Make use of our RBSE Class 12 Accountancy Notes here to secure higher marks in exams.

Rajasthan Board RBSE Class 12 Accountancy Notes Chapter 14 Computerised Accounting System

With the expansion of business the number of transactions increased. The manual method of keeping and maintaining records was found to be unmanageable. With the introduction of computers in business, the manual method of accounting is being gradually replaced. And finally, the database technology has revolutionised the accounts department of the business organisations. In this lesson, we will study about characteristics of computer, role of computer in accounting, need of computerised accounting etc.

What is Computerised Accounting System?

A computerised accounting system is that accounting information system that helps in processing the financial transactions and events as per the Generally Accepted Accounting Principles (GAAP) and leads to the generation of reports as per the requirements of the users.

An accounting system whether manual or computerised has two parameters, namely :

- It has to follow the well-defined concepts known as the Accounting Principles.

- It has to maintain the user-defined structure for maintenance of records and generation of reports.

The framework of storage and processing of data in a computerised accounting system is known as the Operating Environment. It consists of the hardware and software in which the accounting system operates. The hardware and software components are dependent on each other and the type of hardware selected depends upon the secrecy level the types of users, number of users and type and extent of functional activities in the organisation.

The complexity of the computerised accounting system depends upon the type of the organisation. For example, in a small company where the number of transactions are less and the number of customers and suppliers is relatively very few, there a simple computer system with a standard software may be sufficient. And in a large company whose work is scattered over large geographical areas, more sophisticated and specified software and other techniques may be required. Such complexed needs of large organisations are handled by multi-user operating systems such as UNIX, Linux etc.

The modern accounting systems make use of database to generate various information. Database is a set of computer softwares that manage and organise data effectively. Database helps in achieving an access to the stored data. The usage of computers in any database oriented applications has four basic requirements as given below :

- Front-End Interface : It is the link between the user and the database oriented software through which the user communicates to the back-end database.

- Back-End Database: It stores data which can be retrieved by the user only to the extent he is authorised to access.

- Data Processing: It is the process of transforming the data into information useful for taking decisions.

- Reporting System : It is the system which helps in composing all the information in some integrated form known as Report.

Thus, the computerised accounting system is a system where in the different data is collected, stored, classified, processed and interpreted using suitable software to render useful reports.

![]()

Computer

Computer is an electronic device that can perform a variety of operations in accordance with a set of instructions called Programme. It is a fast data processing electronic machine. It can provide solutions to all complicated situations. It accepts data from the user.

Converts the data into information and gives the desired result. Therefore, we may define computer as a device that transforms data into information. Data can be anything like marks obtained in various subjects. It can also be name, age, sex, weight, height etc. of all the students, savings, investments etc. of a country. Computer is defined in terms of its functions.

Computer is a device that accept data, stores data, processes data as desired, retrieves the stored data as and when required and prints the result in desired format.

![]()

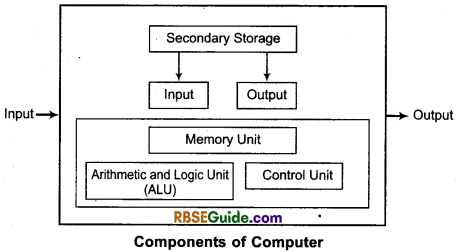

Parts of Computer

A computer consists of the major components, i.e., input unit central processing unit, and output unit. Diagrammatically, these components may be presented as follows :

1. Input Unit: Input unit is controlling the various input devices which are used for entering data into the computer. The mostly used input devices are keyboard, mouse and scanner. Other such devices are magnetic tape, magnetic disk, light pen, barcode reader, smart card reader etc.

Besides, there are other devices which respond to voice and physical touch. Physical touch system is installed at airport for obtaining the online information about departure and arrival of flight. The input unit is responsible for taking input and converting it into binary system.

2. Central Processing Unit (CPU) : The CPU is the control centre for a computer. It guides, directs and governs its performance. It is the brain of the computer. The main unit inside the computer is the central processing unit.

Central processing unit is to computer as the brain is to human body. This is used to store program, photos, graphic and data and obey the instructions in program. It is divided into three sub-units

- Control Unit

- Memory Unit

- Arithmetic and Logic Unit (ALU)

Control Unit: Control unit controls and coordinates the activities of all the components of the computer. This unit accepts input data and converts it into computer binary system.

Memory Unit: This unit stores data before being actually processed. The data so stored is accessed and processed according to instructions which are also stored in the memory section of computer well before such data is transmitted to the memory from input devices.

