Make use of our RBSE Class 12 Accountancy Notes here to secure higher marks in exams.

Rajasthan Board RBSE Class 12 Accountancy Notes Chapter 3 Accounting for Retirement and Death of Partner

Retirement of Partner :

As per Section 32(1) of Indian Partnership Act, 1932, “A partner can separate himself from a firm

- with mutual consent of all partners

- on the basis of a agreement between partners

- in case of voluntary partnership, by informing his retirement from the firm,”

Therefore, any partner can retire from the firm due to old age, poor health, mutual dispute etc. When any partner voluntarily or due to any other reason separates himself from the firm, then this is called Retirement of a Partner.

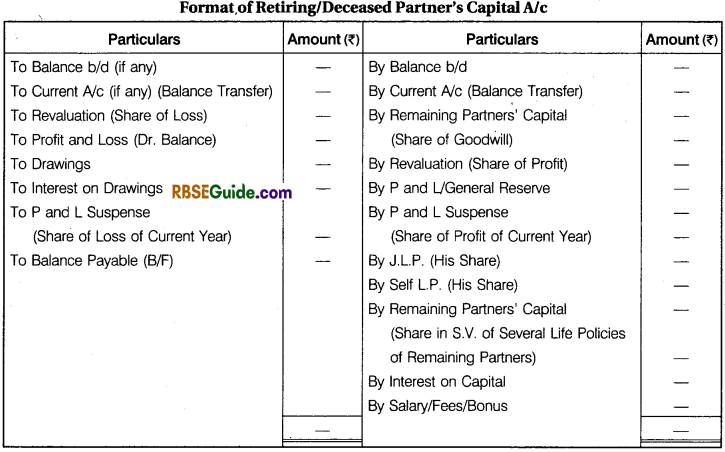

Accounting Problems Arising at the Time of Retirement of Partner :

Following accounting problems arise on the retirement of a partner :

- Calculation of new profit sharing ratio and gaining ratio of the continuing partners.

- Treatment of goodwill.

- Accounting treatment of revaluation of assets and liabilities.

- Accounting treatment of reserves, accumulated profits and losses.

- Payment of retiring partner.

- Adjustment of capital in proportion of profit sharing ratio.

- Joint life policy and Seperate life policy transaction.

Calculation of New Profit Sharing Ratio :

Case 1.

If new profit sharing ratio is not given in the question, it would be presumed that remaining partners will continue share profit/loss in their old ratio.

Case 2.

Sometimes, remaining partners buy out share of the retiring partner, then new ratio would be arrived at by adding the bought out ratio in the old profit sharing ratio.

Case 3.

Sometimes new profit sharing ratio is given in the question in that case, there is no need to calculate new ratio.

Calculation of Gaining Ratio

For calculation of gaining ratio following rules apply :

1. If there is not given new profit sharing ratio of remaining partners, there gain ratio will be their old ratio.

2. New profit sharing ratio of remaining partners is given, their gain ratio will calculate by follwoing formula :

Gaining Ratio = New Ratio – Old Ratio

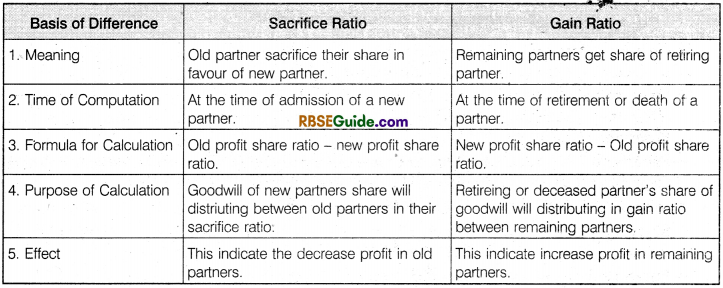

Difference Between Gaining Ratio and Sacrifice Ratio

Illustration 1.

A, B and C are Partner sharing profit in the Ratio of 3 : 2 : 1 A Retire from the firm and B and C decided to share future Profit equally. Calculate the gaining ratio of B and C.

Solution:

A’s Share will be divided between B and C in the ratio 1 : 1.

B will Gain = \(\frac {1}{2} \) – \(\frac {2}{6} \) = \(\frac {1}{6} \)

C will Gain = \(\frac {1}{2} \) – \(\frac {1}{6} \) = \(\frac {2}{6} \)

Gain Ratio = \(\frac {1}{6} \) : \(\frac {2}{6} \) = 1 : 2

![]()

Illustration 2.

X, Y and Z are partners sharing profits in the ratio of 5 : 3 : 2. Calculate new profit sharing ratio and gaining ratio. If (1) X retires (2) Y retires (3) Z retires.

Solution:

Old Ratio X, Y and Z 5 : 3 : 2

- If X Retires. New profit sharing ratio between Y and Z will be 3 : 2 and Gaining Ratio of Y and Z = 3 : 2.

- If Y Retires. New Profit Sharing Ratio between X and Z will be 5 : 2 and Gaining Ratio of X and Z = 5 : 2,

- If Z Retires : New Profit Sharing Ratio between X and Y will be 5 : 3 and Gaining Ratio X and Y = 5 : 3.

Illustration 3.

A, B and C were partners in a firm sharing profits in the Ratio of 5:4 :3. B retired and his share was divided equally between A and C. Calculate the new profit sharing and gaining ratio of A and C.

Solution:

B’s share will be divided between A and C in the Ratio of 1 : 1

A will gam = \(\frac {1}{6} \) of \(\frac {4}{12} \) = \(\frac {2}{12} \)

A’s New Ratio = \(\frac {5}{12} \) + \(\frac {2}{12} \) = \(\frac {7}{12} \)

C will Gain = \(\frac {1}{2} \) of \(\frac {4}{12} \) = \(\frac {1}{12} \)

C’s New Ratio = \(\frac {3}{12} \) + \(\frac {2}{12} \) = \(\frac {5}{12} \)

New Ratio of A and C = 7 : 5

Gaining Ratio = New Ratio – Old Ratio

A = \(\frac {7}{12} \) – \(\frac {5}{12} \) = \(\frac {2}{12} \)

C = \(\frac {5}{12} \) – \(\frac {3}{12} \) = \(\frac {2}{12} \)

Gaining ratio of A and C = 1 : 1

Illustration 4.

A, B and C were partners sharing profits in the ratio of 5 : 3 : 2. B retires with A and C agreeing to share the profits in future in the ratio of 6 : 4. Find out the gaining ratio.

Solution:

Gaining Ratio = New Ratio – Old Ratio

Gaining ratio of A = \(\frac {6}{10} \) – \(\frac {5}{10} \) = \(\frac {1}{10} \)

Gaining Ratio of C = \(\frac {4}{10} \) – \(\frac {2}{10} \) = \(\frac {2}{10} \)

Gaining Ratio of A and C = 1 : 2

Accounting Treatment of Goodwill :

The retiring or deceased partner is entitled to his share of goodwill at the time of retirement or death because the goodwill earned by the firm is the result of the efforts of all the existing partners in the past. Since a part of the future profit will be accruing because of the present goodwill and the retiring or deceased partner will not be sharing future profits. It will be fair to compensate the retiring or deceased partner for the same. At the time of retirement or death of a partner, the goodwill is evaluated on the basis of agreement among the partners.

As already discussed in the previous chapter, Accounting Standard 26 specifies the goodwill can be recorded in the books only when some consideration in money or money’s worth has been paid for it. Hence, only purchased goodwill can be recorded in the books and the goodwill account cannot be raised.

As such, in case of retirement or death of a partner, the adjustments’ for goodwill will be made through partners’ capital account.

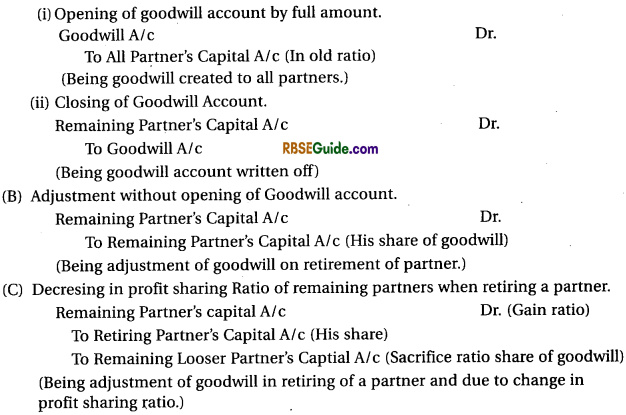

The methods of accounting of goodwill are as follows :

(2) When the Goodwill Account is already appearing in the books:

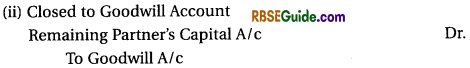

(A) Closed to goodwill account which is already opened.

(B) Overvaluation of goodwill at the time of retirement.

(Being goodwill account raised with new value.)

(Being goodwill account closed.)

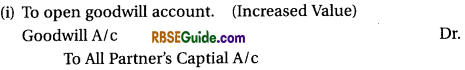

(3) When goodwill Account open only retiring partner’s share.

(A) To open goodwill A/c (Retiring partners share)

![]()

(Being goodwill a/c raised.)

(B) To Closed Goodwill A/c (In Gain Ratio)

(C) Adjusted Goodwill Account by retiring partner’s share of goodwill.

![]()

(Being adjustment made for goodwill.)

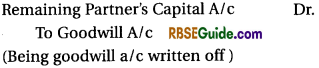

Illustration 5.

A, B and C are partners sharing profits in the ratio of 3 : 2 : 1. Goodwill does not appear in the books but it is agreed to be worth ₹ 30,000. A Retiree from the firm and B and C decided to Share Future Profit Equally. Pass the Journal Entries for Goodwill under various circumstances.

Solution:

Gain ratio of B and C will as follows at the retiring of A :

New Ratio = Old ratio – Gain ratio

B = \(\frac {1}{2} \) – \(\frac {1}{6} \) = \(\frac {1}{6} \); C = \(\frac {1}{2} \) – \(\frac {1}{6} \) = \(\frac {2}{6} \)

Gain Ratio = \(\frac {1}{6} \) : \(\frac {2}{6} \) = 1 : 2

Journal entries for goodwifi under various circumstances :

(A) When goodwill account to be open on full value and keep maintain in the books.

(B) When Goodwill account opened by full value and immidiately to be closed.

(Goodwill written off in new ratio)

(C) When goodwill opened only share of retiring partner.

![]()

(A’s share of goodwill transferred to his capital A/c)

(D) When goodwill account opened by share of retiring partner and immediately closed.

![]()

(A’s share of goodwill cridited W his captial A/c)

(Goodwill Account written off in gain ratio)

(E) Adjustment of share of retiring partner’s without opening of goodwill account.

(A’s share of goodwill borne by B and C in gain ratio.)

Hidden Goodwill :

Sometimes the firm agrees to settle the retiring or deceased partner’s account by payment of a lump-sum amount. If such amount is an excess of his capital and share in reserves/revaluation etc. The excess amount will be treated as his share of goodwill. That is hidden goodwill.

