arrived at will be charged to profit and loss account for five years. This method is followed where debentures are redeemed at the end of a specified period.

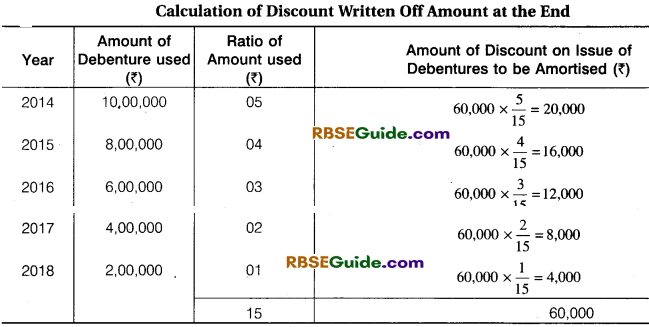

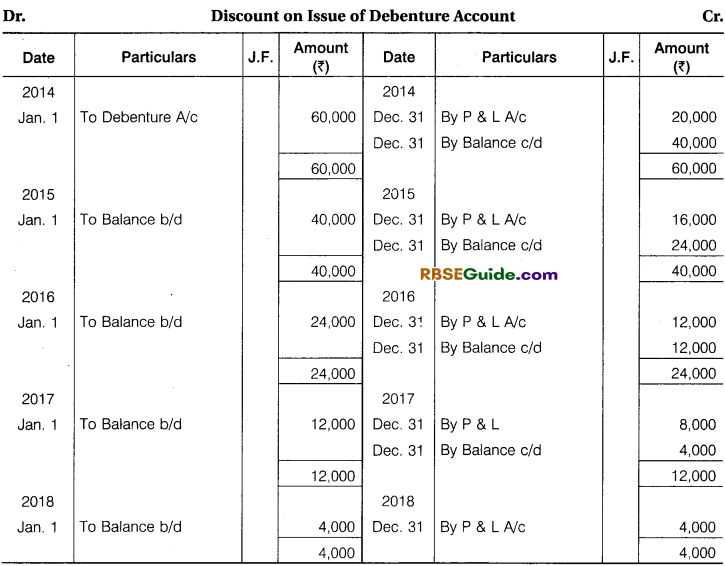

Second Method : In this method discount is written off every year in proportion to the amount of debentures used every year. This method is followed where debentures are redeemed every year by serving a notice and by draw of lots.

The entry will be in the condition

Illustration 16.

On 1st January, 2014 a Company Issued Debenture of the Face Value of ₹ 10,00,000 at a Discount of 6%. The Debenture were payable by Five Annual Drawing of ₹ 2,00,000 each on 31st Dec. each year. Discount on Issue of Debentures be Written off in the Ratio of Amount of Debentures outstanding in each year. Show the Discount on Issue of Debenture Account

Solution :

Company Accounts: Issue of Shares and Debentures Notes Important Terms

Share : Share means a share in the share capital of a company and includes stock. [Section 2(84) of the Companies Act, 2013]

It is a unit into which share capital of company is divided

Share Capital :

→ Share capital means the capital raised by the issue of shares. Share capital of a company limited by shares is of two kinds, namely,

- Preference share capital and

- Equity share capital.

→ Preference Share Capital : It is a kind of share capital which carries preferential rights in respect of payment of dividend and repayment of capital over equity share capital if the company is wound up.

→ Equity Share Capital : It is that share capital which is not preference share capital.

→ Allotment of Shares : Allotment is the allocation of shares to the successful applicants by the directors of a company.

→ Authorised or Nominal Capital : Authorised capital means such capital as is authorised by the memorandum of a company to be the maximum amount of share capital of the company. [Section 2(8) of the Companies Act, 2013]

It is the maximum amount of capital which the company is, for the time being, authorised to raise.

→ Isssued Capital : Issued capital means such capital as the company is for the time being subscribed by the members of a company. [Section 2(86) of the Companies Act, 2013]

→ Paid up Share Capital : Paid up share capital means such aggregate of money credited and paid up as is equivalent to the amount received as paid up in respect of shares issued and also includes any amount credited as paid up in respect of shares of a company but does not include any other amount received in respect of such shares, by whatevesr name called. [Section 2(64) of the Companies Act, 2013]

![]()

→ Subscribed and Fully Paid up : It is the amount of share capital issued by a company that is subscribed on which the company has called and also received entire nominal (face) value of tire shares.

→ Subscribed But not Fully Paid up : It is the amount of the share capital issued by a company that is subscribed but the company has not received entire nominal (face) value of the share.

→ Reserve Capital: It is that part of the subscribed capital that a company resolves to call in the event of its winding up.

→ Under Subscription of Shares : The shares are said to be under subscribed if the number of shares applied for is less than the number of shares issued for subscription.

→ Over Subscription of Shares : When the company receives application for more shares than issued, it is known as “Over subscription”.

→ Pro-Rata Allotment: Pro-rata allotment means allotment in proportion of shares applied for.

→ Calls-in-Arrears : It is that part of the calls money that has been called up by the company but has not been received by the company.

→ Calls-in-Advance : It is that amount which has not been called up by the company but has been received by the company.

→ Debentures : Debenture is a written acknowledgement of debt issued by the company. According to Section 2(30) of the Companies Act, 2013, Debentures includes debenture stock, bond or any other instrument of a company evidencing a debt, whether constituting a charge on the assets of the company or not.

→ Employees Stock Option : It means the option granted to the employee directors and employees of a company which gives such employee directors and employees, the right to purchase or to subscribe for the shares of the company at a future date of a pre-determined price.