Arithmetic and Logic Unit: It is responsible for performing all the arithmetical calculations and computations such as addition, subtraction, division and multiplication. It also performs logical functions involving comparisons among variable and data items.

3. Output Unit: After processing the data it ensures the convertibility of output into human readable form that is understandable by the user. The commonly used output devices include like monitor also called Visual Display Unit, printer, etc.

![]()

Elements of Computer System

A computer system is a combination of six elements :

- Hardware

- Software

- People

- Procedures

- Data

- Connectivity

1. Hardware : All the components of a computer discussed earlier are known as “Hardware”. These include keyboard, monitor, CPU, magnetic recorder, etc.

2. Software: In order to solve a problem with the help of computer a sequence of instructions written in a proper language will have to be fed into the computer. A set of such instructions is known as a “Program” and the set of programs is called “Software”.

A computer machine (hardware) can be used for various purposes only by a change of program (software). For example, a computer by feeding a particular software can be used to prepare pay roll whereas by feeding a second software, it can be used to prepare accounts and similarly by feeding a third software, it can be used for inventory control and also by feeding a fourth software, it can be used for word processing. No change is to be effected in a computer (hardware) for putting it to various uses.

A very large number of software packages recorded on the floppy discs are available in the market. Each floppy disc is accompanied by a “Manual” wherein the details of the programmes recorded on the floppy disc and the method of its use is explained in detail.

3. People : People are basically those individuals who use hardware and software to develop, maintain and use the information system residing in the computer memory. The main categories of people involved with the computer system are :

- System Analysts: They design data processing system.

- Operators: They operate the computers.

- Programmers: They write programs to implement the data processing system design.

4. Procedures: The procedures are the various operations performed in a certain way in order to achieve some desired results.

There are basically three types of procedures which form a part of computer system which are as follows:

- Software-Oriented : They provide a set of instructions required for using the software of a computer system.

- Hardware-Oriented: They provide information about the various components of a computer system and their various uses.

- Internal Procedure: The internal procedures help in sequencing the workings or operations of each sub-system of a computer system.

Data: Data can be anything like bio-data of various applicants when the computer is used for recruiting personnel or the marks obtained by various students in various subjects, when the computer is used to prepare results or the details (like name, age, sex, etc.) of various passengers, when the computer is employed for making airline or railway reservations etc.

A computer stores, processes and retrieves data as and when desired in order to provide information which is required for taking decisions.

Connectivity: The element of connectivity refers to the way in which a computer system is connected to other electronic devices and link ups, such as satellite link, telephone lines etc.

![]()

Types of Computer

On the Basis of Functionality : According to functionality computer can be divided into following three types :

- Analog

- Digital

- Hybrid

1. Analog Computer : An analog (spelled analogue in British English) computer is a form of computer that uses the continuously changeable aspects of physical fact, such as electrical, mechanical or hydraulic quantities to modal the problem being solved.

Analog meaps continuity of associated quantity just like an analog clock measures time by means of the distance travelled by the hand of the clock around a dial.

2. Digital Computer : A computer that performs calculations and logical operations with quantities represented as digits, usually in the binary number system of “0” and “1”.

Computer capable of solving problems by processing information expressed in discrete form. By manipulating combinations of binary digits (“0”, “1”) it can perform mathematical calculations organise and analyse data, control industrial and other processes and simulate dynamic systems such as global weather patterns.

3. Hybrid Computer : “A computer that processes both analog and digital data.” “Hybrid computer is a digital computer that accepts analog signals, converts them to digital and processes them in digital form.” A hybrid computer may use or produce analog data or digital data. It accepts a continuously varying input which is then converted into a set of discrete values for digital processing.

![]()

On the Basis of Purpose : There are two types of computers according to their purpose :

1. General Purpose Computers: Most computers in use today are general purpose computers, those built for a great variety of processing jobs. Simply by using a general purpose computer and different software, various tasks can be accomplished, including writing and editing (word processing), manipulating facts in a database, trading, manufacturing inventory, making scientific calculations, or even controlling organisations security system, electricity consumption and building temperature.

General purpose computers are designed to perform a wide variety of functions and operations. A general purpose computer is able to perform a wide variety of operations because it can store and execute different programs in its internal storage. Unfortunately, having this ability is often achieved at the expense of speed and efficiency. In most situations, however, we will find that having this flexibility makes this compromise a most acceptable one.

2. Special Purpose Computers: As the name states special purpose computers are designed to be task specific and most of the times their jobs is to solve one particular problem. They are also known as Dedicated Computers because they are dedicated to perform a single task over and over again.

