Rajasthan Board RBSE Class 12 Business Studies Notes Chapter 15 Goods and Service Tax (GST)

Overview :

- India’s biggest tax reform is now a reality. A comprehensive tool-Goods and Service Tax – (GST) has replaced the complex multiple indirect tax structure from 1st July, 2017.

- Four important GST Bills which enabled the implementation of GST are Central GST Bill, Compensation GST Bill, Integrated GST Bill and Union Territory GST Bill.

- Ex-President Pranab Mukherjee, on 12th April, 2017, signed four enabling Bills related to the GST into law. The Act was passed in accordance with the provisions of Article 368 of the Constitution and has been ratified by more than half of the State Legislatives.

![]()

History and Development

References to indirect taxes in ancient India are found in ‘Arthashastra’ – the famous work of Kautilya. There are other evidences available of payment of taxes of manufactured goods during the Mauryan reign.

In the 19th century, British government imposed excise duty on producing salt. This was followed by a long list of articles on which Britishers imposed excise duty, like- motor spirit in 1917, Kerosene in 1922, tobacco products in 1943 during the world war to raise funds.

Cigarette in 1948 was also included in its purview. Government was facing serious difficulty in imposing and charging excise duty on different goods. For making tax collection easy, the government made separate sets of statutory laws that administer collection of excise duty for different types of commodities.

In 1935, right to impose sales tax on commodities was obtained under Indian Government Act, 1935. After that, many state governments started charging sales tax on purchase and sale of goods in their states. Sales tax was implemented first in Madhya Pradesh in 1938. Now, other state governments were also free to impose taxes in different ways in different goods. But, this right was misused by State Governments against traders and consumers.

Before introduction of the Central Excise Act, 1944, the government passed 16 different laws for charging duty on different goods. But, after introduction of Central Excise Act, 1944 all these 16 laws were consolidated and a single law was used for charging duty.

After that, the government of India, in 1953, set up a committee to study the expansion of tax structure under the chairmanship of Dr. John Matthai.

On the recommendations of the committee, many new commodities were brought in the ambit of excise duty.

Therefore, necessary amendments in Section 286 of the Indian Constitution were brought by the government in 1952 after a long discussion with different state governments.

In 1965, Government set up Bhutlingam Committee under the chairmanship of ex-secretary of Finance Department to give suggestions for the rationalisation and simplification of tax structure.

The Service Tax was first introduced in 1994, and only 3 services, namely, telephone bills, non-life insurance and brokers were brought in the ambit of Service Tax.

Service Tax was an indirect tax which was applicable all over India, except Jammu & Kashmir, on Services provided or agreed to be provided in taxable territory as given in Section 65 (105).

It is clear from the above discussion that multiple taxes imposed by Central, State and Local authorities increased the burden on business due to which businessmen were getting directionless. Therefore, need was felt to harmonise the tax structure by imposing a single tax (GST) to replace multiple taxes. But, the Constitution does not vest the power to central or state government to levy a single tax on goods and services.

Therefore, India adopted a dual GST which was imposed concurrently by the centre and states, i.e. the centre and the states simultaneously taxed goods & services.

![]()

Introduction

GST is a value added tax levied on manufacture, sale and consumption of good and services. Presently, the tax system has 3 types of taxes – Excise duty, Service tax and VAT. GST is a single tax, replacing all these indirect taxes. GST = one country, one tax, one market.

In our country, system of governance is federal and both the centre and the state have the power to collect indirect taxes.

Hence, India will adopt a total GST which will be imposed concurrently by the centre and States. The Centre will have the power to tax intra-state sales and states will be empowered to tax services.