1. Revaluation of Assets and Liabilities :

At the time of retirement, the assets and liabilities are revalued and a revaluation account is prepared in the same way as is done in case of admission of a new partner. The only difference is that in case of retirement any profit or loss due to revaluation is divided among all the partners, including the retiring partner. Whereas in case of admission of a new partner, the new partner does not share.

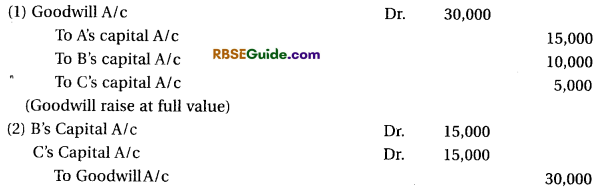

2. When Revalued Value Is Not Shown in the Books (Liabilities and Assets Shown on Old Value) :

This method is also called as “Memorandum Revaluation Method.” Similar to admission of a new partner, it is divide into two parts. In the first part, it is prepared as revaluation account and in the second part, the gain/loss is divided among old partners in the profit sharing ratio and the same amount is divided among remaining partners in new profit sharing ratio by passing a reverse entry. No entry is passed for the first part while following two entries are passed for the second part.

(i) To Divide Gain on Revaluation

Note : Reverse entry in case of loss.

To Pass Reverse Entry for Gain or to Close Memorandum Revaluation Account.

Note: Reverse entry in case of loss.

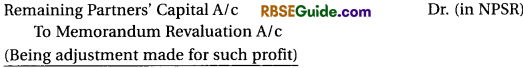

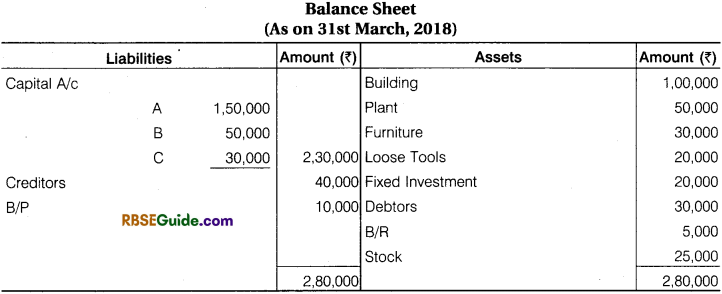

Illustration 6.

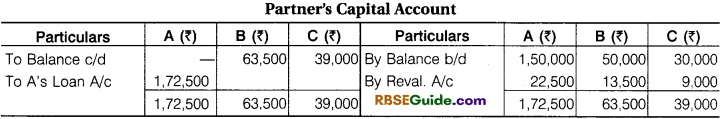

A, B and C are Partners in a firm sharing Profit and Losses in the Ratio of 5 : 3 : 2. A Retires from the firm on 31st March, 2018. The Balance Sheet of the Firm on that date was as follows :

A retire on 31st March, 2018 on that date revaluation of assets and liabilities were as follows:

- Increase value of building upto ₹ 1,80,000.

- Increase value of plant by 20%.

- Decrease value of furniture upto ₹ 20,000.

- Decrease value of loose tools by 20%.

- Provision made of Bad debts on debtors 20%.

- Increase value of stock by ₹ 15,000.

- Provision made for contingent liabilities for ₹ 40,000.

Give Journal entries on retiring of A, prepare revaluation account and after retirment, prepare balance sheet, if assets and liabilities are shown in the balance sheet on new value.

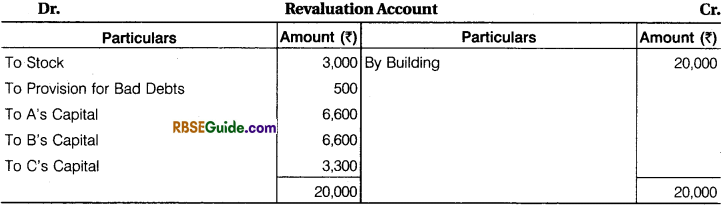

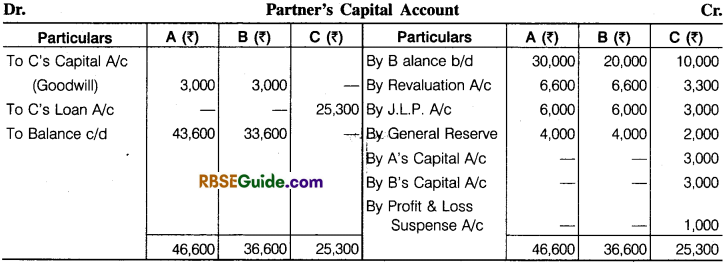

Illustration 7.

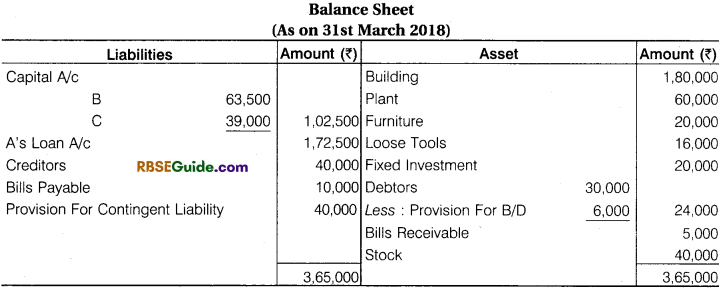

The Partner’s A, B and C were carrying on Business. The Balance Sheet of the firm as at 31st March, 2018 was follows :

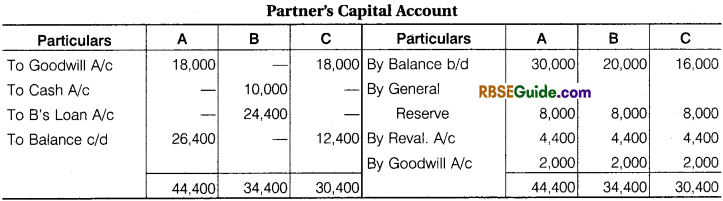

B retire on 1st April, 2018 following decision taken at that time :

- Value of building is increased by ₹ 14,000.

- Provision for doubtful debts ₹ 5% is made on sundry debtors.

- Goodwill valued at ₹ 36,000 and it is also committed that after retirement of B, it will not shown in the books.

- Payment made to B ₹ 10,000 immediately and balance transferred to loan a/c.

Prepare necessary journal entries and partner’s captial accounts.

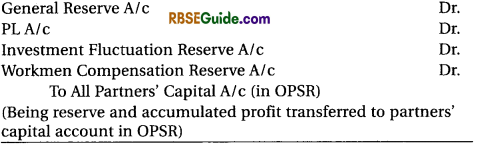

Adjustment of Accumulated Profits/Losses :

If at the time of retirement, there is any balance of general reserve. Reserve fund or any undistributed amount of profit and loss account appearing in the balance sheet, it belongs to all the partners and should be transferred to the capital account of all partners’ in their old profit sharing ratio. Following entries are passed for this purpose :

(i) For Distributing Reserve and Accumulated Profit

(ii) For Distributing Accumulated Losses

Note : Employees provident fund is the liability for the firm, so it is not distributed among the partners.

![]()

Illustration 8.

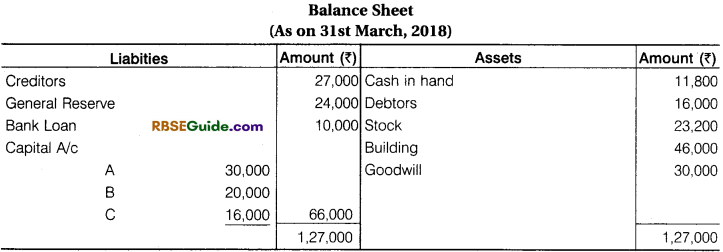

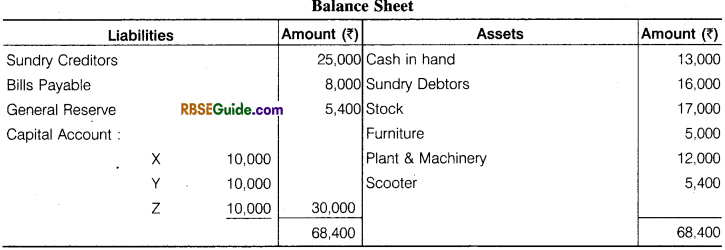

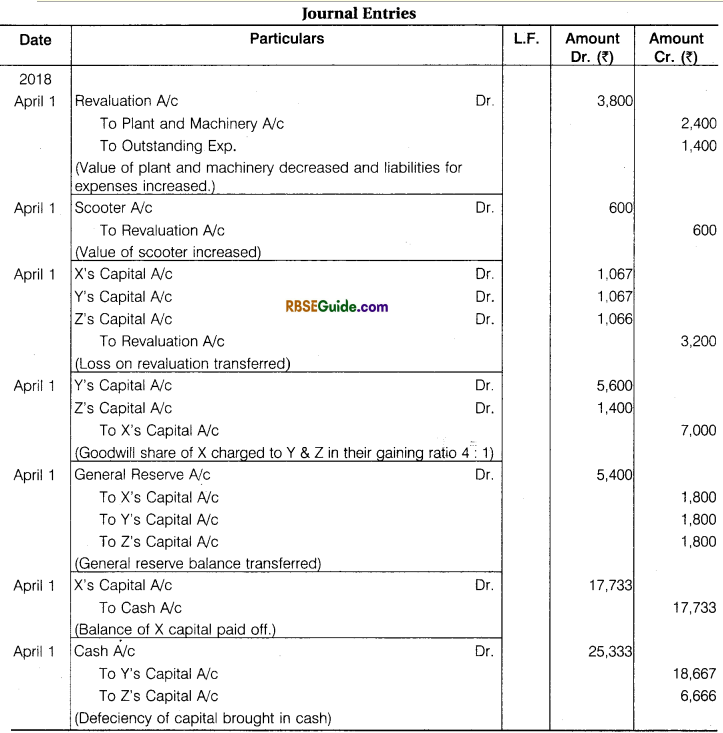

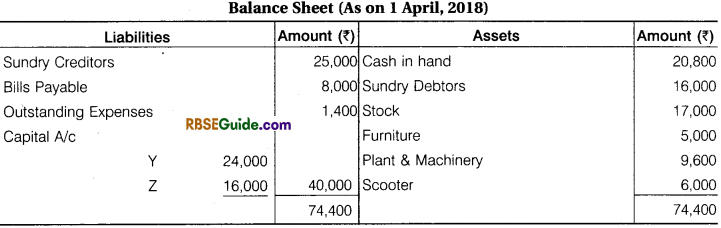

X, Y and Z were equal Partner’s. On 1st April, 2018 X decided to retire from the firm. The Balance Sheet of the firm as on 31st March, 2018 was as follows :

The following decision were taken at the time of X’s retirement:

- That the value of plant and machinery be decreased by ₹ 2,400.

- Scooter was to be revalued at ₹ 6,000.

- A provision at ₹ 1400 be made in respect at outstanding trade expenses.

- The goodwill of the firm be valued at ₹ 21,000 and X’s share of the same be adjusted into the accounts of Y and Z who decided to share the future profits or losses in the ratio of 3 : 2 respectively.