Such a computer system would be useful in playing graphic intensive video games, traffic lights control system, navigational system is an aircraft, weather forecasting, satellite launch/tracking, oil exploration and in automotive industries keeping time in a digital watch or robot helicopter.

While a special purpose computer may have many of the same features found in a general purpose computer, its applicability to a particular problem is a function of its design rather than to a stored programme. The instruction that control it are built directly into the computer which makes for a more efficient and effective operation they perform only one function and therefore, cut down bn the amount of memory needed and also the amount of information which can be input into them.

As these computers have to perform only one task, therefore, they are fast in processing. A drawback of this specialization, however, is the computeTs Jack of versatility. It can be used to perform other operations.

![]()

Features of Computerised Accounting System

The computerised accounting system is based on the concept of databases. It does not involve the process of creating and maintaining journals, ledger etc. which are necessary in the manual accounting system.

A computerised accounting system comprises of the following main features :

- It facilitates online input and storage of accounting data.

- It generates a print out of purchase and sales invoices.

- It facilitates a system of codification of accounts and transactions.

- It facilitates grouping of the various accounts.

- It generates different reports quickly.

- Advantages of Computerised Accounting System

![]()

The computerised accounting system has various advantages over the manual system which are given below:

1. High Speed: The accounting speed of a computer is much faster than that of a human being.

2. High Reliability : The extent of reliability of the information generated by a computer is immense. The reliability remains the same despite the volume of the work whereas, the reliability of a human work can be doubtful in case of voluminous work.

3. Accuracy: The accuracy of a computer cannot be doubted once a particular program is fed. All the results based on such program would be 100% accurate whereas, the results produced by a human being can vary due to fatigue, carelessness etc.

4. Updation of Information: All the related records in a computer get automatically updated once any information is punched in whereas in case of manual accounts all the records will have to be altered one-by-one.

5. Timely Reporting : The computerised accounting system facilitates the generation of the Management Information System (MIS) reports at a very high speed which enables the management to take quick decisions whereas, the generation of the same reports manually is very time consuming and less accurate.

6. Storage and Retrieval: It enables the users to store data in a manner that does not require a large amount of physical space which is in the form of hard disks CD ROM’s, floppies that occupy a fraction of physical space as compared to books of accounts in the form of ledger journal and other accounting registers.

7. Security of Data : Under computerised accounting the accounting data is safer in comparison to manual system. Under computerised system secrecy of data can be maintained by using a password which means only authorised persons will have access to the data.

![]()

Management Information System (MIS)

An information system is any combination of information technology and people’s activities and using that technology to support operations and management. In a very broad sense the term information system is frequently used to refer to the interactions among people algorithmic processes data and technology.

In this sense the term is used to refer not only to the Information and Communication Technology (ICT) an organisation uses, but also to the way in which people interact with this technology in support of business processes.

A Management Information System (MIS) is a system that provides information needed to manage organisations effectively. Management information system involve three primary resources technology, information and people where

1. Technology: It is any improvement in the existing set of operations.

2. Information: It is nothing but processed data which is in useful form e.g., accounting data is an example of data and when processed and presented in the form of final accounts, ratio analysis or cash flow statements etc. becomes information.

3. People : As already defined it refers to the system users. The people who are using the computer systems for entering and analysing accounting data.

Earlier, business computers were mostly used for relatively simple operations, such as tracking, sales or payroll data, often without much detail. Over the time these applications have become more complex and began to store increasing amount of information while also interliking with previously separate information system.

The term “MIS” arose to describe these kinds of applications, which were developed to provide managers with information about sales, inventories and other data that would help in managing the enterprise.

![]()

Features of MIS

1. Flexibility : All organisations are dynamic and changes occur for a wide range of reason. A good MIS must be able to adopt to meet these changes.

2. Economy : An MIS should be cost effective. There are many hidden costs in the design, development and operation of system, the most important of which is the time of the people involved.

3. Simplicity: Anyone can design a complicated system but it takes real skill and experience to design simple system which are easy to operate and control.

4. Accuracy : Information should be accurate as far as possible and if not then the level of inaccuracy should be within limits.

5. Common Data Flows: It means the use of common input processing and output procedure and media wherever possible or desirable.

6. Brevity: Information should not only be clear, but should also be brief. Brevity does not mean that certain matter be left out but it means that maximum information should be communicated in minimum words. Graphs, charts, tables, figures and other such media helps in making the information brief.

7. Relevance: The information given to each manager should be relevant to his responsibility and authorities.

![]()

Accounting Information System

An accounting information system is one of the oldest and most popular information systems. It is widely used in profit as well as non-profit organisations because the accounting information that it provides is used not only by the accounts department but also by other departments like sales department, production department, human resource department, etc.

