Make use of our RBSE Class 12 Accountancy Notes here to secure higher marks in exams.

Rajasthan Board RBSE Class 12 Accountancy Notes Chapter 8 Consignment Accounts

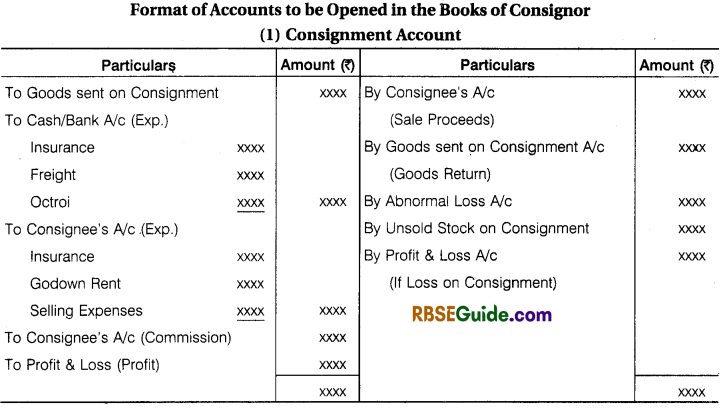

Consignment Account:

The present era of globalisation, advertisement and communication revolution has shifted the local market of a product to international level. Today consumer is the king of market and to make available everything of his requirement at the proper time and with ease is the moral responsibility of the businessman.

This responsibility can be fulfilled only when the business agents are present at different places. These people (agents) arrange to make the things available to the consumer. This particular requirement of market and the objective of earning profit have encouraged the consignment business.

Meaning of Consignment

When the owner of goods or principle sends goods to his agent on this basis that goods will be sold by the agent and he will be entitled get commission as remuneration at a certain rate on sale of goods. This procedure is known as Consignment. Ownership of goods remains with the consignor. Therefore, he enjoys the whole amount of profit and bears all risks, expenses and losses regarding consignment.

Characteristics of Consignment

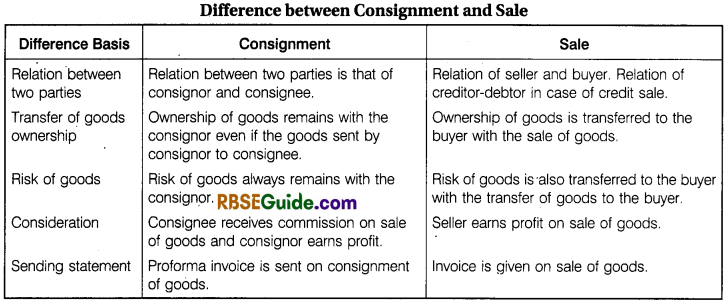

- The consignor sends the goods to the consignee for the purpose of sale.

- Consignment of goods is not a sale.

- The relationship between the consignor and consignee is that of principal and agent.

- The consignee acts according to the consignor’s instructions.

- The consignor is the real owner of the goods. He is entitled for profit and also responsible for losses and expenses.

- The consignee sell the goods as an agent of the consignor.

- The consignee is entitled for commission on sale of goods.

- The consignee is the bailee of goods. It is his duty to exercise reasonable care in protecting goods.

![]()

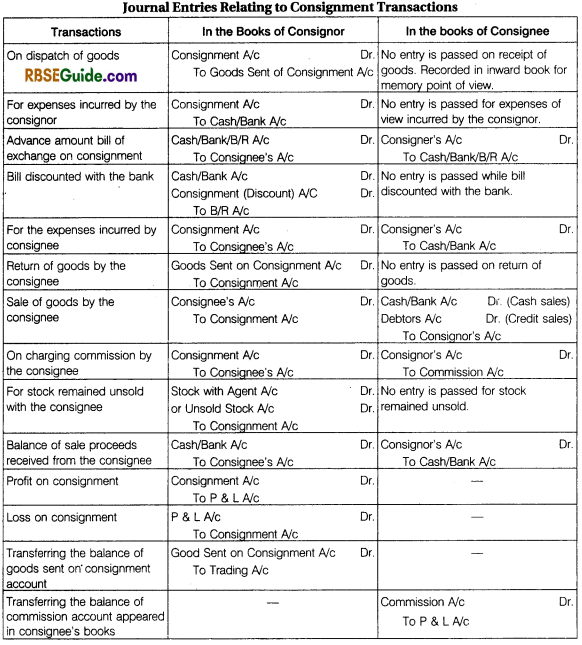

Terminology Regarding the Consignment

1. Consignment: When goods are sent by the consignor to the consignee for sale on commission

basis then it is known Consignment or Goods sent on consignment.

- Outward Consignment: Goods sent on consignment is called Outward Consignment for the consignor.

- Inward Consignment: Goods received on consignment is called Inward Consignment for the consignee.

2. Consignor: The owner of goods or the principal who sends goods on consignment for sale is known as Consignor.

3. Consignee: The person to whom goods are sent on consignment. This is only the person who sells goods to consumer after receiving goods on consignment. He is called Agent or Consignee.

4. Commission: Commission is the remuneration paid by the consignor to the consignee for the services rendered to the former for selling the consigned goods. Three types of commission can be provided by the consignor to the consignee, as per the agreement, either simultaneously or in isolation. They are

Ordinary Commission: The term commission simply denotes ordinary commission. It is based on fixed percentage of the gross sales proceeds made by the consignee. It is given by the consignor regardless of whether the consignee is making credit sales or not. This type of commission does not give any protection to the consignor from bad debts and is provided on total sales.

