Make use of our RBSE Class 12 Accountancy Notes here to secure higher marks in exams.

Rajasthan Board RBSE Class 12 Accountancy Notes Chapter 6 Introduction of Financial Statement of Company

Meaning of Financial Statements:

Financial statements are the end products of accounting process. They provide information about the profitability and the financial position of a business. As per Section 2 (40) of the Companies Act, 2013, “Financial Statements” in relation to a company include the following :

- A balance sheet at the end of the financial year

- A statement of profit and loss for the financial year

- Cash flow statement for the financial year

- A statement of changes in equity, if applicable, and

- Explanatory notes.

One person company, small company and dormant company are exempted from preparing cash flow statement with their financial statements.

![]()

Financial Year

As per Section 2(41) of the Companies Act, 2013, all companies are required to have as uniform financial year which shall be a period from 1st April to 31st March every year. Only companies which are a holding or subsidiary of a foreign company required to follow different financial year for the purpose of consolidation of its accounts outside. India may apply to the tribunal for a different financial year. Section 129 (1) of the Companies Act, 2013, requires that the financial statement of a company:

- shall give a true and fair view of the state of affairs of the company

- shall comply with the accounting standards noticed under Section 133.

- shall be in the prescribed form given in Schedule III.

The prescribed form for the preparation of balance sheet has been given in Part I of Schedule III and prescribed form for the preparation of statement of profit and loss has been given in Part II of Schedule III. .

The Board of Directors shall present the financial statements before the shareholders for their approval at every Annual General Meeting of the company. The auditor’s report and director’s report must be attached to the financial statements of the company.

Objectives of Preparing Financial Statements

- To present a true and fair view of the financial performance {i.e., profit/loss) of the business.

- To present a true and fair view of the financial position (i. e., assets / equity and liabilities) of the business.

Characteristics of Financial Statements

- Financial statements are related to past period and hence are historical documents.

- They are expressed in terms of money.

- Financial statements show profitability through statement of profit and loss and financial position through balance sheet,

![]()

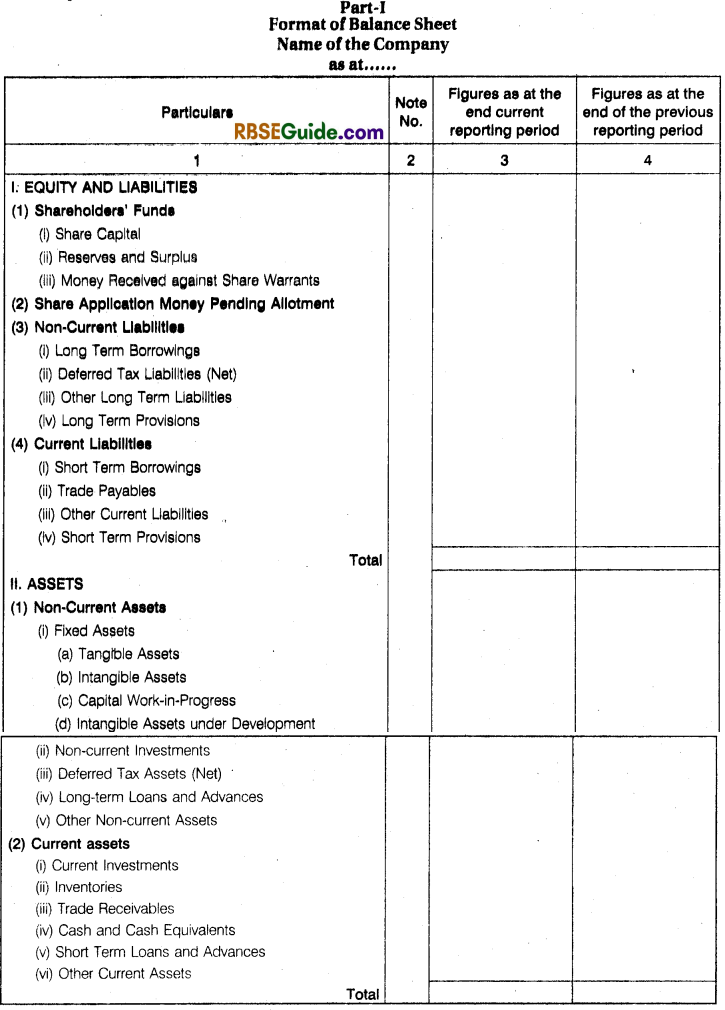

Balance Shift of a Company

Balance sheet is a financial statement that summarises company’s equity (shareholders’ funds), liabilities and assets at a specific point of time, These three balance sheet segments, i.e., equity (shareholders’ funds), liabilities and assets show what the company owns and what is owes.

Balance sheet of a company Is prepared following the same principles as are followed in preparation of balance sheet of a sole proprietorship or partnership firm. However, it differs from them in presentation, Balance sheet of a company is prepared in the prescribed format i.e., Schedule III, Part I of Companies Act, 2013,

![]()

General Instructions for Preparation of Balance Sheet:

1. Current Assets : An asset shall be classified as current when it satisfies any of the following criteria:

- It is expected to be realised in or is intended for sale or consumption in the company’s normal operating cycle.

- It is held primarily for the purpose of being traded.

- It is expected to be realised within twelve months after the reporting date.

- All other assets shall be classified as non-current.

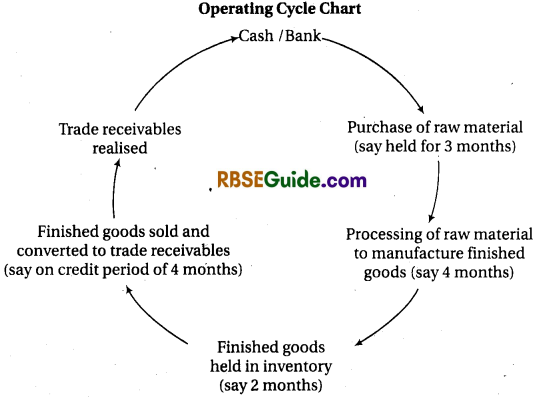

2. Operating Cycle : An operating cycle is the time between the acquisition of assets for processing and their realisation in cash or cash equivalents. Where the normal operating cycle cannot be identified, it is assumed to have a duration of 12 months.

3. Current Liability: A liability shall be classified as current when it satisfies any of the following criteria:

- It is expected to be settled in the company’s normal operating cycle.

- It is held primarily for the purpose of being traded.

- It is due to be settled within twelve months after the reporting date.