- The entire capital of the newly constituted firm be fixed at ₹ 40,000 and read justed between Y and Z in their new profit sharing ratio by bringing in or paying out cash.

From the above particulars give Journal entries on the date of retirement and prepare Balance Sheet of the new firm assuming that X’s balance has been paid.

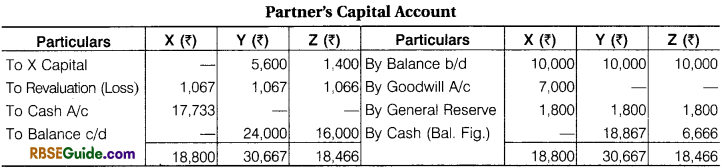

Solution:

(2) Calculation of Y and Z gain ratio is as follows :

So, gain ratio is \(\frac {4}{15} \) : \(\frac {1}{15} \) = 4 : 1

(3) Cast balance calculate as under :

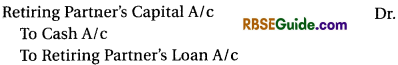

Payment of Amount Due to Retiring Partner :

The amount payable is paid to the retiring partner as per procedure mentioned in the partnership deed. Normally one of the following methods can be used to pay the amount payable:

1. Lump – Sum Payment System :

After making all adjustments, the balance in the capital accounts of retiring partner shows the amount payable to retiring partner or in case of death of partner to his legal heir. If the financial condition of the firm is strong, the payment can be made in lump-sum cash or through bank. The following entry is passed for amount payable at the time of payment under this method.

(Being amount due to retiring partner paid)

2. Payment Partly in Cash and Partly by Transferring into Loan Account At the time of payment under this method, the following entry is passed :

(Being retiring partner paid partly in cash and balance transfer to his loan account)

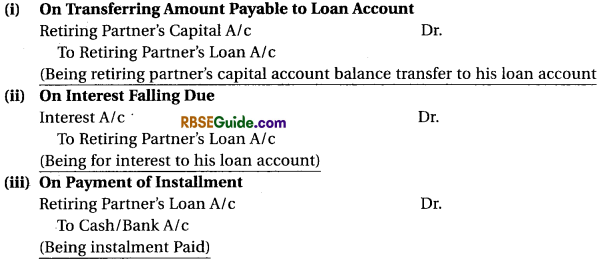

3. Payment by Installment :

To make lump sum payment, firm must have sufficient cash or bank balance. Generally, it is not considered prudent to withdraw large sums, therefore instalment payment system is considered more practical way of payment. Under this method, the balance in the capital account of the retiring or deceased partner is transferred to a loan account in his name and this amount is paid in predetermined instalments. Interest is also paid on the balance amount as per mutual agreement. At the time of payment under this method, following journal entries are passed :

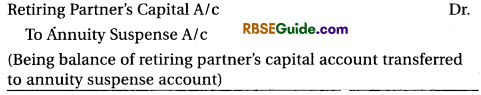

4. Payment by Annuity :

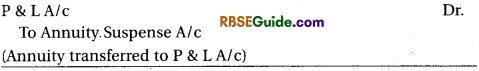

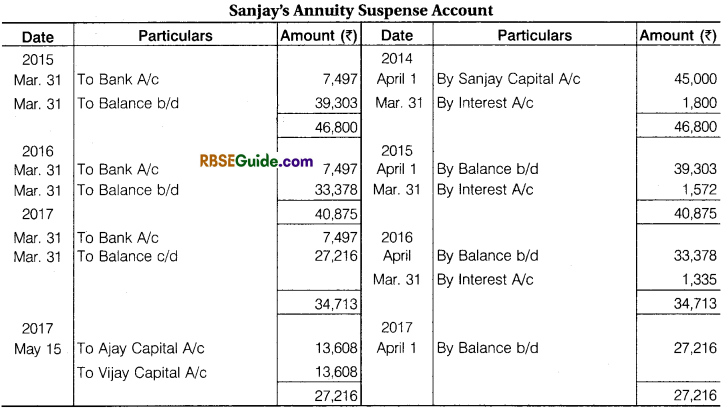

Under this method, the partner retired is given an annuity (annual payment) of certain amount (to be ascertained from annuity tables) till he is alive or to the executor of a deceased partner till his life. This stipulated amount payable is called an Annuity. According to this method, the balance of capital account of a partner retired or deceased is transferred to annuity suspense account. This account is credited with a certain amount of interest at a specified rate. If the partner or the executor at deceased partner dies leaving a balance in this account, it distributed by the remaining partner in their profit sharing ratio.

This account is credited every year beginning balance at a specified rate of interest. In case, the rate of interest is not given, in the question at 6% per annum. The payment from this account is made till the death of retired partner. In case no balance is left in this account, the necessary amount is transferred to annuity account from profit and loss account.

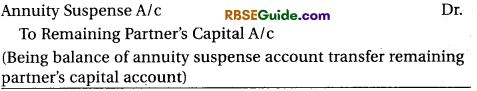

(i) On Transferring the Amount Payable to Annuity Account.

(ii) On Interest Falling Due Every Year on Annuity Account

(iii) On Yearly Payment of Annuity

(iv) On Death of Retired Partner while there is Balance in Annuity Account

(v) If the retired partner survives beyond the balance in annuity account he will continue to receive annuity from firm till his survival. In this case following entry will be passed at the end of year a part from the entry at for accounting of annuity.

Illustration 9.

Ajay, Vijay and Sanjay are Partner’s Sharing Profit and Losses equally. Sanjay retires on 1st Apr. 2014 and his total claim on the firm is calculated at ₹ 45,000. He agreed to receive an annuity of ₹ 7,497 per year. The Firm learns that if Interest at 4% Per annum is taken into account a sum of ₹ 45,000 is paid off in seven years. Time by paying an annuity of the account mentioned above. You are required to prepare Sanjay’s annuity suspense account assuming that the annuity is paid on 31st March, each year and Sanjay dies on 15th May, 2017.

Solution:

Illustration 10.

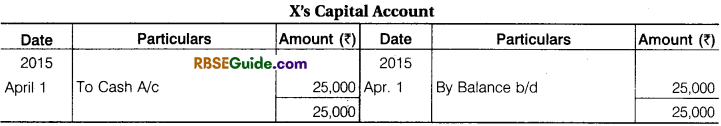

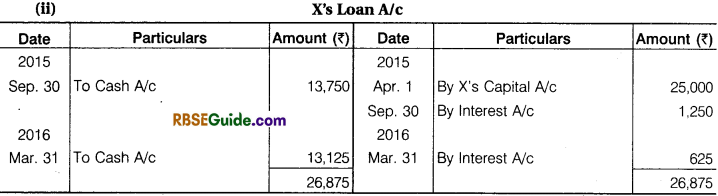

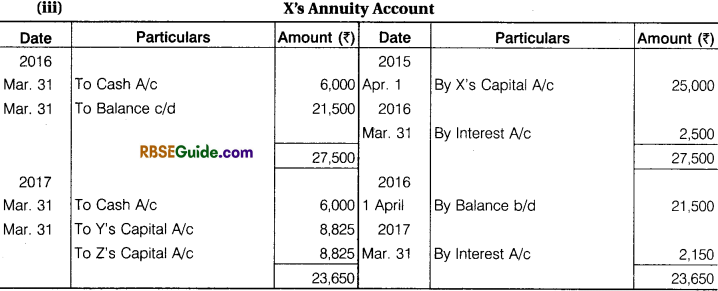

X, Y and Z were carrying on business as equal partner’s. X Retires on 1st Apr, 2015 from Partnership and his Capital Account shows a credit Balance of ₹ 25,000 and Journal after all adjustment. Show the Relevant Ledger Account and Journal Books of the firm after X retirement. If –

(i) Full payment to X is made immediately after retirement in cash.

(ii) The payment is made to X in two equal half yearly instalment of ₹ 12,500 each together with interest at 10% per annum.

(iii) The life annuity of ₹ 6,000 per annum with 10% Interest p.a. assuming that the annuity passes away immediately after payment of the second annuity.

Solution:

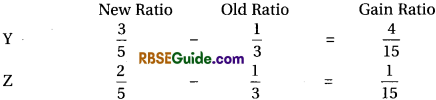

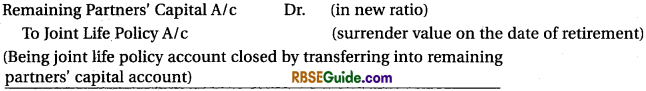

Adjustment of Capital :

After retirement of a partner, the remaining partners may decide to adjust their capital. Often the remaining partners determine the total amount of capital of the reconstitued firm and decide to keep their respective capital account in proportion to the new profit sharing ratio. The total capital of the firm may be more or less than the total of their capital at the time of retirement.

The new capital of the partners are compared with the balance standing to the credit of respective partners’ capital account. It there is a surplus in the capital account, the amount is withdrawn by the concerned partner. The partner brings cash in case the balance in the capital account is less than the calculated amount.

![]()

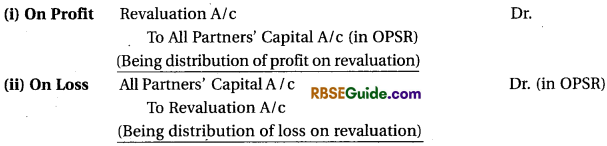

1. When Total Capital of the New Firm is Given :

Steps involved in adjusting capital of partners as follows :

(i) Ascertain present capital of remaining partners (after all adjustment).

(ii) Calculate proportionate capital of remaining partners on the basis of total capital of the new firm and new profit sharing ratio.

(iii) Find surplus/deficit by comparing proportionate capital (step 2) and present capital (step 1).

Surplus = Present capital is more than the proportionate capital

Deficit = Present capital is less than the proportional capital

(iv) Adjust the surplus by paying or by transfer to the credit side of current account of the concerned partner. In case of deficit the amount of deficiency is brought by the concerned partner or alternatively transfer to the debit side of his current account.

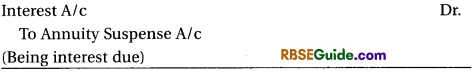

(a) If the adjusted present capital is more than the proportionate capital

![]()

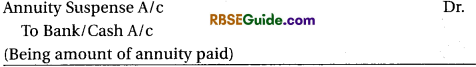

(b) If the adjusted present capital is less than the proportionate capital

![]()

2. Adjustment of Remaining Partners’ Capital in Their Profit Sharing Ratio When the Total Capital of the New Firm is Not Pre-Determined

In this case the total amount of adjusted capital of the remaining partners is rearranged as per agreed proportion in which they share profit of the reconstitued firm. The following steps may be adopted.

- Add the balance standing to the credit of the remaining partners’ capital account.

- The total so obtained is the total capital of the firm.

- This capital is divided according to the new profit sharing ratio.

3. When the Retiring Partner is to be Paid through Cash Brought in by the Remaining Partners in a Manner to Make Their Capital Proportionate to Their New Profit Sharing Ratio

Steps involved for adjusting the capital of partners are as follows :

- Calculate adjusted capital of remaining partners after adjustment.