Delcredere Commission : To increase the sale and to encourage the consignee to make credit sales, the consignor provides an additional commission generally known as delcredere commission. This additional commission when provided to the consignee gives a protection to the consignor against bad debts.

In other words, after providing the delcredere commission bad debts is no more the loss of the consignor. It is calculated on total sales unless there is any agreement between the consignor and the consignee to provide it on credit sales only.

Overriding Commission : It is an extra commission allowed by the consignor to the consignee to promote sales at higher price than specified or to encourage the consignee to put hard work in introducing new product in the market. Depending on the agreement it is calculated on total sales or on the difference between actual sales and sales at invoice price or any specified price.

5. Proforma Invoice : The particulars of the goods sent by the consignor to consignee which contains information as to quality of product, quantity of goods, invoice price, weight and measurement, marking expenses etc. is known as Proforma Invoice. Necessary instructions e.g., goods to be sold on credit or not, goods to be sold on above the invoice price or not, types and rate of commission are also mentioned in this.

6. Advance on Consignment: When the consignee remitters advance amount to the consignor or accepts bill of exchange written by the consignor before the sale proceeds then it is known as Advance on Consignment. If the bill of exchange is discounted by the consignor from the bank then the discount will be debited to consignment account treating as a loss. But some scholars assuming it as part of trading loss in financial items don’t transfer to consignment account.

7. Account Sale : A statement sent by the consignee to the consignor after the sale of goods is called Account sale which contains quality and quantity of goods soid , sale proceeds expenses, commission advance on consignment etc.

![]()

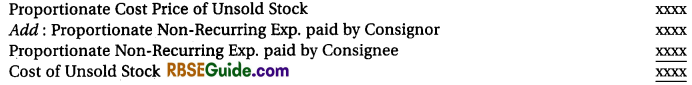

Valuation of Unsold Stock

It is very necessary to valuate the cost of unsold goods of consignee. It is calculate as follows:

- Inventories will be valued at cost or market value whichever is lower.

- All expenses incurred by consignor should be added in the cost of unsold goods proportionately.

- All expenses incurred by consignee, for reaching goods to godown will be added.

But expenses incurred after the reached goods to consignee are not treated as part of the cost of goods, purchase for valuation of inventories on hand.

Alternate method:

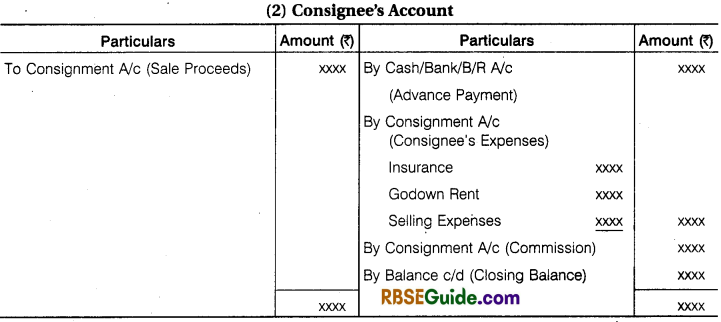

When a gods sent on consignmentat invoice price valuation of unsold stock as follows:

![]()

Stock Reserve (Unrealise Profit) = Invoice Price of Unsold Stock – Cost Price of Unsold Stock

![]()