GST is a destination-based tax applicable on all transactions involving supply of goods and services. GST in India comprises of Central Goods and Service Tax (CGST) – levied and collected by the Central Government, State Goods and Service Tax (SGST) levied and collected by the State Govemments/Union Territories with State Legislatures and Union Territory Goods and Service Tax (UTGST) – levied and collected by the Union Territories without State Legislatures, on intra-state supplies of taxable goods and services. Inter State supplies of taxable goods and services will be subject to Integrated Goods and Service Tax (IGST). IGST will approximately be a sum total of CGST and SGST/UTGST and will be levied by the centre on all inter-state supplies.

GST is a tax on goods and services under which a person is liable to pay tax on his output and is entitled to get input tax credit on the tax paid on its inputs (therefore a tax on value addition only), and ultimately, final consumer shall bear the tax.

In GST, three input taxes are there :

- CGST: Central Goods and Service Tax.

- SGST: State Goods and Service Tax.

- IGST: Inter-State Goods and Service Tax.

![]()

Meaning of Goods and Service Tax :

- GST is a value, added tax levied on manufacture, sale and consumption of goods and services.

- GST offers comprehensive and continuous chain of tax credits from the producer’s point/ service provider’s point upto the retailer’s level/consumer’s level, thereby taxing only the value added at each stage of supply chain.

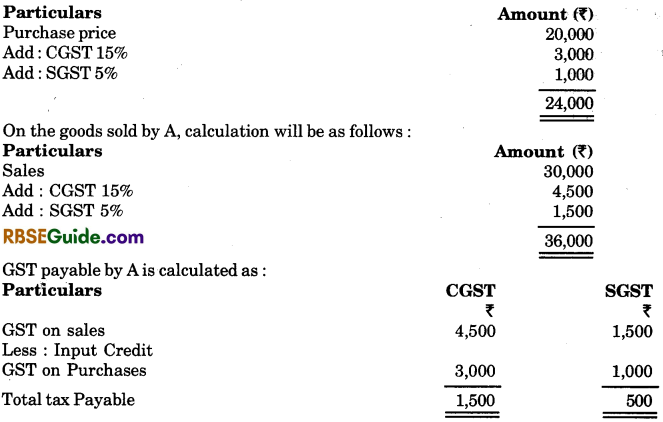

- For example, A buys some goods or services worth ₹ 20,000 and sells them to B for ₹ 30,000. So, the value added by him i.e. ₹ 10,000 is value addition by him.

- Suppose, CGST is 15% and SGST is 5%.

On the goods or services bought by A, input tax credit for CGST and SGST will be :

Salient Features of GST :

- GST would be applicable on “Purchase” of goods or services.

- It will be imposed on each stage of sales.

- GST would be based on the principle of destination-based consumption taxation.

- Taxable event in case of goods would be ‘Sale’, instead of Manufacture.

- It would be a dual GST with the centre and the states simultaneously levying it on a common base.

- The administration of Central GST would be with the centre, and of the state GST, with the state.

- For interstate transactions, an IGST is levied by central government.

- Import of services would be treated as inter-state transactions and would be subject to IGST.

- The tax payers would need to submit periodic returns to the central and the state GST authorities.

- GST would replace the following taxes currently levied and collected by the centre :

- Central Excise Duty.

- Duties of Excise (Medicinal and Toilet Preparations).

- Additional Duties of Excise (Goods of Special Importance).

- Additional Duties of Excise (Textiles and Textile Products).

- Additional Duties of Customs (Commonly Known as CVD).

- Special Additional Duty of Customs. (SAD)

- Service Tax.

- Cesses and Surcharges related to supply of goods or services.

- State taxes that would be subsumed within the GST are :

- State VAT

- Central Sales Tax

- Purchase Tax

- Luxury Tax

- Entry tax (All forms)

- Entertainment Tax (Except those levied by Local Bodies)

- Taxes on advertisements.

- Taxes on lotteries, betting and gambling.

- State cesses and surcharges related to supply of goods or services.

- GST would apply to all goods and services except alcohol for human consumption.

- GST on five specified petroleum products (Crude, Petrol, Diesel, ATF & Natural Gas) would be applicable from a date to be recommended by the GSTC.