4. No Debit Balance of Profit and Loss aiongwith Assets: An important change in the Schedule III is elimination of debit balance of profit and loss statement from the assets. It is now to be presented as negative balance within “Reserve and Surplus”.

5. Treatment of Miscellaneous Expenditure : As per AS-16 borrowing costs and discount or premium on redemption relating to borrowing could be amortised over loan period. Further, share issue expenses, underwriting commission, discount on debentures, premium on redemption etc.

being special nature items are excluded from the scope of AS-26 (intangible assets). These items can be amortised over the period of benefit i.e., normally 3 to 5 years. Guidance notes on Schedule III issued by “The Institute of Chartered Accountants of India” suggests that unamortised portion of above mentioned expenses be shown on the assets side of the balance sheet as “Unamortised Expenses” under the head “Other Current/Non-current Assets” depending on whether the amount will be amortised in the next 12 months or thereafter.

Amount to be amortised in the next 12 months will be shown under the head “Other Current Assets” and the amount to be amortised after 12 months will be shown under the head “Other Non-current Assets”.

As per AS-26 preliminary expenses are to be written off in the year in which they are . incurred.

6. Schedule III has eliminated the concept of “Schedules” and henceforth, such information is to be furnished in terms of “Notes to Accounts”.

![]()

Explanation of Equity and Liabilities

1. Shareholders’Funds

(i) Share Capital:

- Under this head “Share Capital” some of the important items to be shown are as under:

- Number and amount of share authorised.

- Number of shares issued, subscribed and fully paid up and subscribed but not fully paid up.

- Par value per share.

- A reconciliation of the number of shares outstanding at the beginning and at the end of the reporting period.

- Shares in the company held by each shareholder holding more than 5% shares specifying the number of shares held.

- For the period of five years immediately preceding the date at which the balance sheet is prepared.

- Aggregate number and class of shares allotted as fully paid up for consideration other than cash. For example, shares issued for purchase of assets services taken and for underwriting, commission etc.

- Aggregate number and class of shares allotted as fully paid up by way of bonus shares,

- Aggregate number and class of shares bought back.

- Calls unpaid (showing aggregate value of calls unpaid by directors and officers).

- Calls unpaid (calls-in-arrears) will be shown as a deduction from subscribed but not fully paid capital.

- Forfeited shares (amount originally paid up).

- It is shown by adding it to “Subscribed Capital”.

(ii) Reserves and Surplus : The following items are shown under this head :

Reserves and Surplus shall be classified as :

- Capital Reserve o Capital Redemption Reserve

- Securities Premium Reserve

- Debenture Redemption Reserve

Revaluation Reserve : It is a reserve which is created by the upward revision of the book value of an asset. It cannot be used for payment of dividend or for issuing bonus shares. (Accounting treatment not to be evaluated)

Share Options Outstanding Account : It is a reserve which represents the difference between the market value and issue price of shares issued to employees under Employees Stock Option Scheme i. e., ESOP. For example, if the shares are issued to employees at ₹ 60 per share whereas the market price is ₹ 100 per share, the difference i.e., ₹ 40 should be credited to this reserve.

Surplus i.e., balance in statement of profit and loss after appropriations such as, dividend bonus shares and transfer to/from reserves etc.

(Schedule III does not provide for preparation of profit and loss appropriation account. This means the appropriations should be presented in the notes to accounts.)

A reserve specifically represented by earmarked investments shall be termed as a “Fund”.

Debit balance of statement of profit and loss shall be shown as a negative figure under the head “Surplus.” Similarly, the balance of “Reserves and Surplus” after adjusting negative balance of surplus if any shall be shown under the head “Reserves and Surplus” even if the resulting figure is in the negative.

Money Received against Share Warrants: A share warrant is a financial instrument issued by a public company which gives the holder the right to acquire certain number of equity shares specified there in at a later date. Amount received against share warrant is included in shareholders’ funds as they will be converted into equity shares on specified date at a predetermined separate line item.

(Accounting treatment not to be evaluated)

2. Share Application Money Pending Allotment

If a company has received application money but date of allotment falls after the balance sheet date, such application money pending allotment will be shown in the following manner :

- Share application money not exceeding the issued capital and to extent not refundable is to be disclosed under this line item.

- Share application money to the extent refundable or where minimum subscription is not met, such amount shall be shown separately under “Other Current liabilities.”

![]()

3. Non-Current Liabilities

A non-current liability is a liability which is not classified as current liability. Non-current liabilities shall be classified as follows :

(i) Long Term Borrowings : Long term borrowings refer to loans taken by the company. Borrowings shall be classified as long term borrowings when they are payable by the company after 12 months from the date of the loan. It shall be shown under the following heads

- Bonds/Debentures

- Long term loans

- From banks

- From other parties

- Public deposits

Borrowings shall further be sub-classified as secured and unsecured. Some parts of the long term borrowings may be due for payment within 12 months from the date of balance sheet. It will be shown under “Other Current Liabilities” as current maturities of long term Debts.

(ii) Deferred Tax Liabilities (Net):

(Accounting Treatment not to be evaluated)

(a) Deferred Taxes :

Taxable income is different from accounting income. Taxable income is the income based on tax laws whereas accounting income is determined as per the accounting practices followed in the enterprise. For example, depreciation may be charged in the books of accounts on straight line method but income tax act allows it on written down value method. Thus, difference will arise between the taxable income and accounting income. Accounting income is reported by statement of profit and loss of the enterprise. The current practice has been to make “Provision for Tax” on the taxable income. However, tax can also be calculated on the accounting income. The difference between tax on accounting income and taxable income is called “Deferred Tax”.

(b) Deferred Tax Liabilities :

A deferred tax liability comes into existence when accounting income is more than taxable income. For example, only a part of heavy expenditure on advertisement is charged to statement of profit and loss for calculating accounting income whereas they are allowed in full in one year for calculating taxable income.

(iii) Other Long Term Liabilities (Accounting treatment not to be evaluated)

Examples are, premium payable on redemption of debentures, premium payable on redemption of preference shares.

(iv) Long Term Provisions: All provisions for which the related claims are expected to be settled beyond 12 months after the balance sheet date are classified as long term provisions. Examples are, provision for employee benefits, provision for warranty claims etc.

4. Current Liabilities : A liability shall be classified as current when it satisfies any of the following criteria:

- It is expected to be settled in the company’s normal operating cycle.

- It is held primarily for the purpose of being traded. It is a liability which the company holds with an intention to trade i.e., purchase and sell.

- It is due to be settled within twelve months after the reporting date (i.e., balance sheet date).