- Calculate total capital of the firm as follows :

Aggregate of adjusted capital of remaining partners + Shortage of cash to be brought in by continuing partners to pay the retiring partner - Calculate, new capital of remaining partners by dividing total capital of the new firm in their new profit sharing ratio.

- Find surplus/deficit capital by comparing the new capital (step 3) with the adjusted old capital (step 1).

- Pass necessary journal entry for adjusting the surplus/deficit.

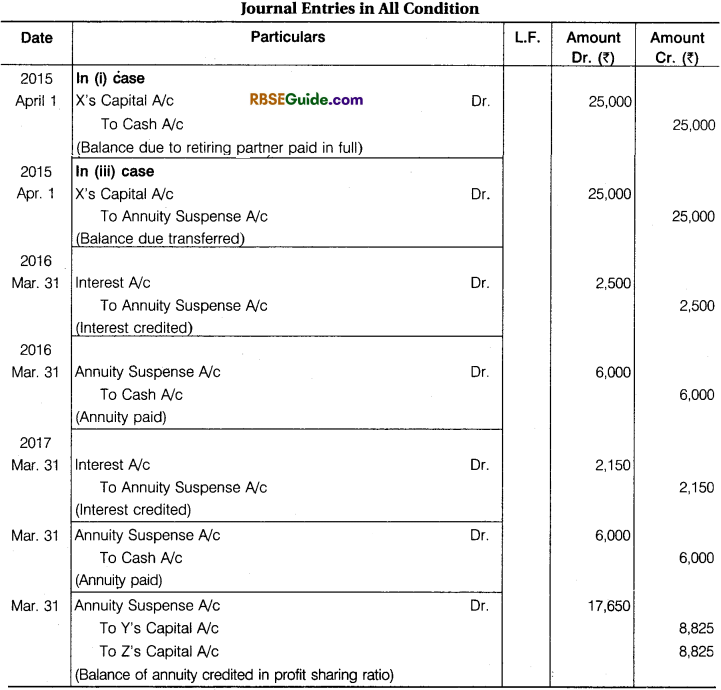

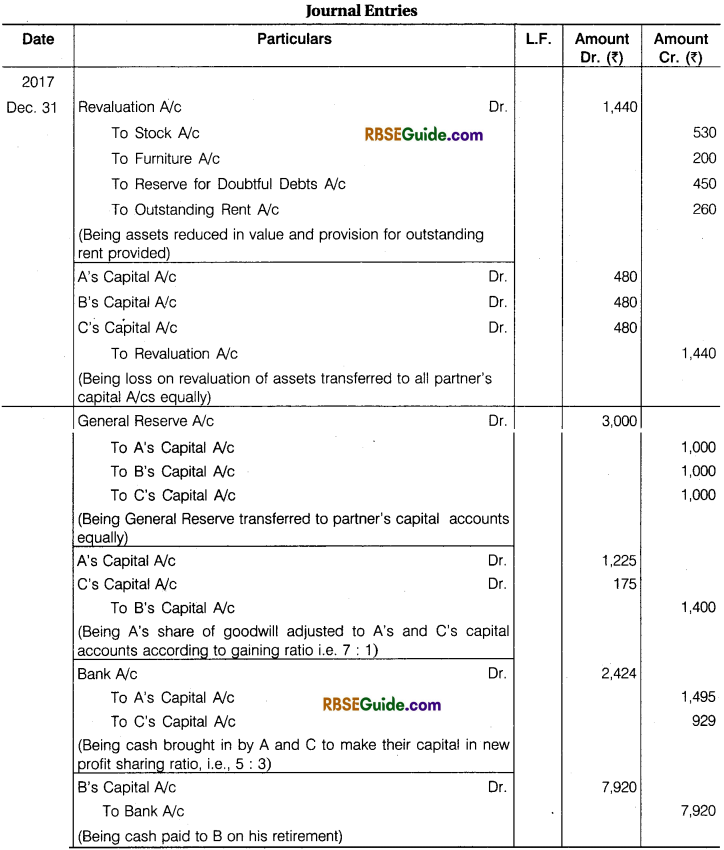

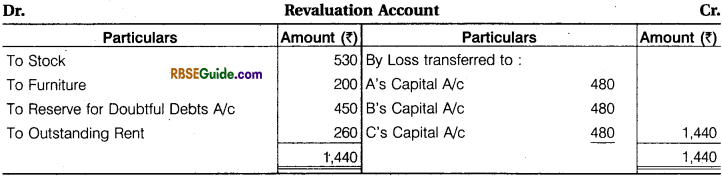

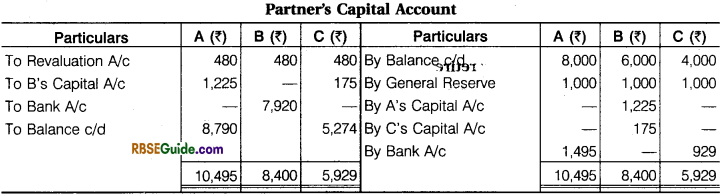

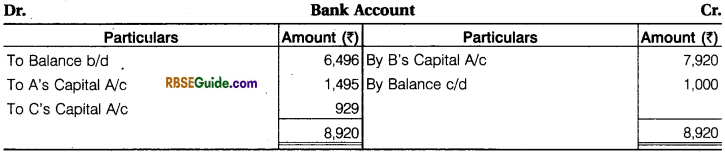

Illustration 11.

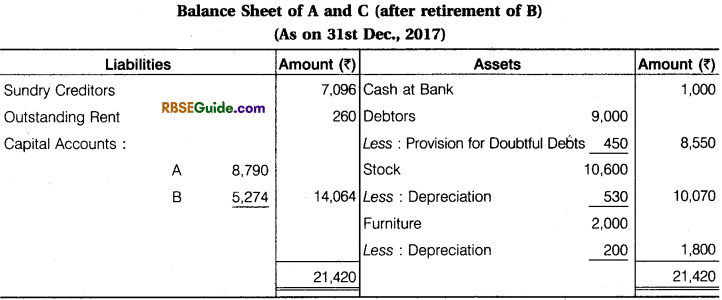

A, B and C are partners in a firm whose Balance Sheet on 31st December, 2017 was as follows :

B retired on that date. In this connection it was decided to make the following adjustments :

(a) To reduce Stock and Furniture by 5% and 10% respectively.

(b) To provide for doubtful debts at 5% on Debtors.

(c) Outstanding Rent was ₹ 260.

(d) Goodwill was valued at ₹ 4,200.

A and C decided :

- To share profits and losses 5 : 3 respectively.

- Not to show goodwill in the books.

- To re-adjust their capitals in profit sharing ratio.

- To bring in sufficient cash to pay off B immediately and to leave a balance of ₹ 1,000 in the Bank. B was paid off.

Pass Journal entires to record the above and prepare the Balance Sheet of the new firm.

Solution:

Working Notes :

(1) B’s share in total goodwill of the firm = 4,200 x \(\frac {1}{3} \) = ₹ 1,400

Profit and Loss Ratio of remaining partners = New Profit & Loss Ratio – Old Profit & Loss Ratio

Gain Ratio of A = \(\frac {5}{8} \) – \(\frac {1}{3} \) = \(\frac {15 – 8}{24} \) = \(\frac {7}{24} \)

Gam Ratio of C =\(\frac {3}{8} \) – \(\frac {1}{3} \) = \(\frac {9 – 8}{24} \) = \(\frac {1}{24} \)

Gain Ratio of A & C =\(\frac {7}{24} \) : \(\frac {1}{24} \) = 7 : 1

Distribution of B’s share in Goodwill ? 1,400 in gain ratio between A and C

Share of Goodwill of A =1,400 x \(\frac {7}{8} \) = ₹ 1,225

Share of Goodwill of C =1,400 x \(\frac {1}{8} \) = ₹ 175

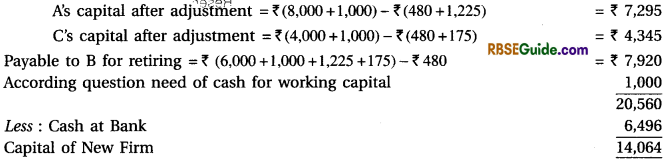

(2) Capital of New Firm after retirement of B

(3) New Capital of A and C in New firm.

As New Capital in New Profit Ratio = \(\frac {14,064 x 5}{8} \) = ₹ 8,790

B’s New Capital in New Profit Ratio = \(\frac {14,064 x 3}{8} \) = ₹ 5,274

Adjustment of Life Policies in Case of Retirement :

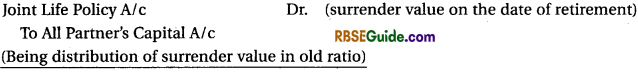

When a Joint Ltfe.lnsurance Policy is Taken on Lives of All Partners

In this case following circumstances may happen :

(i) When Premium is Treated as Revenue Expenditure: In such case the surrender value on the day of retirement is divided among all partners in profit sharing ratio. If remaining partners wish to keep policy account in the books, then this value will be shown in the balance sheet. But if it is desired to close the account, then remaining partners will bear the same amount in their new ratio.

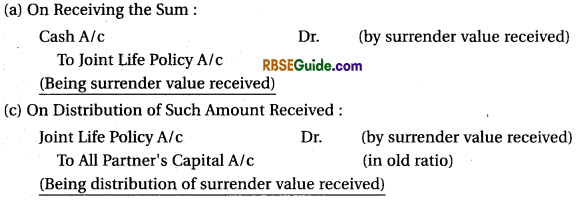

(a) To Record the Surrender Value :

(b) If the Above Joint life Insurance Policy is to be Closed as Per Information Given

Note : If the joint life insurance policy is actually surrendered and amount received

(ii) When Premium is Treated as Capital Expenditure: In this case the policy account is always shown at surrender value in the books. Hence, no separate is required to make. However, the policy is revalued on retirement and the difference in the ,h$pk value and the revaluation value is adjusted through revaluation account and the policy will be shown at revalued value in the balance sheet. Thus entry for this will be passed along with revaluation entries. But if remaining partners want to close the policy account then, following entry need to be passed :

Note : If the joint life policy is actually surrender and cash received on the day of retirement, then following’entries will be passed and balance, if any in the policy account will be :

(a) On surrender value received :

(b) On Distribution of Sum Received.

Note : If the sum received is less than the value shown in the books, then the entry would be reverse to the above entry.

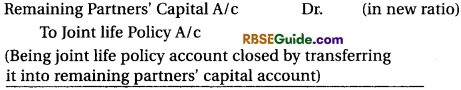

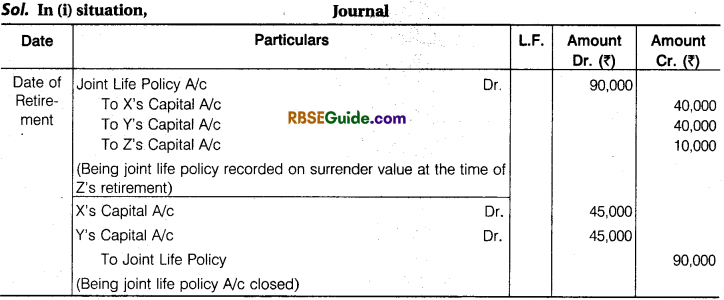

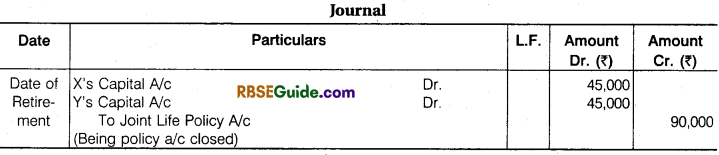

Illustration 12.