- Tobacco and Tobacco products would be subject to GST. In addition, the centre would continue to levy Central Excise Duty.

- All exports and supplies to SEZs and SEZ units would be zero-rated.

- For categorisation of goods, harmonised system of Nomenclature Code will be used.

- The GST council has decided threshold exemption would be an annual turnover of ₹ 20 lakh for both GST and SGST.

- For services, the present coding system will be used.

![]()

Input Credit in GST

In GST, three components of taxes are levied. Sales within the state are subject to both CGST and SGST, and on sale outside the state, IGST is payable. For these three taxes, separate accounts will have to be maintained and will be adjusted in following manner :

[Input tax credit means at the time of paying tax on output, you can deduct the tax you have already paid on inputs.]

1. Credit of IGST: If any trader makes inter-state purchase on which IGST is paid, then input tax credit (ITC) will be first utilised for payment of IGST and then CGST and SGST respectively. For example : Ram & company buys goods of ₹ 4 lakh from Mumbai on which 18% (₹ 72,000) IGST is paid. During that period, the ouput tax of IGST is of ₹ 30,000, CGST ₹ 30,000 and SGST ₹ 20,000. Then dealer receives input tax credit from output tax in following way :

In this way, after utilizing the ITC in the said manner, the dealer is liable to pay SGST of .₹ 8,000 (20,000-12,000).

2. Credit of CGST: If a trader makes local purchases of the goods in the state and has paid both CGST and SGST, then the amount of ITC of CGST will be available from output tax of CGST. The credit of CGST cannot be taken against SGST.

3. Credit of SGST : When buying goods within the state, the credit of SGST paid on inputs may be used for paying SGST and the remaining balance is to be used for payment of IGST. Cross Utilization of ITC between CGST and SGST would not be allowed.

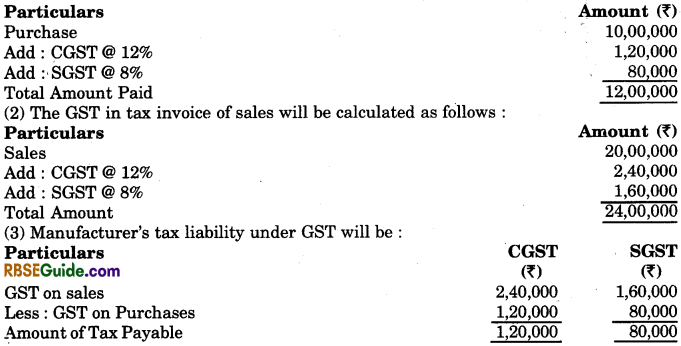

Example : A manufacturer in Rajasthan has bought raw material worth ₹ 10,00,000 from a trader of Udaipur, who sold the goods at tax rate 12% CGST and 8% SGST. The manufacturer makes 20,000 units of a commodity from this raw material by spending ₹ 2,00,000 as additional amount. He sold all the units on profit to a registered trader for ₹ 20,00,000 and charged 12% CGST and 8% SGST.

Example 2:

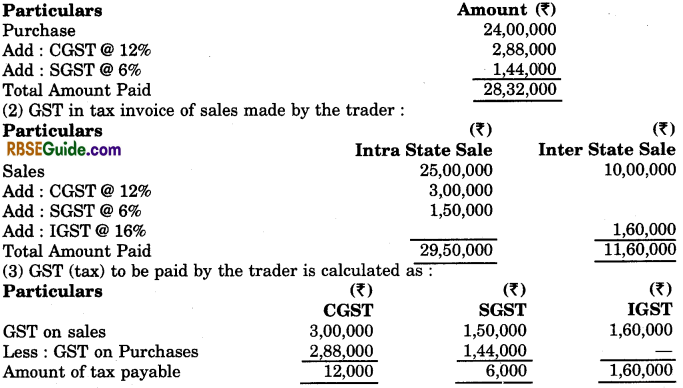

A trader of Rajasthan buys goods worth ₹ 24,00,000 from a trader of Ajmer and rate of tax under CGST and SGST is 12% and 6% respectively. 3/4 part of the goods purchased are sold to a registered trader of Jaipur for ₹ 25,00,000 and collected CGST is @ 12% and SGS is @ 6%. Remaining goods he sold to a trader in Gujarat for ₹ 10,00,000 and collected IGST @ 16%. Calculate tax liability under CGST, SGST and IGST and tax payable:

1. GST tax invoice of purchases made by the trader will be :

Job work in GST

Job work shall constitute any treatment or process on goods, belonging to some other person. Many production units get various related works done by other producers, for e.g.- engineering units outsource works such as painting, welding, drilling, machinery, etc. on thebasis of job work. Similarly, chemical units also get some of their work done from outside on the basis of job work.

Job work provisions already existed under Central Excise, VAT and Service Tax regulations. Under these regulations, concessions were given to the job workers and the principal was made responsible for tax compliance on behalf of the job worker.

Under GST as well, the principal can send taxable goods, without payment of tax, to the job worker. There can be futher movement of such goods from one job worker to another. However, such goods must be brought back to principal’s place of business and must be removed after payment of tax thereon.

Recent changes are made in the provisions pertaining to job work. Earlier, GST law provided, that commissioner may, by special order, subject to conditions, permit a registered taxable person to send taxable goods without payment of tax to job worker for job work. It means, permission of commissioner was required to be taken for sending goods for job work.

But revised GST law permits that a registered taxable person, may, under intimation and subject to conditions, send any inputs or capital goods without payment of tax to job work.

GST law has made provisions in relation to job work under section 43(A) which are as follows:

![]()

Special procedure for removal of goods for certain purposes :

The commission may by special order and subject to conditions as may be specified by him, permit a registered taxable person (hereinafter referred to in this section as the “Principal”) to send taxable goods, without payment of tax, to job worker for job work, and from these, subsequently be sent to another job worker, and likewise, and may after completion of job work, allow to:

Bring back such goods to any of his place of business, without payment of tax, for supply there from on payment of tax within India, or with or without payment of tax for export, as the case may be, or Supply such goods from the place of business of a job worker on payment of tax within India, or with or without payment of tax for export, as the case may be. The responsibility for accountability of the goods including payment of tax thereon shall lie with the “principal”.

Administrative Structure of CGST and SGST

The administrative structure of CGST and SGST will be different, CGST and IGST matter will be looked after by the present goods and services tax department, which now will be known as Central Goods and Service Tax Department. It will work under the central government and will be responsible for monitoring, determination, collection of tax and issuing refunds.

All the matters related to SGST will be looked after by the ‘Department of Commercial Tax’ of each state. For Rajasthan, it will be known as Rajasthan Goods and Service Tax Department. It will deal with all the issues related to SGST, its determination, collection of tax, refunds, etc.

Thus, every tax payee, whether he is a trader, or not, has to report to both the Central and the State Departments, and officers of both the departments will have right of inspection, search, enquiry, seizures and the tax payer is answerable to both the authorities, central as well as state.

![]()

Registration :

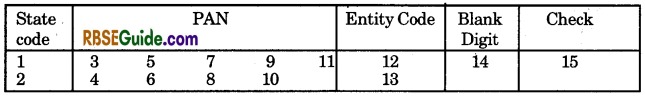

Even though GST will be collected by both the central as well as the state governments, but the tax payer who is liable to be registered, has to make single application for online registration and to file only one return. GST computer system will automatically furnish the information of registration to ‘central as well as’ state authorities. Any person, who is presently registered with the state under VAT, will be issued GST registration automatically, but before

Registration work will be in the hands of state governments and state GST departments will be doing the registration of tax payers.

Current Status of Registered Persons :

All existing taxpaying persons who are currently registered under VAT or Service Tax laws, the information about them will be passed by GST common portal to the IT system of the concerned State and Central Tax authorities and their GSTIN will be generated.