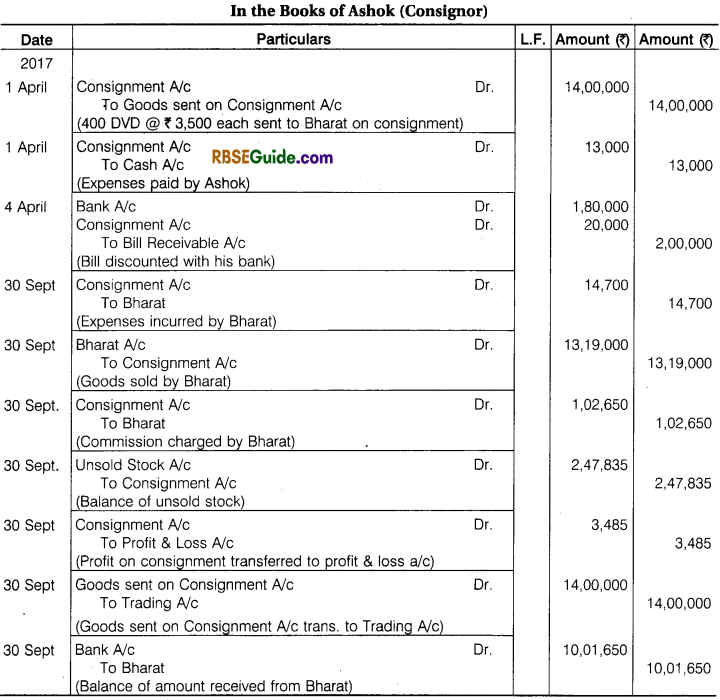

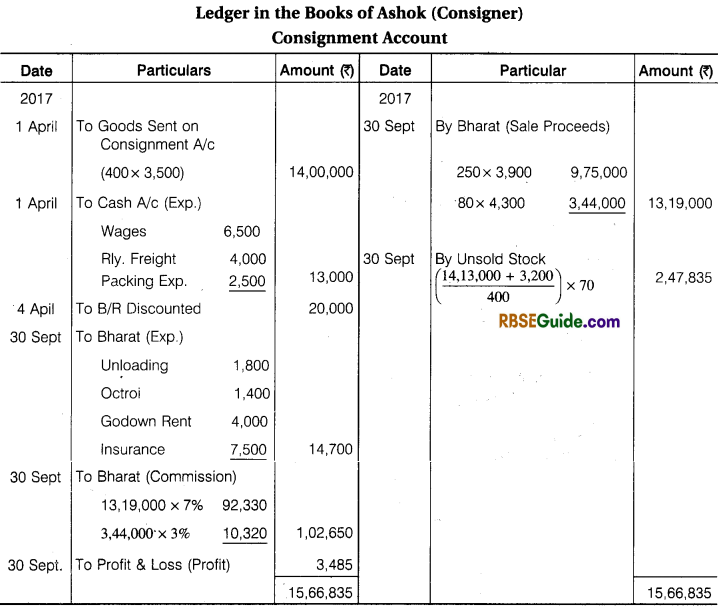

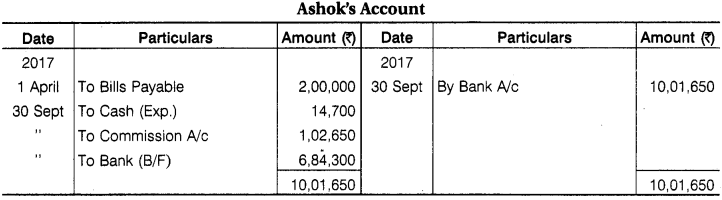

Illustration 1.

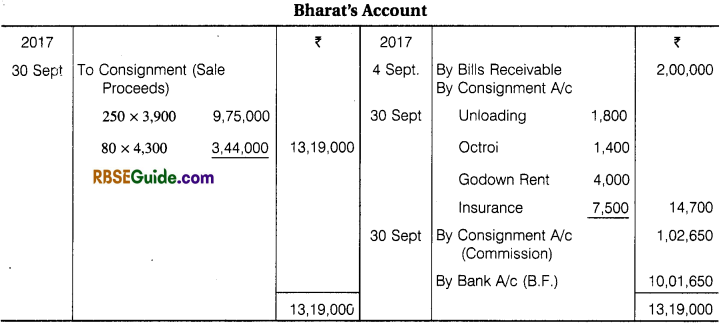

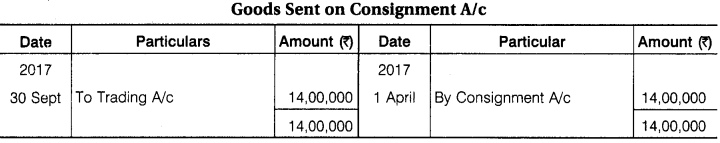

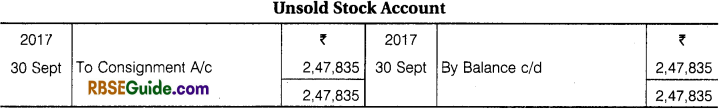

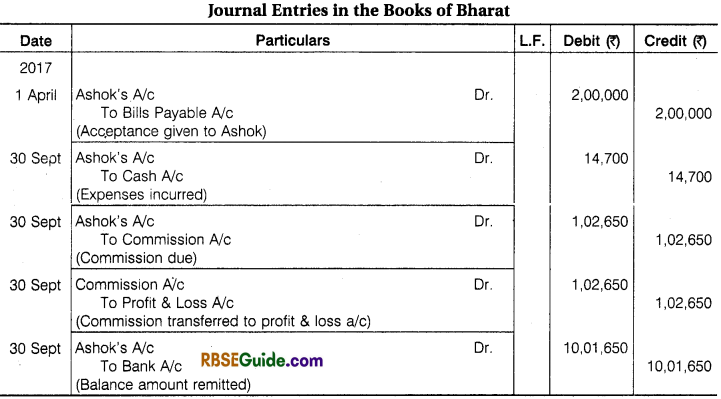

Mr. Ashok of Delhi Consigned to Mr. Bharat on 1 April, 2017 400 D.V.D. Player @ ₹ 3,500 per D.V.D. at cost. Bharat accepted of ₹ 2,00,000 Bills Receivable on 4 April, Ashok discounted 10% from Bank. Consignor paid ₹ 6,500 Wages, 4,000 Railway Freight and ₹ 2,500 Packing Charges. Bharat paid ₹ 1,800 Unloading, 1,400 Octroi, ₹ 4,000 Godown Rent and ₹ 7,500 Insurance Premium.

Bharat received 7% General Commission and 3% Delcredere Commission. Bharat sold 250 D.V.D. for cash at ₹ 3,900 per DVD and 80 DVD on credit @ ₹ 4,300 per DVD. Bharat sent account of sale after deducting expenses and commission on 1 Oct, 2017. Prepare necessary journal entries and accounts in the books of Ashok & Bharat.

Solution:

Loss on Goods Sent on Consignment

1. Normal Loss :

Any loss of goods due to its inherent characteristics and natural causes to which it is not possible to avoid. For example evaporation, drying, sublimation etc. are the causes.