X, Y and Z sharing profits in 4 : 4 : 1 ratio. On retirement of surrender value of Joint Life Policy was ₹ 90,000. Policy account is not to be shown in the books in future and remaining partners decided to share profit equally between them.

Pass necessary entires in following circumstances :

(1) When premium is treated as revenue expenditure.

(2) When surrender value of Joint Life Insurance Policy is already shown in the books.

Solution:

One entry can made instead of above two entries :

(Share of Z’s in joint life policy charged to X and Y in their gain Ratio)

In (ii) situation,

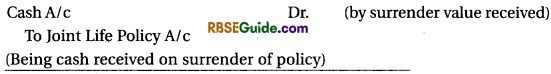

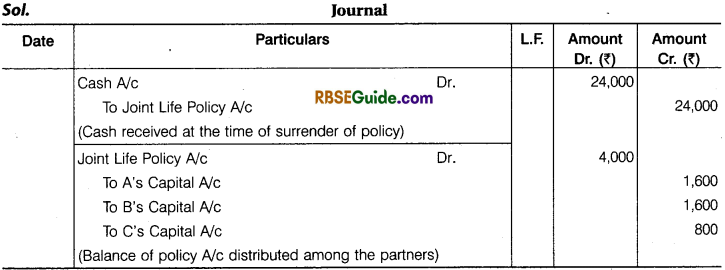

Illustration 13.

A, B and C are partners sharing profits in 4 : 4 : 2 ratio. On retirement of C firm’s books show Joint Insurance Policy at ₹ 20,000. The same day the policy is surrendered by the firm and receive ₹ 24,000. Pass necessary entries.

Solution:

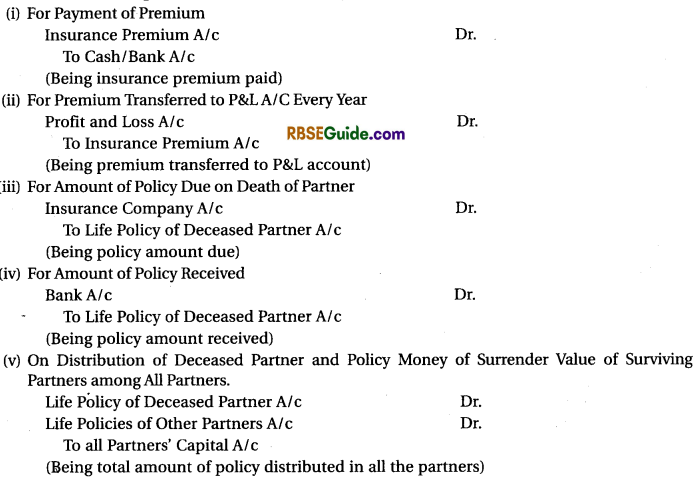

Adjustment of Life Insurance Policy on Death of the Partner :

If a joint life insurance policy is taken on lives of all partners, then sum insured is payable on death of any one partner when separate life insurance policy are taken on lives of partners, then sum insured is payable only on the policy of that partner. However to find out the sum payable to the legal heir of the deceased partner, the surrender value of other partners policies is also kept in mind. Principally there is no difference in the accounting procedure whether policies taken are several or joint. It is noteworthy that firm is responsible for payment of premium to insurance company if the policy/policies are taken by the firm.

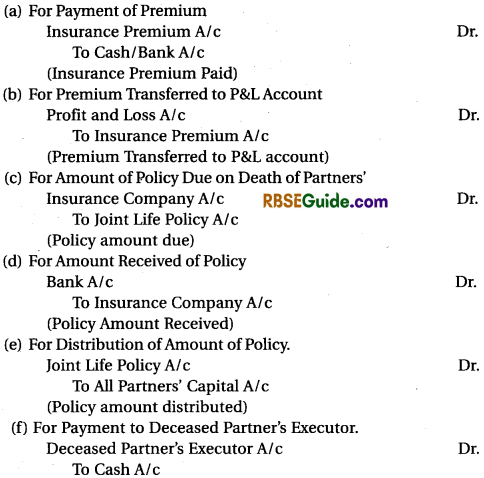

1. Individual or Separate Life Insurance Policy :

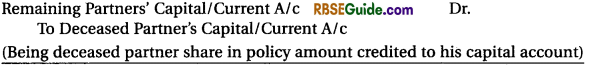

Alternative Method :

When insurance policy account is not to be shown in books, then with the total amount of policy, amount of deceased partner and the surrender value of surviving partners are added and the share of deceased partner is ascertained and with this amount, deceased partner’s capital account is credited and surviving partners’ capital account are debited in gaining ratio.

2. Joint Life Insurance Policy on the Lives of Partners :

In case of joint life insurance policy accounting can be done as per any one of three different methods.

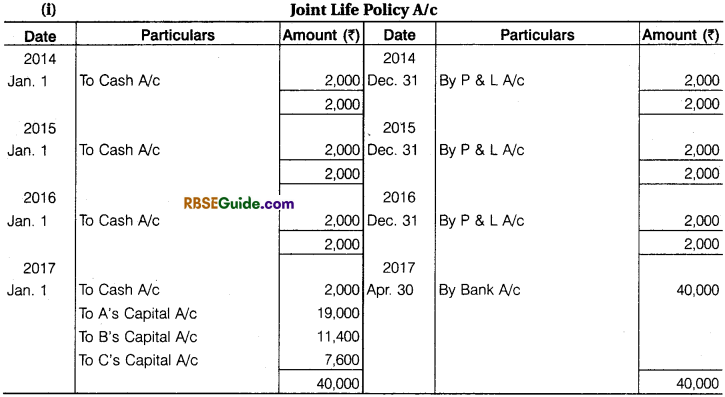

(i) Treating Premium as Trade Expenses : In this situation the following entries will be passed :

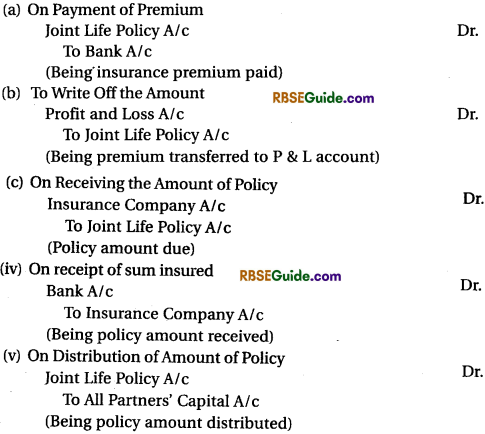

(ii) When Premium is Treated as an Investment : In this case the total amount of premium paid is not transferred to profit and loss account but only the excess of premium paid over surrender value at the end of the year is transferred to profit and loss account. By following this method the balance in life insurance policy account always remains equal to the surrender value which is shown on the assets side of the balance sheet. Following entires are passed for accounting under this method :

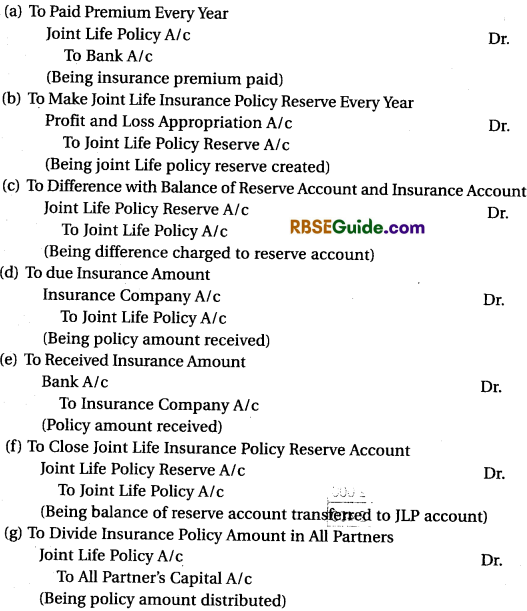

(iii) When Premium is Treated as Reserve or Appropriation of Profit : Sometimes, a few firms treat premium payment as an investment and simultaneously create a reserve every year. The amount calculated on the basis of surrender value i.e., excess of premium paid over surrender value is transferred to reserve account instead of profit and loss account following entries are passed under this method :

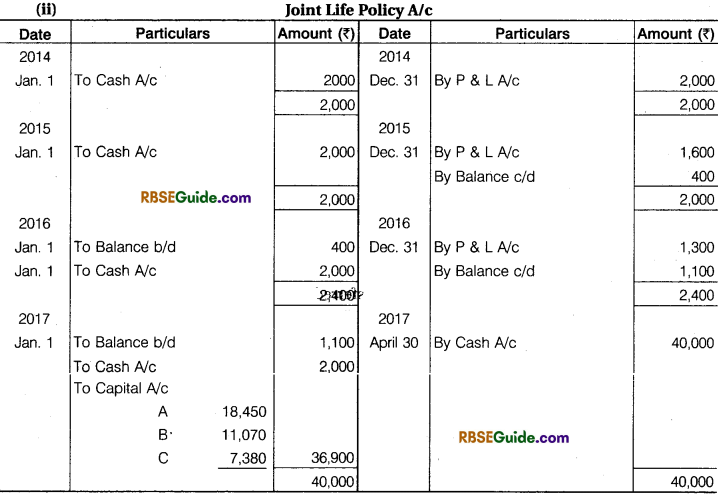

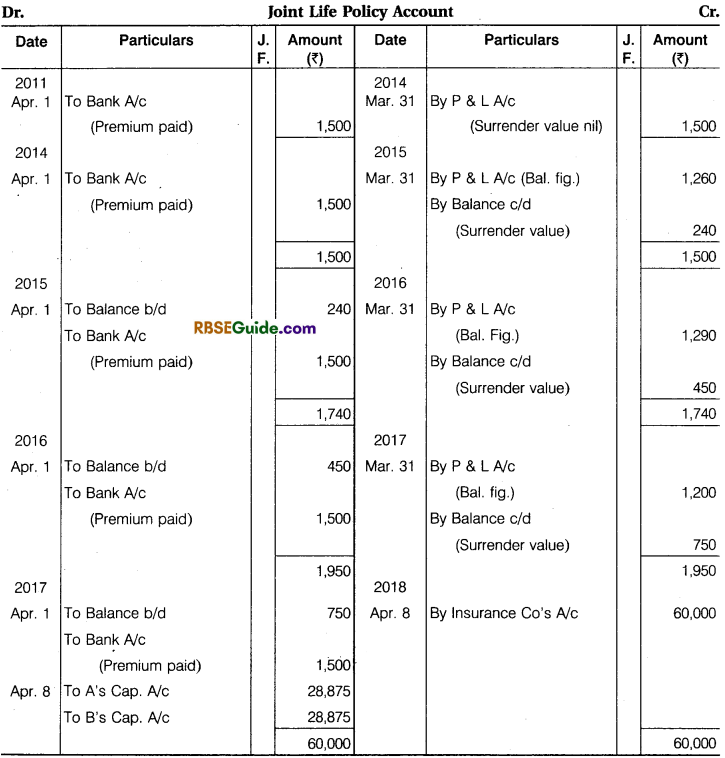

Illustration 14.

