RBSE Class 12 Accountancy Model Paper 2 English Medium are part of RBSE Class 12 Accountancy Board Model Papers. Here we have given RBSE Class 12 Accountancy Sample Paper 2 English Medium.

| Board | RBSE |

| Textbook | SIERT, Rajasthan |

| Class | Class 12 |

| Subject | Accountancy |

| Paper Set | Model Paper 2 |

| Category | RBSE Model Papers |

RBSE Class 12 Accountancy Sample Paper 2 English Medium

Time: 3.15 Hours

Maximum Marks: 80

General Instructions to the Examinees

- Candidate must write his/her Roll No. on the question paper compulsorily.

- All the questions are compulsory.

- Write the answer to each question in the given answer book only.

- The questions that have internal sections, write their answers together in continuity.

- I. The questions are divided into two sections- A and B.

II. Section A is compulsory for all.

III. Section B has two parts, and each part has seven questions. Candidate has to answer all the seven questions of either of the part. -

Section Question no Marks per Questions A 1-8 1 9-14 2 15-21 4 22-33 6 B 24-25 1 26-27 2 28-29 4 30 6 - Question number 22 (Section A) and 30 (Section B) have internal choices.

Section – A

Question 1.

When did Indian Partnership Act come into force? [1]

Question 2.

Where is the surrender value of Joint Life Insurance Policy shown in the balance sheet? [1]

Question 3.

What is Joint Life Insurance Policy? [1]

![]()

Question 4.

X, Y and Z are partners sharing profits in ratio of 5 : 3 : 2. Goodwill is not shown in the books, but its value is ₹ 1,00,000. X retires from the firm and Y and Z divide the profit in future equally. In what ratio the share of X in goodwill will be debited in accounts of Y and Z. [1]

Question 5.

What do you mean by realisation account? [1]

Question 6.

What is a one man company? [1]

Question 7.

According to table F, how much a company can provide for the payment of interest on calls in advance? [1]

Question 8.

Which account will be credited on the sale of goods of joint venture? [1]

Question 9.

A and B are partners in a firm, sharing profits in the ratio of 3 : 2 C is admitted for 1/5 th share in profits of the firm which he aquired entirely from B. Calculate new profit sharing ratio. [2]

Question 10.

What do you mean by memorendum joint venture account? Why is it prepared? [2]

Question 11.

What is account sale? Who prepares it? [2]

![]()

Question 12.

100 ton coal sent on consignment for ₹ 1,300 per ton at invoice price and ₹ 800 per ton at cost price and consignor paid ₹ 20,000. Agent sold 76 ton coal and paid ₹ 8,000 for sales expenses. It is informed that 5 tonnes of coal is found less. Calculate the value of remaining stock with agent. [2]

Question 13.

What do you mean by endowment fund? [2]

Question 14.

Calculate the sports material expenses of an institution to be showed in income and expenditure account from the following statement: (RBSC 2009) [2]

Image

Question 15.

A and B are partners sharing profits in the ratio of 7 : 3. On 1st April, 2016, their capitals were ₹ 1,00,000 and ₹ 40,000 respectively. Interest is to be charged on capital and drawings at 10% per annum. B is to be allowed salary ₹ 1,000 per month. A and B withdrew ₹ 1,000 and ₹ 600 per month respectively on the first day of every month. The profits for the year, prior to calculation of interest on capitals and drawings, but after charging B’s salary amounted to ₹ 54,960. A provision for A’s commission at 5% on net profit (after charging such commission) is to be made. Prepare Profit & Loss Appropriation Account for the year ending 31st March, 2017. [4]

Question 16.

A, B & C are partners in a firm sharing profits in the ratio of 5 : 3 : 2. B retires and the goodwill of the firm is valued at ₹ 21,000. Pass necessary journal entries for treatment of goodwill. [4]

Question 17.