An accounting information system gathers data describing the organisation’s activities, maintains a detailed financial record of the organisations operations, transforms the data into information and makes the information available to users both inside and outside the organisation.

An accounting information system contributes to problem solving by :

- Producing standard management reports that summarise the firm’s financial conditions.

- Providing the database that is used by other information system.

An accounting and information system is a system of collecting, processing, summarising and reporting information about a business organisation in monetary terms.

![]()

Features of AIS

An accounting information system is a transaction based information system. It caters to the accounting applications of an organisation.

The main characteristics of AIS are as follows :

- AIS helps in handling and manipulating accounting and financial transactions of an organisation.

- AIS is responsible for meeting information needs by generating reports.

- AIS is helpful in producing futuristics data in the form of budget forecasts etc.

- AIS is helpful in maintaining accounting information as per the guidelines of the law.

- AIS is highly crucial for the organisation and thus, can easily be harmfully manipulated.

- Thus, it is required to keep a highly safe and secure environment to ensure its safety.

Comparison between Manual and Computerised Accounting

According by definition it is the process of identifying, recording, classifying and summarising financial transactions to produce the financial reports for their ultimate analysis. Let us understand these activities in the context of manual and computerised accounting system.

1. Identifying : The identification of transactions, based on application of accounting principles is common to both manual and computerised accounting system.

2. Recording: The recording of financial transactions in manual accounting system is through books of original entries while the data content of such transactions is stored in a well-designed accounting database in computerised accounting system.

3. Classification: In a manual accounting system transactions recorded in the books of original entry are further classified by posting into ledger accounts. This results in transaction data duplicity. In computerised accounting no such data duplication is made to cause classification of transactions.

In order to produce ledger accounts, the stored transaction data is processed to appear as classified so that the same is presented in the form of a report. Different forms of the same transaction data are made available for being presented in various reports.

4. Summarising : The transactions are summarised to produce trial balance in manual accounting system by ascertaining the balances of various accounts. As a result preparation of ledger accounts becomes a prerequisite for preparing the trial balance. However, in computerised accounting the originally stored transactions data are processed to churnout the list of balances of various accounts to be finally shown in the trial balance report. The generation of ledger accounts is not a necessary condition for producing trial balance in a computerised accounting system.

5. Adjusting Entries : In a manual accounting system these entries are made to adhere to the principle of cost matching revenue. These entries are recorded to match the expenses of the accounting period with the revenues generated by them. Some other adjusting entries may be made as part of errors and rectification.

However, in computerised accounting, journal vouchers are prepared and stored to follow the principle of cost matching revenue, but there is nothing like passing adjusting entries for errors and rectification except for rectifying an error of principle by having recorded a wrong voucher, such as using payment voucher for a receipt transaction.

6. Financial Statements : In a manual system of accounting the preparation of financial statements pre-supposes the availability of trial balance. However, in computerised accounting there is no such requirement. The generation of financial statements is independent of producing the trial balance because such statements can be prepared by direct processing of originally stored transaction data.

7. Closing the Books : After the preparation of financial reports the accountants make preparations for the next accounting period. This is achieved by posting of closing and reversing journal entries. In computerised accounting there is year end processing to create and store opening balances of accounts in database.

It may be observed that conceptually, the accounting process is identical regardless of the technology used.

![]()

Accounting Software

A variety of accounting software is available in the market. The most popular software used in India are Tally and Ex. An accounting software is an integral part of the computerised accounting system. But before acquiring any software it is very important to analyse the level of expertise of the people who would use it. Because eventually it is people and not the computer who are responsible for accounting. The need for the accounting software arises in two situation namely :

1. When the computerised system is replacing the manual system.

2. When the computerised system already exists in the organisation and it is to be altered according to the recent changes.

There are various types of accounting software available in the market. However, the choice of the accounting software would depend upon the suitability to the organisation in terms of its accounting needs.

The accounting software are classified into the following categories :

- Ready to use software

- Customised software

- Tailor-made software.

1. Ready to Use Software: It is also called as General Purpose Application Software as they are purchased from the market with no modifications.

Sometimes, prepared program is more suitable than others. There are many types of software packages readily available in market. But the proper selection requires a lot of care and precautions, so that it should match our computer system, e.g., Tally.

2. Customised Software : We can ourselves prepare a software according to our requirement but, it does not mean that whole of the software is developed by the user groups. In fact, it is an improved form of “Readymade Software”. Here readymade softwares are changed a little to suit the needs of user. The word “customized” means making changes.