Accounting for Normal Loss of Goods and Valuation of Closing Stock: No entry is passed for normal loss. Its cost is realised from goods units i.e., the total cost of goods is considered as the cost of remaining good units unsold stock is calculated with the help of the following formula :

![]()

![]()

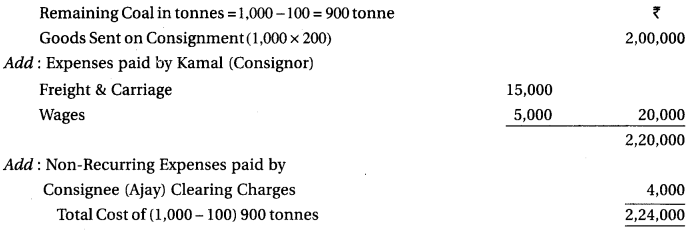

Illustration 2.

Mr. Kamal of Kolkata sent 1,000 tonnes Coal on Consignment @ ₹ 200 per tome. Consignor paid ₹ 15,000 Freight & Carriage and ₹ 5,000 for wages. Mr. Ajay spent ₹ 4,000 for clearing expenses. Mr. Ajay received 10% less coal. Ajay sold 850 tonnes coal @ ₹ 325 per tome. Calculate value of unsold stock.

Solution:

Normal Loss 1,000 x 10 100 = 100 tonne

Unsold unit (900 tonnes – 850 tonnes) 50 tonne

Cost of unsold coal = \(\frac { 2,24,000×50 }{ 900 } \) = ₹ 12,444

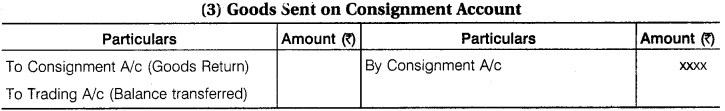

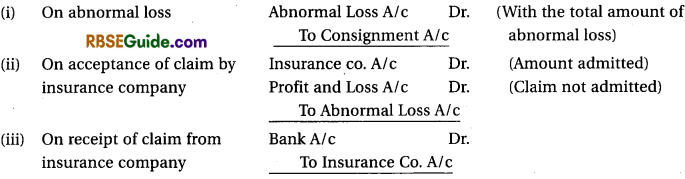

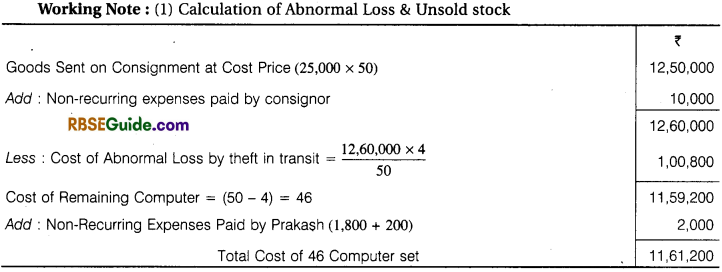

2. Abnormal Loss : Such loss of goods which arises due to abnormal causes and carelessness which may be avoided by efficient management and carefulness. Loss of goods caused by theft, loss of goods by fire, breakage due to defective packing etc. are included in this category.

Calculation of Abnormal Loss : After valuation of abnormal loss its amount is deducted from the cost of total units and written off from profit and loss account.

There are two stages of its calculation; viz,

Loss in Transit (Loss of Goods before Bringing the Goods to the Godown of the Consignee):

In this situation the amount of abnormal loss is calculated by adding expenses incurred by the consignor to the cost of goods. Expenses incurred by the consignee are not included.

Loss in the Godown of the Consignee : In this situation the amount of abnormal loss is calculated by adding all expenses incurred by the consignor and expenses of non-recurring nature incurred by the consignee to the cost of goods.

Accounting of Abnormal Loss : The consignor bears the loss on consignment, therefore, its accounting is done in only the consignor’s books.

Entries are as follows :

![]()

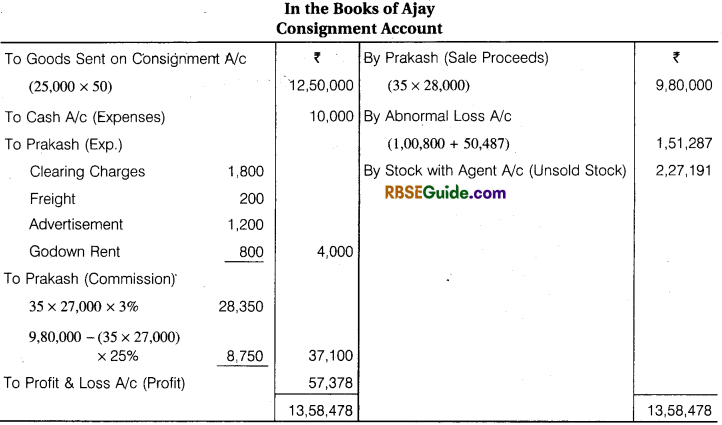

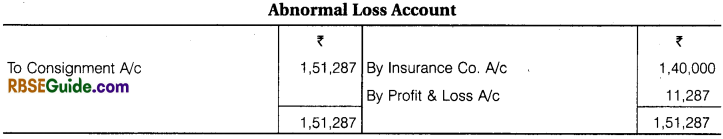

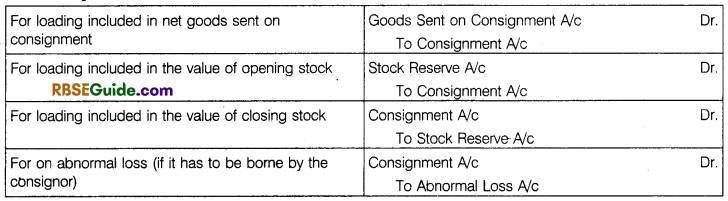

Illustration 3.