If a liability is expected to be settled within the company’s normal operating cycle from the date of balance sheet. It will be called “Current Liability” operating cycle of a company may be a period of 12 months or more. Operating Cycle: As per Schedule III “An operating cycle is the time between the acquisition of assets for processing and their realisation in cash or cash equivalents. Where the normal operating cycle cannot be identified, it is assumed to have a duration of 12 months.”

In case operating cycle cannot be identified, if it assumed to have a duration of 12 months from the date of balance sheet.

If the operating cycle is of a period more than 12 months (say 15 months) all liabilities of that business which are due for settlement within 15 months of the balance sheet date, shall be classified as current liabilities.

It the operating cycle is of a period less than 12 months (say 8 months) all liabilities of that business which are due for settlement within 12 months of the balance sheet date, shall be classified as current liabilities.

Hence, the liabilities which are not classified as current shall be classified as non-current liabilities.

![]()

Schedule III prescribes that current liabilities shall be classified as follows:

- Short term borrowings

- Trade payables

- Other current liabilities

- Short term provisions

(i) Short Term Borrowings: Borrowings which are due for payment within 12 months from the date of loan are termed Short Term Borrowings.

Short term borrowings shall be classified as :

Loans repayable on demand i.e., overdraft or cash credit from banks

Loans from other parties

Deposits

Other loans and advances (specify nature)

(ii) Trade Payables : A payable shall be classified as a “Trade Payable”, if it is in respect of the amount due on account of goods purchased or services received in the normal course of business. It includes both “Sundry Creditors” and “Bills Payables”.

(iii) Other Current Liabilities: The amount shall be classified as :

Current maturities of long term debts. Amount due to be paid within 12 months of the date of balance sheet out of long term borrowings is shown as current maturities of long term debts.

- Interest accrued but not due on borrowings.

- Interest accrued and due on borrowings.

- Income received in advance.

- Unpaid dividends.

- Excess application money which is due for refund and interest accrued thereon is shown under “Other Current Liabilities”.

- Unpaid matured deposits and interest accrued thereon.

- Unpaid matured debentures and interest accrued thereon.

- Other payables, such as outstanding expenses, calls-in advance and interest thereon. Unclaimed dividends, provident fund payable, VAT payable etc.

(iv) Short Term Provisions : Short term provisions are the provisions against which liability is likely to arise within 12 months from the date of balance sheet.

- Provision for Doubtful Debts: Trade receivables are shown at their full value under Current Assets and Provision for Doubtful Debts is to be shown under ‘Short Term Provisions’.

- Provision for employee benefits (who will retire within 12 months from the date of balance sheet).

- Others such as provision for taxation, proposed dividend etc.

![]()

Explanation of Assets

1. Non-current Assets : These assets are classified into five sub-heads :

(i) Fixed Assets : Fixed assets refer to those assets which are held for continued use in the business for the purpose of producing goods or services and are not meant for sale. They are categorised into :

(a) Tangible Assets : Tangible assets are those assets which can be physically seen and touched,

- Land

- Building,

- Plant and equipment

- Furniture and fixtures

- Computers

- Vehicles

- Office equipment

- Others (specify nature)

(b) Intangible Assets : Intangible assets are those assets which do not have a physical existence and thus cannot be seen or touched.

- Goodwill

- Brands/Trademarks

- Computer software and plining rights

- Plastheads and publishing titles

- Copyrights and patents and other intellectual property rights services and operating rights

- Licenses and franchise

- Receipts, formulas, modals, designs and prototypes.

It may be mentioned that the term “Depreciation” is used for writing off fixed tangible assets over their useful life whereas the term “amortisation” is used for writing of fixed intangible assets over their useful life.

(c) Capital Work in Progress: It refers to fixed tangible assets which are under construction such as building, plant and equipment etc.

(d) Intangible Assets under Development: Like patents, intellectual property rights etc. which are being developed by the company.

(ii) Non-current Investments: (Investments for more than one year) Non-current investments are those investments which are held by a company not with the purpose of selling but to retain them. Non-current investments shall be classified as trade investments and other investments.

(a) Trade investments refer to the investments made by a company in shares or debentures of another company not being its subsidiary to promote its own trade and business.

(b) Other investments are the investments which are not trade investments.

- Investment property

- Investments in equity instruments

- Investment in preference shares

- Investments in government or trust securities

- Investments in debentures or bonds

- Investments in mutual funds

- Investments in partnership firm

- Other non current investments (specify nature).

(iii) Deferred Tax Assets: A deferred tax assets comes into force when accounting income is less than taxable income. For example, while calculating accounting income certain provisions are made for anticipated losses. But tax authorities allow such loss to be deducted in the year when it crystallises.The common example is provision for doubtful debts. In accounts, provision is made for anticipated bad debts whereas tax authorities allow only actual bad debts.

(iv) Long Term Loans and Advances : Long term loans and advances are those loans and advances that are expected to be received back in cash or kind i.e., in the form of an asset after 12 months from the date of balance sheet or after the period of operating cycle.

![]()

These are classified as below:

Capital Advances : Capital advances are those advances which are advanced for acquiring fixed assets. Normally, such advances are not received back in cash but are received in the form of an asset. It means capital advances get converted into assets of the company. Fixed assets are non-current assets, therefore, capital advances are also classified or shown as Long Term Advance i.e., Non-current assets.

Security Deposits: Security deposits that are given for a long period i.e., for a period which is beyond the period of 12 months from the date of balance sheet or after the period of operating cycle of the business are classified or shown as long term advances i.e., Non-current asset. Examples of security deposits are security deposit for electricity and telephone etc.

Other Loans and Advances (Nature to be Specified) : Long term loans and advances other than those classified or shown under capital advances and security deposits are classified or shown as other loans and advances. Other loans and advances are shown according to its nature. Examples of such loans and advances are, long term loans to employees and long term advances to suppliers etc.

Other Non-current Assets: All other non-current assets that do not fall into any of the above classifications (categories) are classified or shown as other non-current assets.

They are classified into :

Long Term Trade Receivables : Trade receivables are classified or shown as long term receivables i.e., non-current assets if the amount is receivable after 12 months from the date of balance sheet or after the period of operating cycle, whichever is later.

Others : Besides trade receivables, there may be other assets, such as unamortised expenses, losses, insurance claim receivable or amount due for asset sold etc. Such assets are classified or shown under Other Non-current Assets.