A, B and C are in partnership sharing Profit and Losses in the Ratio of 5 : 3 : 2. They took out on 1 Jan. 2014 a Joint Life Policy for ₹ 40,000. The Premium per year being ₹ 2,000 payable. The surrender value of policy was end of the year as follows for 2014 Zero, for 2015 400, for 2016 ₹ 1100 and for 2017 ₹ 1940. B dies on 10 March 2017 and cliams for Sum Assured Received on 30 Apr. 2017.

Prepare necessary Accounts for that if :

1. When full Premium is treated as a Business expenditure.

2. When full Premium is treated as an Investment.

3. When full Premium is treated as on Investment and Made a Reserve.

Solution :

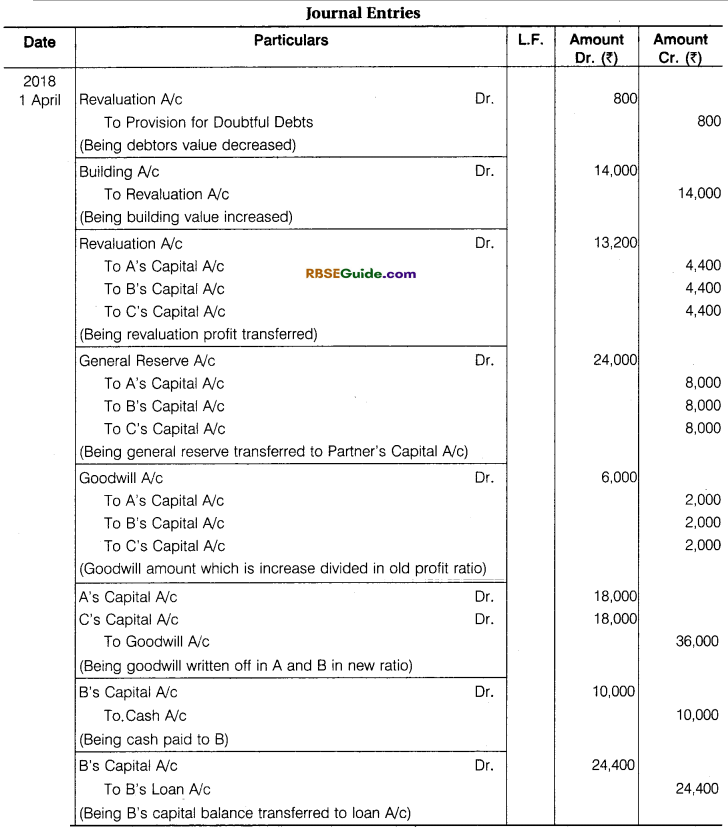

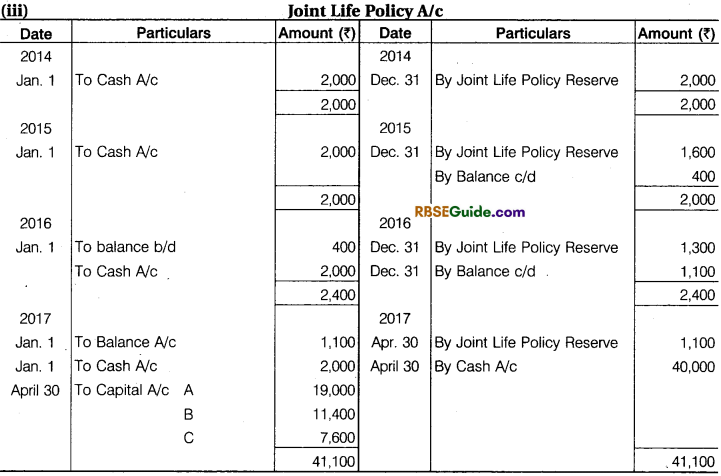

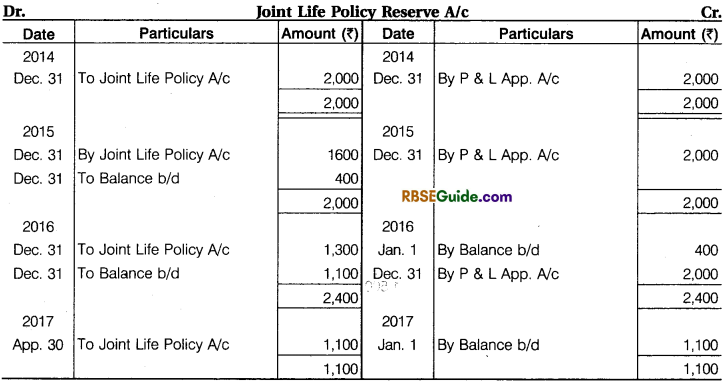

Illustration 15.

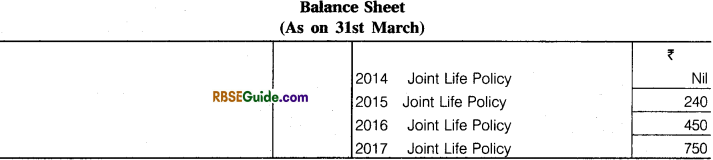

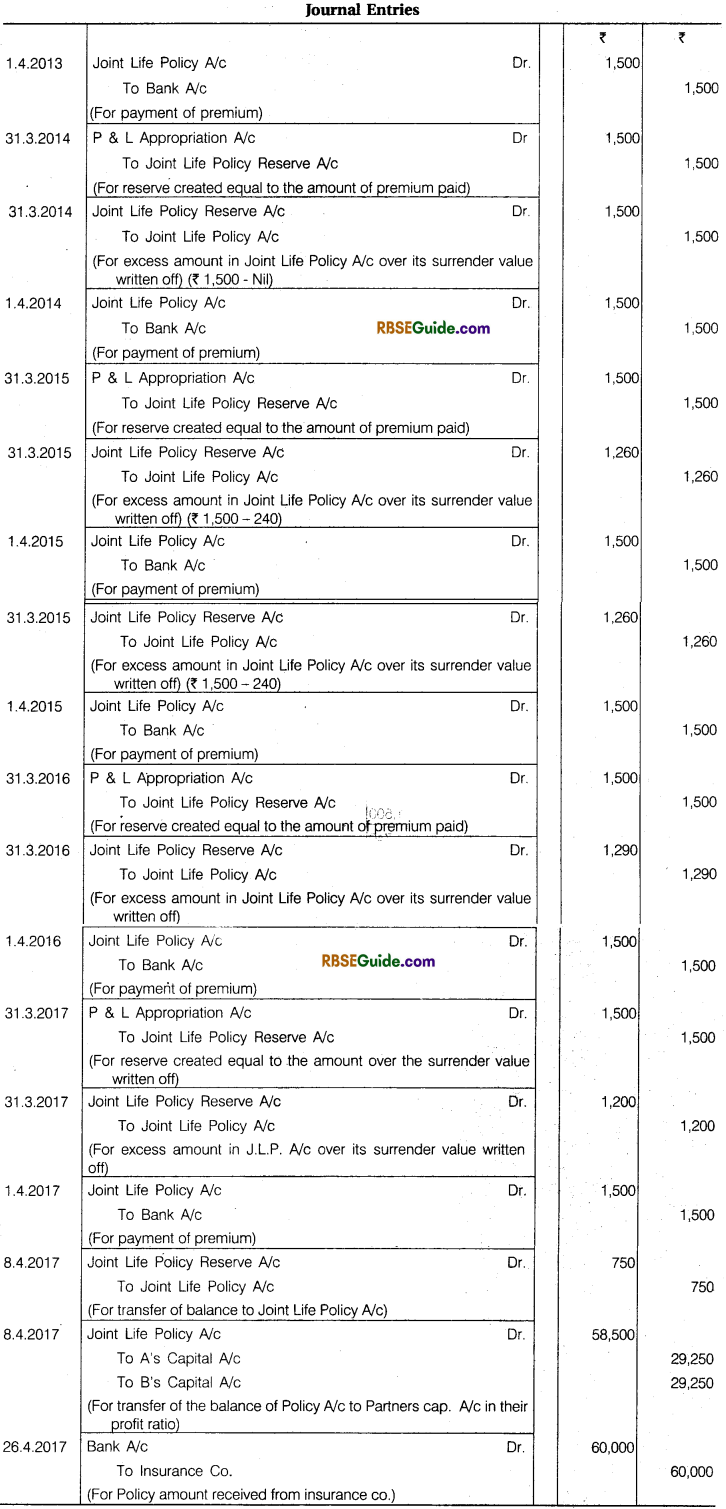

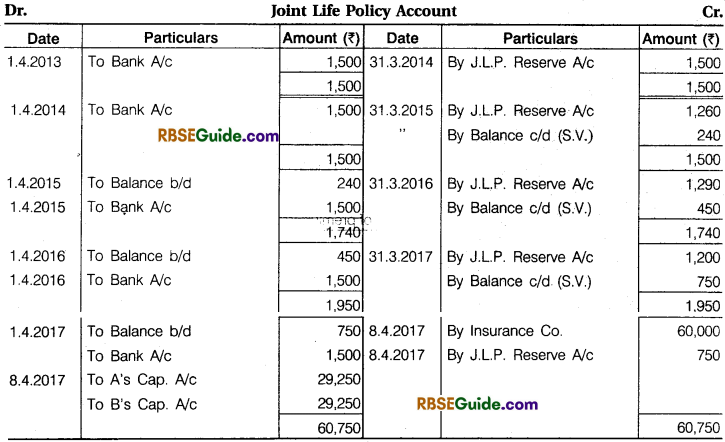

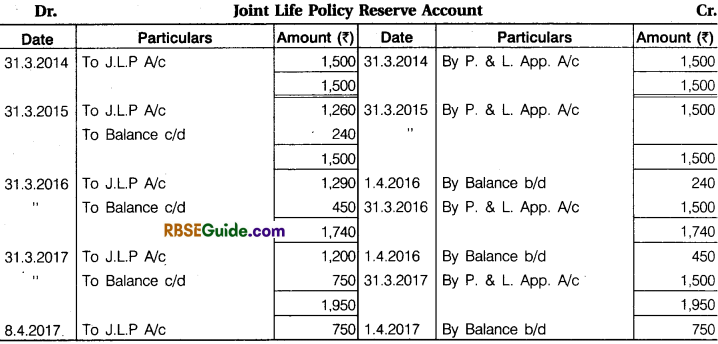

The firm of A and B took out a Joint Life Policy on 1st April, 2013 for ₹ 60,000 in order to provide a fund for repayment of a deceased partner’s share. The annual premium of ₹ 1,500 is payable form 1st April, 2013. B died on 8th April, 2017, but Insurance company paid the policy amount on 26th April, 2017. Assume that the surrender value of the policy was as follows :

In 2013-14 Nil; in 2014-15 ₹ 240; in 2015-16 ₹ 450 and in 2016-17 ₹ 750. The partners shared profits in the proportion of 1 : 1 and the books were closed on 31st March every year. Prepare the necessary Accounts and B/S when the Joint Life Policy Account is maintained at surrender value and the excess of premium over surrender value is transferred to (i) P & L A/c and (ii) Joint Life Policy Reserve A/c.