Ajay of Delhi sent 50 Computer set sent (₹ 27,000 per Computer invoice price) @ ₹ 25,000 per Computer cost price to Prakash of Jaipur. Consignor paid 10,000 for carriage & insurance. On the way 4 Computer set fully destroyed. Prakash paid ₹ 1,800 clearing charges, Freight & Carriage 1200. Advertisement expenses 11,200 and godown rent ₹ 800. The 2 Computer are theft of Prakash’s godown.

Prakash sold 35 Computer @ 28,000 per computer, consignor got 1,40,000 from insurance co. Prakash received 3% commission in invoice price and 25% commission on excess price of invoice price overriding commission. Prepare consignment account & abnormal loss a/c in the books of Ajay.

Solution:

(2) Cost of Abnormal Loss by theft in godown

\(\frac { 11,61,200×2 }{ 46 } \) = ₹ 50,487

Total Cost of Abnormal Loss (1,00,800 + 50,487) = ₹ 1,51,287

(3) Valuation of Unsold Stock

\(\frac { 11,61,200x(50-41) }{ 46 } \) = ₹ 2,27,191

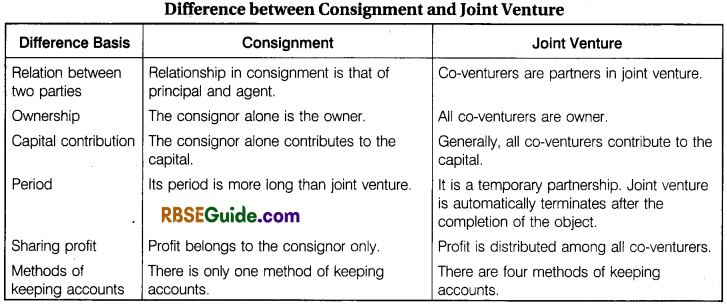

Accounting and Good Sent on Consignment at Invoice Price

When goods sent on consignment and accounting is done at invoice price then entries as to goods

- On sending goods on consignment

- Stock of unsold goods – Opening and closing

- Abnormal loss will be entered at invoice price.

Invoice price is a composite of cost and profit, i.e., Invoice Price = Cost + Profit. In such a situation in order to ascertain correct profit and loss, it is necessary to reduce the effect of loading included in the above entries. Adjustment entries (in only the books of the consignor) to reduce the effect of loading included in invoice price.

While preparing final accounts the amount of closing stock (invoice price) is shown on the asset side of the balance sheet after deducting stock reserves.

[Note: In the absence of information as to accounting of goods at cost price or invoice price, students are advised to opt any one of these methods.]

![]()

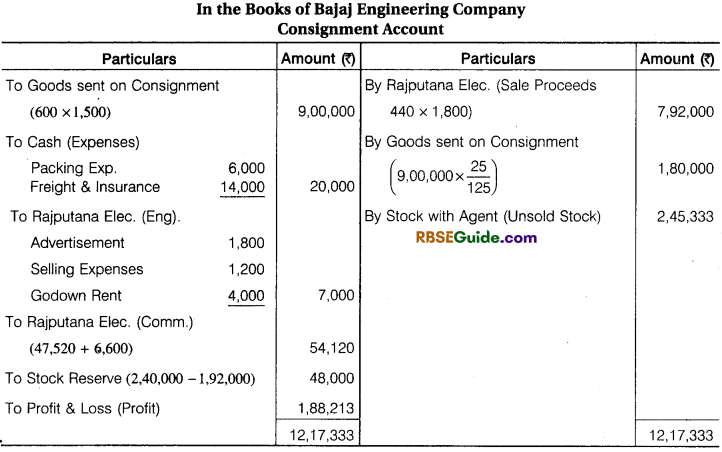

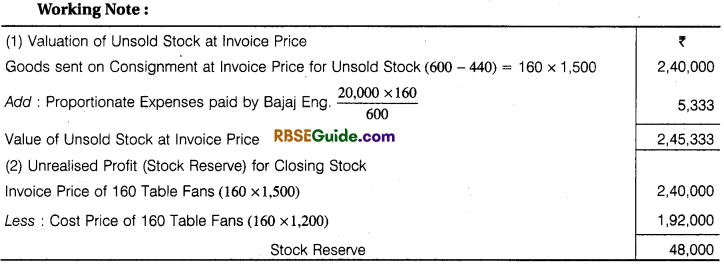

Illustration 4.

Bajaj Engineering Co. sent 600 Table Fans @ ₹ 1,500 per Table Fans to Rajputana Electric, Ajmer at invoice price which is 25% above the cost price. Consignor paid ₹ 6,000 Packing charges and Freight & Insurance ₹ 14,000 consignee sent account of sale 440 Table Fans @ ₹ 1,800 per Fan and paid Advertisement ₹ 1,800 selling expenses ₹ 1,200 and godown rent ₹ 4,000. Consignee received 6% Commission on invoice price and 5% above on invoice price as additional commission. Prepare consignment account at invoice price.

Solution:

Cost Price of per fan = \(\left( 1,500x\frac { 100 }{ 125 } \right) =1,200\)

Fall In Market Price of Stock

In case of market price of stock is less than cost price, it is valued at market price. Stock with the consignor and the value of the stock with consignee is reduced by this fall in market value of stock.