![]()

2. Current Assets :

Current assets are classified or shown under following six heads :

- Current investments

- Inventories

- Trade Receivables

- Cash and cash equivalents

- Short term loans and advances

- Other current assets

(i) Current investments are those investments which are held to be converted into cash within a short period i.e., with in 12 months from the date of purchase of investment.

These are to be classified into :

- Investments in equity instruments

- Investments in preference shares

- Investments in government or trust securities

- Investment in debentures or bonds

- Investments in mutual funds etc.

(ii) Inventories: Inventories means stock held for the purpose of trade in the normal course of business.

- Raw material

- Work in progress

- Finished goods

- Stock in trade

- Stores and spares

- Loose tools.

(iii) Trade Receivables: Trade receivables refer to the amount receivable on account of sale of goods or services rendered by the company in the normal course of business. They are classified as current assets if the amount is expected to be realised within a period of 12 months from the date of balance sheet or within the operating cycle of the business. Trade receivables include both debtors and bills receivables provision for doubtful debts is to be shown under “Short Term Provision” on the equity and liabilities side of the balance sheet.

(iv) Cash and Cash Equivalents : Cash and cash equivalents shall be classified as :

- Balances with banks

- Cheques, drafts on hand

- Cash in hand

- Others (specify nature)

(v) Short Term Loans and Advances: These are the loans and advances which are expected to be realised within 12 months from the date of balance sheet or within the operating cycle of the business.

(vi) Other Current Assets: (Specify nature) This is an all inclusive heading which incorporates current assets that do not fit into any other asset categories, such as prepaid expenses, interest accrued on investments, advance tax and unamortised expenses to be written off within 12 months from the date of balance sheet.

![]()

3. Contingent Liabilities and Commitments:

(i) Contingent liabilities are those liabilities which may or may not arise because they are dependent on a happening in future. For example, a claim is filed against the company in a consumer court by a customer. The court may hold the company at fault and may impose penalty.

It may happen otherwise also whether the company has a liability or not is dependent on court order. Thus, it is contingent liability. Contingent liability is not recorded in the books of account but it is disclosed in the notes to accounts for the information of the users.

It is to be classified into :

- Claims against the company not acknowledged as debt,

- Guarantees given by the company,

- Other money for which the company is contingently liable.

(ii) Commitments: Commitment is defined as an agreement to perform a particular activity at a certain time in the future under certain circumstances. Commitments shall be classified as :

Estimated amount of contracts remaining to be executed on capital account and not provided for.

Uncalled liability on shares and other investment partly paid. If the company hold partly paid shares of other companies as investment. The uncalled amount on these shares is a commitment as it will have to be paid when called.

Other commitments (specify nature), such as arrears of dividends on cumulative preference shares.

![]()

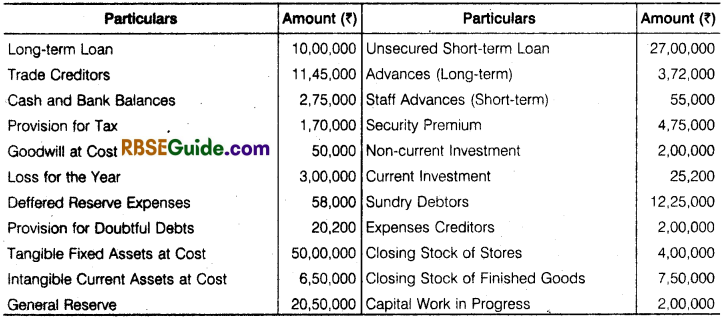

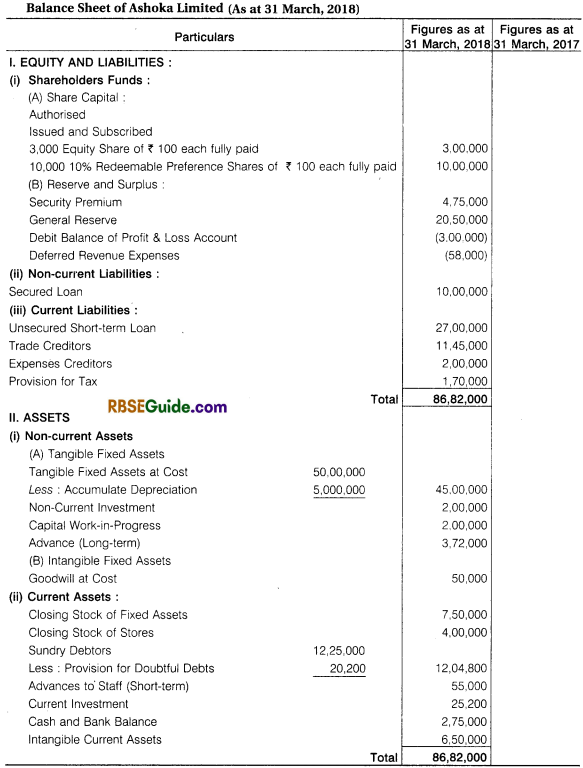

Illustration 1.

Prepare Balance sheet as at 31 March, 2018 in the Schedule III format from the following information of Ashoka Limited:

Additional Information:

- (Share Capital Consists)

- 3000 equity share of 100 each fully paid.

- 10,000, 10% redeemable prefereance share ₹ 100 each fuily paid.

- Long term long are secured.

- Collected depreciation on tangible fixed assets ₹ 50,0000.

- Notes need not to be given.

Solution:

To facilitate the student main-main items of financial statement are presenting in brief of title and subtitle of fanancial balance sheet.

![]()