3. Tailor Made Software : Business enterprises usually employ a programmer for preparing a program. Until all bugs (errors) are not removed in the program prepared by him, he will continue to be employed in the enterprise. It will be quite expensive to afford even a little change in the earlier program.

It may possible that the other programmer is not satisfied with the program prepared by first programmer. To avoid this problem business organisations first get the manuals (rule book) prepared according to the needs and nature of their business and then the programmer is instructed to follow the manual while preparing a program.

![]()

Generic Considerations Before Sourcing an Accounting Software

The following factors are usually taken in considerations before sourcing an accounting software :

1. Flexibility: An important consideration before sourcing an accounting software is flexibility viz. data entry and the availability and design of various reports expected from it. Also it should offer some flexibility between the users of the software the switch over between the accountants (users), operating systems and the hardware. The user should be able to run the software on variety of platforms and machines, e.g., Windows 98/2000, Linux etc.

2. Cost of Installation and Maintenance : The choice of the software obviously requires consideration of organisation ability to afford the hardware and software. A simple guideline to take such a decision is the cost benefit analysis of the available options and the financing opportunities available to the firm. Sometimes, certain software which appears cheap to buy involve heavy maintenance and alteration costs, e.g., cost of addition of modules training to staff updating of version data failure/restoring costs. Conversely the accounting software which appear initially expensive to buyers, may require least maintenance and free upgrading and negligible alteration costs.

3. Size of Organisation: The size of organisation and the volume of business transactions do affect the software choices. Small organisations, e.g., in non-profit organisation where the number of accounting transactions is not so large may opt for a simple single user operated software. While a large organisation may require sophisticated software to meet the multi-user requirements, geographically scattered and connected through complex networks.

4. Ease of Adaptation and Training Needs: Some accounting software is user friendly requiring a simple training to the users. However, some other complex software packages linked to other information systems require intensive training on a continuous basis. The software must be capable of attracting users and if its requires simple training should be able to motivate its potential users.

5. Utilities/MIS Reports : The MIS reports and the degree to which they are used in the organisation also determine the acquisition of software. For example, software that requires simply producing the final accounts or cash flow/ratio analysis may be ready to use software. However, the software which is expected to produce cost records needs to be customised as per user requirements.

6. Expected Level of Secrecy (Software and Data) : Another consideration before buying accounting software is the security features which prevent unauthorised personnel from accessing and/or manipulating data in the accounting system. In tailored software for large businesses the user rights may be restricted to purchase vouchers for the purchase department.

Sales vouchers to the billing accountants and petty cash module access with the cashier. The operating system also matters. Unix environment allows multi-users compared to windows. In unix the user cannot make the computer system functional unless the user clicks with a password which is not a restriction in windows.

7. Exporting/Importing Data Facility: The transfer of database to other systems or software is sometimes expected from the accounting software. Organisations may need to transfer information directly from the ledger into spreadsheet software such as, Lotus or Excel for more flexible reporting. The software should allow the hygienic untouched data transfer.

Accounting software may be required to be linked to MIS software in the organisation. In some ready to use accounting softwares the exporting-importing facility is available but is limited to MS Office modules only e.g., MS Word, MS Excel, etc. However, tailored softwares are designed in manner that they can interact and share information with the various sub-components of the organisational MIS.

8. Vendors Reputation and Capability: Another important consideration is the reputation and capability of about the vendor. This depends upon how long has he been the vendor is in business of software development whether there are other users of the software and extent of the availability of support mechanism outside the premises of the vendor.

![]()

Limitations of Computerised Accounting System

Despite many advantages offered by a computerised accounting system, it is not free from limitations. Various limitations of a computerised accounting system are as follows :

1. Staff Opposition : Introduction of computers lead to a lot of retrenchment as well as complication of activities which result in resistance of the staff.

2. High Cost of Training : The sophisticated computerised accounting packages generally require specialised staff personal, which leads to heavy amount of cost of training.

3. Adverse Effects on Health : The excessive use of computers may lead to various health problems like eye strains, back aches, muscular pains, etc.

4. Security Problems : Fraud and embezzlement are usually committed on a computerised accounting system through alteration of data. People responsible for tampering of data cannot be located in a computerised setup whereas, the same can be easily done in case of manual records.

5. System Failure: System failure due to hardware failures, attack by viruses, system down etc. are the usual problems faced by a computerised system.

6. Wastage of Time: A lot of significant time is wasted when an organisation switches over to the computerised accounting system due to the changes in the working environment and other adjustments.

7. Lot of Errors: The computer software is unable to detect unknown and unanticipated errors.