![]()

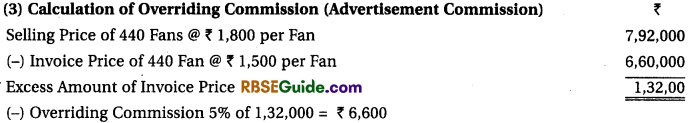

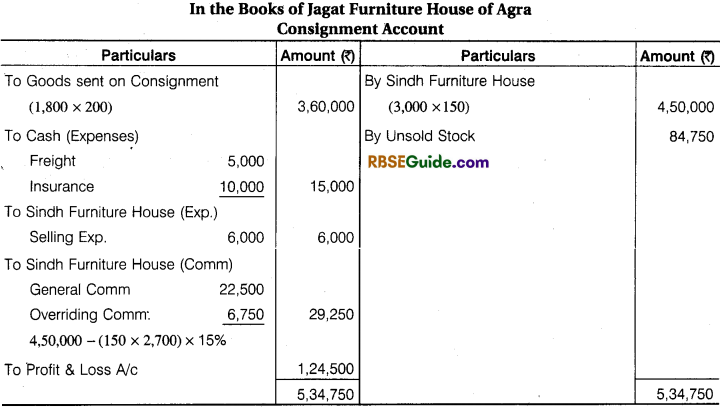

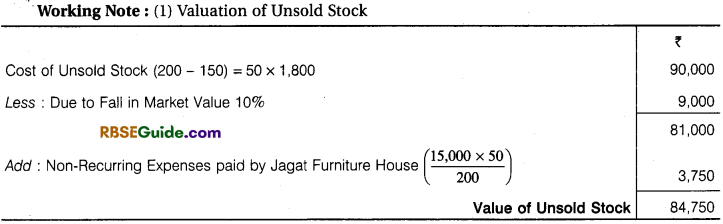

Illustration 5.

Jagat Furniture House of Agra purchased 400 computer table @ ₹ 1,800 per computer table and sent to Sindh Furniture House, Ajmer 200 computer table @ ₹ 2,700 at invoice price. Consignor paid Freight 5,000 and Insurance 10,000 and Sindh furniture sold 150 computer table @ ₹ 3,000 per table in cash and paid selling expenses 4,500. Advertisement 1,500 and Godown Rent 1,000.

Jagat Furniture sold 120 computer table @ ₹ 2,700 per table and paid selling expenses 6,000. Due to fall in market valued at 10% less then cost price. Sindh Furniture House will get 5% general commission and overriding commission @ 15% on excess amount received over 2,700 per computer table. Prepare Consignment A/c, Trading and Profit & Loss a/c in the books of Jagat Furniture House.

Sale of Damaged Goods by Consignee

![]()

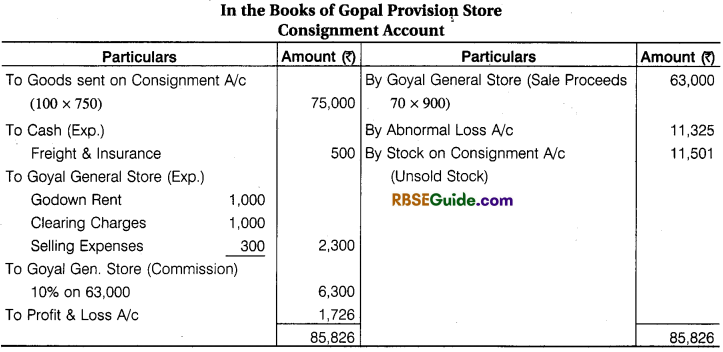

Illustration 6.

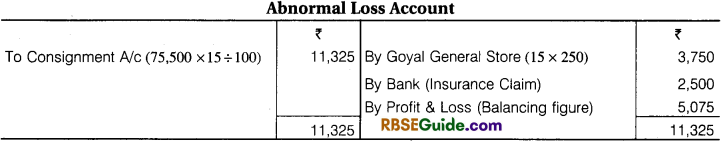

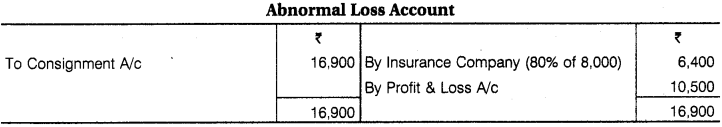

Gopal Provision Store consigned 100 bags of Sugar each bag costing ₹ 750 to Goyal General Store. He paid ₹ 500 towards Freight & Insurance. 15 Bags were damaged in transit and consignor had received ₹ 2,500 from Insurance Company. Goyal General Stores accepted a bill drawn on him for ₹ 52,500 for 60 days and report them to bags were sold at 900 per Bag, the damaged bags were sold at ₹ 350 per bag, he had included the following expenses :

Godown Rent 1,000, Clearing Charges 1,000 & Selling Expenses were ₹ 300. He is entitled of commission @ 10% on the sales proceeds of the goods excepting of damaged goods. Prepare necessary accounts in the books of Gopal Provision Store.

Value of unsold stock = \(\frac { 64,175×15 }{ 85 } \) = ₹ 11,501

Share in Profit to Consignee or Special Commission

![]()

Illustration 7.