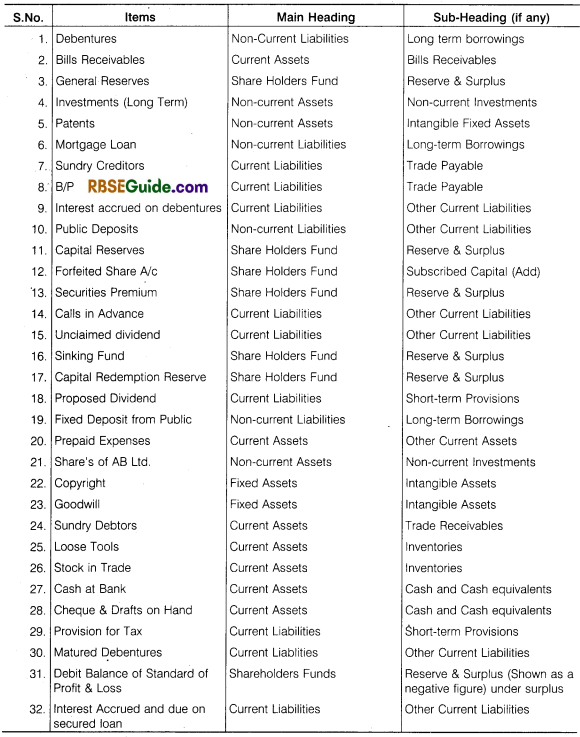

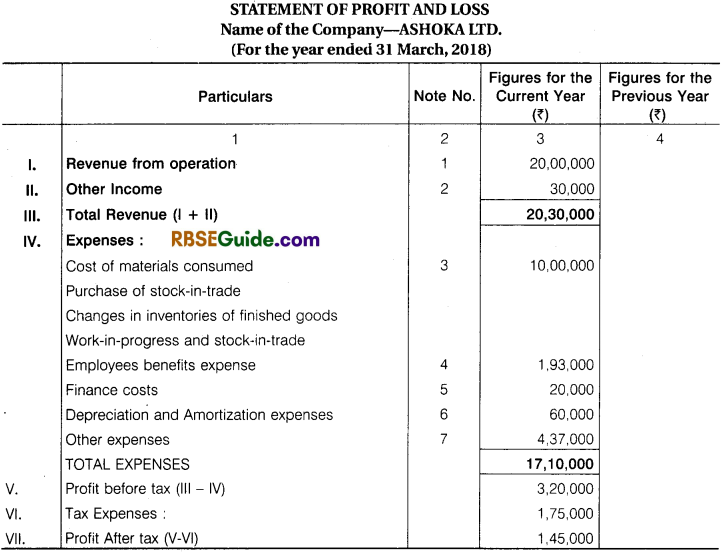

Illustration 2.

From the following particulars furnished by Ram limited prepare the Balance Sheet as at 31st March, 2018 in the form prescribed in the Schedule 111 of the Company Act, 2013.

- The following Additional Information are also provided:

- 2,000 Equity Share were issued for consideration other than cash are included in share capital.

- Debtors of ₹ 52,000 are due for more than six months.

- Cost of Assets Building ₹ 4,00,000, Plant & Machinery ₹ 7,00,000, Furniture ₹ 62,500.

- The balance of 1,50,000 in the loan from Rajasthan State Finance Corporation Account is inclusive of ₹ 7,500. Interest accrued but not due. The loan is secured by hypothecation of plant & machinery.

- Discounted Bills Receivable for ₹ 2,75,000 will mature on 30th June, 2018.

- Balance at Bank includes ₹ 2,000 with Gulatti Bank Limited which is not a Scheduled Bank.

- The company had a contact for the errection of Machine at ₹ 1,50,000 which is still incomplete.

The foLlowing Assumed contigent Liabilities:

- ₹ 275000 Bills receivable discounted which are payable June 2018.

- A contract of establish of a machine is incomplete. So no entry make.

![]()

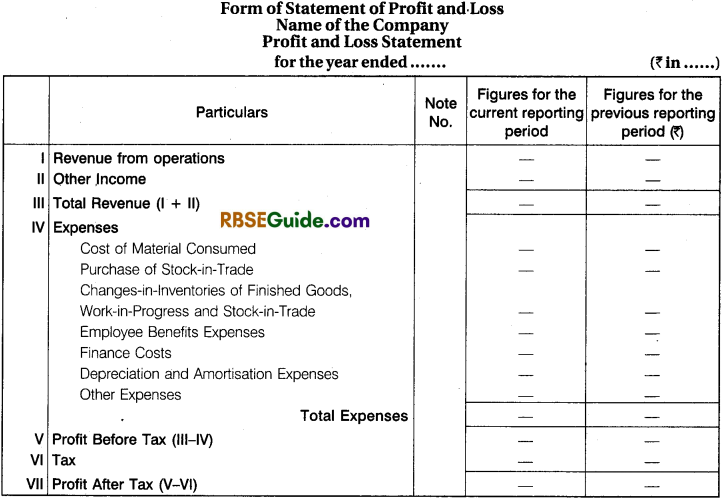

Part-II Form of Statement of Profit and Loss Important Note

As per revised syllabus major headings and sub-headings of statement of profit and loss are also a part of syllabus for board examination.

Format of statement of profit and loss is specified in Part Il Schedule III of the Companies Act, 2013

(format given in C.B.S.E. circular no. 43 dated 2nd July, 2013 for Board Examination is given below:)

General instructions for Preparation of Statement of Profit and Loss

1. Revenue from Operations means revenue earned by the company from its operating activities i.e., activities carried on by the company to earn profit. Commonly, it is net sales (sales less sales return) for a manufacturing company or trading company fee earned by a service company and interest and dividend earned by a financial company.

2. Other Income: A company besides earning revenue from operations may earn income from source i.e., the sources that are not its business activities. These income are shown as “other income” in the statement of profit and loss. Thus, other income means income earned by a company from its non-operating activities. Examples of other income are gain (profit) on sale of fixed assets, excess provision written back, bad debts recovered, interest earned on fixed deposits with banks by non-finance company, dividend earned by non-finance company etc. In case of finance company interest and dividend etc. is revenue from operations, it being the operating activity of the company.

3. Expenses:

Cost of Materials Consumed is the first entry or line item in the “expenses” part of the statement of profit and loss. The term “Materials” means raw materials and other materials used in manufacturing of goods. Cost of materials consumed means cost of raw materials and other materials consumed in manufacturing the goods. Thus, it is opening inventory (stock) of materials + purchase of materials – closing inventory (stock) of materials.

Purchase of Stock-in-Trade : Purchase of stock-in-trade means goods purchased for reselling. If the company carries out further processing on the goods purchased, they do not remain stock-in-trade but become part of the cost of materials consumed. For example, if a company purchases paper for resale, it will be shown as “purchase of stock-in-trade” but if paper is purchased for (say) manufacturing copies, it will be shown under cost of materials consumed.

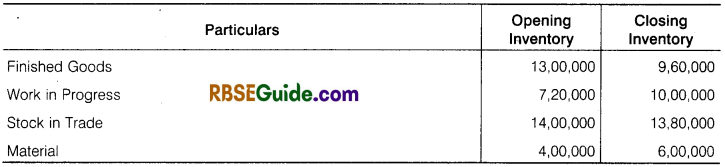

Change in Inventories of Finished Goods, Work in Progress and Stock in Trade:

This will be shown as follows :

Net difference between opening inventory and closing inventory may be positive or negative.

(iv) Employee Benefit Expenses (Showing Separately)

- Wages, salaries, bonus and leave encashment.