At present some tax payers are registered under the central tax or the state tax or both. Now, under GST law, a person can be registered only under SGST. He may be exempted for single registration or separate registration for multiple business. NSDL and GSTN both will utilise the data of the registered person.

Those persons, who are not enrolled or whose complete data is not available with tax authorities, are informed through advertisement in newspaper so they furnish their data to the department’s website within the specified time period. If data is not submitted within specified time period, his registration will be postponed until he furnishes the required data.

![]()

Registration of New Tax Payers :

Every new person who wants to obtain registration, needs to apply for registration through GST Network Portal (GSTN).

The following procedure needs to be followed for registration :

1. To apply online for registration as per the rules and to enclose scanned copy of the following documents :

- Proof of constitution such as Partnership Deed in case of Partnership, Registration Certificate in case of cooperative society, MCA-21 in case of companies.

- Details and proof of place of business, like muncipal tax receipt, electricity bill copy, rent agreement, etc.

- Bank accounts details.

- Authorised signatories details.

- Photograph of Proprietor, Partners, Karta, MD, Managing Trustee, Person is charge in case other then the above category of persons.

2. GSTN system shall carry out preliminary verification of documents like CIN Number, PAN Number, etc. with various authorities through interportal connectivity.

3. After preliminary verification, GSTN portal shall carry forward such application to central / state authorities.

If the details filed by the applicant are correct, registration certificate shall be granted, and if tax authorities refuse the registration, reason for refusal will be communicated to the concerned person by the state GST officer or central GST officer.

![]()

Tax returns :

After implementation of GST, businessmen have to file monthly returns. Under VAT, the small traders were filing quarterly returns, and under service tax, half yearly returns. Under GST, every assessee has to present the following 3 returns :

1. Sales Return (Section 25) (GST R-2): This return contains information regarding sales of goods/services made during a month. This return is filed within 10 days of the end of the

month. It includes details of outbound supplies, sales at zero rate, interstate sales, purchase return, export to other countries, debit note, credit note, etc. This information is matched with the return filed by buyer under section 26, and in case of mismatch, the tax payer is given a chance to rectify the mistake.

2. Purchase Return (Section 26) (GSTR-2): It will contain all the details of purchases of goods and services on which GST is paid by assessee. The due date for filing GSTR-2 is 15th of next month. The details filed under this return are matched with the return filed under Section 25 by the seller and any mismatch will impact input tax credit eligibility.

3. Monthly Returns (Section 27) – (GSTR-3): After filing sales and purchase returns on 10th and 15th of next month, the monthly summary of purchases, sales, tax amount given in GSTR-1 and GSTR-2 returns, has to be filed online by the 20th of subsequent month.

A registered taxable person paying tax under the composition scheme shall furnish quarterly returns within 18 days after the end of relevant quarter. Levy or Late fees – for defaulted returns (Section 33): A penalty of ₹ 100 per day is applicable for late filing of GST return under Sections 25, 26, 27 and 31, with a maximum penalty of ₹ 5,000. And penalty for Annual Reports (Section 30) is ₹ 100 per day of delay with a maximum. 25% on aggregate turnover.

![]()

Unaswered Questions in GST Model

Presently, under excise duty, there is exemption upto ₹ 1.5 crore on sales, ₹ 10 lakhs exemption under VAT and ₹ 10 lakh exemption under Service Tax also. But there is no clear information about exemption in GST.

Whether all assessees to be in contact with GST and SGST ₹ For availing input tax credit of-CGST and SGST and refunds, which departments of which government, central or state, assessee has to be deal with ?

Can the central and state GST departments separately inspect, seize, enquire and take similar action on tax payee or only one among them is authorised to do so ₹ Will the areas for taxes be distributed among central and state government on the basis of turnover or both the central and the state will have their jurisdiction on a trader ?