Solution:

(i) When Joint Life Policy is maintained at surrender value and the excess of premium over surrender value is transferred to P & L A/c:

![]()

(ii) When Joint Life Policy Account is maintained at surrender value and the excess of premium over surrender value is transferred to Joint Life Policy Reserve A/c :

Retirement/Death of a Partner During the Accounting Year :

In extra ordinary circumstances a partner retires during the accounting year. Similarly, in case of death of a partner, the amount payable to the legal heir of the deceased partner had to be determined on any date falling during the accounting year. In such situation the following adjustments are made to determine the amount payable to the retiring partner or the legal heir of the deceased partner :

1. Salary, Bonus, Commission and Fee etc : Salary, bonus etc. of the partner from the date of last balance sheet till the date of death/retirement of the partner is credited to the capital/current account.

2. Interest on Capital : Interest on capital from the date of last balance sheet till the date of death/retirement of partner is credited to capital/current account of the partner.

3. Drawings and Interest There On : Any drawings and interest thereon if any from the date of last balance sheet till the date of the death/retirement is debited to capital/current account of the partner.

![]()

4. Life Insurance Policy : If joint or separate life policies are taken on the lives of the partners, then retiring/deceased partner’s share is calculated and his share is credited the capital/ current account. (This has already been explained in earlier)

5. Share in Firm’s Profit : Profits are calculated from the date of last balance sheet till the date of retirement Death of the partner. This can be computed by one of the following methods :

(i) On Time Basis : Either on the basis of Immediately preceding year or on the basis of average of past few years, the proportionate profit from the date of last balance sheet till the date of retirement/death is calculated and credited to the capital/current account of the partner.

(ii) On Turnover Basis : The percentage of profit to the turnover in the last year is found and profit on the turnover since the date of last balance sheet till the date of retirement/death on the same percentage is arrived at. The deceased or retired partner’s share is then calculate on the basis of profit sharing ratio and credited to the capital/current account of the partner.

Accounting Treatment for Non-Settlement of Final Payment of Retiring Partner and Deceased Partner :

According to Section 37 of Indian Partnership Act, 1932, if remaining partners continue to carry on the business without payment of final settlement amount to the retiring partner then there are two options available to the retiring partner, he is entitled (i) get interest 6% per, annum on the outstanding amount till receipt of the final payment or, (ii) to get share in earned profit for that period in the ratio of capital, whichever is beneficial to him can be accepted by him.

Illustration 16.

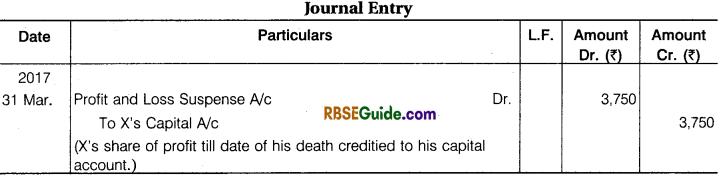

X, Y and Z were Partner’s in a Firm. X died on 31st March, 2017 his share of profit from the closure of the last accounting year till the date of death was to be calculated on the basis of the average of three completed years of profit before death. Profit for 2014, 2015 and 2016 were ₹ 45,000,42,000 and ₹ 48,000 respectively.

Calculate X’s Share Capital of Profit till his death and pass the necessary Journal Entry for the same.

Solutuion:

![]()

3 Months Profit of the Firm (1 Jan., 2017.1a 31 March, 2017) = 45,000 x \(\frac {3}{12} \) = ₹ 11,250

X’s Share of Profit = 11,250 x \(\frac {1}{3} \) = ₹ 3,750

Illustration 17.

A, B and C share profit in the Ratio of 3 : 2 : 1. C dies on 30 June 2017 account closed on 31st March, every year. Sales for the year ending on 31st March, 2017 amounted to ₹ 8,00,000 and profit on it was ₹ 40,000. Sales form 1st April, 2017 to 30 June, 2017 amounted to ₹ 3,00,000. Calculate the Profit of deceased partner on the basis of time and sales basis.

Solution:

(i) Time basis :

In current year ‘C’ alive for 3 Month

So firm Profit’ for 3 months on the basis of Last Year.

40,000 x \(\frac {3}{12} \) = ₹ 10,000 12

C’s Share = 10,000 x \(\frac {1}{6} \) = ₹ 1,667 6

(ii) Sales Basis :

Rate of Profit in Last year = \(\frac {40,000}{8,00,000} \) x 100 = 5%

Profit of Current year’s Sales = 3,00,000 x \(\frac {5}{100} \) = ₹ 15,000

C’s Share = 15,000 x \(\frac {1}{6} \) = ₹ 2,500

![]()

Illustration 18.

X, Y and Z were partner sharing profit in the Ratio of 2 : 2 : 1 a dies on 31st March, 2017. Accounts were closed on 31st December. Total Sales for the year 2016 amounted to ₹ 4,00,000 and Net Profit was ₹ 40,000. Total Sales from 1st Jan. 2017 to 31st March 2017 were ₹ 2,00,000. Calculate the Deceased Partner’s Share of profit.

Solution:

1. Rate of Profit last year = \(\frac {40,000}{4,00,000} \) x 100 = 10%

2. Profit for current year = 2,00,000 x \(\frac {10}{100} \)= ₹ 2,000

3. Z’s Share of Profit = 2,000 x \(\frac {1}{5} \) = ₹ 400

Illustration 19.

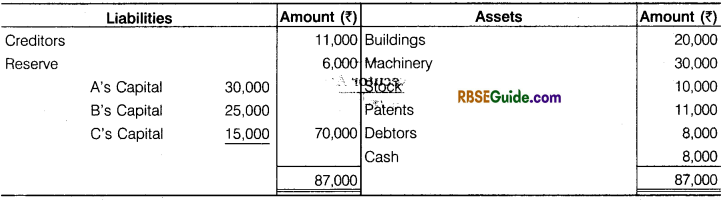

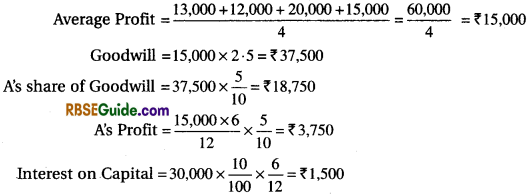

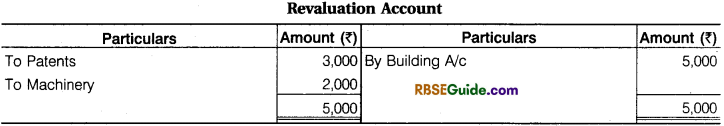

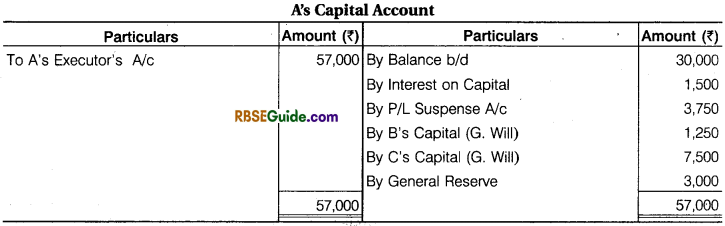

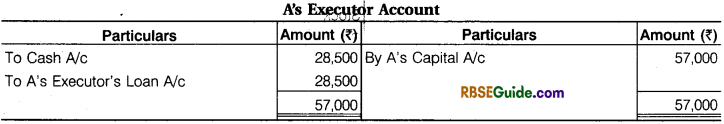

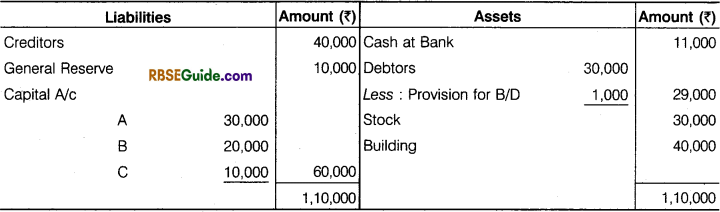

A, B and C are partners in a firm sharing profits in the ratio of 5 : 3 : 2. On 31st March, 2017. Their Balance Sheet was as under :

A died on 1st October, 2017. It was agreed between his executors and the remaining partners that :

(a) Goodwill to be valued at 2 \(\frac {1}{2} \) years. Purchase of the average profits of the previous four years which were = 2014 : ₹ 13,000, 2015 : ₹ 12,000, 2016 : ₹ 20,000 2017 : ₹ 15,000.

(b) Patents be valued at ₹ 8,000, Machinery at ₹ 28,000 and Building at ₹ 25,000.

(c) Profit fortheyear2017-18be taken as having accrued at the same rate as that of the previous year.

(d) Interest on capital be provided at 10% p.a.

(e) Half of the amount due to ‘A’ to be paid immediately to the executor and the balance transferred to his (Executor) loan A/c.

Prepare A’s Capital A/c and A’s Executor A/c (as on 1st October, 2017)

Solution:

Valuation of Goodwill

Illustration 20.

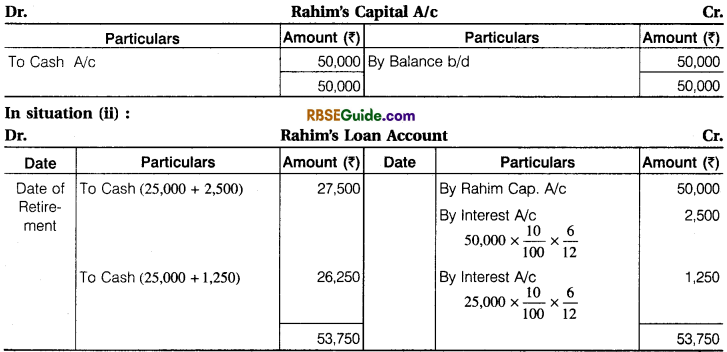

A, B and C distribute profit and loss respectively in ratio of 2 : 2 : 1. C retires from 1st June 2017. The balance sheet on 31st March, 2017 was as follows :

The following decisions were taken at the time of C’s retirement :

- Stock value is less by 10%.

- Provision of contingent loan should be increased upto 5% of debtors.

- Building’s value should be increased by 50%.

- Firm’s goodwill should be valued at ₹ 30,000 and C’s share will be adjusted into A and B account from this amount which decide to distribute profit equally in future.

- C’s share should be calculate on the basis of last year’ profits till the date of retirement’s profit. Last year’s profit was ₹ 30,000.

- Firm’s has a joint insurance policy which surrender value is ₹ 15,000. On C’s retirement amount obtained from insurance was distributed among partners.

Prepare revaluation account and capital account on date of retirement.