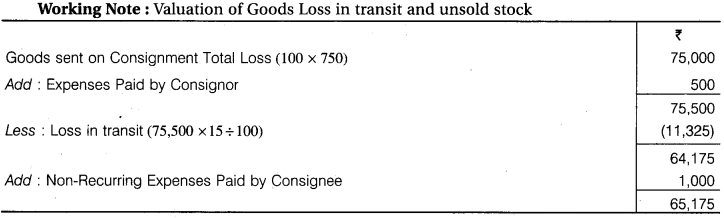

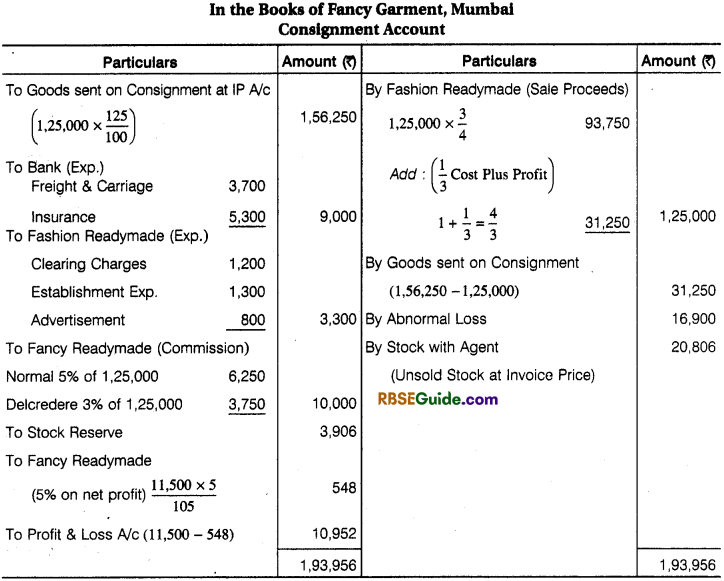

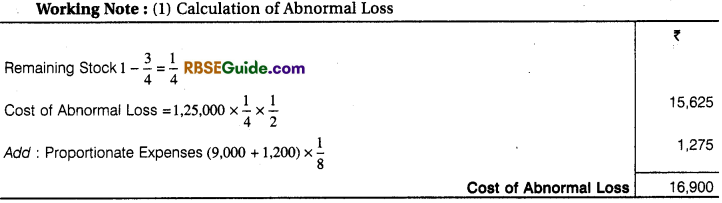

Fancy Garment, Mumbai sent goods to agent costing ₹ 1,25,000 at invoice price, which was 25% higher than cost price. Fashion Readymade of Udaipur consignor paid on consignment Freight carriage 3,700 and Insurance paid for 5,300 Agent paid for clearing charges ₹ 1,200. Establishment expenses ₹ 1,300 and Advertisement paid 800.

Fashion Readymade sold \(\frac { 3 }{ 4 } \) of goods at cost plus \(\frac { 1 }{ 3 } \) for profit. Half of the remaining goods destroyed by fire. Insurance company accepted the claim for ₹ 8,000. Which settled at 80% of the said amount.

Agent will get 5% commission on gross sale and 3% overriding commission and he will get 10% special commission (After deducting such commission) on net profit on consignment. Prepare necessary account in the books of consignor Fancy Garment received balance of amount from Fashion Readymade through bankdraft. Accounting is done at invoice price excluding abnormal loss.

Solution:

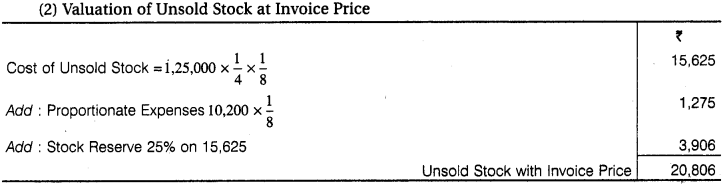

Repair of Partially Damaged Goods

If some repair expenses have been incurred on damaged goods to make saleable then accounting for such expenses will be as follows :

(1) Debit to consignment account treating as consignment expenses

Consignment A/c Dr.

To Cash A/c

(Being repair of partially damaged goods debited to consignment account)

(2) To include in the cost of damaged goods, abnormal loss is calculated by adding repair expenses incurred on such units to the cost of damaged goods. For this abnormal loss charged to profit and Loss account = cost of damaged goods + repair expenses + saleable value.

(3) If partially damaged units after repair may again be sold at the value of good units then repair expenses are added to the cost of unsold stock (including damaged units).

![]()

Illustration 8.

Sonata Watch Co. sent 100 watches @ ₹ 1,600 per watch to Roop Watch Stores on consignment. Consignor paid 4,000 for carriage & other expenses. 20 Watch are left unsold with consignee. Out of which 8 watches are damage. Repairs Expenses ₹ 2,000 on it if.Repairs expenses treated as consignment expenses.

Repairs expenses included in the value of damaged goods and then the value of damaged watch is 800 per watch. Calculate value of abnormal loss. After repair the damaged watch unsold as good watch. Calculate the value of unsold stock.