- Contribution to provident fund and other funds like gratuity fund, superannuation fund etc.

- Staff welfare expenses, such as canteen expenses, medical expenses, expenses on employees stock option scheme (ESOS), employees stock purchase plan (ESPP).

(v) Finance Costs means cost incurred by the company on the borrowings i.e., loans taken by it. It therefore, includes interest paid on borrowings (such as term loans, overdraft and cash credit limit) from banks and from others (such as public deposits, debentures, bonds etc.)

Finance costs also include expenses incurred for the borrowings such as loan processing fee, discount on issue of debentures and premium payable on redemption of debentures etc. as these expenses are incurred by the company for borrowings. However, bank charges are not shown under finance costs but are shown under “other expenses” they are being an expense for services availed from the bank.

(vi) Depreciation and Amortisation Expenses : Depreciation is an expense written off to statement of profit add loss, it being cost of tangible fixed assets written off over their useful life. Depreciation is the fall in value of fixed assets due its usage or efflux of time or obsolescence. Amortisation, like depreciation is also an expenses written off to statement of profit and loss being cost of intangible fixed assets written off over their useful life.

(vii) Other Expenses: All other expenses not classified under other heads will be shown here:

- Carriage, carriage inwards and carriage outwards

- Freight

- Consumption of loose tools, spare parts, stores, power and fuel

- Manufacturing expenses

- Rent, rates and taxes

- Insurance expenses less prepaid if any

- Discount allowed

- Commission allowed

- Directors fees

- Audit fees

- Trade expenses

- Bad debts written off and provision for bad debts

- Repairs to machinery, building and other fixed assets

- Office and administration expenses

- Telephone and internet expenses

- Conveyance expenses and travelling expenses

- Bank charges

- Excise duty paid

- Loss on sale of fixed assets

- Entertainment expenses

- Business promotion expenses

- Courier expenses

- Lease rent

- Computer hiring charges

- Share Issue Expenses written off

- Underwriting-commission on issue of shares written off

![]()

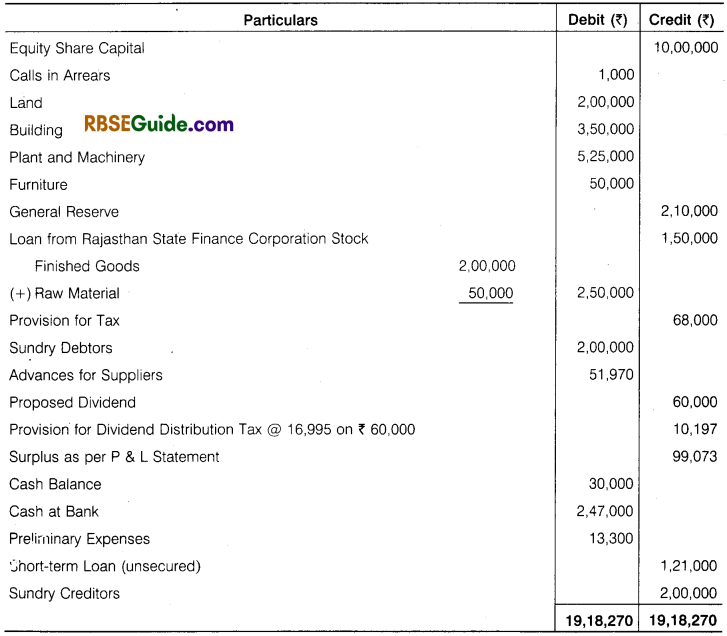

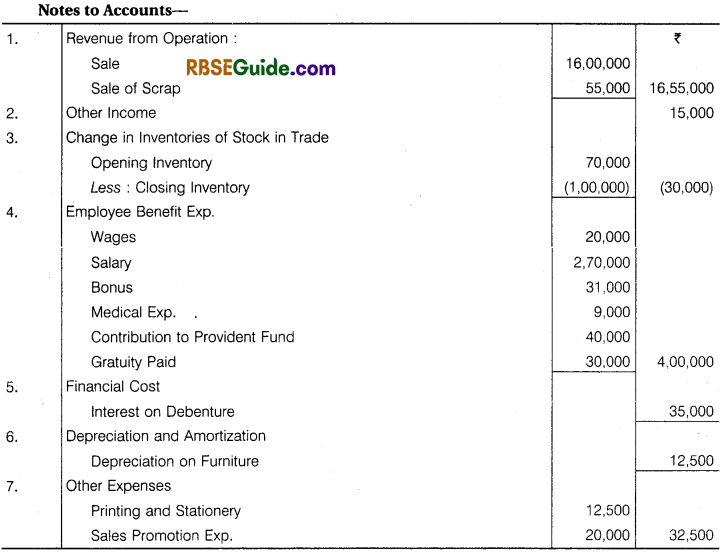

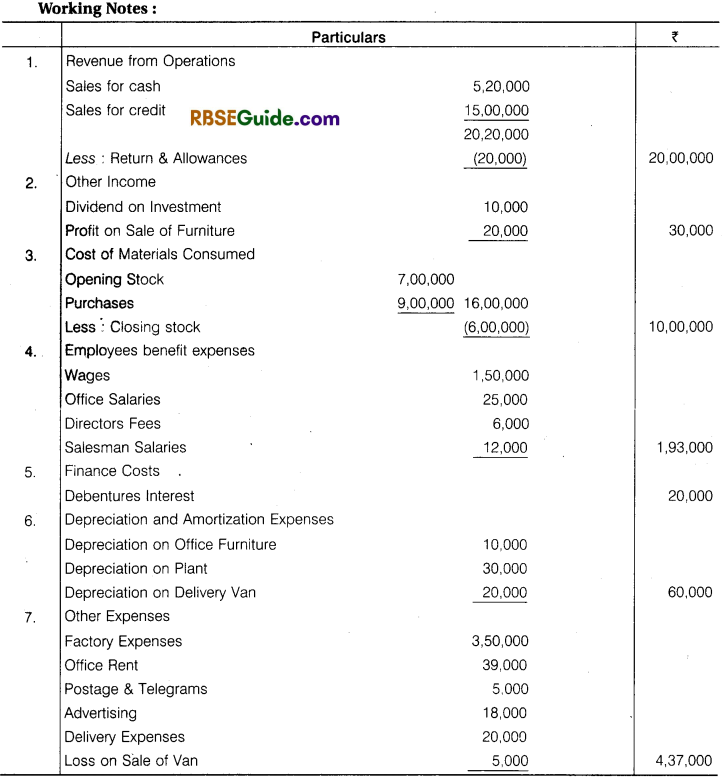

Illustration 3.