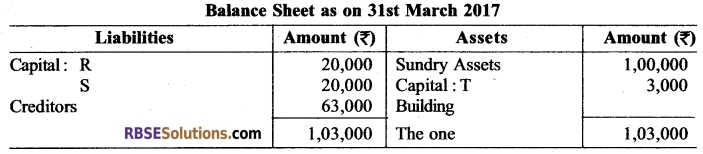

R, S and T are partners in a firm. Balance Sheet as on 31st March 2017 of the firm is as follows [4]

The firm is dissolved on 31st March 2017 due to T because insolvent. Nothing is realised from T. ₹ 40,000 is realised from the assets of the firm. Prepare necessary accounts on dissolution, when Garner Vs Murray rule applies. Loss on realisation is not brought in cash by the partners.

![]()

Question 18.

Under what headings will you show the following items in the Balance Sheet of the Company [4]

(i) Goodwill

(ii) Unclaimed Dividends

(iii) Provision for Tax

(iv) Securities Premium

(v) Loose Tools

Question 19.

Pavan and Pratush entered in joint venture with sharing profit ami lasses equally. Pavan sent goods worth ₹ 3,00,000 and paid carriage & freight ₹ 10,000 and other expenses ₹ 4,000. Pratush sent goods worth ₹ 2,40,000 and paid consignment expenses ami sundry expenses ₹ 15,000 and godown rent ₹ 5,000.

Goods to be sold by Pavan. They decided 2% commission on sate to be paid to Pavan. Pavan sold ail the goods for ₹ 6,84,000. Prepare Memorandum joint Venture Account and Joint Venture with Pratush Account in the books of Pavan. Final payment is made through bank draft [4]

Question 20.

Mr Bharat of Alwar sent goods to Kapil of Udaipur for ₹ 1,00,000 on consignment and paid sundry expenses ₹ 20,000. Kapil sent ₹ 60,000 to Bharat in advance. Kapil paid wages and cartage ₹ 4,000 and godown rent ₹ 3,000. Kapil sold all the goods for ₹ 1,60,000 in cash. 5% commission on sales is payable to consignee. Kapil sent remaining amount to Bharat. Prepare necessary ledger accounts in the books of Bharat. [4]

Question 21.

Calculate the capital of Rai Club as on 1 st April 2017, from the following information:

Building 25,000, outstanding Salary 1,800, Furniture 18,000, Cash in hand 30,700, Bank overdraft 3,400, Fixed Deposit 18,000, Outstanding subscription 3,600, Creditor for Sports Material 7,200, Subscription Received in advance for next year 4,800. [4]

Question 22.

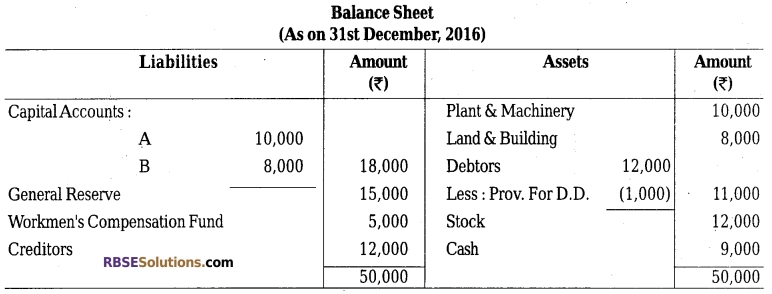

A and B are partners in a firm sharing profits in the ratio of 3 : 2. On 31st December, 2016 their Balance Sheet was as follows. [6]

They agreed to admit C into partnership for 1/5th share of profits on the following terms: (i) Provision for doubtful debts be increased by 2,000. (ii) The value of stock be increased by 4,000 and Land & Building be increased to 18,000. (iii) The liability against workmen s compensation fund is determined at 2,000. (iv) C brought in as his share of goodwill 10,000 in cash. (v) C would bring cash as would make his capitai equal to 20% of combined capital of A & B, afier the above revaluation and adjustments are carried out, Prepare Revaluation Account, Partners Capital Accounts and the Balance Sheet of the firm after Cs admission.