Solution:

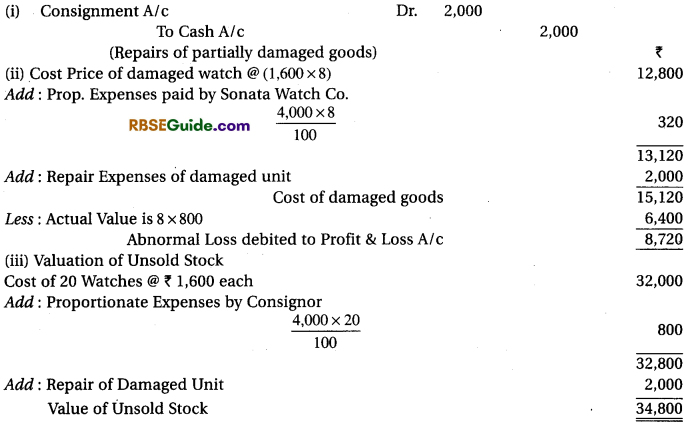

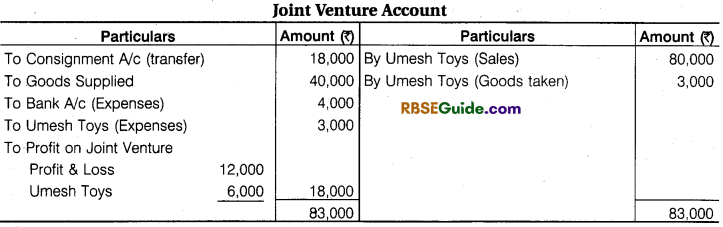

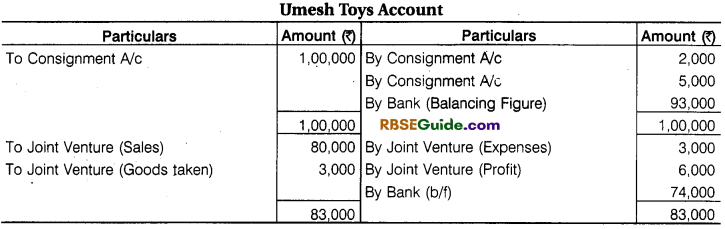

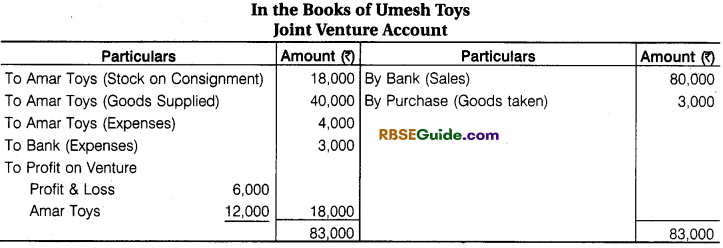

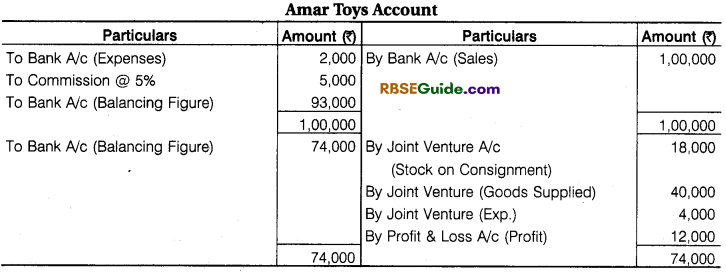

Conversion of Consignment into Joint Venture

If the principal and the agent decides during the consignment business that they will act joint venture in future then the consignment is converted into joint venture and the consignee share profit in place of commission. Unsold stock with consignee is transferred to joint venture account and accounting is done according to joint venture system.

![]()

Illustration 9.

Amar Toys of Ajmer sent ₹ 80,000 toys to Umesh toys, Bharatpur on consignment for sale on the basis of 5% commission. Consignor paid 8,000 for packing and carriage. Consignee paid ₹ 2,000 for carrying goods to godown. Consignee sold 80% goods for 1,00,000 and paid for remaining amount. Consignee denied to work on commission for remaining goods.

Consignor proposed to consignee for carrying business. On joint venture by taking 1/3 share in Profit & Loss. Consignee accepted it. Consignor sent goods worth 40,000 to Umesh toys of Bharatpur on Joint Venture. Amar toys spent ₹ 4,000 and Umesh toys, Bharatpur spent 3,000. Amar toys retained the goods costing ₹ 3,000 at same value and remaining goods sold at 80,000. Accounts are settled between both parties amount to consignor. Prepare necessary accounts in the both of parties.

Solution:

Consignment Accounts Notes Important Terms

→ Consignment : When the owner of goods or principal sends goods to his agent on this basis’that goods will be sold by the agent and he will get commission as remuneration at a certain rate on sale of goods. This procedure is known as consignment.

→ Consignee : The person to whom goods are sent on consignment. This is only the person who sells goods to consumer after receiving goods on consignment.

→ Consignor : The owner of goods or the principal who sends goods on consignment for sale.

→ Advance on Consignment : When the consignee remitters advance amount to the consignor or accepts bill of exchange written by the consignor before the sale proceeds. then it is known as advance on consignment.

→ Account Sale : A statement sent by the consignee to the consignor after the sale of goods is called account sale.

→ Performa Invoice : The particular’s of the goods sent by consignor to consignee which contains information as to quality of product, quality of goods, invoice price, weight and measurement, marking expenses, etc. is known as performa invoice.

→ Delcredere Commission : To increase the sale and to encourage the consignee to make credit sales, the consignor provides an additional commission, that is called delcredere commission. This additional commission when provided to the consignee gives a protection to the consignor against bad debts.

→ Overriding Commission : It is an extra commission allowed by consignor to consignee to promote sales at higher price than invoice price.

→ Normal Loss : Any loss of goods due to its inherent, characteristics and natural causes to which it is not possible to avoid, called normal loss.

→ Abnormal Loss : Such loss of goods which arises due to abnormal causes and carelessness which may be avoided by efficient management and carefullness.