From the following information for the year ending 31 March, 2018, prepare flotes to

accounts to calculate the amount to be shown in statement of profit & loss, change in inventory.

Solution:

Note : Opning and closing stock of material is included to calculation of cost of material consumed.

![]()

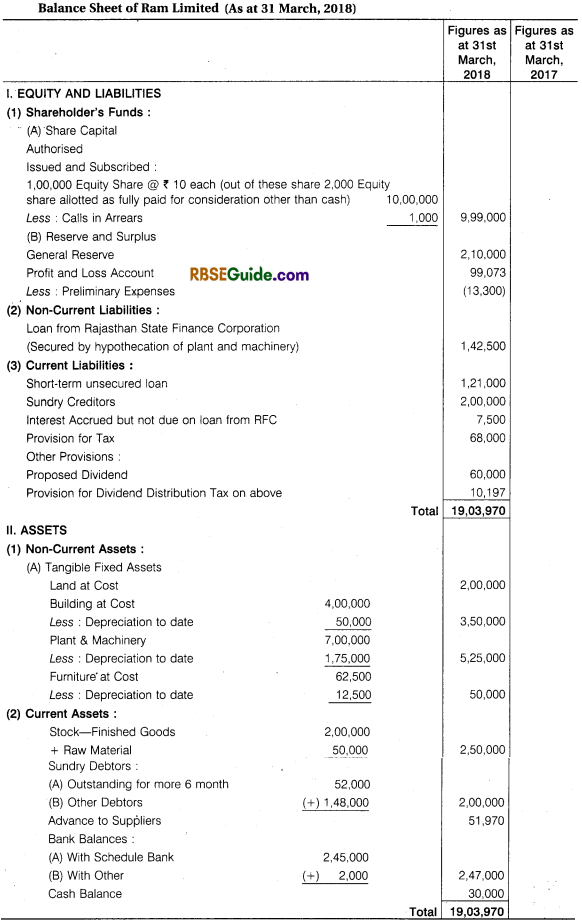

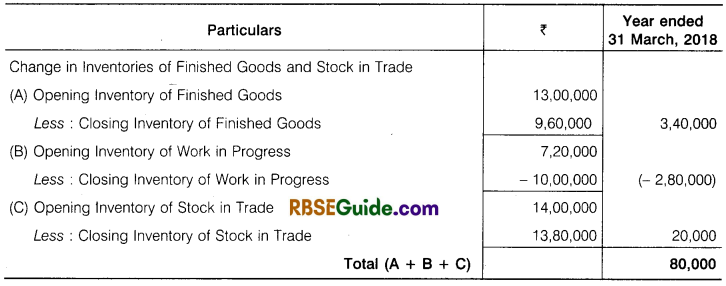

Illustration 4.

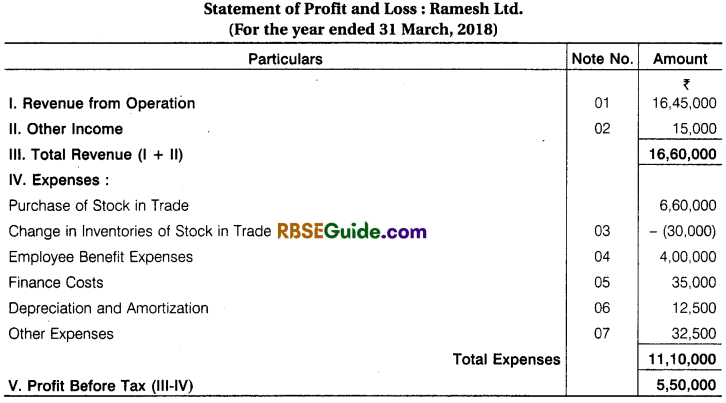

Following information extracted from the books of Ramesh Ltd. prepare a statement of profit and loss for the year ending 31 March, 2018:

Solution:

![]()

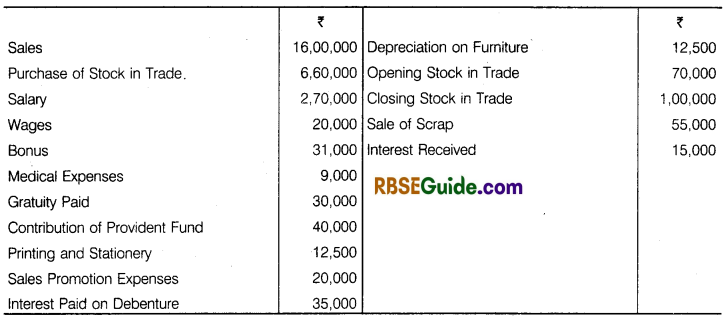

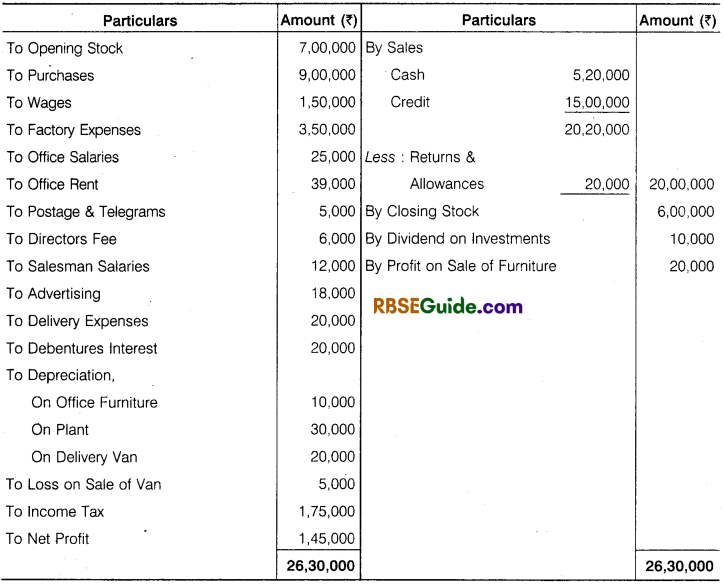

Illustration 5.

From the following information, prepare statement of Profit and Loss of Ashoka Ltd. on 31st March, 2018:

Solution:

Introduction of Financial Statement of Company Notes Important Terms

→ Shareholders Funds : Shareholders funds are the funds belonging to the shareholders of the company. They consist of share capital ‘Reserve and Surplus’ and money received against share warrants.