Working Note :

1. C’s share in goodwill = 30,000 x \(\frac {1}{5} \) = ₹ 6.000 (Adjusted byA and Bin gain ratio)

2. Gain ratio A = \(\frac {1}{2} \) – \(\frac {2}{5} \)

B = \(\frac {1}{2} \) – \(\frac {2}{5} \) = \(\frac {1}{10} \)

\(\frac {1}{10} \) : \(\frac {1}{10} \) = 1 : 1 or equally.

3. C’s share of profit upto date of retirement :

Total profit of 2 months =30,000 x \(\frac {1}{12} \) = ₹ 5,000,

C’s share = 5,000 x \(\frac {1}{5} \) = ₹ 1000

4. Share in Joint Life Insurane Policy

A = 15,000 x \(\frac {2}{5} \) = ₹ 6,000

B = 15,000 x \(\frac {2}{5} \) = ₹ 6,000

C = 15,000 x \(\frac {1}{5} \) = ₹ 3.000

![]()

5. Distribution of General Reserve :

A = 10,000 x \(\frac {2}{5} \) = ₹ 4,000

B = 10,000 x \(\frac {2}{5} \) = ₹ 4,000

C = 10.000 x \(\frac {1}{5} \) = ₹ 2,000

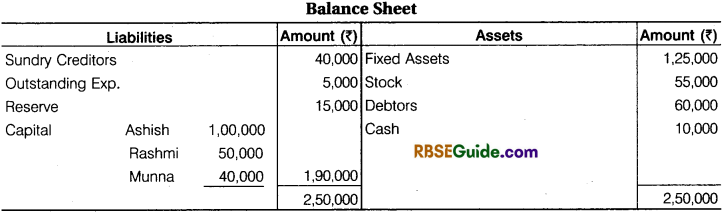

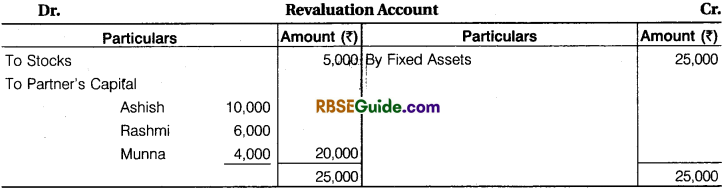

Illustration 21.

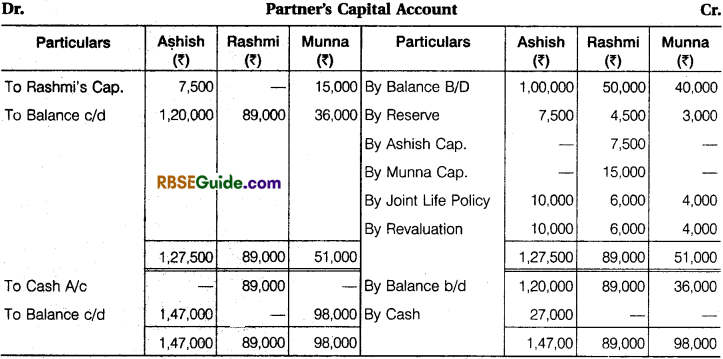

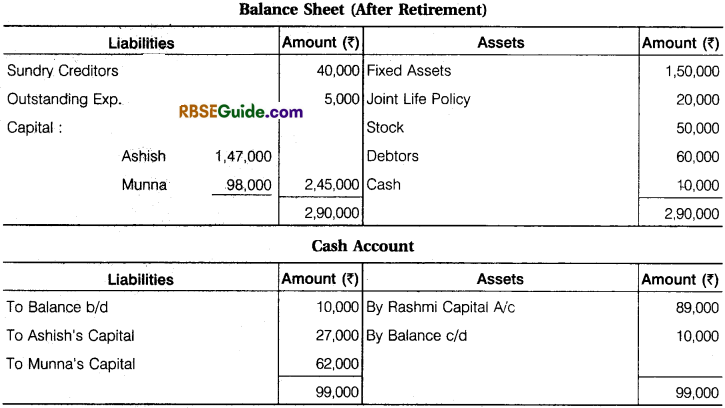

Ashish, Rasmi and Munna share partner in 5 : 3 : 2 ratio on 31.3.16. Balance sheet is as under : Balance Sheet

Rashmi retired on 31.03.16 at that date goodwill was valued at ₹ 75,000. Fixed Assets ₹ 1,50,000 and stock ₹ 50,000. Firm had a joint life insurance policy on this date, its surrender value is ₹ 20,000 valued. Ashish and Munna bring cash as the way which their capital and profit ratio would be in 3 : 2 for payment to Rashmi. Joint life insurance policy ¡s to be shown in the books.

Prepare necessary account at the time of retirement of Rashmi and Balance Sheet after retirement.

Working Notes :

(1) Gain ratio :

Ashish = \(\frac {3}{5} \) – \(\frac {1}{5} \) = \(\frac {6 – 5}{10} \) = \(\frac {1}{10} \)

Munna = \(\frac {2}{5} \) – \(\frac {2}{10} \) = \(\frac {4 – 2}{10} \) = \(\frac {2}{10} \)

So, \(\frac {1}{10} \) : \(\frac {2}{10} \) = 1 : 2

(2) Adjustment entry for goodwill :

Share of Rashmi = 75,000 x \(\frac {3}{10} \) = ₹ 22,500 (Ashish and Munna will adjusted in gain ratio)

(3) Total capital on retirement of Rashmi

(4) Ashish’s capital in new firm = 2,45,000 x \(\frac {3}{5} \) = ₹ 1,47,000

Munna’s capital in new firm = 2,45,000 x \(\frac {2}{5} \) = ₹ 98,000

Additional capital will bring by Ashish and Munna :

Ashish = 1,47,000 – 1,20,000 = ₹ 27,000 (in cash)

Munna = 98,000 – 36,000 = ₹ 62,000 (in cash)

(Amount will bring in cash)

![]()

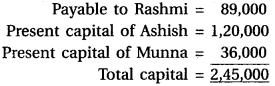

Illustration 22.

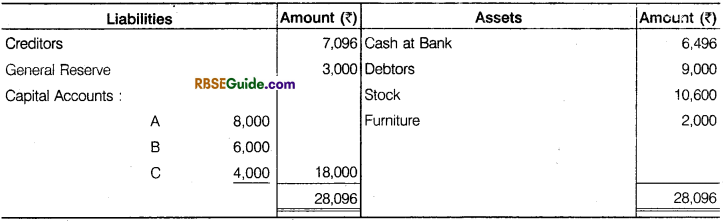

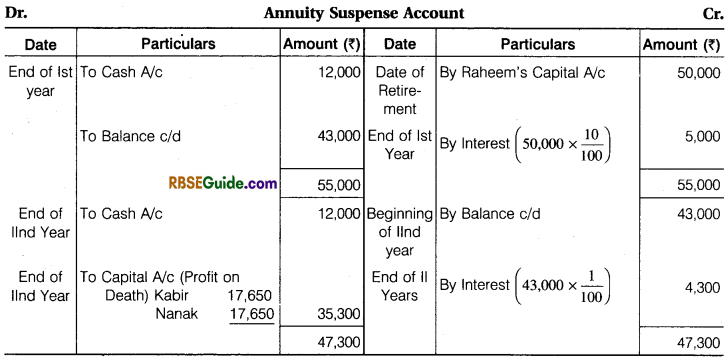

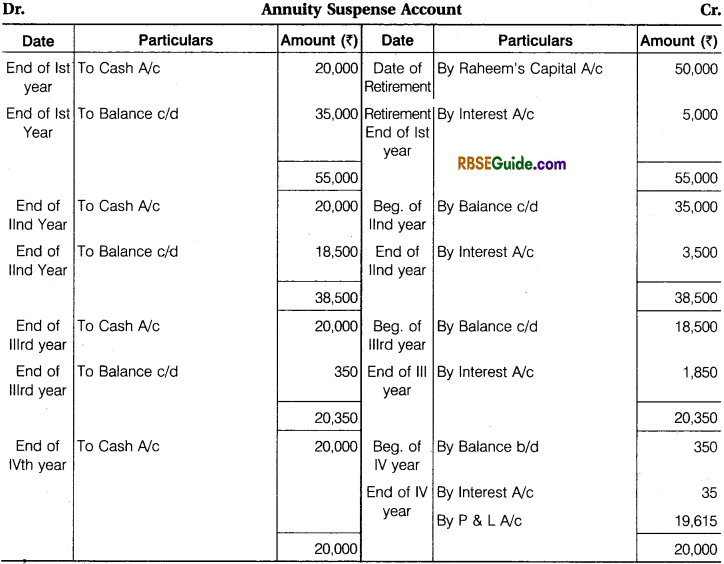

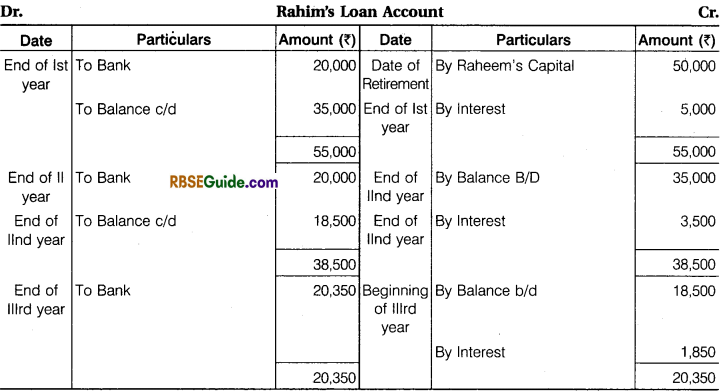

Rahim, Kabir and Nanak were carrying business with equally sharing profit ratio. Rahim takes retirement from partnership. After doing all adjustment his capital account showing ₹ 50,000 credit balance. Make necessary account after retirement of rahim in following circumstances :

1. Immediately paid to Rahim in cash after retirement.

2. Payment made to Rahim two half yearly equally instalment at @ 10% interest p.a. (Interest separately).

3. The annuity given per year @10% interest to whole life ₹ 12,000.

4. The annuity given per year @10% interest to whole life ₹ 20,000.

Solution:

In situation (i) :

In situation (iii) :

In situation (iv) :

In situation (v) :

Accounting for Retirement and Death of Partner Notes Important Terms

→ Retirement of a Partner : When a partner decides to retire from a partnership for any reason, it is known as Retirement of a Partner.

→ Gaining Ratio : The ratio in which the continuing partners acquire the outgoing (retired , or deceased) partners’s share is called Gaining Ratio.

→ New Profit Sharing Ratio : The ratio in which the continuing partners (i.e., partners other than an outgoing partner) decide to share future profits and losses I known as New Profit Sharing Ratio.

→ Profit and Loss Suspense Account : It is the account which is debited to adjust the share of profit upto the date of death of the deceased partner.

→ Joint Life Policy : When a Joint Life Insurance Policy is taken on lives of all partners.

→ Surrender Value : Insured person surrender his policy to insurance company then on that date, which amount he received called surrender value.

→ Purchased Goodwill : Cash consideration paid for that.