![]()

OR

The Balance Sheet of A, B and C, who were sharing profits in the ratio of 5 : 3 : 2, is given below as on 31st March, 2017:

B retires on the above date and the following adjustments are agreed upon his retirement:

(a) Stock was valued at 1,72,000.

(b) Furniture was undervalued by 3,000.

(c) An amount of 10,000 due from D was doubtful and a provision for the same was required.

(d) Goodwill of the firm was valued at 2,00, 000.

(e) B was paid 40,000 immediately on retirement and the balance was transferred to his loan account.

(f) A and C were to share future profits in the ratio of 3 : 2.

Prepare Revaluation Account, Capital Accounts and Balance Sheet of the reconstituted firm.

Question 23.

Modern Ltd. offered to public 10,000 equity shares of ₹ 10 each at ₹ 11 per share. Amount was payable as follows on Application ₹ 3; on Allotment ₹ 4 (including premium) and on first and final call ₹ 4. Applications were received for 12,000 shares and directors allotted on pro rata basis. Rakesh, who applied for 240 shares paid call money along with allotment money. Sukesh to whom 100 shares were allotted paid allotment money along with call money. Give necessary journal entries. [6]

Section – B

Question 24.

Give any two names of external users of financial statement. [1]

Question 25.

Differentiate between current ratio and liquid ratio on the basis of relationship. [1]

Question 26.

Explain non-current liabilities with example. [2]

![]()

Question 27.

The Current Assets of a company are ₹ 1,26,000 and the current ratio is 3 : 2 and the inventories are ₹ 2,000. Find out the liquid ratio. [2]

Question 28.

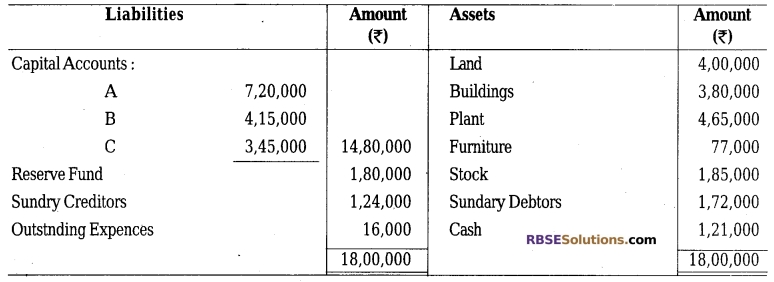

Make a profit & loss account from the following information: [4]

Question 29.

In what was a professional accountant is concerned with ethics? [4]

Question 30.

From the following information of Janvi Ltd. calculate [6]

1. Working Capital Ratio

2. Quick Ratio

3. Inventory Turnover Ratio

4. Gross Profit Ratio

5. Solvency Ratio

6. Operating Ratio

7. Operating Profit Ratio

8. Net Profit Ratio.

Informations-

Revenue from operations ₹ 2,00,000

Purchases ₹ 1,20,000

Opening Inventory ₹ 12,000

Closing Inventory ₹ 12,000.

Wages ₹ 8,000

Selling Expenses ₹ 2,000.

Tangible Fixed Assets ₹ 2,12,000.

Other Current Assets ₹ 50,000.

Current Liabilities ₹ 30,000.

Equity Share Capital ₹ 1,00,000.

7% Preference Share Capital ₹ 80,000.

Reserves ₹ 10,000 and 8% Debentures ₹ 60,000

![]()

OR

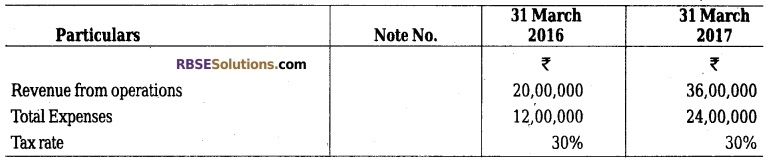

From the following information of Rishabh Ltd. find out:

(i) Gross Profit Ratio

(ii) Operating Ratio

(iii) Operating Profit Ratio

(iv) Net Profit Ratio

(v) Return on Investment

(vi) Interest Coverage Ratio.