→ Share Capital : It is the amount received by the company as capital. It includes both equity share capital and preference share capital.

→ Reserves : It is the amount set aside out of surplus, i.e., balance in statement of profit and loss or amount received as security premium. A reserve may be free reserve or committed reserve.

→ Surplus : It is the amount of accumulated profit which may be appropriated towards reserve or for payment of dividend.

→ Money Received Against Share Warrants : It is the amount received against share warrants. Share warrants are the financial instruments which give the holder the right to acquire equity shares in the company at a specified date and at a specified rate.

→ Share Application Money Pending Allotment : It is the amount received as share application and against which the company will make allotment.

→ Non-current Liabilities : Non-current liabilities are defined in Schedule III of the Companies Act, 2013 as those liabilities which are not current liabilities. These are sub-classified into Long term borrowings, deferred tax liabilities (net), other long term liabilities and long term provisions.

→ Long Term Borrowings : Long term borrowings are the borrowings which is on the date of borrowings are repayable after more than 12 months from the date of balance sheet or after the period of operating cycle.

→ Deferred Tax liabilities (Net) : It is the amount of tax on the temporary difference between the accounting income and taxable income. It is only a book entry and not an actual liability. It arises when accounting income is more than the taxable income.

→ Other Long Term Liabilities : They are the long term liabilities other than long term borrowings of the company.

→ Long Term Provisions : These are the provisions for liabilities that will be payable after 12 months from the date of balance sheet or after the period of operating cycle.

Current Liabilities : Current liabilities are those liabilities which are :

- expected to be settled in company’s normal operating cycle.

- due to the settled within 12 months after the reporting date.

- held primarily for the purpose of being trade.

- there is no unconditional right to defer settlement for at least 12 months after the reporting date.

![]()

Operating Cycle : It is the time between the acquisition of assets for processing and their realisation into cash and cash equivalents. Where the operating cycle cannot be identified it is assumed to be a period of 12 months. Operating cycle can be different for different business. Current liabilities are classified into short term borrowings, trade payables, other current liabilities and short term provisions.

Short Term Provisions : These are the borrowings that are repayable within 12 months from the date of balance sheet or within the period of operating cycle.

Trade Payables : These are the amount payable within the period of 12 months from the date of balance sheet or within the period of operating cycle for goods purchased or services taken in the ordinary course of business. It includes bills payable and sundry creditors.

Other Current Liabilities : These are short term liabilities other than short term borrowings, trade payables and short term provisions,

Short Term Provisions : These are provisions for liabilities that will be payable within 12 months from the date of balance sheet or within the period of operating cycle,

Non-current Assets : Non-current assets are those assets which are not current assets. These are sub-classified into fixed assets, non-current investments, deferred tax assets (net), long term loans and advances and other non-current assets,

Tangible Assets : These are the assets which have physical existence, i.e., can be seen and touched. Examples are land, building, machinery and computers, etc.

Intangible Assets : These are the assets which do not have physical existence, i.e., cannot be seen and touched. Examples are patents, trademark and computer software, etc.

Capital Work-in-Progress : Capital work-in-progress means expenditure incurred on construction or development of intangible assets not yet complete.

Intangible Assets under Development : Intangible assets under development means expenditure incurred on development of intangible assets not yet complete.

![]()

Non-current Investment : Non-current investments are those investments that are invested to be held for a period of more than 12 months from the date of balance sheet or for a period that is more than the period of operating cycle. A trade investment is an investment made by the company in another company for the furtherance of its own business. It is non-current investment when it is invested to be held for more than 12 months from the date of balance sheet or for a period that is more than the period of operating cycle.

Deferred Tax Assets (Net) : It is the amount of tax on the temporary difference between the accounting income and taxable income. It is only a book entry and not an actual assets. It arises when accounting income is less than the taxable income.

Long Term Loans and Advances : Long term loans and advances are loans and advances given by the company that are repayable or adjustable after 12 months from the date of balance sheet or after the period of operating cycle.

Other Non-current Assets : All non-current assets that are not shown or classified under the above heads are other non-current assets.

Current Assets : These are those types of assets which is convertable into cash within a year. Current assets are classified into current investments, inventories, trade receivables, cash and cash equivalents, short term loans and advances and other current assets.

Current Investment: Current investments are those investments that are inverted to be held for a period of less than 12 months from the date of balance sheet or within the period of operating cycle.

![]()

Inventories : Inventories (Stock) is a tangible assets held :

- For the purpose of sale in the normal course of business.

- For the purpose of using it in the production of goods meant for sale or service to be rendered.

In case of trading company, it comprises of stock of goods traded in. In case of manufacturing company it comprises of raw materials, work in progress and finished goods. Inventories are valued at lower cost or net realisable value, i.e., market price.

Trade Receivables : Trade receivables are the amount receivable within 12 months from the reporting date or within the period of operating cycle for the sale of goods or services . rendered in the normal course of business. It includes bills receivable and sundry debtors.

Cash and Cash Equivalents : It includes cash in hand and balance with bank.

Short Term Loans and Advances : Short term loans and advances are those loans and advances given by the company that are receivable or adjustable within 12 months from the date of balance sheet or within the period of operating cycle,

Other Current Assets : All other current assets that are not shown or classified under the above heads are shown as other current assets.

Revenue from Operations : It is the revenue earned by the company from its operating activities, i.e., business activities carried on by the company to earn profit.

Other Income : It is the revenue earned by the company from the sources other than its operating activities.

Cost of Material Consumed : It is the aggregate of cost of raw materials and other materials used in manufacture of goods.

![]()

Purchase of Stock-in-Trade : It means purchase of goods for resale, i.e., goods purchased on which no further process is carried before sale.

Change in Inventories of Finished Goods, W.I.P. and Stock-in-Trade : It is the difference between the opening inventories and closing inventories of finished goods, W.I.P. and stock-in-trade. It is shown separately in the notes to accounts and one single amount on the face of the statement of profit and loss.

Employees Benefit Expenses : These are the expenses incurred for the benefit of employees. Examples are wages, salaries, bonus, staff welfare and medical reimbursement, etc. .

Finance Cost : These are the expenses of the company incurred to borrow, i.e., loans taken by it and cost incurred to service the borrowings.

Depreciation and Amortisation : Depreciation is allocation of cost of fixed assets over its useful life. In other words, it is the fall in the value of fixed assets due to its usage or efflux of time or obsolescence. Amortisation is the term associated with writing off intangible assets.

Other Expenses.: Expenses that do not fall in the above classifications are shown as other expenses.