Informations-

Revenue from operations ₹ 4,00,000.

Cost of Revenue from Operations ₹ 2,25,000,

Interest on Short-term Loan ₹ 5,000.

Office Expenses ₹ 25,000.

Selling Expenses ₹ 50,000.

Rent Received ₹ 4,000.

A loss by Fire ₹ 10,000.

Interest on Long-term Loan ₹ 10,000.

Commission Received ₹ 5,000.

Capital Employed ₹ 6,00,000. Income Tax Rate 30%.

Answers

Answer 1:

It came into force on the first day of October 1932.

Answer 2:

Surrender value of Joint Life Insurance Policy is shown in assets side of a balance sheet.

Answer 3:

Joint Life Insurance Policy occurs when a partnership firm decides to take a Joint Life Insurance on the lives of all the partners.

Answer 4:

The share of X’s goodwill will be debited in ratio of 2 : 3 in the accounts of Y and Z.

![]()

Answer 5:

On dissolution of a firm all assets are sold and liabilities are paid off. In order to record the sale of assets and discharge of liabilities, a nominal account is opened called the realisation account.

Answer 6:

One person company means a company which has only one member.

Answer 7:

12%.

Answer 8:

Joint venture account.

Answer 9:

Answer 10:

When each venturer records only those transactions conducted by himself only, then on transaction of joint venture each co-venturer sends the copy of conducted transaction to each other. Each co-venturer opens an account in his books called Memorandum Joint Venture Account.

After entering the transaction by all entries to calculate net profit and loss and net payables and receivable, Memorandum Joint Venture Account is prepared.

Answer 11:

A statement sent by the consignee to the consignor after the sale of goods is called account sale which contains quality and quantity of goods sold, sale proceeds expenses, commission advance on consignment, etc.

Answer 12:

Answer 13:

Endowment fund arises from a bequest or gift. The income generated from it is utilized for a specific purpose while the original amount is kept intact either forever or for a specific period.

![]()

Answer 14:

Answer 15:

Answer 16:

Answer 17:

Answer 18:

| Items | Headings |

| Goodwill | Intangible Assets under ‘Fixed Assets’ |

| Unclaimed Dividends | Current Liabilities |

| Provision for Tax | Short-term provisions under Current Liabilities |

| Securities Premium | Reserves and Surplus under Shareholders Fund Inventories |

| Loose Tools | Inventories under current assets |

![]()

Answer 19:

Answer 20:

Answer 21:

Answer 22:

OR

![]()

Answer 23:

Answer 24:

- Bank and Financial Institution,

- Creditors.

Answer 25.

Current ratio shows the relationship between current assets and current liabilities while liquid ratio shows the relation between liquid assets and current liabilities.

Answer 26.

According to Companies Act, 2013, List III, the liabilities not included in current liabilities category are called non-current liabilities. Long-term loan, Deffered tax liabilities, Long-term provision and other long-term liabilities are included in this category.

![]()

Answer 27:

Answer 28:

Answer 29:

Professional Accountant has an important role in society. Investors, employees, lenders, government and public all depend on Professional Accountant. Their most valuable asset is the honest reflection. The main tasks are effective financial management, effective advice in business and tax related matters. To conduct and behave in availing such services of Professional Accountant effects economical happiness of couchy.

So, Professional Accountant are assumed to give their best services to the society which will be according to the moral necessities. Many different institutions of Professional Accountant such as Institute of Chartered Accountants of India etc, have applied code of conduct for their members to ensure the high ethical behaviour of Professional Accountant.

Answer 30:

![]()

OR

We hope the given RBSE Class 12 Accountancy Model Paper 2 English Medium will help you. If you have any query regarding RBSE Class 12 Accountancy Sample Paper 2 English Medium, drop a comment below and we will get back to you at the earliest.